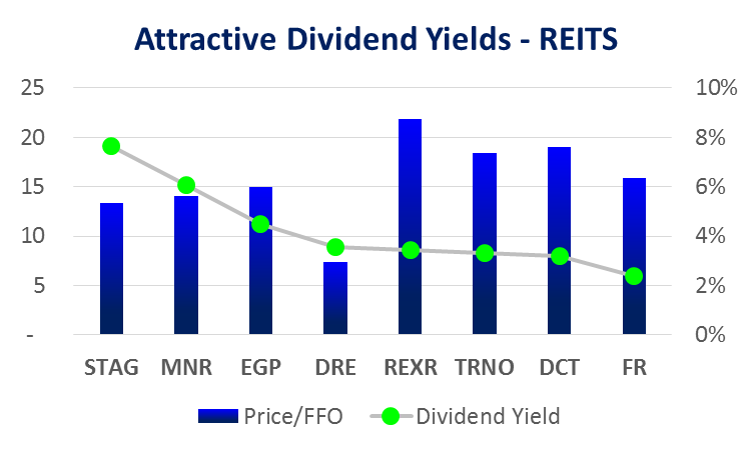

We have released some exciting updates in our members-only area this weekend. Specifically, our high dividend “Income Equity” strategy is now available to all subscribers. Also, we have renamed our ETF strategy; it’s now called “Smart Beta” because that is a more accurate description of what it really is. Additionally, we review one of our latest holdings, a high-divided REIT (Hint: it’s one of the REITS in this table, and no it’s not Stag Industrial!).

The REIT we have added to our new Income Equity strategy is EastGroup Properties (EGP). EGP is an industrial Real Estate Investment Trust (REIT), and we like it a lot despite its negative 8.4% total return in 2015. It declined in 2015 for a variety of reasons including lackluster overall market performance, slightly lower occupancy rates, lower year-over-year third-quarter earnings, fear that company’s Houston area properties will suffer from a challenged local energy market, and fear that rising interest rates will pressure the business. However, we believe EGP’s poor 2015 performance is temporary, and it provides an outstanding buying opportunity right now for long-term value investors seeking an above average dividend yield. You can read more about EGP here.

Recent market declines:

As you are likely well aware, 2016 has been one of the worst starts for the stock market in many years. And this is a good time to remind yourself: Don’t do anything rash! It’s times like these that investors often panic, and end up making mistakes (e.g. selling low!). As the saying goes, “Buy when there is blood in the streets." For your reference, here are a few paragraphs from our September 26 2015 Blue Harbinger Weekly to remind you of the types of mistakes investors should avoid during times of heightened market volatility (like we’re seeing so far this year):

With major US stock market indexes negative for the year, many investors are wondering if it is time to bail on the stock market. Plenty of investors have not forgotten the painful period between late 2007 and early 2009 where the stock market collapsed and many investors saw their account balances cut in half. And now with the high volatility we’ve been seeing... investors are scared.

However, we at Blue Harbinger know that if you are a long-term investor, bailing on the stock market now is the complete wrong thing to do. In fact, if you have a long-term investment horizon, stocks are cheaper now... thus making now an even better time to invest.

Of course you’ll hear all kinds of gloom and despair in the media, but the truth is if you leave the stock market now, you won’t know when to get back in, and you’ll very likely miss out on a great rally. In fact, this is exactly what happened in the panic of 2009 when many investors sold and never got back in. They missed out on one of the greatest stock market rallies in history whereby stocks more than doubled in value in the years that followed and investors made back all of their losses and then some.

Further, if you’re working with a full service stock broker, selling now and then buying back later only lines his pockets with your money. Don’t forget that stock brokers charge very high hidden sales charges every time you make a transaction (buy or sell). This, and other hidden transaction related fees throughout the industry, are another great reason why you should NOT sell now!