With stocks sitting firmly in oversold territory this year, especially after last week’s powerful selloff (worst week since 2020, as fed hiked 75bps), stocks are bouncing.

The Big-Dividend Report

Chip Stocks: Price-to-Sales Ratios Decline

Looming Recession?

China "Tech Crackdown" Reversing

40 Big-Dividend BDC's: Price-to-Book Values

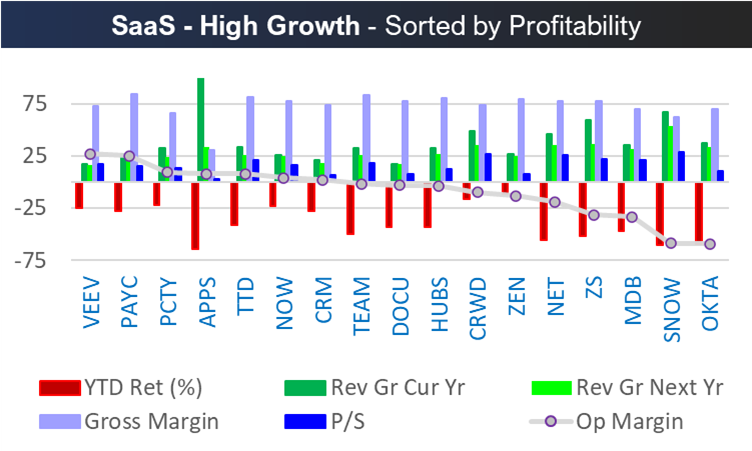

High Growth Stocks - with Room to Run

These are potentially “rocket fuel” stocks in the coming months, IF inflation has peaked and the Fed becomes less hawkish. It also doesn’t hurt that China has decided to lighten up on its crack down on tech. The “% of 52-Week Price Range” shows how much more upside these stocks could have relatively to where they sit between their 52-week highs and lows.

The Tech Bubble Took Over 2.5 Years to Fully Burst

The Tech Bubble (QQQ) peaked on 3/10/2000 and it took more than 2.5 years for it to fully burst. We are in a different environment today (i.e. low rates rising, massive revenue also rising for top growth stocks), but here is sector performance when the bubble burst (the first year and peak to bottom). Cathie Wood’s ARKK ETF peaked in June 2021 and the Nasdaq (QQQ) peaked in late 2021.