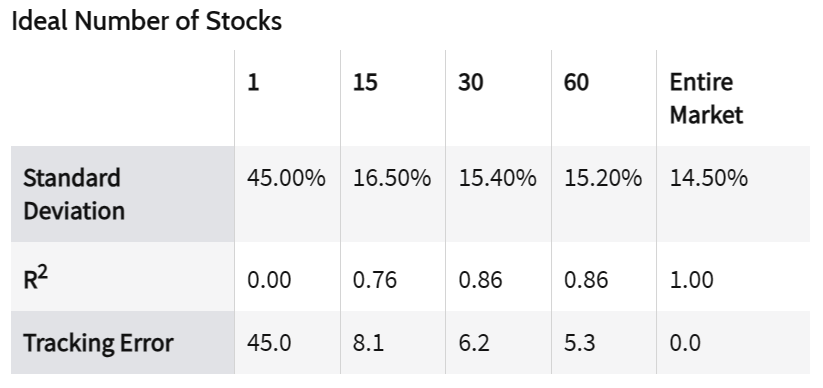

25-30 stocks is the “magic number” to be diversified (according to a popular 1970 study by Fisher and Lorie) as you can see in the chart below (i.e. once you own 25-30 stocks, you’ve already diversified away the lion’s share of stock specific risk, from a standard deviation standpoint).

“The Entire Market” View

And while the 25-30 stock number has been widely popular for decades, some academic types (i.e. nerds) believe standard deviation is the wrong metric, and 60 stocks is the bare minimum, but holding the ENTIRE MARKET is ever better (as you can see in the following table) when you consider “more prudent” metrics like tracking error and R-square.

source: Investopedia

Biased Opinions:

Of course there are huge biases (and conflicts of interest) by the people creating the studies. For example, many academics will push the maximum diversification story (i.e. just buy a market ETF and own ALL stocks) because they have little to no real world experience/skill and they personally are better off this way.

Similarly, many real world “sales people” (CFP types, nothing against them, they can add value in other ways) with little to no actual investment experience/skill will also push the passive ETF story (because it’s easier for them and their business can generate more sales selling the passive ETF story).

Stock Picking & Portfolio Constructions Skills:

But what is actually true? The truth is, there are people with actual stock picking skill AND portfolio construction skill. It’s just really hard to identify and separate them from those winning through sheer luck (statistically, there should be a fair amount of lucky investors) and from those who are just really good sales people (whether they are inexperienced academics and/or unskilled CFP types, or fintwits bragging about their short-term luck as if it were skill).

Critically important as well, the chart and table above are all about eliminating “stock specific risk” so you are only left with “non-diversifiable” market risk. The problem with this is that they are based on the implicit assumption that no one has any stock-picking skill therefore you don’t want any stock-specific risk. The problem with this, of course, is that if you have stock picking skill (combined with prudent portfolio construction/risk management skill) you absolutely DO want stock-specific risk!

The Bottom Line:

If you are skilled, 25-35 stocks is an ideal stock portfolio size, but only if you:

Sectors: Keep your portfolio weights roughly close to the market in terms of sectors (there are 11 GICS sectors, such as technology, consumer staples, materials, etc.).

Market Caps: Keep market cap weights (small, mid, large and mega-cap exposures) loosely similar to the market.

International: Consider adding a little international exposure too, but there are different opinions on this one. For example, Vanguard founder Jack Bogle didn’t really think international was necessary.

Style Exposures: Stay cognizant of the ebbs and flows of growth and value, especially in light of interest rate dynamics (i.e. keep your emotions in check as you invest for the long-term).

Specific Stocks: But most importantly, above all else, pick a few good stocks!

The long-term compound growth of just a little alpha snowballs into a lot of money over multiple market cycles.

Be smart people. Do what is right for you.