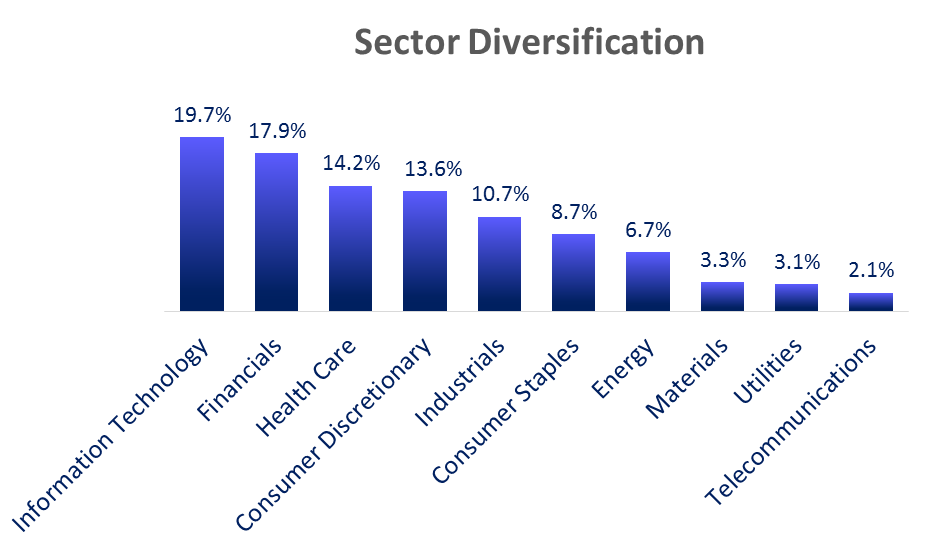

Diversification is critical to successful long-term investing. For example, investors can reduce their risk by owning a variety of stocks that operate across major market sectors (e.g. technology, healthcare, financials, etc.). Both our "Blue Harbinger 15" and our "Lazy Person" portfolios are diversified across market sectors. Specifically, the individual stocks we own form a diversified portfolio, and the exchange traded funds (ETFs) we own add to this diversification (each ETF holds a diversified basket of many stocks). For reference, the following chart shows the major market sectors and their weights as defined by the Global Industry Classification Standard (GICS).

The weight of each sector (above) is equal to the value of all the stocks in that sector.

Johnson & Johnson (JNJ) is one of our "Blue Harbinger 15" stocks, and it adds diversification. JNJ is in the Health Care sector, and the performance of this stock often follows the performance of other Health Care stocks because they are often impacted by the same economic news. For example, changes to Health Care laws may likely impact JNJ more than they impact companies in the Financials sector. So if there was hypothetically "bad news" in the Health Care sector, it would be really bad news if all of our holdings were in the Health Care sector. But of course they are not, and it is this diversification that helps reduce our overall investment risk.

Apart from diversification, we received good news about JNJ this week. Specifically, the company announced positive earnings and also announced additional share buybacks. You can read more about how we view the JNJ news here.

McDonald's (MCD) is another stock that adds diversification to our "Blue Harbinger 15" portfolio. MCD is in the Consumer Discretionary sector.

Interestingly, this week McDonald's announced that it is close to making a decision on what to do with its vast real estate holdings. The company believes it may be able to create shareholder value by spinning off its real estate holdings into a Real Estate Investments Trust (REIT). You can read our views on this potential REIT spinoff here.

Lastly, and as a reminder, both "The Blue Harbinger 15" and "The Lazy Person Portfolio" are very well diversified. And even though the Lazy Person portfolio holds only four ETFs, each ETF consists of a large diversified basket of stocks. As the old saying goes, don't ever put all your eggs in one basket.