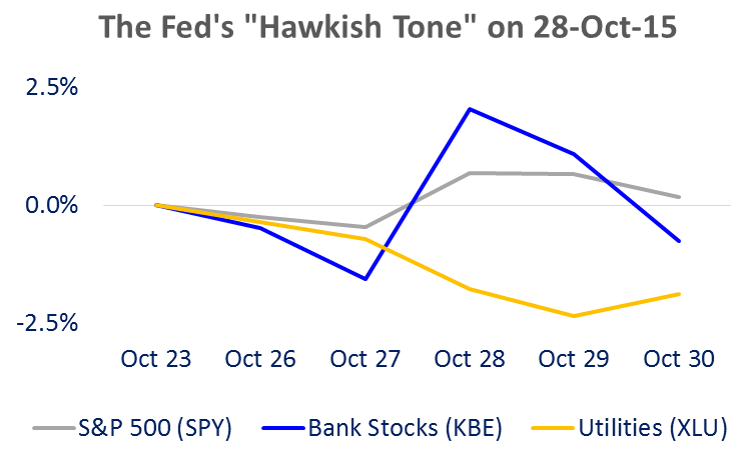

Immediately following this week’s more hawkish Fed announcement, high-dividend utilities stocks declined and interest rate sensitive banking stocks increased. We continue to believe strongly in picking high-quality individual stocks for the long-term instead of making economic predictions that even the most respected economists get wrong 50% of the time.

Our “Blue Harbinger 15” utilities stock, Westar Energy (WR), declined sharply this week immediately after the Fed came out with its more hawkish announcement on interest rates, but then gained back a significant portion of the losses by the end of the week. We continue to believe in Westar going forward because the company sources its electricity from diversified sources including renewables (not just dirty coal like other utilities). Also, it’s in a state that is more balanced in its views on the tradeoffs between economics and expensive regulations. Additionally, it adds diversification to our overall Blue Harbinger 15 portfolio. Lastly, its 3.6% dividend yield is attractive, and suggests the stock has some upside because 3.6% is historically high for the company. You can read our complete Westar thesis and research report here.

Our S&P 500 ETF holds large and mid-sized companies, and it outperformed our Russell 2000 small cap ETF during the week. Both of these ETF’s are very low cost, and add important diversification to our Blue Harbinger 15 and to our Lazy Person Portfolio.

Important to note, the S&P 500 ETF pays dividends at the end of each January, April, July and October, which means its dividend payment will be showing up soon if it’s not already in your account. If you don’t need this dividend for your own personal spending purposes, then it is important to reinvest the cash received so it doesn’t add up and drag down the returns of your account over the long term.

Ideally, we want zero cash in a long-term investment account, but generally speaking it is not the end of the world if you have 1% cash in your account. But if you accumulate much more than 1% then you should really think about getting that invested as soon as possible. As a reminder, most discount brokers (E-Trade, Scottrade, TD Ameritrade) offer automatic dividend reinvestment programs, and it’s a good idea to take advantage of these programs if you are a long-term investor and don’t need the cash right away. However, if you do need the cash then it’s always especially nice to see those dividends come rolling in quarter after quarter.

You can read our complete Russell 2000 Small Cap ETF thesis and research report here, and you can view the same for our S&P 500 SPDR ETF (SPY) here.

This week’s free Stock of the Week was IBM. We like IBM over the long-term, but we don’t own it because we like Accenture even more (Accenture is a Blue Harbinger 15 holding). The two companies compete for the same business and technology consulting services, but Accenture has a higher growth rate. We expect Accenture’s growth rate to remain higher because the company is more agile, less bogged down by legacy businesses, and doesn’t have to deal with the same big defined benefit obligations as IBM (Accenture is defined contribution which shifts the risk away from the company and to the employees and former employees).

Next week we have big earnings announcements coming from Blue Harbinger 15 holdings Facebook (FB) and Paylocity (PCTY). It will be interesting to see what happens to these stocks and the market overall next week.

Lastly, we just finished a great month of October (the S&P 500 was up around 9%, which is unusually high). We're hoping we don’t give any of those gains back next month, but if we do it will be a good investment opportunity for long-term investors to buy low.