As we mentioned in Part I of this report, the worst performers this year are often the best performers next year, and vice-verse. Here's a more detailed look at what has (and what has not) been working so far in 2016, and our views on what might deliver the best and worst performance in 2017, as well as how we are positioning our current holdings.

Sectors and Industries:

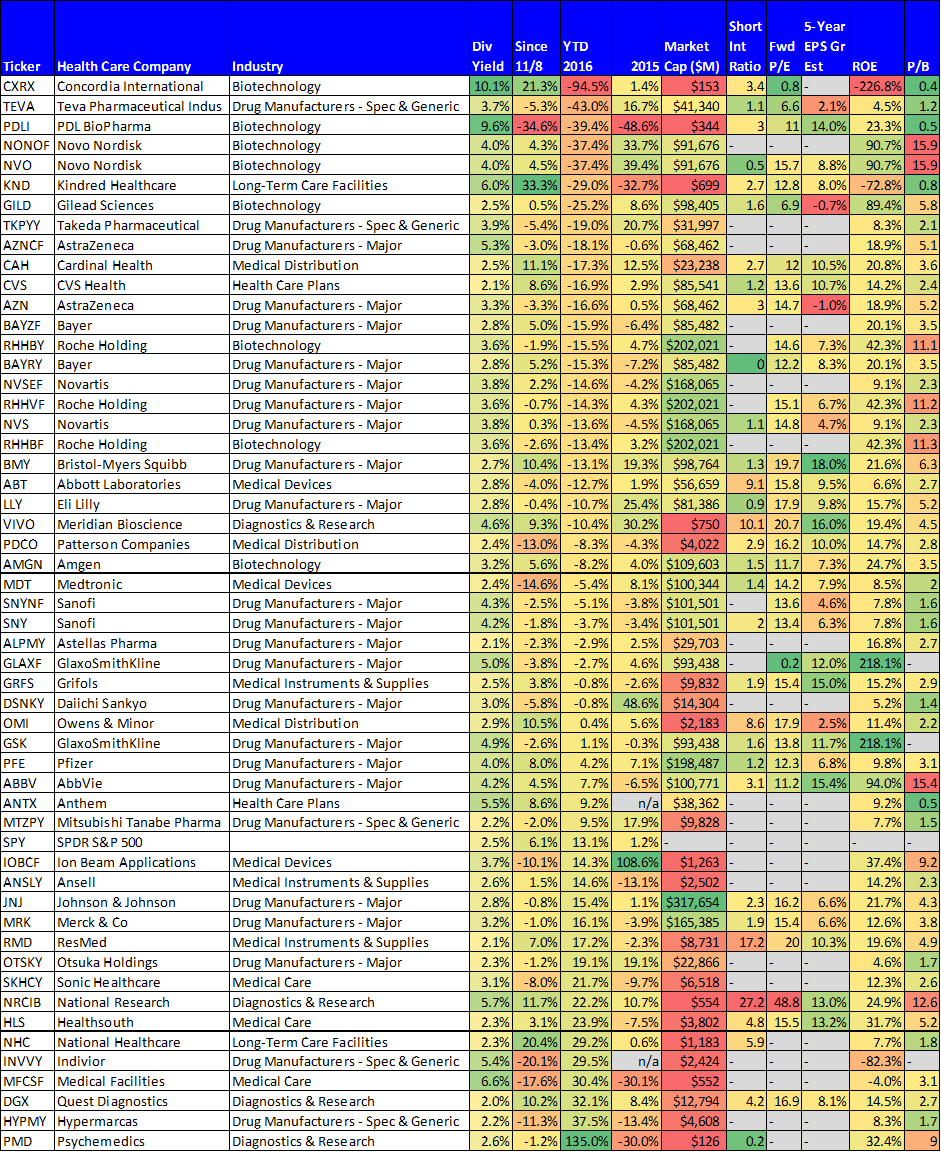

With regards to your personal holdings, it may make sense to take a closer look into Health Care stocks heading into 2017. The sector has been plagued by uncertainty, and that has kept prices low, but with the new administration set to take office in January, we may get clarity quickly, especially in light of the Republican controlled House, Senate and White House. This could be the catalyst to send health care stocks much higher. In particular, we'll be taking a closer look at some of the biotechnology stocks over the coming week, and may make changes to our portfolios.

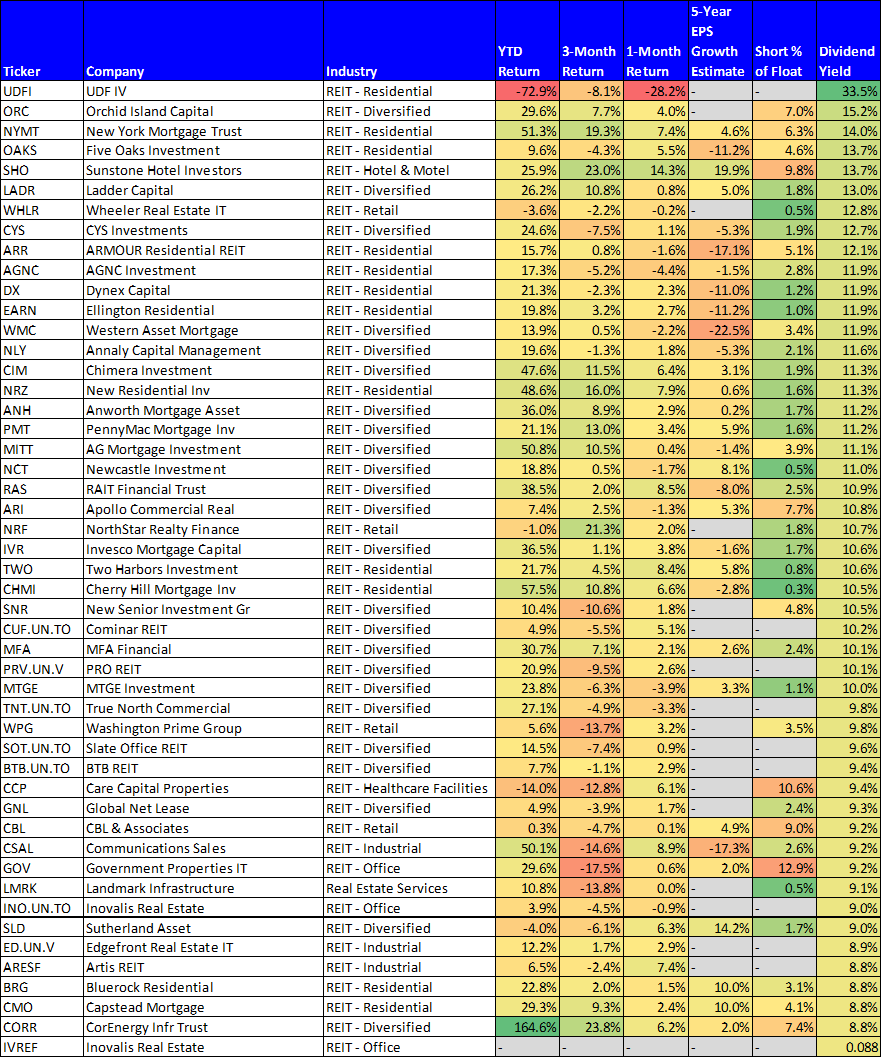

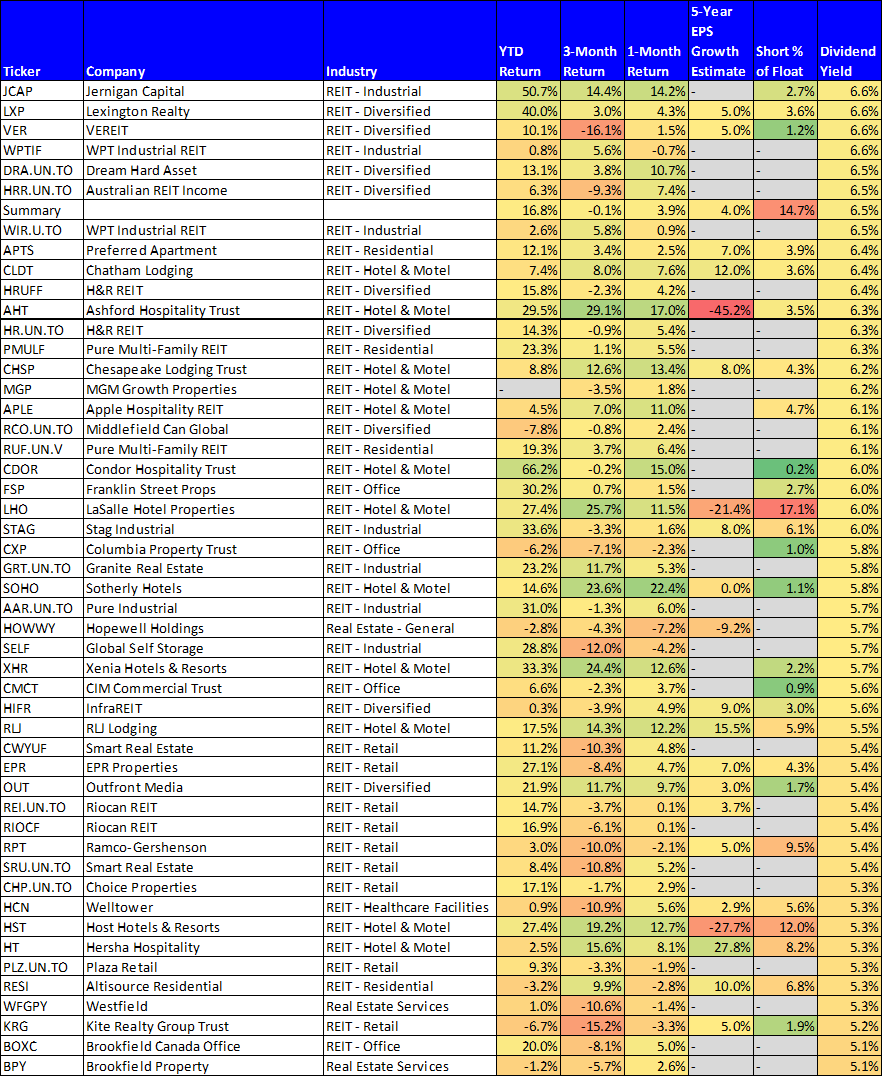

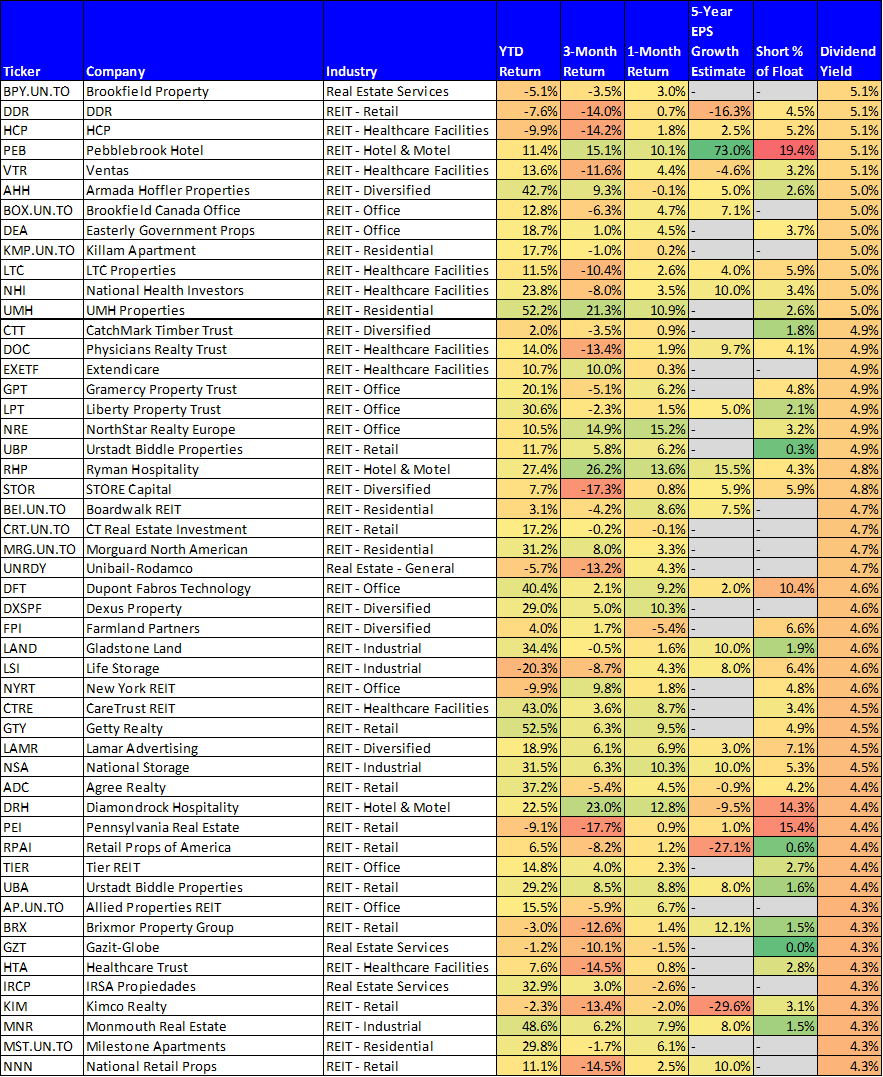

REITs also underperformed in 2016, and that could change quickly in 2017 as is often the case. We are comfortable with our current REIT holdings (OHI and EGP), but may give NRZ a closer look, especially given its strong performance in 2016.

Regarding Energy, another strong performer in 2016, we continue to be very comfortable with Phillips 66 (PSX), but may reconsider WPZ given its large gains.

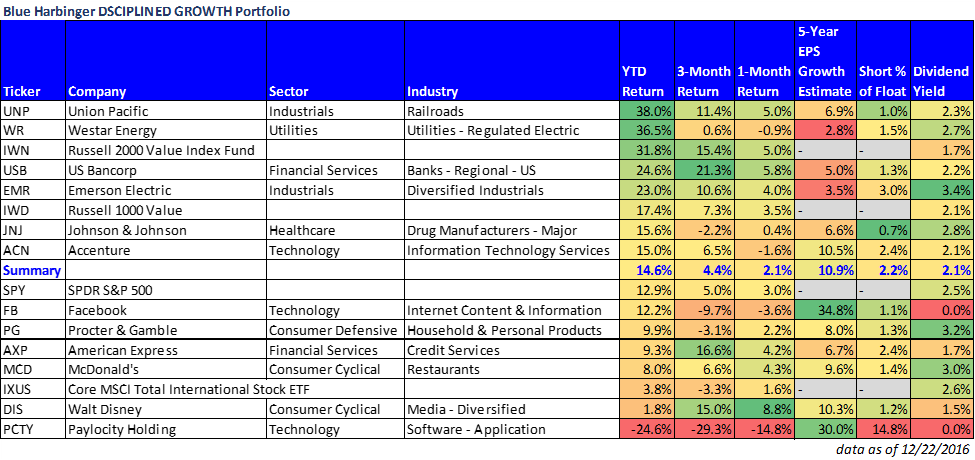

Regarding Financials, we continue to like US Bancorp (USB) and First American Financial (FAF), but we'll be giving a very close look at our BDCs (PSEC in particular) over the next week given its very strong 2016 performance.

For reference, here are our current holdings within our Income Equity and Disciplined Growth portfolios, as well as data on some of the sectors we discussed above...