Many dividend investors are overlooking these three obvious opportunities. It’s time to acknowledge the financial crisis is in the rear view mirror for some banks. In particular, we highlight three big bank stocks that have big growing dividends, very low risk, and the potential for very big price appreciation. We own two of them, and we’re considering purchasing the third.

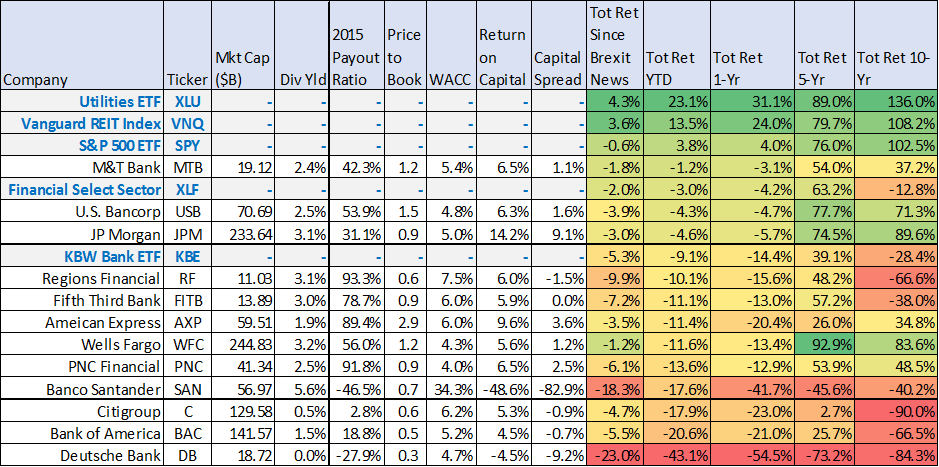

For reference, this following table provides high-level data on a variety of the systematically important, too-big-to-fail, banks...

(Total Returns as of 6/30/2016)

3. M&T Bank (MTB): Our new investment idea this week is M&T Bank. This is a bank with a big dividend (2.4%) and we believe it will continue to grow. M&T just increased its payout ratio this week, and the stock dramatically underreacted because of the fallout from all the macroeconomic Brexit news that brought down financials somewhat indiscriminantly. We also believe this stock has lots of price appreciation potential considering its lack of distressed assets, its attractive price to book ratio, and its room for price multiple expansion. You can read our full write-up on M&T Bank here:

2. American Express (AXP): We continue to believe American Express has huge price appreciation potential. Not only have macroeconomic headwinds weighed heavily on this stock, but the market has also overly punished the stock for some of the challenges in faced last year (e.g. the loss of Costco exclusivity an losing an antitrust case on some of the fees it charges). American Express is safe, it has the potential for a big rebound in earnings, and you can read our full writ-up on the company here:

1. U.S. Bancorp (USB): This is a great company. It has a big dividend, and the ability to increase the dividend. Specifically, its payout ratio is very low (demonstrating the ability for dividend increases). Additionally, it has avoided the volatile risks of capital market operations that so many other big banks (BofA, Citigroup) are involved in. USB has a large healthy fee-based business that can survive regardless of the interest rate sensitivities that have a bigger impact on many other banks. Still, USB has exposure to interest rates, and would benefit if rates were to rise because its net interest margin would improve. Worth noting, this is a bank that consistently earns a return on capital greater than its cost of capital- something many other banks cannot do. The price of USB has held up very well relative to other big banks and financials, but it was still dragged down somewhat inappropriately which suggest to us there is even more potential for upside price appreciation ahead. As more investors begin to shun the very rich valuations of other big dividend payers like utilities stocks and REITS, they should increasingly look to the reduced risk and big dividend opportunities provided by many undervalued banks such as US Bancorp, in particular. You can read our previous updates and thesis on U.S. Bancorp here: