Closed-End Funds (CEFs): Huge Overlooked Yield...

The very safe Adam’s Diversified Equity Fund (ADX) pays a much bigger yield (7.8%) than sites like Google Finance report, and if you’re comfortable with a few caveats, then it’s a Closed-End Fund (CEF) that is absolutely worth considering. Further, this article highlights our top 3 high-income CEFs that income-focused investors may want to consider.

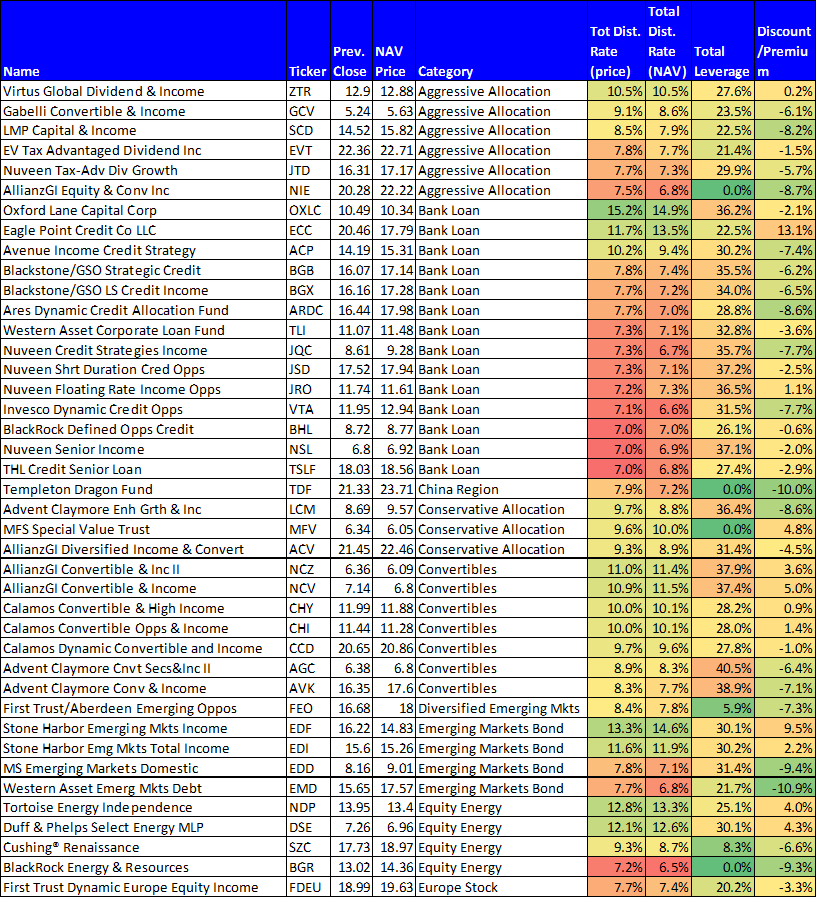

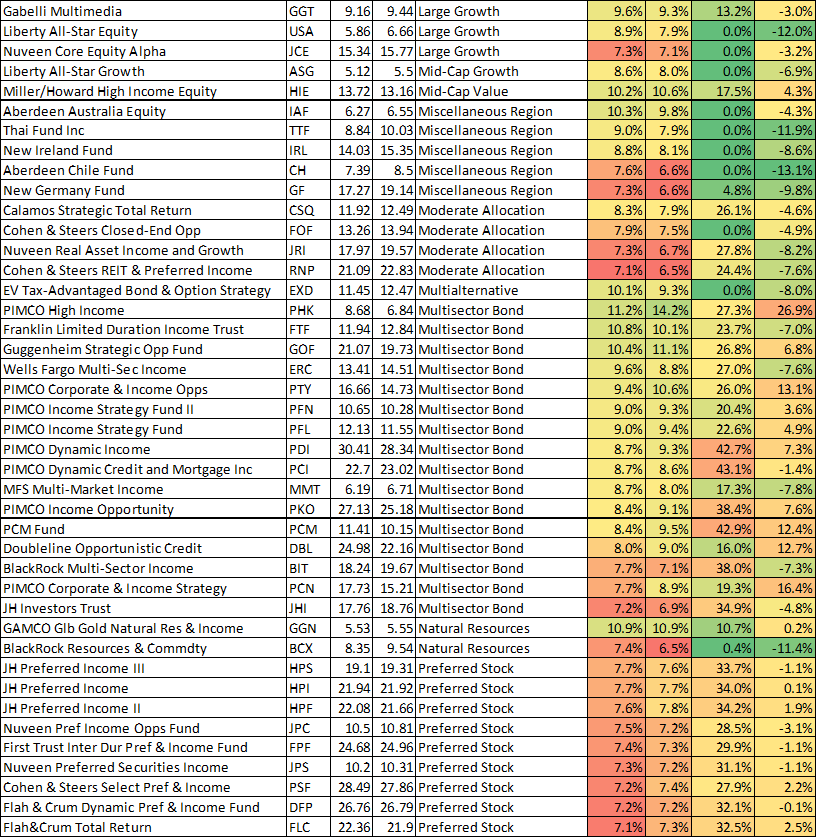

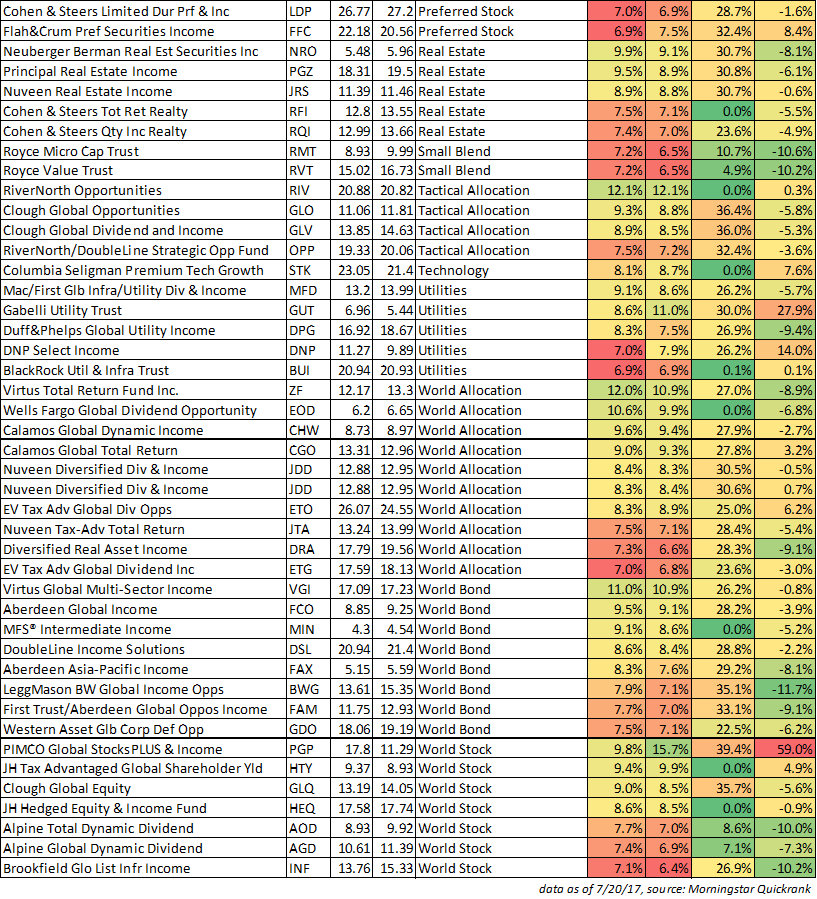

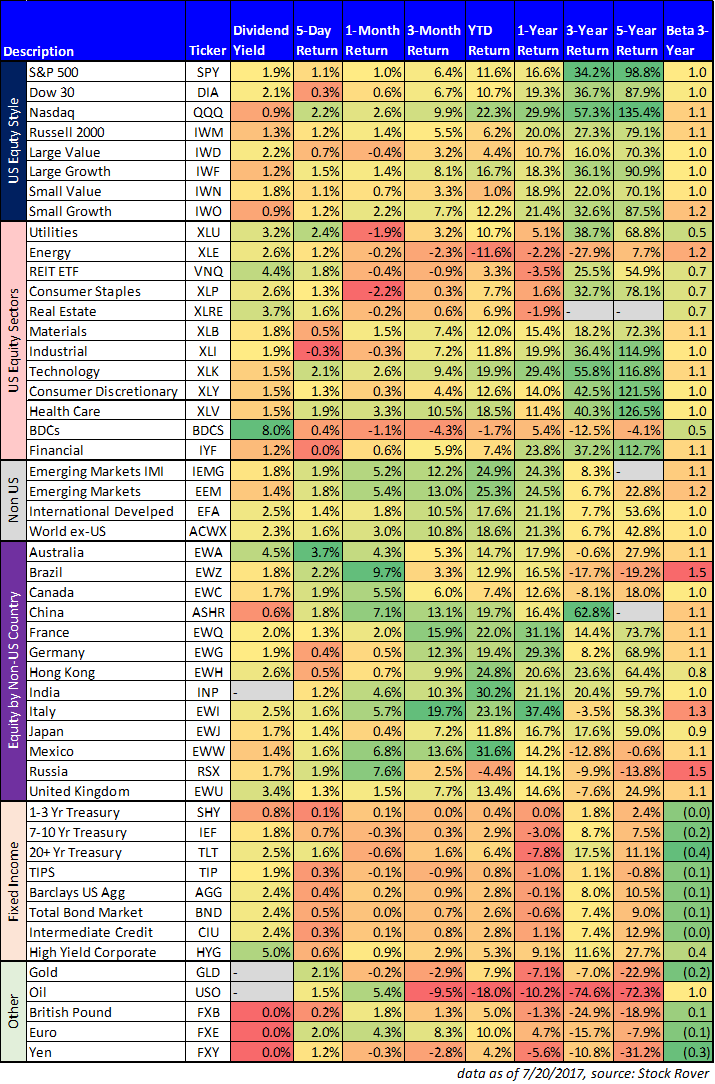

Before getting into ADX and our top 3 CEFs, the following table gives you a flavor for the types of high yield CEFs that are available (all the CEFs in the table yield at least 7%).

Our Top 3 CEFs (We own All 3)…

1. Adams Diversified Equity Fund (ADX), Yield: 7.8%

Adams Diversified Equity Fund is one of our favorite CEFs, and we own shares. However, a lot of potential investor don’t invest because they don’t realize the yield is actually as high as it is. For example, according to Google Finance, the Adams Diversified Equity Fund yields only 1.28%. However, Google is wrong.

In reality this fund offers investors a minimum 6% yield annually, and it’s usually even higher than that (it was 7.8% in 2016).

The discrepancy stems from Google’s procedure of reporting the most recent dividend payment (in ADX’s case, $0.05 per share, and then annualizing it. However, the ADX policy is to pay three smaller quarterly dividends in the first three quarters of the year, followed by a large dividend in the fourth quarter of each year. This policy is on display in the following historical ADX distribution table:

So the point here is that a lot of investors overlook ADX because they incorrectly believe the yield is small. In reality, the yield is quite large and quite attractive, in our view. In fact, we own shares of ADX, and if you are an income focused investor, we believe it’s worth considering. Here is some background on ADX, and a few things investors need to consider before investing.

ADX Overview:

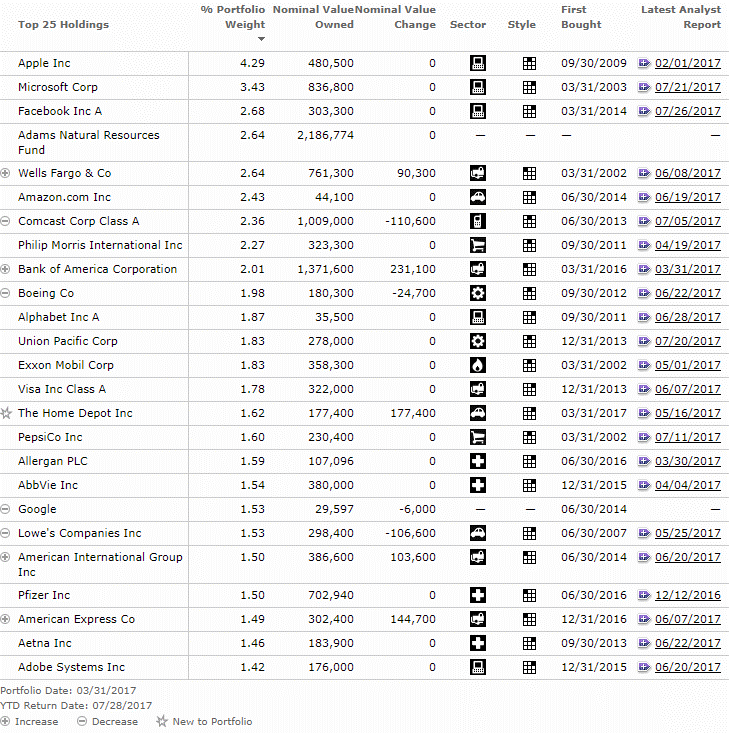

ADX is an internally managed CEF founded in 1929 and focused on generating long-term capital appreciation and committed to paying at least 6% in annual distributions to shareholders. The fund has broadly diversified exposure to large cap US equities, as shown in the following table.

And for your consideration, here are the recent top holdings.

The Yield:

As we mentioned earlier ADX pays a big distribution yield (7.8% in 2016, and committed to at least 6% every year). But we particularly like this yield because it is sourced mainly from capital gains and NOT from a return of capital, as shown in the following chart.

This is important because a lot of other less desirable CEFs actual support their dividends mainly by returning a portion (in some cases a large portion) of your own capital. Not only is this misleading to some investors, but it can also create a large unexpected tax bill when they sell their shares because on paper they have a much larger capital gain than expected. On the other hand, ADX does a fantastic job of managing its distribution in a way that is beneficial for shareholders.

The Discount/Premium:

Another critical metric CEF investors need to watch is the discount or premium at which it trades compared to the value of the investments that it holds (i.e. its Net Asset Value, or “NAV”). Unlike mutual funds and ETFs, CEFs can trade at a very wide discount or premium to their NAV. We like ADX because it currently trades at a large discount (as shown in the following chart), and that discount is a little larger than its historical norm which suggest to us that there is room for this fund to get a little extra boost to its returns if/when the discount dissipates and normalizes.

We like to buy CEFs trading at a discount to NAV because, in some sense, it’s like buying something on sale (why pay full price, when you can get it for less).

Leverage:

Another reason we like ADX is because it doesn’t use leverage. Specifically, a lot of CEFs borrow money (use leverage) to help increase their returns. Leverage can magnify returns in the good times, but it can also magnify losses in the bad times, and it’s a risk factor investors need to consider. ADX has been delivering strong returns to investors since 1929, and we like that it doesn’t use leverage.

Management Fees:

Ben Franklin said “a penny saved, is a penny earned,” and in the case of ADX we like that its management fee is very low for a closed-end fund at only 0.64% year. This is the amount you pay the fund’s high-quality management team to manage your investments and deliver big safe steady returns to you. We like that the ADX fee is relatively quite low.

2. Royce Value Trust (RVT), Yield: 7.3%

The Royce Value Trust (RVT) is another very high quality CEF that we really like, and we currently own shares.

RVT Overview:

For starters, RVT is the first small cap CEF (its inception date is in 1986). It’s delivered average total returns (dividends plus price appreciation) of 10.6% since its inception, and it currently offers a big 7.3% distribution yield.

RVT Yield:

In addition to being large at 7.3%, we also like the yield on this CEF because it is sourced responsibly from a combination of mainly dividends and capital gains (with an occasional return of capital) as shown in the following table.

RVT Discount to NAV:

Another reason we like this fund is because it currently trades at a discount to its NAV, as shown in the following table.

In our view, this is like buying the fund on sale, and it gives an added layer of price security and price appreciation potential. And worth noting, the small cap stocks in which this fund invests (as represented by the Russell 2000 small cap index in the following table) have underperformed large cap stocks this year, and from a contrarian standpoint we like that.

Over long-periods of time (e.g. 5-7 year market cycles) small cap stocks tend to outperform the rest of the market, and this is another reason we like this small cap CEF.

Leverage:

The total leverage ratio on RVT is currently only 4.9%, according to Morningstar. We like this because it is conservative and responsible. Even though leverage can increase returns in the good times, it can also increase losses (and cause all kinds of operational problems) in the bad times. We are comfortable with RVT’s low use of borrowed money (i.e. its low leverage ratio).

RVT’s Management Fee:

The Royce Funds, the company that manages RVT, has a reputation in the industry for top quality management. The founder of the company (and manager of this fund) Chuck Royce has a long track record of success as an investor. Further, we like that the management fee on this fund is only 0.62%, extremely low for a closed-end fund, especially a small cap CEF of this caliber.

3. Royce Micro-Cap Trust (RMT), Yield: 7.4%

Similar to the Royce Value Trust (RVT) we also like the Royce Micro-Cap Trust (RVT) for many of the same reasons. However RMT gives a slightly different type of market exposure by investing in the often long-term lucrative micro-cap (very small company) section of the market. Specifically, this fund focuses on investing in companies with market caps below $300 million (i.e. very small micro caps).

RMT Yield:

The yield on this fund is also attractive, currently at 7.4%. Micro cap companies don’t generally pa dividends anywhere this high, so a portion of the yield is sourced from capital gains (and in some quarters a return of capital) as shown in the following table.

It’s important for investors to understand these sources of distribution yield because anytime a fund uses capital gains to help fund the distribution that means the investor will have less capital invested in the fund (assuming they keep the dividend instead of reinvesting). Also worth noting, we like that the holdings of this fund are tilted towards value stocks (instead of growth stocks) because value stocks (particularly small and micro-cap value stocks) tend to perform better than the rest of the market over the long-term.

RMT Discount to NAV:

Like the other funds we’ve covered so far, RMT also trade at an attractive discount to its NAV as shown in the following graph.

And again, we prefer to buy funds trading at a discount to NAV because it’s like buying something on sale. Conversely, we’d be nervous to buy any closed-end fund at a large premium because it suggests that if the price moves back towards its actual NAV we could end up with a larger loss, something we obviously try to avoid.

RMT Leverage:

The leverage ratio (borrowed money) on RMT is currently 10.78%. This is higher than the other funds we have reviewed so far, but it is still relatively low compared to the many other CEFs that often use as high (or higher) than 30% leverage. In our view, 10.78% leverage is relatively low-risk for a CEF.

RMT Management Fees:

The total fee on the Royce Micro Cap Trust is only 1.02%. An d while this is slightly higher than the other funds we’ve reviewed so far, it is still very low for a CEF (many CEFs charge around 2%). Plus, this asset class (micro cap) is generally much more expensive (from a management fee standpoint) so RMT is particularly inexpensive, in our view.

Honorable Mention:

Tekla World Healthcare Fund (THW), Yield: 9.4%

Current income and long-term capital appreciation. Those are the objectives of the Tekla World Healthcare Fund. Approximately 98% of this fund’s holdings are in the healthcare sector, and that’s a decent bet to make considering the sector could soar if/when we get more clarity out of Washington DC on the Affordable Care Act. Healthcare has underperformed the S&P 500 significantly over the last year, and from a contrarian standpoint the sector is worth considering.

THW Yield:

The yield on THW is currently an attractive 9.3%, and it consists of a combination of dividends and capital gains (the fund also uses a reasonable amount of “return of capital” to support the yield, as necessary) as shown in the following table.

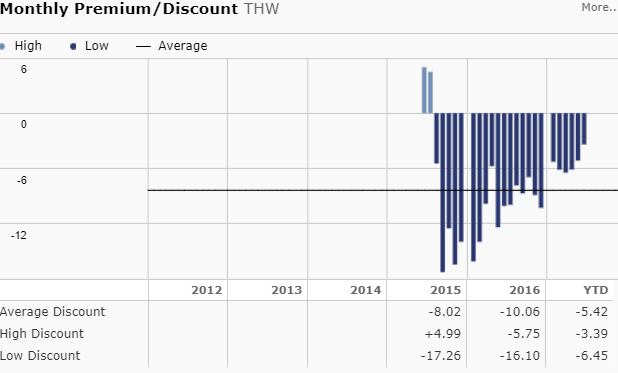

THW Discount

THW currently trades at a discount to its NAV (which we like), as shown in the following table.

We purchased shares of THW earlier this year when the discount was greater. And it is the fact that the discount has shrunk in recent months that makes this fund only an “honorable mention” instead of ranked higher in our top 3. However, the fund still does trade at an attractive discount. And if you’re not comfortable purchasing it now, it’s absolutely worth adding to you watch list. Again, we own THW, and we like its total return potential (dividends plus capital gains) going forward.

THW Leverage:

THW has a 19.9% leverage ratio, which is higher than the other funds in this report, but still not as high as many of the other CEFs that are available. This leverage can increase returns, but it also increases risk. We are comfortable with the fund’s use of leverage, especially considering we own the shares within a diversified portfolio.

THW Management Fee:

The total expense ratio for this fund, according to Moringstar, is 1.47%. Again, this is highr than the other funds lited in this report, but it is still ery competitive for a CEF when compared to the larger universe which often charges 2% (or more) in expenses. THW’s management fee is reasonable, and highly competitive.

Final Thoughts:

The big yields offered by CEF make them a favorite choice among many income focused investors, but there are pros and cons. For example, some CEF’s pay distributions monthly, while others pay quarterly. And in the case of ADX, it pays three small distributions followed by one big one at year end (this is one of the negatives about ADX) for many investors. Further, CEF fees tend to be higher than ETF fees, but then ETF generally don’t pay anywhere near as high in the yield department (plus CEFs are actively managed). And of course leverage (borrowing) is a risk factor. And further, investors must pay close attention to the discounts and premiums at which CEFs trades because if they’re not careful they can get burned (i.e buying in at a big premium, and then being forced to sell at a discount, for example). We believe the specific CEFs highlighted in this report (ADX, RVT, RMT and THW) are all particularly attractive for income investors, and we currently own all four of them.

You can view all of our current holdings here.