ABB Ltd is an attractive, big-dividend (4.3% yield), industrial automation company that operates out of Switzerland and trades on the New York Stock Exchange. And the options market is currently offering some very attractive premium income on the shares thanks to an unsurprising dose of shortsighted market participants. This report explains why we like the company and why we like the trade. More specifically, we believe this is an attractive trade to place today, and potentially Tuesday and/or Wednesday, as long as the share price doesn’t move too dramatically before then.

The Trade:

Sell PUT Options on ABB Ltd (ABB) with a strike price of $17.00 (6.4% out of the money), and expiration date of November 15, 2019, and for a premium of $0.30. That’s an extra 21% income for us on an annualized basis (0.30 / 17.00) x 12 months). If the shares get put to us before the options contract expires then we're happy to buy the shares of this big dividend yield (4.3%) industrial automation company at the lower price of $17.00. And if the shares don't get put to us, we still get to keep the extra income we generated no matter what.

Your Opportunity:

We believe this is an attractive trade to place today and potentially Tuesday (and even Wednesday) as long as the price of ABB doesn't move too dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 15% to 20%, or greater.

Our Thesis:

As we mentioned in our previous full report on ABB:

“The current valuation is attractive (we expect multiple expansion and earnings growth), the company has significant competitive advantages, and it generates tons of cash to support its growing dividend payments, attractive share repurchases and important capex.”

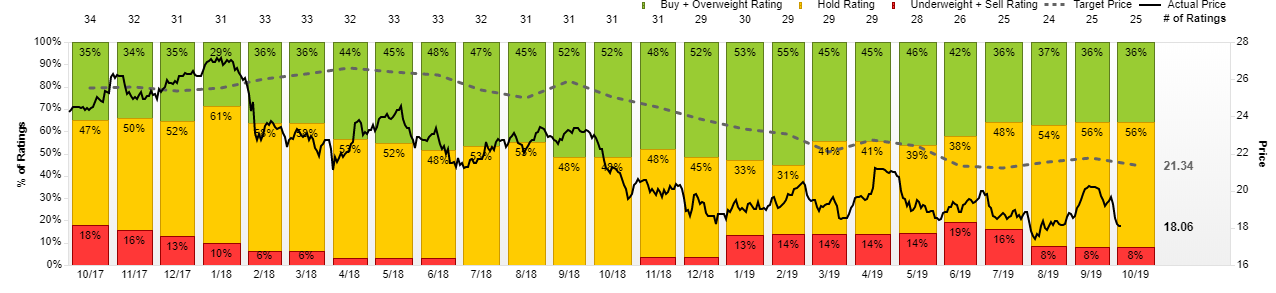

In fact, since we wrote that full report earlier this year, ABB’s business has continued to improve, and the shares continue to be highly attractive, but the market continues to view the shares through too shortsighted of a lens. For a little perspective, here is the average Wall Street Analyst price target and recommendation for the shares (i.e. they think the shares have 18% upside versus the current market price, and more than 25% upside versus the strike price on our put). We believe over the long-term these shares have even much great upside than these Wall Street estimates.

Since our last full report on ABB (link above), the company has been working to position itself better for future growth and profitability. For perspective, according to the most recent quarterly earnings call:

“In the Americas, total orders grew 7% in comparable terms. All of our businesses were up, led by strong growth in Industrial Automation, Robotics & Discrete Automation and Electrification. Orders continued to grow in the United States, our largest market, while developing very well in South America.”

However, the market seems to be incorrectly reacting negatively to short-term operational activities, causing the share price to temporarily decline and thereby making the share price more attractive to long-term investors, in our view. For example, according to the call:

“Cash flow from operating activities was 0 compared to $1 billion in the second quarter of '18. This primarily reflected the timing of employee incentive payments, which were paid in the second quarter this year, while in 2018, they were paid in the first quarter. It was further affected by less favorable movement in accounts payables compared to the same period last year.”

Despite these short-term dynamics, this company continues to generate powerful long-term cash inflows, thereby contributing to the attractiveness of the shares.

Nonetheless, continuing short-term interpretations have caused these attractive shares to sell off moderately (as you can see in the chart below), and this makes for an attractive income-generating opportunity because the premium income available in the market generally goes up when volatility goes up.

In particular, the premium income available on this trade is bigger than normal (especially for a relatively steady big-dividend industrial stock) thanks to recent volatility.

Important Trade Considerations:

Two important considerations when placing options trades are upcoming earnings announcements and dividend dates because they can increase volatility and dramatically impact the value of your options contract in unexpected ways. And in the case of ABB, only the next earnings announcement is a big factor for this trade. Specifically, isn’t expected to go ex-dividend again until after this options contract expires, however it is expected to announce earnings later this month on October 23rd (i.e. before this options contract expires). It there are any big surprises in that announcement, it could impact the results of this options trade, however considering the relatively large income we’re generating for this trade, we are comfortable with the additional volatility risk of the earnings announcement.

Cash Secured Or Margin:

If you're going to place this trade, you'll need to keep enough cash in your account to cover the cost of the shares if they do get put to you. Options trade in lots of 100, so you'll need too keep at least $1,700+ of cash on hand for each contract trades ($17.00 strike price times 100 shares). The other alternative, if your account is approved for margin, you don't need to keep the cash on hand, but if the shares do get put to you then you'll buy them with borrowed money (on margin), and there is a cost to that (currently around 2.7% annual interest charge at Interactive Brokers, for example).

Conclusion:

ABB is an attractive steady income producer and big dividend payer. If you’d like to buy the shares straight up—that’s probably not a bad idea (we currently own some shares). However, if you’re nervous about a potential market pullback, and you’d prefer to pick up shares at an even lower price, then selling these income-generating put options is currently attractive. Specifically, selling the puts allows you to generate big attractive upfront income now (that you get to keep no matter what), and the big risk is that the shares will be put to you (you’ll have to buy them) at $17.00, which is lower than the current market price. And we’d be happy to own shares of this attractive big dividend payer, as a long-term investment, especially at a lower price of $17.00 per share.