If you are an income-focused investor, you might be interested to know intermodal shipping container company, Triton International (TRTN), just issued some very attractive new 8.5% yield preferred shares this week. And as many of our readers know, we’ve written about the common shares of Triton, and we’ve also had a success selling income-generating put options on the common shares over the last year. But if you’re looking for high steady income (and less volatility) than the 6.5% yield the common shares offer, consider this before you jump headfirst into these compelling new 8.5% yield preferred shares.

To cut right to the chase, we like the preferred shares. Unlike the common shares, the preferreds offer essentially zero long-term price appreciation potential (their par value is $25 per share, and they’re callable by Triton starting in 2024), but maybe you only care about the big steady income and not price appreciation. In the case of Triton, it really comes down to what you’re seeking: more steady income (i.e. the preferreds) or more volatile price appreciation potential (i.e. the common shares). For your consideration, we have highlighted our Triton thesis (and additional important information) below.

Thesis:

Triton is a leader in its industry, it continues to grow, it’s in a healthy cash position, and its valuation is attractive (management agrees with us considering they’re buying back shares). So what gives?... The market is fearful due to uncertainty surrounding the US China Trade Skirmish (and the potential for new tariffs) as well as the volatile price of steel and aggressively priced containers from the competition. But the good things outweigh the risks, in our view, as we will cover below.

The New Preferred Shares:

For your consideration, here is the skinny (below) on the new preferred shares issued this week. Some of the key points are they pay 8.5% (quarterly), they still trade close to par (they’re actually trading just below $25), they’re callable by Triton starting in 2024. Also, the preferred shares rank senior to the common stock, but junior to all of Triton’s debt.

Triton is a Leader in its Industry:

If you don’t know, Triton engages in the acquisition, leasing and sale of the intermodal shipping containers and equipment that you see on ships, trains and trucks. Publicly traded peer companies include Textainer Group Holdings (TGH) and CAI International (CAI), however Triton in the biggest and benefits from economies of scale.

Triton Continues to Grow:

Also importantly, Triton continues to grow its fleet, its earnings and its cash flow. Per CEO Brian Sondey on the most recent quarterly earnings call:

“For the full-year of 2018, Triton generated $363 million of adjusted net income or $4.52 per share an increase of 63% from 2017, our return on equity was 16.7% for the full-year. Our strong financial results and 2018 were driven by favorable market conditions and outstanding operational performance. And we continue to leverage our scale, cost, supply and operating capability advantages to go faster than our market, while also driving industry best investment returns.”

And for reference, here is a look at some historical and street estimates of earnings per share, which continues to head in the right direction.

Further still, Triton’s book value per share is also growing.

Triton Common Shares Trade at an Attractive Valuation:

Currently, Triton’s common stocks trades at an attractive valuation, and we currently own the shares. For example, here is a valuation summary and Triton is currently trading at an attractive price relative to a variety of valuation metrics.

Further still, Triton’s compound annual growth rate continues to be attractive as shown in the table above. And Street analysts like the shares, estimating they have at least 27% upside from here, and potentially significantly move over the long-term as the global economy (and trade) continues to grow.

Also, here is a recent historical look at Triton on various valuation metrics, reflecting it is relatively attractively priced now.

Triton is in a Healthy Cash Position:

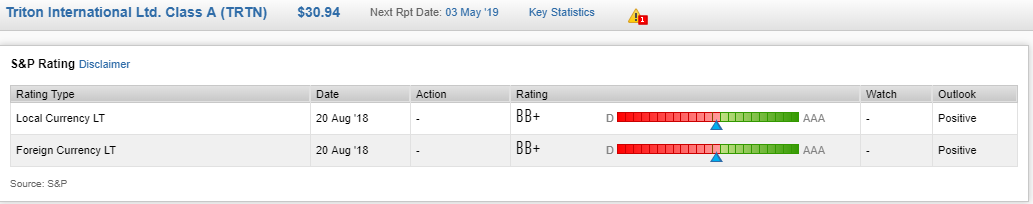

Also important to note, Triton is in a healthy cash position. For example, they were recently given a positive outlook on their BB+ credit rating from S&P.

However, to be clear, there are risks to this business, and that’s why the yield are so high in the first place. For example, here is a look at Triton’s uses of cash (below) and as you can see, most of it goes for servicing debt.

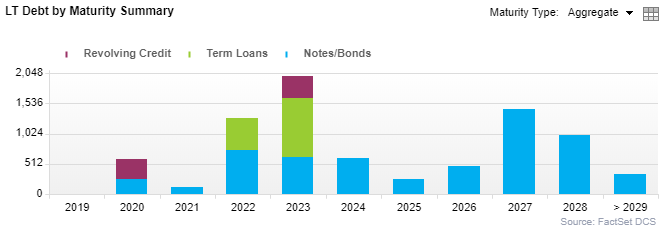

And for reference here is a look at the debt maturity schedule:

It’s an encouraging sign that Triton was recently able to raise more capital in the market by issuing the new convertible shares (it suggests investors have confidence that Triton will pay). And it’s also encouraging that Triton is repurchasing its own shares. Specifically, Triton repurchased roughly 2.4% of its shares outstanding in 2018. Also interesting to note, CEO Brian Sondey owns shares and has recently increased his position, as shown below.

The Risks:

Of course there are risks to investing in Triton, that’s why the yield is high in the first place. For example, the risk of deteriorating trade conditions and new tariffs between the US and China have investors frightened because that would reduce international trade thereby hurting Triton’s business. According to the company’s most recent earnings call, and with regards to 2019, Triton had this to say:

“But I think the confidence around just what to expect for the year is lower because of the uncertainty from that - the direct uncertainty and what the U.S. China trade dispute might do to, tariffs and trading volumes, and then I think the indirect uncertainty about what it does to a business investment and the economy in general.”

Another risk to consider is the price of steel and its impact on the price of intermodal shipping containers (i.e. Triton’s business). For example, according to Triton’s earnings presentation:

“New container prices have dropped to the $1,700 range reflecting a decrease in steel prices and aggressive manufacturer competition for a limited number of slow-season orders.”

Further price deterioration and competition pose risks to Triton’s business. However, Triton’s leasing business has multiyear contracts which helps reduce the negative impact of near-term pricing volatility pressures. According to Triton’s most recent earnings presentation, the company’s…

“lease portfolio provides strong protection against seasonal and cyclically slow periods, and utilization remains well over 97%.”

Yet another risk is Triton’s debt load. Despite the fact that Triton’s current cash position is strong (as we reviewed earlier) a prolonged downturn in business could create increased pressures on the company’s liquidity.

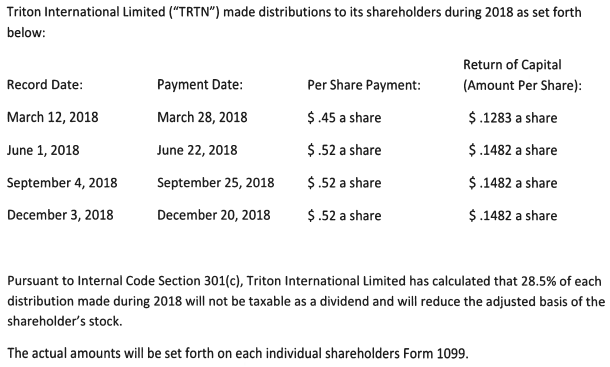

One additional risk, or at least important consideration to keep in mind is that a portion of Triton’s dividend has been classified as a return of capital, as shown in the table below. This impacts your cost basis, and the timing and type of taxes you’ll pay on the dividend.

Conclusion:

Despite the risks, we believe Triton’s business is attractive, and so are the newly issue 8.5% yield preferred shares. In fact, we believe that the preferred shares demonstrate Triton’s ability to access the capital it needs to run its business which bodes well for the common shares too. The yield on the preferred shares is high, and the price of the common shares is low, because the market is uncertain and afraid of what a prolonged US China Trade War might do to hurt international trade and to hurt Triton’s business. In our view, it would take a serious escalation of tariffs and potential embargos to make Triton unattractive at these levels, and we believe cooler heads are much more likely to prevail. We like both the common and preferred shares of Triton, and depending on your tolerance for volatility and your need for steady income—you may want to consider investing in Triton too.