If you haven’t heard, market volatility spiked last week and the yield curve inverted—a red flag many investors consider an ominous recessionary warning. And while current conditions almost certainly spell imminent doom for many investors, this article shares our top 10 ideas for investors to quickly adjust their portfolios to profit from the current market turmoil.

1. Buy and Hold is Dead:

The constant drumbeat of “buy and hold” investing just doesn’t work anymore. Considering all the technologies, tools and trading strategies we have available right at our fingertips there are far better and quicker ways to profit. The following graphic about famous value investor Seth Klarman telling everyone to follow the same strategy because “the returns will [eventually] come” is nuts. He is just trying to prevent people from withdrawing assets from his firm.

2. Value Investing Is Dead:

We are constantly inundated with the propaganda of value investing from millions of Warren Buffer, Benjamin Graham and Seth Klarman disciples. Well guess what, here is a chart of value versus growth stocks over the last decade. Growth is killing value. Value Investing is absolutely dead.

3. Timing the Market Is The Best Way to Win!

Sure there are expensive implicit and explicit trading costs, psychological errors, cash drag and the risk of just being wrong, but timing the market is still a far better strategy than just sitting on your hands and doing nothing. Especially if you’ve been around long enough and have the experience to see the obvious. For example, it doesn’t take a rocket scientist to see our market was overheating, and the China Trade War and the Fed’s tomfoolery were absolutely going to cause this most recent sell off. We were obviously due!

4. Hedge Funds Are The Smart Money:

If you recognize the smart money exists, and you are smart enough to recognize you don’t personally have the skill or resources to implement complex winning strategies, then hedge funds are virtually always the smart way to go, especially if you select wisely. Sure the fees are usually higher, but it’s worth it have fearless and experienced ivy league leaders at the helm. They don’t usually let dummies into Wharton.

5. Passive Investing Is Absurd:

Buying and holding everything in the S&P 500 through an indexed ETF is like riding an F-16 fighter jet with no pilot. When times are good, simpletons mistake beta for alpha. And then in good and bad times, smart money is constantly front-running telegraphed index rebalances at the expense of the dumb money index participants.

6. Everyone Needs a Full Service Advisor:

With the emergence of the fiduciary rule, and the growing prominence of Finra and the CFP board, you’d be crazy not to have someone managing your money for you. Fees really aren’t that high for what you get, and in this day and age of course they’re always acting in your best interest. Caveat emptor be gone.

7. Predicting Market Sell Offs Is Easy:

They say hindsight is 20-20, and if you do an internet search it becomes obvious there are many very loud voices out there that have correctly predicted every single sell off in recent market history. Does it really matter if they also predicted hundreds more that never happened? Better safe than sorry.

8. There is Such Thing As Riskless High Returns:

They’re called arbitrage opportunities and they pop up all over the place. The market gets emotional and irrational all the time, and some things are not just good bets--they’re sure bets. You just have to work hard, be passionate about the markets, and do your homework. George Soros did break the Bank of England. And Long-Term Capital Management was a bunch of dummies.

9. Diversification is for Dummies:

When you find a good investment, of course you should go all in. We’re not saying 100% of your next egg in a single stock, but what’s wrong with 30 to 40%? You don’t want to be a closet index fund. Keep your active share high!

How Not To Invest: 7 Deadly Sins of Long-Term Investing

10. Asset Allocation Is For Suckers:

For example, Target Date Funds… Do you really want a bunch of academic types with little real world experience telling you what types of things you should be invested in? Asset Allocation and goal-oriented investing is totally irrelevant when exceptional opportunities pop up like they have been over the last week. Sometimes (like our recent bout of market volatility) it’s okay to ditch your long-term goals to chase after a rare time-sensitive market opportunity. How else are you going to win!

The Bottom Line:

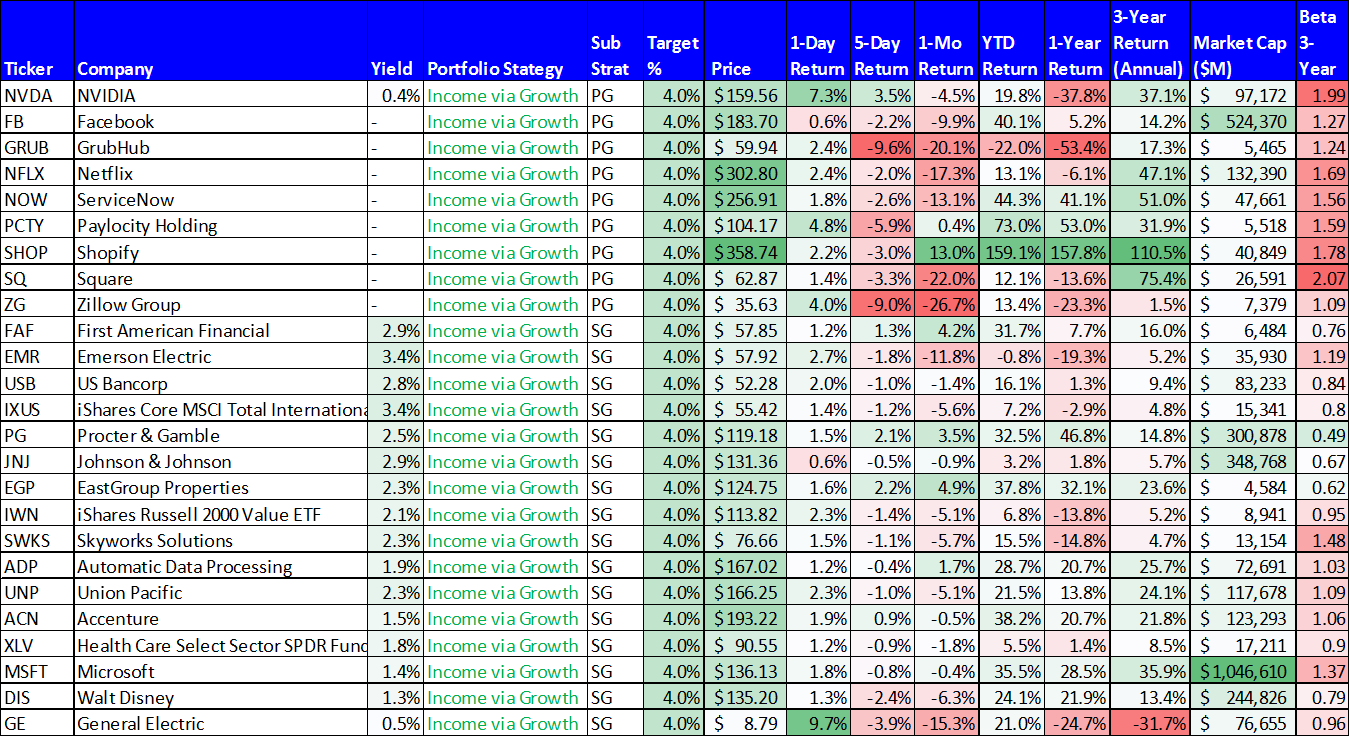

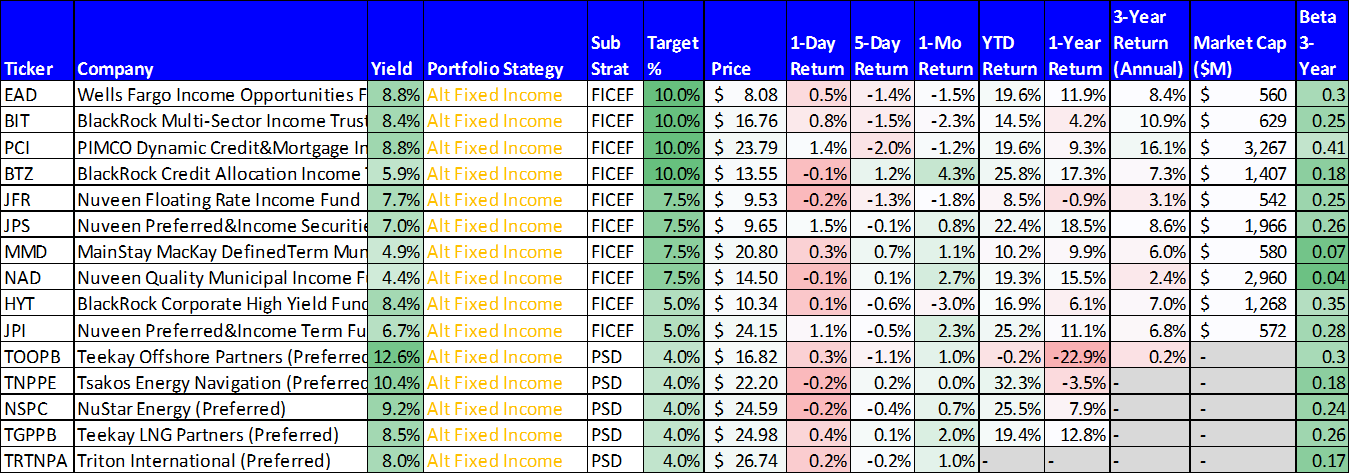

If you haven’t already guessed, this top 10 list is an attempt at satire. However, the tweets are a selection of a few of the best ones we saw on Twitter this past week. Our long-term, goal-oriented investment portfolios continue to perform well, and we’re keen on not making any of the ridiculous mistakes described above. Recent performance for each holding within each of our portfolios is listed below.

Data as of Friday’s close 8/16/19. Source: Stock Rover

Data as of Friday’s close 8/16/19. Source: Stock Rover

Data as of Friday’s close 8/16/19. Source: Stock Rover