Investors have been bemoaning the extended rally by growth and momentum stocks for years considering value has been meaningfully underperforming (value stocks are still up a lot, just not as much as growth). However, there’s been a significant market style rotation going on in recent weeks whereby the fastest “revenue growers” have sold-off hard. Pundits have also recently been obsessed with the idea of a coming recession, and view the rotation as the beginning of the end (or as chicken little would say, “the sky is falling.”) This week’s Weekly reviews the rotation, identifies attractively priced opportunities, and shares some common sense wisdom on the current market environment.

Review: Last Week’s Blue Harbinger Weekly…

Last week we reviewed the competing views between the US Fed Vs the President on Interest Rates. We noted that low rates punish savers, but high rates punish the US government because it must pay more interest on the money it borrows by selling Treasuries, especially as compared to many other countries which actually have negative interest rates.

This Week…

For perspective, the following chart shows that Growth stocks (Russell 3000 Growth) have been performing much better than Value stocks (Russell 3000 Value) in recent years.

However, more recently, here is one visualization of the recent powerful stylized market rotation that’s been going on. The following table shows how the top 25 performing stocks this year with strong sales growth (between 20% and 80%, this year and next) have sold-off very hard over the last week, especially versus the S&P 500 (SPY) which was up over the last week. And much of the media punditry is suggesting this rotation is yet another recession warning (in addition to the inverted yield curve we’ve been hearing about so much lately)

In reality, absolutely no one knows when the next recession is coming, and investors are far better off simply picking good investments that match up well with their investment goals, instead of trying to time stylized market moves (which in reality is a fool’s errand).

For example, one stock we like (It’s a growth stock) that has sold off hard over the last week is payment/payroll processing company Paylocity (PCTY). We’ve actually owned this one in our Blue Harbinger “Income Via Growth” portfolio for several years, and it has served us very well (it’s up a ton). And we believe Paylocity continues to have more upside from here based on its great business (sales are growing like wildfire because Paylocity’s cloud-based solutions are better and cheaper than stalwart ADP, and they are less expensive, and the business is very sticky—it has a high renewal rate). We also think the recent Paylocity sell-off (thanks to the stylized sector rotation) has created an attractive buying opportunity.

Importantly however, only buy/own stocks that are consistent with your long-term investment objectives (don’t buy 100% Growth Stocks like Paylocity if your goal is to generate dividend income with lower volatility. And if you are looking for high dividend income with lower volatility, here are a few ideas we have written about recently, that you may want to consider:

And in addition, we’ve shared a few more very attractive durable income stocks (that have recently sold-off, and are now trading at attractive lower prices) with our members. We share specific examples and full reports/write-ups in the members-only part 2 version of this weekly report (see link below). We also share an update on all of our recent holdings as well as a few more investment ideas that are specifically attractive “buys” right now.

Important Takeaway:

The bottom line here is that it’s a far better strategy to pick attractive investments that are consistent with your long-term goals, than it is to try to time stylized market moves (trying to time the market truly is a fool’s errand). If you can’t handle the threat of a recession and/or market sell-off, then don’t put all of your nest egg in volatile stocks. Prudently-diversified, goal-oriented, long-term investing has proven to be a winning strategy over and over again throughout history. Don’t let the media punditry’s recession obsession scare you into making dumb mistakes. Know your goals. Stick to your plan. It’s a proven strategy for success.

Blue Harbinger Weekly (Part 2):

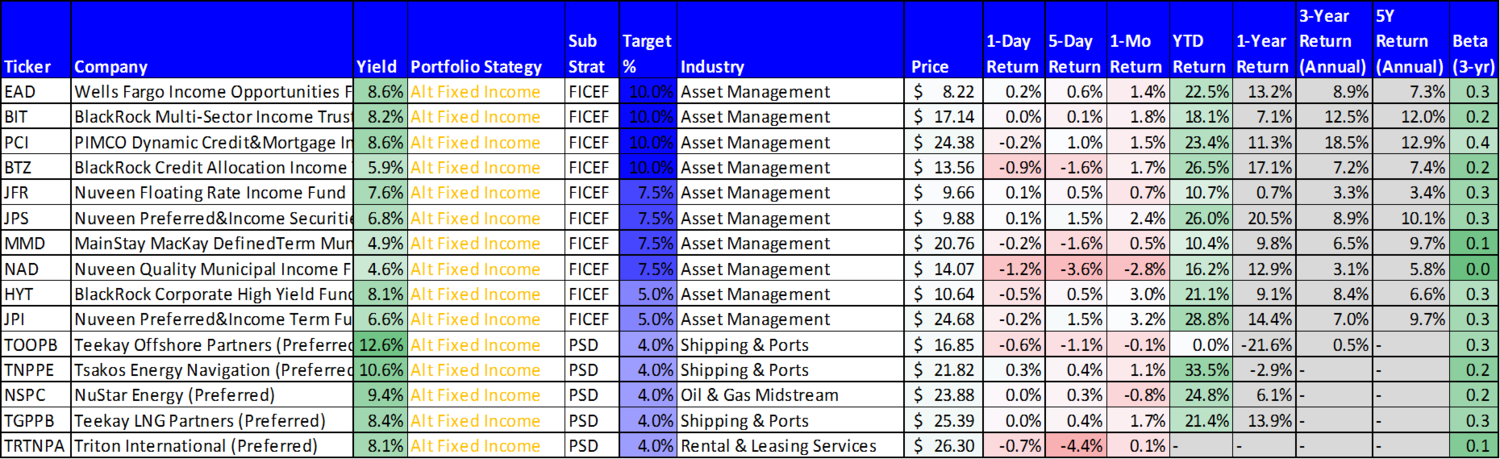

Part 2 of this week’s Weekly shares the performance of all of our recent holdings, and our watch list (The Contenders). We also share a several very attractive “members-only” investment ideas, especially considering their recently discounted prices.

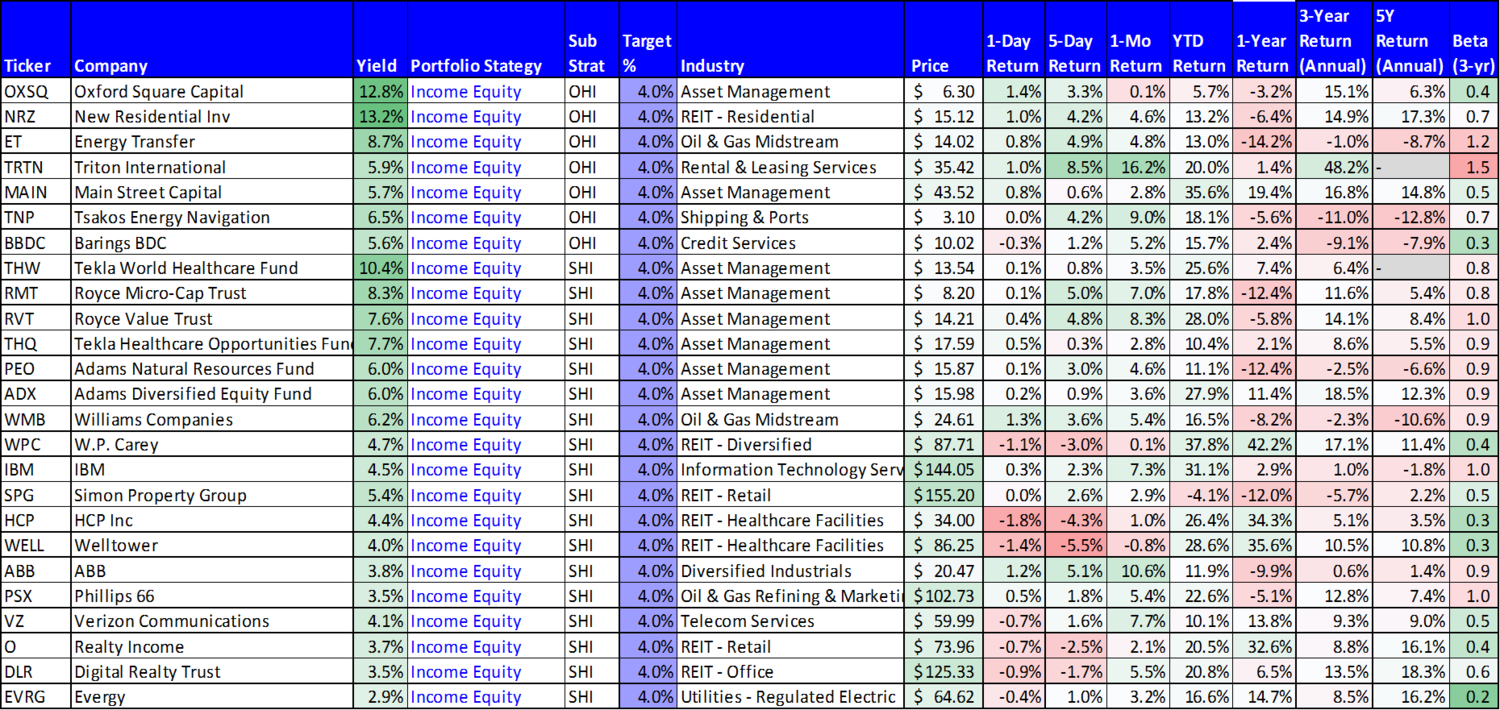

For starters, here is a look at all of our recent holdings, including how they’ve performed over the last week:

And here is a link to an Excel version of this file that includes the names on our watch list (the contenders) as well.

Attractive Opportunities: Adding and Rebalancing Selectively:

One thing that stands out about our current holdings list is that several of the names in our “Income Via Growth” portfolio got caught up in the recent “high sales and momentum” sell-off that we reviewed earlier in this report. Specifically, we like (and own) shares of Paylocity, ServiceNow, Shopify and Square, and they all have sold-off hard over the last 5 trading sessions, and we believe this makes for an increasingly attractive buying opportunity, so long as these “Income Via Gowth” names are consistent with your long-term investment objectives and strategy. We’re not at all advocating that you ditch your long-term strategy to just start haphazardly buying and selling names. However, if you have extra cash on hand, or if you are due to rebalance the weights of your current holdings, now may be an attractive time to add more of one (or more) of these names.

As mentioned earlier, no one knows if, or when, the next recession or big market sell-off is coming. And it’s a fool’s errand to try to predict it. Instead, you’re better off selecting attractive individual investments (that are consistent with your goals) and then holding them for the long-term. As we have written about in the past, PCTY, NOW, SHOP and SQ are currently attractive, especially after getting caught up (“babies thrown out with the bathwater”) in last week’s style-driven sell-off.

What’s Been Working:

All of our strategies continue to put up impressive growing long-term performance track records, however, a few names have been standouts recently. For example, Triton (TRTN) has had a great week and month, Nvidia has had a great month (after the over fearful China trade war mongers caused it to get way too cheap relative to it’s long-term value), and Grubhub (GRUB) has done well over the last 5-days (as we’ve written in the past, Grub continues to be significantly underpriced relative to its long-term value).

Members-Only Reports

Also, here is a list of our recent members-only reports that we consider attractive:

Energy Transfer's 8.8% Yield: Solid Income Potential? Improving Fundamentals?

Royal Dutch Shell: Stable Dividend (6.7% Yield) in a Volatile Sector?

Options Trade: WP Carey REIT, Attractive Income

Also, as some readers are aware, outside of Blue Harbinger, I help an old graduate school classmate run an investment firm, and he’s recently launched a new investment service (with my help). You can read more about that here: Left Brain Investment Research. I encourage you to follow Left Brain, as there are plenty of additional good (albeit slightly different) investment ideas there.

The Bottom Line:

The media pundits continue to be obsessed with a recession that they actually want to come. The media knows that when the markets get more volatile, they get more listeners and readers, and that helps them sell more advertisements. The media is absolutely not acting in your best interest as an investor. Do your best to ignore their sensationalized fear-driven stories, because no one knows when the next recession or big market sell-off is coming (especially the media). Don’t let the media frighten you into making dumb investment mistakes. Instead, stick to your prudently-diversified, goal-oriented, long-term investment strategy. This is what has proven to work, over and over again, throughout history.