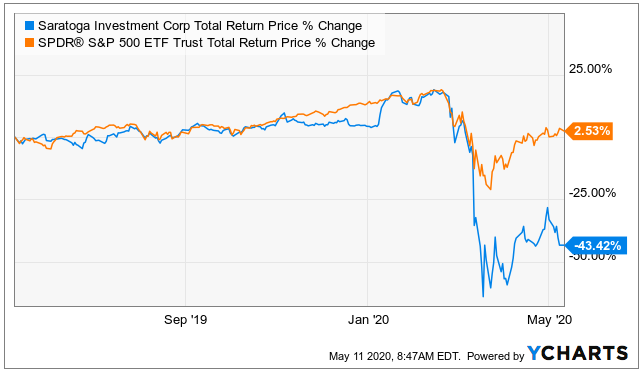

We are sharing a new options trade that generates high upfront premium income. Business Development Company (“BDC”) Saratoga Investment Corp (SAR) (they provide financing to small middle-market companies) was recently firing on all cylinders, but has decided to proactively defer dividend payments to shareholders as a result of the coronavirus. We believe the trade highlighted in this article is an attractive one to place today, and potentially over the next few days, so long as the underlying stock price doesn’t move dramatically before then.

The Trade:

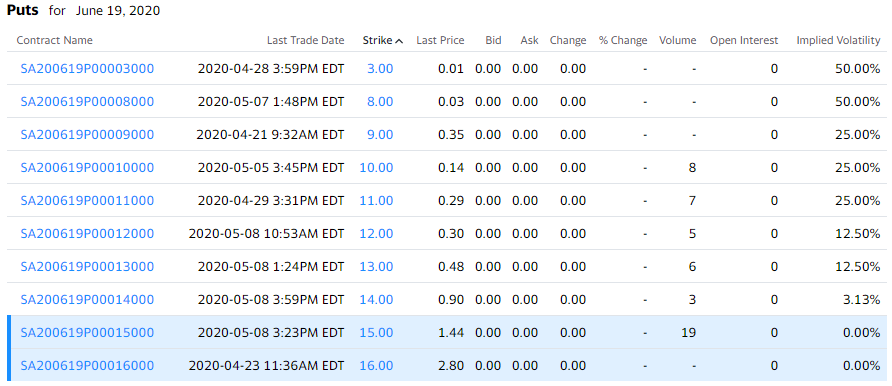

Sell Put Options on Saratoga (SAR) with a strike price of $13 (10.3% out of the money), and an expiration date of June 19, 2020, and for a premium of at least $0.40 (this comes out to approximately +36% of extra income on an annualized basis, ($0.40/$13 x (12 months, annualized). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of SAR at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own SAR, especially if it falls to a purchase price of $13 per share—see our full SAR report link below).

Note: If you want higher upfront income, and a higher chance of having the shares put to you, consider selling the $14 puts instead.

Your Opportunity:

We believe this is an attractive trade to place today and potentially over the next few days as long as the price of SAR doesn't move too dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 30% or greater.

Our Thesis:

Our thesis is basically that SAR will survive this pandemic recession, and come out healthy on the other side because it was healthy going into the pandemic and it is wisely and proactively preserving cash temporarily, which many of its peers will not (because they’ll stubbornly stick to their dividends). No one likes a temporary dividend deferment, but the long-term total return potential (future dividends plus price appreciation) is attractive. We like that SAR has two Small Business Insurance Corp licenses, which will help it whether the storm better than peers. Further, the deferment may help preserve liquidity so SAR can be more opportunistic when other BDCs don’t have enough liquidity. Basically, if you like generating upfront income—the premium on this trade is very attractive!

You can read our previous full report on Saratoga here:

Please also keep in mind, options contracts trade in lots of 100, so to secure this trade with cash (in case the shares get put to you and you have to buy them) you’ll need to keep $13 times 100 on hand (the strike price times an options contract lot of 100). You’ll also need to be comfortable holding that many shares in your account from a position-sizing / risk management standpoint.

Important Trade Considerations:

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the price and thereby impact your trade. In this particular case, they are both largely a non-issue because SAR won’t announce again after this contract expires, and it won’ go ex-dividend again until after this contract expires (the dividend has been deferred). Had either of these events been scheduled for before this options contract expires, we’d need to be comfortable with the added risks (i.e. we’d need to receive more upfront premium income on the trade).

Conclusion:

SAR is an attractive BDC that was recently firing on all cylinders (per its latest earnings report), but has decided to proactively defer its dividend because of the coronavirus. We believe this is a wise move, and Saratoga will come out of this pandemic healthy. We believe SAR presents an attractive long-term investment opportunity at its current price, however if you’re uncertain about pulling the trigger on a normal buy order, you might consider this trade instead. It allows you to generate attractive upfront income that you get to keep no matter what. And this options trade also gives you a chance of picking up shares of this attractive long-term BDC at an even lower price, if the shares fall even further than they already have, and they get put to you at $13. And at a price of $13, SAR is an extremely attractive long-term investment.