We wrote about the attractive, yet somewhat speculative, opportunity in this newly public stock just over 1-week ago, and the shares have surged more than 50% since that report (i.e. they’ve climbed from $18 to $28). We still believe the shares are somewhat speculative here (especially at the higher price), but the extremely high upfront premium income available in the options market is hard to ignore. In this report, we share a trade that generates very high upfront premium income (that you get to keep no matter what) and it gives us a chance to own shares of this company at a much more reasonable price. We believe this is an attractive trade to place today and potential over the next few trading days, as long as the price doesn’t move too dramatically before then.

Palantir Technologies (PLTR)

The company we are referring to is Palantir Technologies. Palantir builds and deploys software platforms for the intelligence community, and the shares just recently started trading publicly within the last two months. You can access our full report on Palantir here.

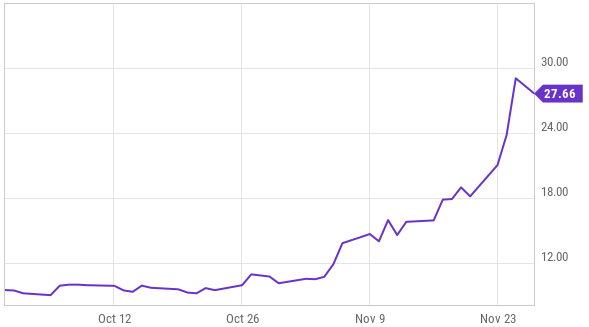

Palantir Share Price:

The share price volatility (as you can see in the chart above), has created a very attractive trading opportunity. Specifically, the upfront premium income available in the options market is higher when volatility is higher (like it currently is for Palantir), and we especially like the set up considering the shares just traded down in the last trading session (despite the strong rise in the last 10-days). We also like the business—a lot—it’s just the current valuation that gives us pause (in terms of purchasing shares outright), and also makes this options trade particularly attractive.

The Trade:

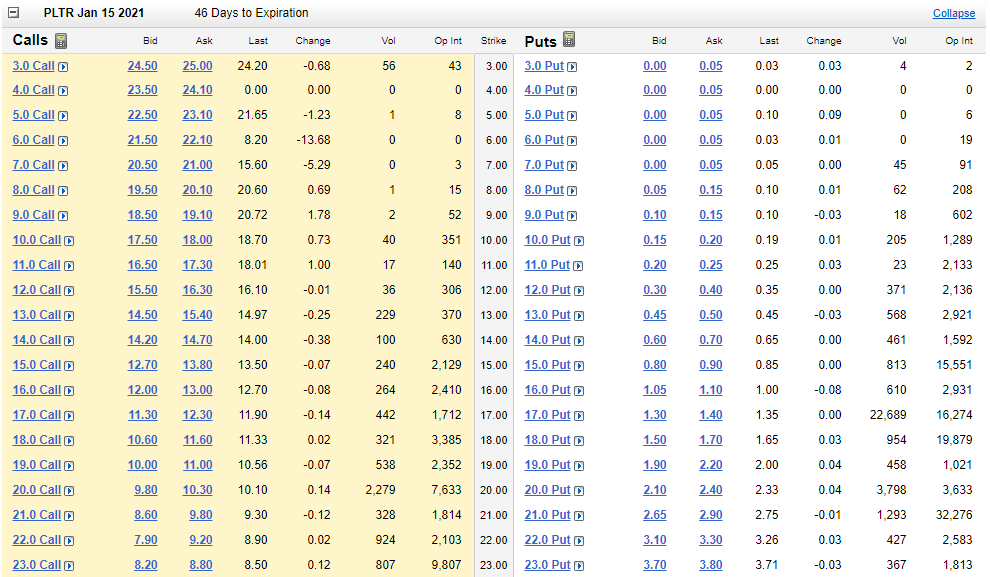

Sell Put Options on PLTR with a strike price of $14 (~50% out of the money, it currently trades at ~$27.66), and with an expiration date of January 15, 2021, and for a premium of $0.60 (this comes out to approximately 4.3% of extra income in just 46 days, and approximately 34% extra income on an annualized basis). This trade not only generates attractive upfront premium income for us now, but it gives us a chance at buying shares of this very attractive business at a much more reasonable price ($14—the strike price) if the market price falls below $14 and the shares get put to us before this option contract expires in 46 days. And we get to keep the upfront premium income no matter what.

*Important Note: Depending on your preferences, and how badly you do (or don’t) want to have the shares put to you, you can adjust the strike price and/or expiration date (there is decent premium income available on the Dec 18th contracts too) of this trade.

Your Opportunity:

We believe this is an attractive trade to place today, and potentially over the next few trading days, as long as the price of PLTR doesn't move too dramatically before then and you’re able to generate enough premium income to your liking.

Our Thesis:

Our overall thesis is simply that PLTR is a very attractive long-term business (as we wrote about in the report linked above), but the price/valuation seems a bit speculative considering it’s still only operated as a public company for a couple months and its valuation is high and seems speculative (it trades at 45x sales, more on this in a moment). We’d be much more comfortable owning these shares if we could get them at a significantly lower price, and that is exactly what this trade is designed to do. Plus, we get to keep the upfront premium income this trade generates, no matter what (i.e. whether the shares do or don’t get put to us).

Important Trade Considerations:

Two important considerations when selling put options are ex-dividend dates and quarterly earnings announcements because they can both impact your trade. Palantir just announced earnings on November 12th, so that volatility risk is off the table during the duration of this trade, and the company doesn’t pay a dividend (so that doesn’t factor into the equation either).

Conclusion:

We like Palantir’s business. It is attractive. However, the valuation gives us pause. Specifically, Palantir forecasts (guidance) it will have $1.071 billion in total revenue for 2020, but the shares already have a market cap of $48.2 billion. That is a price-to-sales ratio of 45x (very high). The company does expect that year-over-year revenue growth will be over 30% in 2021, which is a lot, but at that rate it would still take over 5 years for the price-to-sales ratio to get down to the more reasonable level of 10x. Said differently, there are some very high expectations baked into this strong business at a share price of $27.66, and we’d be much more comfortable owning it at $14.00/share (if the price falls that far before our options contract expires in 46 days, and the shares get put to us). And if they don’t get put to us, we happy to simply keep the attractive upfront premium income generated by this trade (we get to keep that income no matter what).

Note: options contracts trade in lots of 100, so to secure this trade with cash, you need to keep $1,400 of cash in your brokerage account per each contract ($14 strike price x 100).