Simon Property Group (SPG) is a retail REIT, with a pristine balance sheet, and a consistent history of growing revenue and dividends. However, growth in revenue has slowed marginally due to a rise in retail bankruptcies (online shopping is disrupting traditional retail). This article reviews the business, the enticing 5.6% dividend yield, the valuation, the risks, and concludes with our opinion about investing.

Overview:

SPG is a retail REIT that owns and operates shopping locations throughout the world but primarily in the US in the form of Malls and Premium outlets. The properties are either fully owned or owned in partnership with others. Revenue is generated in the form of base minimum rents, a percentage of sales volume made by tenants and reimbursement of operation and management expenditures including property taxes. As of Q3 FY 2019, SPG owns or has interest in 233 income-producing properties globally:

Lease rentals generated from tenants are well diversified with no tenant comprising more than 3.5% of the total revenue. The top tenants are listed below:

Source: Simon Property Group

Secular decline in brick and mortar retail

There have been fears surrounding the death of offline retail over the last decade. Online retail has taken significant share from offline retail as consumer behavior evolves and the value proposition of online retail improves. The rise of online retail has led to store closures and bankruptcies of various big retail outlets such as Forever 21, Fred’s, Payless and Toys--Us. As a result, investor sentiment pertaining to the mall REIT space has gone sour. Despite the mayhem, stronger players will reinvent themselves and successfully manage through the broader trends.

Not surprisingly, mall REIT valuations have receded significantly. In fact, at the end of FY 2019, retail REITs were yielding 5.1%, much higher than the overall REIT space. Given the appealing valuations, we believe investors should selectively look at high-quality companies in this space that have the portfolio and balance sheet to successfully navigate through the external changes over the next 4-5 years.

Source: NAREIT

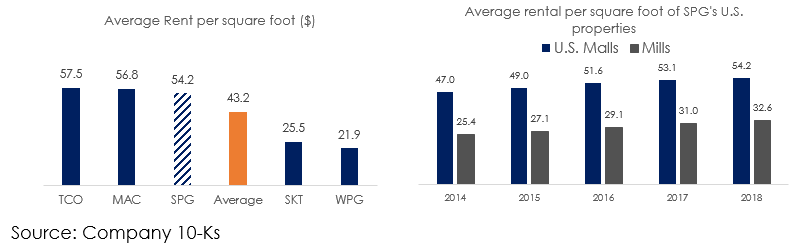

SPG is the largest operator of shopping complexes in the U.S and also has a global presence. Its gross leasable area at the end of FY 2018 was more than 190 million square feet, which is 16 times that of peer TCO and 3 times to that of peer MAC. The company’s average rentals are above the market average and has been consistently growing its rentals per sq. ft. for the last 5 years as evident in the chart below. Additionally, SPG has continuously reported high occupancy rates of above 95% for its U.S. as well as international properties. Also, it is worth noting that in Q3 2019, company reported a 5% increase in YTD total sales per sq. ft. in U.S. malls and premium outlets.

Strategies in place to mitigate dislocation in broader retail universe

While we think it is going to be difficult for a large mall operator to be completely insulated from the broader shakeup in the retail world, SPG is using strategies to soften the impact from the external disruption:

The company is focusing on having a broader assortment of retailer tenants to capture the “barbellization” of retail happening where discount on the one hand and luxury on the other are holding up well while the middle is hurting.

The company is focusing on “live, work, play and stay” to diversify into non-retail subsets of the broader consumer space. SPG has made investment in Life Time, one of the largest health club chain in the U.S. Lifetime is expected to build at least 8 health clubs facilities at SPG properties over the next few years. It has already developed a $43 million health club at SPG’s Edina property which also incorporates an indoor athletic field, coworking space and 2 restaurants. SPG has tied up with Allied E-sports to develop dedicated e-sports venues at the properties and organizing e-sports events. Other investments include Sports Illustrated, PARM Italian dining brand and Soho house, a hotel chain.

SPG is selectively making investments in existing properties. Redevelopment capex is being used to reposition and expand facilities when it makes strategic and financial sense. At the end of Q3 2019, redevelopment projects to convert properties into multiuse destinations are being undertaken at more than 30 properties in the U.S., Asia and Europe.

SPG is constructing 4 new properties in Spain, France, U.K. and Thailand. 3 of these projects are scheduled to open in 2020 and 1 in 2021. NOI from international business has grown at a CAGR of 12.3% between 2015 and 2018 and the segment’s share of total NOI has increased from 8% in 2015 to 10% in 2018.

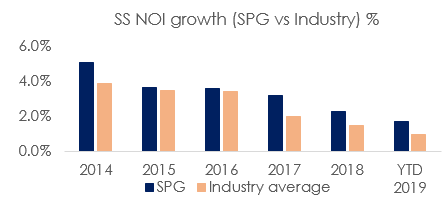

Growth slowing but still positive and outperforming the industry

In Q3 2019, SPG reported Net Operating Income growth of 1.3% on a YoY basis. The primary reason for this was an increase in minimum rentals per square feet. Comparable property NOI (same store NOI) growth was 1.6% during the same period. While retail bankruptcy had a 100 bps impact on the company’s same store NOI growth, the company’s growth was still significantly higher than the industry average of 0.68%. In fact, the company has consistently outperformed the industry on same store NOI as a result of the quality of its properties and tenants. SPG has been experiencing positive lease spreads which effectively means that the company has been successful in re-leasing vacant space to higher rental yielding clients.

Consistently rising lease rentals have also led to growth in FFO over the years. As per Q3 2019 earnings report, YTD FFO per share increased from $8.80 to $9.09, a growth of over 3% YoY. Infact over the last 5 years, FFO per share has increased at a CAGR of 8%, which is much higher as compared to its competitors.

The company scores well on leverage and interest coverage

The company has a high-quality balance sheet providing management with considerable room to reinvest in the business and manage through any market turbulence. The company’s Debt to FFO is one of the lowest in the sector and FFO to interest expense the highest. Additionally, the company’s debt to FFO ratio has improved from 6.36 times in 2014 to 5.5 times in Q3 2019. In 2019, the company refinanced $2.6 billion of debt by issuing notes. These notes have been issued at reduced interest rates which have caused the average interest rates to fall from 3.35% in FY 2018 to 3.21% in Q3 2019.

Consistent Dividend History

SPG has consistently increased its dividend in recent years. The last time it cut its dividend was in 2009 during the great recession in order to maintain a healthy liquidity position and pay down the upcoming debt maturities. In FY 2018, SPG declared $7.90 in dividends per share which has risen to $8.03 in 2019, growing by 5%. Dividends at SPG are more stable than retail peers due to its better quality portfolio assets, stronger tenants and diversification.

Valuation appealing on absolute and relative basis

SPG’s valuation has taken a major beating over the last 2-3 years as investors worry about the ongoing offline to online retail share shift. The negative sentiment has opened up an interesting opportunity for new investors as dividend yields touch multi year highs. While we do not question the impact of the online to offline secular trend, it is also important to acknowledge that SPG has grown its FFO per share at 6.5% between 2014-18 as compared to 4.7% growth for the REIT sector. Additionally, the company is a market share leader in its REIT subset. Despite growth and a strong market position, the company is trading at a higher dividend yield than the overall REIT space.

Risks

Offline to online retail share shifts: The greatest risk to SPG is the growth of E-commerce causing larger disruption to the traditional retail universe. More bankruptcies of SPG’s tenants may increase store vacancies and adversely affect the company’s rental revenue. Further, currently the employment and consumer spending numbers are strong, and an economic slowdown in the future may further compound difficulties for the mall REIT space. Having said that, large, quality mall REITs with strong balance sheets will likely take share and reinvest in their business to stay relevant and will fare much better than investors fear.

Conclusion

Mall REIT valuations have come down sharply in recent years as investors fear the ongoing disruption of traditional retail. And this indiscriminate selling has not spared SPG. However, SPG continues to maintain a leadership position, a growing business, a pristine balance sheet and a healthy growing dividend. From a risk-versus-reward standpoint, we believe SPG offers a compelling valuation and a compelling entry point for disciplined long-term income-focused investors. We currently own shares of this 5.6% dividend yield REIT, and have no intention of selling. Rather, we expect to keep collecting the big growing dividend payments, and we also expect the share price to rise significantly over time.