Municipal Bonds can be an attractive, yet often overlooked, way to generate healthy income with low risk. In particular, and depending on your tax bracket, muni bond’s tax-exempt status can boost your after tax income significantly. In this report, we analyze four Municipal Bond CEFs (closed-end funds) based on portfolio characteristics, return/risk, yield prospects and finally conclude with our thoughts on the pros and cons of each. We currently own two of the four in our Alternative Fixed Income Portfolio.

Overview:

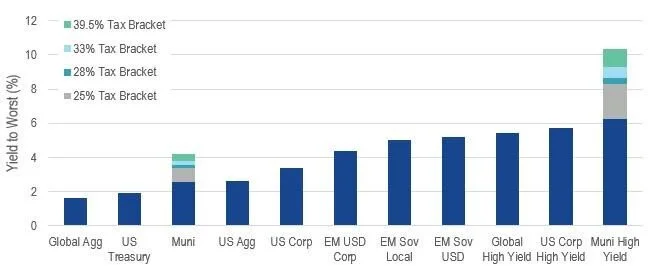

Muni bond CEFs invest in municipal bonds issued by local government or local government agencies. Muni bond CEF yields are often lower than the yields offered by many taxable bond CEFs (such as corporates), as municipal bonds generally have a lower risk profile than corporate bonds. However, considering most muni bonds (and muni bond CEFs) are exempt from taxes, the yields on muni bond investments can become very attractive on a “taxable equivalent yield” basis, especially considering the lower levels of defaults in the muni space.

Source: Vaneck, Moody’s

In fact, as evident in the chart on the right, on a tax equivalent basis, muni bonds offer better yields than their corporate and even EM counterparts with much lower risk levels.

Sources: VanEck as of 2017

Muni bond CEFs in focus

In this report, we focus on Invesco municipal trust (VKQ), Nuveen Quality Muni Income Fund (NAD), BlackRock Muni yield Inv Qty (MFT) and MainStay MacKay Defined Term Muni Opp (MMD). All the above CEFs invest the majority of their portfolios in investment grade municipal bonds with the goal of generating attractive post tax income while preserving capital. The funds are managed by teams with decades of experience investing through multiple interest rate cycles. While Invesco, Blackrock and Nuveen are household names, MacKay Shields, manager of MMD is also a large asset manager with $107.5 billion in AUM ($34.3 billion in municipal securities alone).

Portfolio Characteristics

While all four CEFs have a majority of their investments in bonds rated BBB or higher, the degree varies as per portfolio manager views and secondary objectives. MMD has the lowest exposure to investment grade bonds as it has a secondary focus of generating capital gains apart from regular income.

Source: VKQ, NAD, MFT, MMD

VKQ and MFT have a 20% ceiling when it comes non-investment grade bonds as a percentage of the overall portfolio while NAD has a 35% ceiling when it comes to BBB and lower rated instruments in the portfolio providing it more flexibility. Please note that these CEFs use leverage to amplify returns as detailed in the table below.

The portfolio make-up in terms of exposure to states is largely similar expect for MMD which has a disproportionally large exposure to Puerto Rico. While given the negative headlines around Puerto Rico it is natural for investors to be concerned about MMD’s risk profile. However, it is important to note that majority of the Puerto Rico bonds held by MMD are insured providing significant capital protection.

Source: VKQ, NAD, MFT, MMD

MMD has consistently outperformed Municipal bond CEFs and trades at a premium to NAV

As evident in the chart below, NAD and MMD have outperformed the industry including VKQ and MFT on a 5-year annualized return basis when it comes to both NAV returns as well as price returns. The distribution rate of all four funds has been generally inline with the market median.

Source: CEFConnect

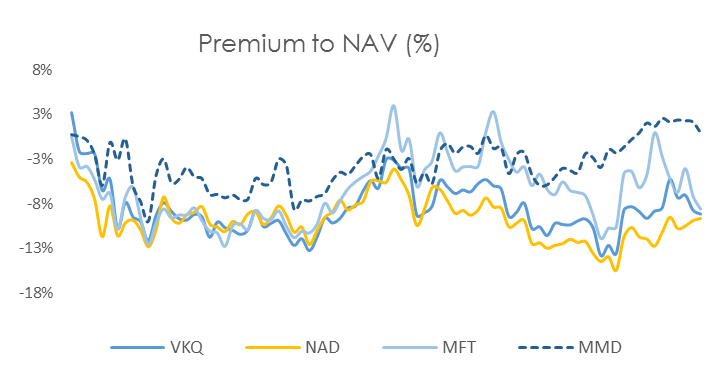

Discounts to NAV in-line with historical averages except in the case of MMD

All funds except MMD trade at a high single digit discount to NAV. MMD at the end of November was trading near its NAV and currently is trading at a premium of 4.7%. MMD has traded at a lower discount to NAV (~-3%) as compared to other CEFs mentioned in this report because of its high distribution coverage ratio and positive undistributed net investment income (UNII). In fact, MMD over the last five years has exhibited a cumulative distribution coverage of 130% as compared to MFT’s 86%, NAD’s 69% and VKQ’s 89%. Not surprisingly, due to superior performance, MMD’s z-scores are over 2 indicating a bit of over optimism in the name while VKQ and MFT have negative z-scores indicating some value.

Source: Blue Harbinger Research

Yields have marginally contracted over the last few years due to yield per share cuts

All four CEFs offer similar yields to investors. However, all four have seen a slight contraction in yields primarily because of the rise in interest rates in FY 2017 and 2018 which impacted portfolio values as well as yield (i.e. coupon payments from the underlying bons). As interest rates have declined in 2019, portfolio values and yields have stabilized.

Source: Blue Harbinger Research

Strong demand and low supply of municipal bond paper putting upward pressure on muni bond pricing

2019 was a strong year for the municipal bond market. Lower interest rates led to increased demand for municipal bonds. Municipal bond demand was also positively influenced as a result of recent changes in the tax code. Federal deductibility of state and local taxes (SALT) has been capped at $10,000 which means certain high-income earnings investors maybe subject to higher federal taxes. Municipal bonds provide investors with tax exempt income that may allow them to lower their federal level tax bill. We encourage our readers to consult with their tax advisors on how municipal bond funds can help lower their tax liability given the recent changes in the tax code. In 2019 YTD (as of Q3) the municipal bond market reported an inflow of $75.1 billion. On the supply side, municipal bond issuance has remained at their historically low levels for YTD 2019 (as of Q3 2019), thereby creating a demand-supply mismatch and pushing up prices.

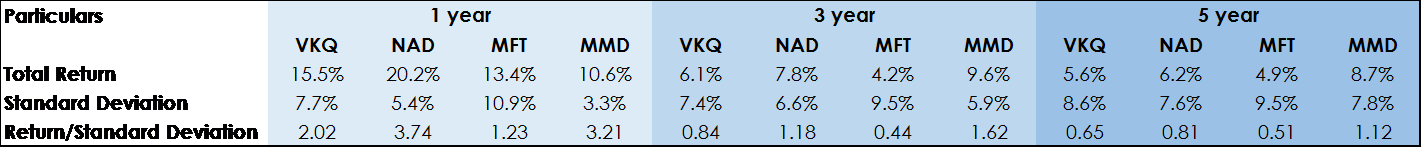

NAD and MMD have been outperformers on price returns as well as risk measures

An analysis of the share price returns and standard deviation shows that even though NAD and MMD have more flexibility to take on non-investment grade investments, the annualized standard deviation (risk) for these names has been lower than the other two CEFs that have a higher investment grade exposure. MMD has been the best performer on a 3 and 5 year annualized price return basis while at the same time exhibiting lower than average peer group risk levels.

Source: Blue Harbinger Research, LLC

Risks:

Reinvestment risk: With a reduction in interest rates, there is always a risk that some of investments may face bond calls and the money received will have to be invested at lower interest rates thereby decreasing investment income.

Political risk: There may be some volatility in the municipal bond market due to the 2020 U.S. presidential elections. If there is a change in power and new tax reforms come into force, there may be direct implications for the municipal bond markets.

Conclusion:

Municipal bond CEFs benefit from tax advantaged status of owning municipal bonds. At the same time, municipal bonds have historically experienced extremely low default rates both in absolute terms as well as relative to corporate bonds. The four muni bond CEFs covered in this report invest the majority of their assets in investment grade muni bonds (even as NAD and MMD have more flexibility to go lower on the credit quality scale should attractive return opportunities arise). Both NAD and MMD have made use of the flexibility to generate superior risk adjusted returns for investors, with MMD being a particularly strong performer. As a result, MMD and NAD both are trading at positive z-scores indicating high investor interest in the names, perhaps creating near term resistance at these price levels.

Note: we continue to hold MMD and NAD in our Alternative Fixed Income Portfolio. We’ve benefited from their strong performance, however consider all four muni CEFs described in this report, as attractive. We would consider rebalancing into the CEF’s that trade at bigger discounts (smaller premiums) to NAV.

Important: as a general rule, muni bonds and muni bond CEFs should NOT be held in tax-exempt accounts (such as an IRA) because that nullifies the tax advantage.