This attractive blue-chip healthcare REIT offers a solid dividend and the potential for healthy long-term growth. We are impressed by its dividend history, healthy payout ratio, investment grade credit rating and significant demographic opportunity. The FFO growth outlook for 2020 is back to positive after a few years of challenges. This article reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion about why it may be worth considering if you are a long-term income-focused investor.

Overview: Welltower (WELL)

Welltower Inc. is an attractive, highly-conservative blue-chip healthcare REIT which focuses primarily on Senior Housing properties. It also owns and operates portfolio of post-acute communities and outpatient medical properties. WELL’s portfolio consists of ~1,701 properties across four categories:

Senior Housing (953 properties), accounts for ~63% of NOI;

Outpatient Medical (392 properties) accounts for 22% of NOI;

Health System (218 properties), accounts for ~7% of NOI; and

Long-term/Post-acute care (138 properties), accounts for ~9% of NOI.

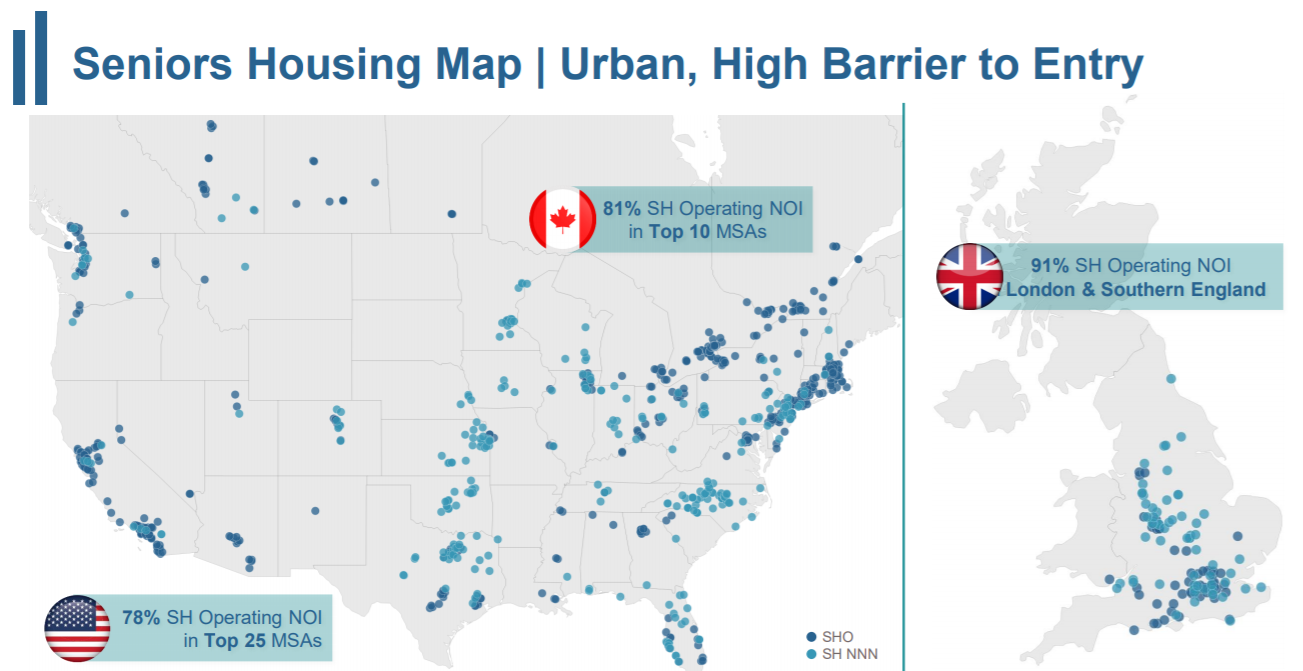

Focusing on high barrier to entry gateway cities, WELL has a leading presence in markets with strong wealth demographics, including major metropolitan areas such as in Los Angeles, New York, Boston, San Francisco, Toronto, Vancouver, Montreal, Edmonton, Calgary, Ottawa, Quebec, London, Birmingham, and Manchester. The US portfolio has 1,337 facilities, the Canadian portfolio has 116 facilities, and the UK portfolio has 148 properties.

Reducing Reliance on Medicare/Medicaid:

Welltower has been steadily reducing its reliance on government funding (Medicare/Medicaid). As of the end of FY19, ~93% of the company’s revenue comes from private pay insurance compared to ~69% in 2010. The tenant base is well diversified with the top 10 partners accounting for just 44% of total NOI. Welltower's largest operator (Sunrise Senior Living) accounts for about 15.6% of NOI and no other operating partner accounts for more than 7%. We like that Welltower’ properties are ~38% triple net leases. A triple net lease means the tenant is responsible for paying rent, taxes and most maintenance/insurance expenses.

(source: Company Presentation)

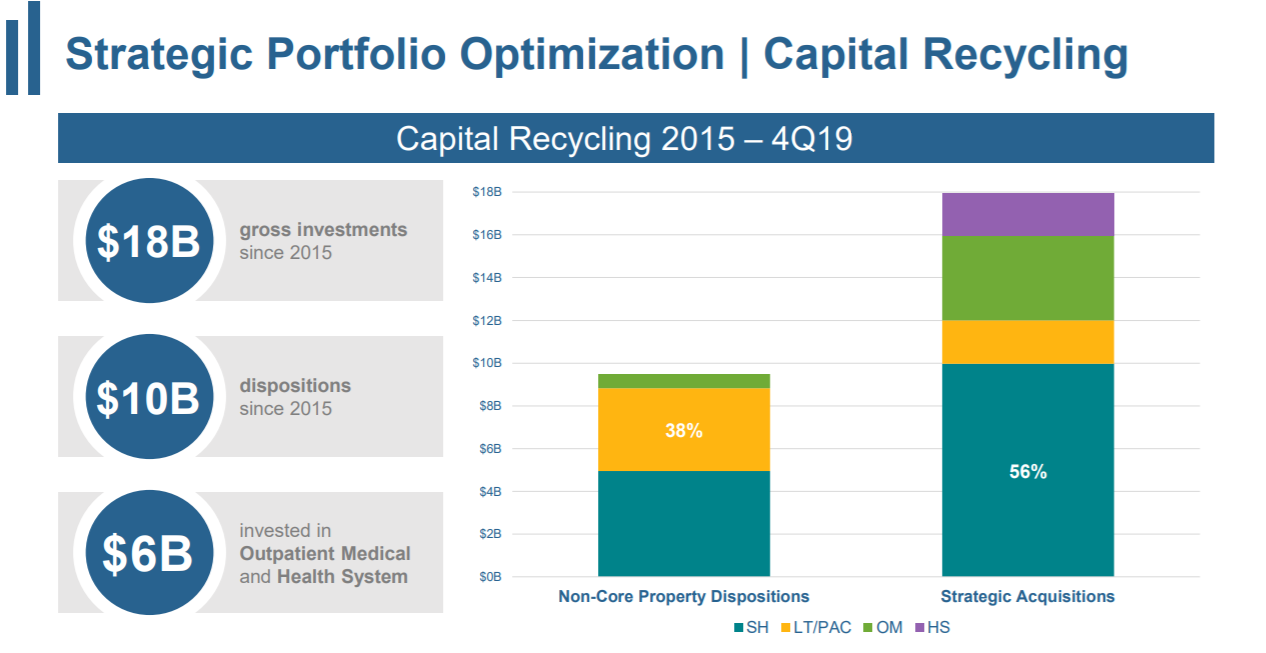

Strategic Portfolio Optimization Enhances Quality of Cash Flow

Over the last few years, Welltowere has recycled about $6 billion of its 2015 asset base into higher quality assets. For example, about 38% of the dispositions were in higher-cost Long term/Post Acute Care, while about 56% of strategic acquisitions were in lower-cost Seniors Housing. Management noted that it is focused on buying assets when they are out of favor at the right price in the right structure. In 2019, WELL acquired ~$4.8 billion of high-quality assets at a blended cap rate of ~5.8%. Management expects many of these newly built assets to stabilize in next 12 to 24 months and consequently that 5.8% will attractively grow to above 6%.

With strategic dispositions, Welltower reduced its exposure to certain underperforming facilities in operating partners such as Genesis Healthcare and Brookdale, from more than 20% of NOI in 2014 to just 9.4% in 2019. Management has instead focused more on investing in senior housing properties that it operates itself and partnering with strongest tenants to stabilize its future cash flows.

With an improved portfolio, WELL initiated an optimistic outlook for 2020. It expects FY20 FFO to be in the range of $4.20-$4.30, suggesting an YOY growth of ~2.1% (at the midpoint of the guidance range). The NOI growth is expected to be around 1.5% to 2.5% consisting of the following:

Outpatient medical growth at 2.25% to 2.75%,

Long term post-acute growth at 2% to 2.5%,

Health systems growth at 1.95%,

Senior housing triple-net growth at 2.25% to 2.75%, and senior housing operating growth at 1% to 2.5%.

(source: Company Presentation)

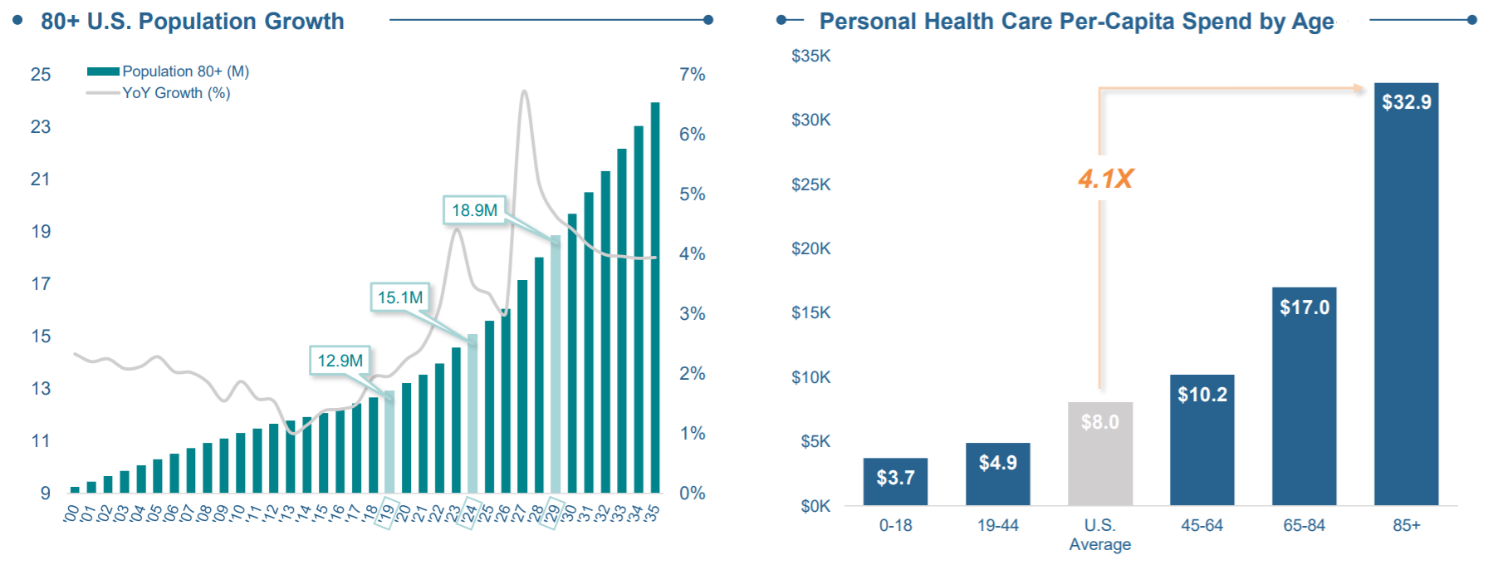

Demographic Tailwinds

WELL is well positioned to benefit from aging population growth in the US. According to data from the National Investment Center for Seniors Housing and Care (NIC), The US ”80+ population” is projected to double in the next twenty years rising from 12.9 million in 2019 to 27 million in 2038. Also, the 80+ population is anticipated to grow 8x faster than total population over next 20 years, and it spends 4x versus every other age cohort combined on healthcare. Only 10.9% of the US 80+ population currently resides in senior housing which suggests significant under penetration. As such, demand is expected to grow with over 200,000 senior housing units needed over next 5 years, generated by growth in the aging population. This should drive occupancy levels for the existing players. According to NIC, an ~150 bps increase in industry penetration rate to 12.4% would produce 100% industry occupancy.

Overall, Senior housing is a $300 billion market, and ownership of senior housing assets is highly fragmented. Given these industry fundamentals and compelling demographics we believe the senior housing industry presents an attractive investment opportunity, well well-managed blue-chip participants, such as Welltower.

(source: Company Presentation)

Safe and Sustainable Dividend

Since inception, WELL has an impressive record of dividend payments to shareholders. Welltower has paid steady or increasing dividends every year for the last five decades since 1971. At the current annualized dividend per share of $3.48, WELL delivers a dividend yield of 5.4% which is fairly attractive. Welltower is best-positioned among all healthcare REITs to capitalize on the favorable aging demographics and generate strong earnings, NAV, and dividend growth for shareholders. With an improved portfolio, Welltower's FFO is now higher quality and expected to be significantly steadier. Its 10-year dividend growth rate is ~2.5%, with FFO payout ratios ranging from a range of 75-89% and an average payout ratio of about 82%. An average payout ratio in low-80s provides plenty of attractive cushion, in our view. This means even if WELL experiences reduced payments from some operators, it has extra cash to keep supporting the dividend.

In our view, the company has plenty financial flexibility. During 2019, WELL removed all major unsecured maturities through 2022, meaningfully de-risking its balance sheet for the next three years and increasing the weighted average maturity of the unsecured debt stack to 8.8 years. The leverage at the end of 2019 was 6.4x, above its long-term target range. However, WELL has investment-grade credit ratings from Standard & Poor's (BBB+), Fitch (BBB+), and Moody's (Baa1). This leads to lower cost of capital and an improved ability to raise capital. Importantly, easy access to capital supports WELL’s ability to sustain and grow its dividends.

Also, worth noting, ~94% of WELL’s revenues come from private pay sources, which is generally considered safer compared to government pay sources which have higher regulatory uncertainties. This adds further to the safety of the dividend.

Valuation:

From a valuation standpoint, we compare WELL to other healthcare REITs with a higher focus on Senior Housing. Specifically, on a Price to Funds from Operations (“FFO”) basis, WELL is trading at ~15.3x its 2020E FFO, a premium to the average of the peer group. This is justified given its large size, strong balance sheet and solid growth prospects. This is also reflected in the dividend yield which is the lowest among the peers suggesting that WELL is considered the safest among the group by the investors. However, despite the relatively lower yield relative to peers, WELL’s dividend yield has recently risen significantly as the indiscriminate market wide sell off has dragged WELL’s share price lower. The current 5.4% dividend yield provides a compelling entry point for long-term income-focused investors.

(source: Company data. Note: these yields are from immediately prior to the most recent market wide sell off, thereby demonstrating the amount by which WELL’s attractive dividend yield has risen)

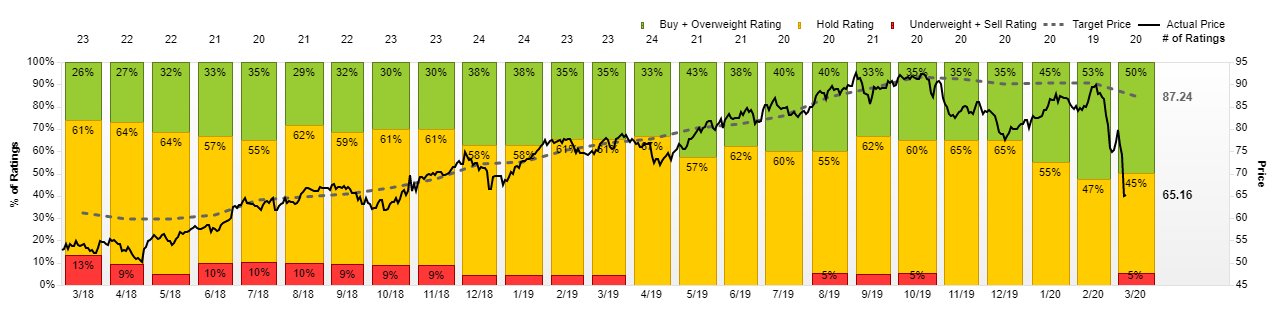

Further still, the majority of Wall Street analysts (as per FactSet) rate the shares a buy or a hold, and believe the shares are dramatically undervalued at the current market price, as you can see in the following table.

Risks:

Tenant bankruptcy: WELL is exposed to the risk of tenants not being able to meet their rental obligations. However, WELL is well diversified with no dramatically significant tenant concentration (as described earlier). Nonetheless, should one or more of these tenants face financial trouble it could lead to future cash flow challenges for Welltower.

Regulatory risks: Both WELL and its tenants are exposed to regulatory risks, especially changes to the Affordable Care Act. WELL in its 2019 annual report stated the following:

“The requirements of, or changes to, governmental reimbursement programs, such as Medicare, Medicaid or government funding, could have a material adverse effect on our obligors’ liquidity, financial condition and results of operations, which could adversely affect our obligors’ ability to meet their obligations to us.”

Nonetheless, we are encouraged that WELL has significantly reduced its exposure to Medicare and Medicaid in recent years.

Interest rate risk: Even though we expect interest rates to remain relatively tame, dramatically rising rates could create challenges. As REITs are often seen as an alternative to bonds, higher interest rates could mean decreased demand for REITs, thereby causing a decline in the share price. Also, higher interest rates could put downward pressure on earnings as interest costs rise. However, as interest rates have actually been reduced recently (the Fed cut rates 50 bps last week), we view this is a noteworthy positive for Welltower.

Conclusion:

Welltower is an attractive dividend stock (REIT). It offers a strong 5.4% dividend yield, and the business is strengthening. Specifically, FFO growth challenges have been brought under control, and the metric is now expected to increase in the years ahead. Also, the payout ratio of ~82% is attractive, and leaves plenty of cushion for the dividend. Further, the company will benefit from powerful demographic trends, and the Fed’s most recent interest rate cut. Finally the recent indiscriminate market sell off has created an attractive entry point. If you are a long-term income-focused investor, Welltower is worth considering for a spot in your prudently diversified portfolio.