The recent market wide sell off has been ugly. This article focuses on a REIT that is particularly attractive considering management has been a sound steward of capital by simplifying the business model, lowering the cost of capital and growing the dividend. Further, this REIT may be poised to take advantage of current market distress thanks to its lower debt and the cushion it enjoys relative to debt covenants. If you are a long-term income-focused investor, this one is absolutely worth considering (we own it).

Overview: WP Carey (WPC), Yield: 5.6%

W.P. Carey is one of the largest diversified REITs with assets spanning multiple REIT segments as well as geographies. The company’s portfolio has 1,214 net-leased properties covering 140 million square feet, leased to over 345 tenants across U.S. and Europe. The US accounts for 63.5% of the company’s revenue while Europe accounts for 34.5%. WPC’s core operating REIT segments include industrials, warehouse, office spaces, retail stores and self-storage. Below is a mix of Annualized Base Rent (ABR) and square footage by property type:

Importantly, investment grade tenants with a rating of BBB- or above account for 30% of total ABR. No tenant accounts for more than 3.5% of the total ABR. The top 5 tenants of the company are:

WPC also has a small investment management business. The company manages a portfolio of non-traded REITs including CPA:18-Global, CWI 1, CWI 2, and CESH and earns a fee. The asset management business accounted for just 5% of total revenue in 2019 and is essentially winding down.

The company’s triple net lease business is high quality with automatic rent escalators

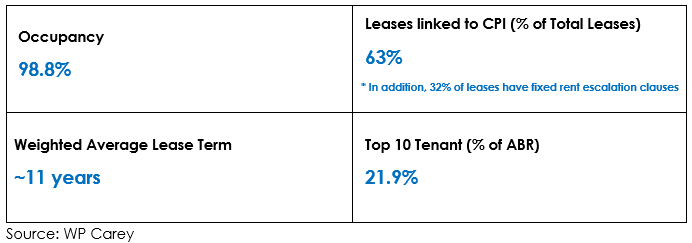

In a triple net lease, real estate taxes, insurance and maintenance expenses are borne by tenants themselves which would otherwise be paid by asset owners. Naturally, the revenue reported by triple net lease companies is of high quality due to the low probability of surprise expenses shaving off revenue upside. The company’s leases with tenants have a weighted average term of close to 11 years and nearly 99% of the leases have built in rent increases with a significant 63% of the portfolio leases linked to CPI. Finally, the company has low tenant concentration with top 10 tenants accounting for just 22% of base rent.

WPC has worked to simplify its business model over the last few years

WPC historically was both a real estate owner as well as an investment manager of non-traded real estate funds. In fact, it has a reasonably good track record of running 20 external investment funds as part of its investment management business. However, regulatory changes around how broker dealers sell these funds to retirees led to drying up of capital. Additionally, income streams associated with the asset management business tend to be more volatile as compared to stable rental income and therefore attract a lower valuation multiple. As a result, WPC’s management made a decision to primarily focus on owning real estate. The company made substantial progress moving away from the investment management business when it merged with one of its managed program CPA:17 in October 2018 in an all-stock deal totaling $5.9 billion, including debt assumed from CPA 17. Not surprisingly, as evident in the chart below, the investment management business has become a fraction of what it was in 2014.

Finally, managed portfolios CWI 1 and CWI 2 are expected to merge in Q1 2020 and the merged entity is expected to internalize the management. Post this deal, 98% of the company’s revenue will come from high quality, triple net lease income.

WPC has improved its funding mix further, amplifying returns for its shareholders

Even as the company focuses on building a stable, growing portfolio of triple net leases, WPC has also been working on bringing its cost of capital down. In the past, roughly half of the company’s debt was in the form of mortgage debt. However, mortgage debt as a percentage of overall debt has declined from 51% in 2015 to 24% in 2019. On the other hand, as evidenced by the chart below, the company has been replacing mortgage debt with cheaper unsecured debt, primarily raised in Europe to lower its cost of capital. As more mortgage debt comes up for maturity, the company will use lower cost vehicles to reduce its overall cost further.

Finally, the table below provides comfort in the company’s ability to service its debt. In fact, the company will be able to increase its leverage in the future to buy more assets given the cushion it currently enjoys relative to covenants.

Rental growth and lower cost of capital driving FFO and dividend growth

The company’s same-store ABR has increased between 1% to 2% over the last few years with 2019 seeing increase of 2%. The increase in same-store ABR growth has primarily been driven by CPI and fixed rental escalators. AFFO per share has grown by 6% CAGR between 2017-19. The company’s 2019 dividend payout ratio was 87% and going forward dividend should grow in line with AFFO.

Risks

Brick and Mortar retail share losses: Retail store tenants account for 21% of the company’s total base rent. As online retail grows in capability and scale, the company’s offline retail tenants may be forced to shut stores. Having said that, it is also important to consider upside potential in the company’s warehouse business from online retailers investing in supply chain.

Coronavirus: The company’s customers might face distress in case there are prolonged restrictions on normal business activity and supply chain disruptions due to the coronavirus. WPC derives 2.3% of its base rent from Italy which has been particularly hit hard in Europe. Having said that, the company’s long-term leases and stable rentals will largely insulate the company in the near to medium term.

Conclusion

WPC’s management has been a sound steward of capital, simplifying the business model, lowering the cost of capital and growing the dividend. WP Carey is a highly diversified REIT with low tenant concentration, long lease terms and automatic rental escalators. Despite these attractive characteristics, the company’s stock is offering an appealing dividend yield of 5.6%, providing a superior risk-reward to investors. We currently own shares.