From time-to-time, we like to write about “income via growth” stocks at Blue Harbinger. These are stocks that can provide high income to investors through long-term capital gains (i.e. selling some of your winners). We write about these types of stocks because they can bring important risk-reducing diversification to an otherwise dividend-focused investment portfolio. And we are writing about this particular opportunity because we own it, and because it is particularly attractive right now following the recent market turbulence.

In particular, this stock is attractive because of its sticky businesses (customers tend NOT to leave), its expanding businesses (customers continue to expand their relationships), its large market opportunity (the migration to the cloud isn’t going away), and its attractive valuation.

Overview: ServiceNow (NOW)

ServiceNow (NOW) is a leading provider of enterprise cloud computing services that define, structure, manage, and automate digital workflows for global enterprises. Their foundational Now Platform enhances enterprise-wide experiences and productivity by simplifying and streamlining processes across systems, functions, and departments. The company’s product portfolio is focused on providing better information technology, employee and customer workflows, and enables customers to build any workflow application that may improve their business.

ServiceNow began as an ITSM platform, and has evolved to provide HR management, customer service management (CSM), and other employee workflow capabilities. The key insight here is “workflow”, as the Now platform doesn’t replace those services but vertically integrates with other novel SaaS products/solutions to provide a cohesive workflow solution for the modern enterprise. Therefore, as Bill McDermott mentioned in the earnings call, ServiceNow is the “platform of platforms.” The company is the industry leader among Enterprise Service Management (ESM) solutions and the current revenue growth rates (32.6% for FY 2019) demonstrate strong product-market fit as they outpace the broader industry. With this unique business model, it is positioned well to continue to benefit from digital transformation and the growth of cloud-based SaaS, well into the long-term.

We first purchased these shares back in March of 2018, and here is what we wrote back then:

“Now is an attractive time to initiate a position in this attractive long-term investment (NOW) because… competition is essentially non-existent, NOW’s subscription model creates a very high retention rate, margins are very high, the total addressable market is huge (NOW anticipates doubling revenues by 2020, we think they’ll do even better by then, and much better beyond 2020), and enterprises migrating to the cloud is not going to end any time soon (NOW compliments the big cloud players like Amazon Web Services and Microsoft Azure, it doesn’t compete with them).”

And we continue to agree with all of that now.

Compelling Land and Expand Strategy

For a little perspective, here is one of our favorite ServiceNow investor presentation charts:

This chart shows ServiceNow’s impressive “Land and Expand” strategy and success. Specifically, it shows the annual customer contract value growth over time. For example, a customer acquired in 2011 or 2012 is contributing a lot more contract revenue now because they have expanded the number of ServiceNow products they are using.

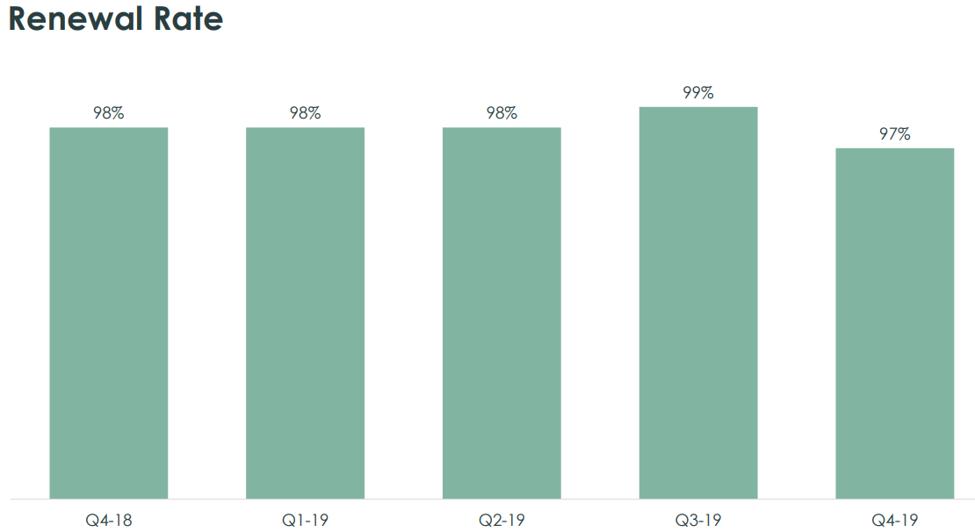

High Customer Retention

This next chart shows customer renewal rates, which are also very high and very attractive.

And what is extraordinarily attractive about ServiceNow’s business is the extremely high gross margins (this is the magic of a software-based business).

Attractive High Gross Margins:

And you may be wondering about competition. However, there essentially is none, as the ServiceNow platform is unique and continues to gain “stickiness” as more customers implement NOW solutions. According to CEO Bill McDermott on the last quarterly call:

“The power of the Now platform, combined with the quality of our IT, employee, and customer workflow products are expanding our addressable market dramatically. Digital transformation is the biggest opportunity of our time, and ServiceNow is exceptionally well-positioned to seize this opportunity to compete and to win. We're a game-changer company for our customers and shareholders. The opportunity to scale ServiceNow is right in front of us, and we have our sights set on achieving $10 billion in revenue and beyond.”

Recent Earnings Announcement:

ServiceNow posted strong fourth quarter earnings at the end of January. Specifically, the company beat street estimates, fueled by a large number of “$1 million plus” deals that closed during the quarter (as the company continues to win larger contracts and move upmarket). More specifically, total revenues grew by 33% year-over-year to $951.8 million. And profit margins, operating margin and net income margin all improved as well. The company also provided healthy 2020 guidance with subscription revenues expected to grow at 30% year-over-year.

Valuation:

The big question about ServiceNow for some investors is valuation, considering the strong share price performance in recent years, as shown below.

And because NOW is a younger company and a growth stock, a different set of valuation metrics are required other than the traditional price-to-earnings valuation multiples (which are more appropriate for more mature companies with lower growth). For ServiceNow, price-to-sales is the multiple that makes the most sense considering the company is so focused on sales growth right now (ServiceNow is spending heavily to achieve growth because once they land the business it is very sticky and customers are retained for a long time. Specifically, it makes sense to forgo short-term profits to instead spend on growth, which will maximize long-term profits). Here is a look at forward price-to-sales multiples for ServiceNow.

For a little perspective, a forward price-to-sales ratio above 10 is generally considered to be quite high, unless it is backed up by the right type of business. And ServiceNow is the right type of business. Specifically, considering the company’s high gross margins, high sales growth and massive total addressable market, NOW’s price to sales ratios are very reasonable and attractive in our view. And they’ve come down a bit verus just a few short weeks ago.

For more perspective, here is a look at the average price target of the 36 Wall Street analysts covering the stock, as per Factset.

The majority of these analyst rate NOW a buy, and none of the rate it a sell. Further, they believe the shares have over 10% upside in the near-term. However, keep in mind these analysts are notoriously too short-term focused (they also thought the shares have only 10% upside when they were trading 65% lower less than two years ago. Given the attractiveness of this business, and the ongoing long-term growth potential, we believe these shares can easily double within the next 2 to 4 years.

Risks:

Of course, there are risks to the business. For example, if the economy slows, IT spending will slow, and NOW’s growth rate will also slow. Also, the newly hired CEO, Bill McDermott, brings a wealth of knowledge and relevant experience, but there could be challenges for the company in adapting to his new management style.

Conclusion:

“Income via Growth” stocks, such as ServiceNow, are NOT for everyone. For example, if you are looking for a big dividend, do NOT buy this stock (its dividend yield is 0.0%). However, if you are looking to opportunistically add a little risk-reducing diversification to your income-focused portfolio (we say opportunistically because NOW’s share price has recently fallen, but the business remains attractive) NOW is worth considering.

This is a “buy-and-hold” stock. We believe ServiceNow’s share price could increase dramatically in the years ahead, and provide investors with powerful long-term income through powerful long-term price gains (i.e. it’ll afford you the opportunity to generate future income by selling shares at a big healthy gain).

We’re not suggesting anyone go dumping 100% of their nest egg into growth stocks like ServiceNow, but it’s worth considering (especially after the sell-off) if you are looking to opportunistically add a little “income via growth” to your portfolio.