From time to time, we like to share attractive “Income via Growth” stocks. These are stocks that don’t necessarily pay big dividends, but they do provide the potential for diversified long-term high income from price gains (i.e. selling some of your winners to generate income). And the stock we review today is an absolute money printing machine, trading at a very compelling price thanks to the coronavirus sell off. Specifically, this company is a fast grower, with a wide moat, high margins, no debt and lots of cash. Simply put, it’s a money printing machine.

Facebook (FB) shares have taken a hit amid the market wide sell-off due to the COVID-19 outbreak. The decline was further exacerbated by a near-term revenue warning from the company which cautioned that ad spending is likely to temporarily fall. However, the silver lining is a meaningful increase in engagement across its platforms as people are forced to stay home. While visibility into the exact duration of the revenue slowdown is low, we believe that Facebook is one of the platforms that will emerge very strong following this crisis given its growing user engagement, its effectiveness for advertisers, and its excellent financial position. This article reviews the health of the business, valuation, risks, the impacts of COVID-19, and concludes with our opinion about why FB is worth considering if you are a long-term investor.

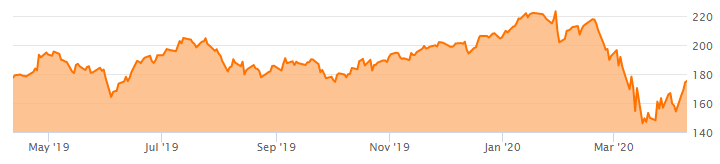

Facebook Share Price:

Overview:

Facebook is the world’s largest online social network. The company owns the Facebook platform, Instagram, Messenger, WhatsApp and Oculus. Additionally, FB has multiple investments in start-ups globally. In aggregate, the company has ~2.9 billion users across Facebook, Instagram and other platforms. For the Facebook platform alone, it had nearly 2.5 billion monthly active users (MAUs) and 1.6 billion daily active users (DAUs). The company generates revenue primarily via advertising which accounts for nearly 98% of total revenue. The remaining is generated via sale of hardware devices and payments infrastructure. Below we highlight in more detail these sources of revenue.

Advertising (~98.5% of 2019 sales): FB generates substantially all of its revenue from advertising. The advertising revenue is generated by displaying ad products on Facebook, Instagram, Messenger, and third-party affiliated websites or mobile applications. The ad revenue is based on the number of impressions delivered or the number of actions taken by the users (such as clicks). Facebook allows companies to target their ads to users that fit a certain profile. This is beneficial for the marketer as it results in higher Return on Investment (ROI) per ad spend.

Other (~1.5% of 2019 sales): This consists of revenue from the sale of Oculus hardware devices and net fees received from developers using FB’s payments infrastructure (Whatsapp Pay or Facebook Pay), as well as revenue from various other sources.

(source: Company Data)

Despite political headlines (mainly privacy concerns) surrounding the company in recent years, Facebook’s business continues to strngthen. Revenues have grown at a CAGR of 37% over the past three years during 2016-2019. The gross margins of the business are over 80% while operating margins are well above 40%. The business is extremely profitable. These high levels of profitability help demonstrate the company’s formidable moat. This is further validated by growth in Facebook’s average ad revenue per user, or ARPU, which indicates advertisers' willingness to pay more for Facebook-placed ads, as they expect high return on investment from the targeted ads. ARPU rose ~15% YOY in Q419.

ARPU Growth

(source: Company Data)

Facebook is trying to monetize its other properties. in particular Messenger and WhatsApp. Both have over a billion users and have significant revenue-generating potential. Facebook is testing new initiatives such as direct ads and click-to-messaging ads in Messenger and WhatsApp. The early results have been promising. Additionally, it is targeting the large payments opportunity via WhatApp Pay and the e-commerce opportunity via Facebook Marketplace and Instagram Shopping. We believe the increasing focus on these under-monetized properties could add significant upside to estimates and earnings forward.

COVID-19 could boost long-term ad trajectory despite near-term impact

The COVID-19 outbreak has adversely impacted businesses worldwide, including an immediate impact on Facebook’s revenue. The company in its blog post noted the following:

“our business is being adversely affected like so many others around the world. We don’t monetize many of the services where we’re seeing increased engagement, and we’ve seen a weakening in our ads business in countries taking aggressive actions to reduce the spread of COVID-19.”

In addition to COVID-19, Facebook has warned that headwinds related to ad targeting will also slow growth. The regulations that restrict third-party tracking will make it harder for Facebook to deliver relevant targeted ads. Facebook also said that its own privacy initiatives may have a negative impact on ad pricing. The company’s CFO Dave Wehner in the Q4 earnings call noted:

“We expect our year-over-year total reported revenue growth rate in Q1 to decelerate by a low-to-mid single digit percentage point as compared to our Q4 growth rate. Factors driving this deceleration include the maturity of our business, as well as the increasing impact from global privacy regulation and other ad targeting related headwinds. While we have experienced some modest impact from these headwinds to date, the majority of the impact lies in front of us.”

However, a silver lining is the meaningful increase in engagement across its platforms, particularly Messenger and Whatsapp. The need for social distancing is leading to people to other forms of communication such as social media and messengers. In many of the countries hit hardest by the virus, total messaging has increased more than 50% over the last month. Similarly, in places hit hardest by the virus, voice and video calling have more than doubled on Messenger and WhatsApp. For example, it’s experiencing a 70% rise in usage across all of its apps in Italy. We think that just like the 2008 financial crisis changed consumer behavior, COVID-19 could result in potential permanent shift in user engagement towards communication products and services.

The growth in users and user engagement, along with the valuable data that they generate, makes Facebook attractive to advertisers in the short and long term. This should benefit Facebook given the long-term increased potential for more ad revenue.

Significant opportunity to unlock ad spend from SMBs

The company noted that the total number of business profiles on its platform reached 140 million (most of them free users). Most of these are small and medium sized businesses (SMBs) which lack the resources of large companies and are likely to benefit the most from FB’s targeted advertising. This is further validated by the the rising number of advertisers, which the company disclosed as having reached 8 million in 4Q19 versus 7 million in 3Q19 and 6 million as of 2Q19. The company is trying to enable this spend with progressively easier-to-use products to democratize advertising for the SMB/local merchant. This includes new products such as Instagram Stories and Instagram Checkout.

This has a meaningful impact, from an ad revenue growth standpoint, as the opportunity is large and penetration remains low. We believe this provides the potential for a greater period of sustained ad revenue growth for the company.

Strong Balance Sheet to Help Weather the COVID-19 Storm

Balance sheet and cash flow strengths are expected to support Facebook through the coronavirus-related downturn. We think the social media giant will not only survive the crisis but will come out stronger and thrive once it dies down. Facebook generated free cash flow of ~$20.6 billion in 2019 (up ~35% over 2018). The company had no debt as of the end of 2019, while total cash and short-term investments stood at $54.8 billion. This gives Facebook ample flexibility to weather the storm, no matter how long it lasts.

(source: Company Data)

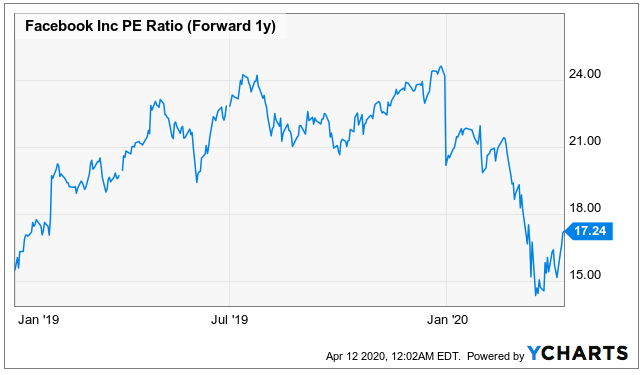

Valuation:

Unlike many other internet businesses, Facebook in incredibly profitable generating significant free cash flow. The stock is currently trading at ~17.2x one-year forward earnings. While this may not sound like a screaming bargain, it is very reasonable in light of its high growth (36% sales CAGR), high gross margins (over 80%) and pristine balance sheet (net cash of ~$55 billion). The recent fall in the share price (more than 20% over the past two months), provides an attractive entry point for investors.

Risks:

Greater regulatory oversight: Facebook has been on the receiving end of heavy political scrutiny with some legislators calling for a break-up of the company. The targeted advertising by Facebook has been at the center of the storm. The regulatory overhang is likely to adversely impact growth which the company noted during its recent Q4 earnings call.

Failure to monetize existing platforms: Facebook invests heavily in new products which are essential to keep engagement levels high. It expects to continue to invest significant resources in growing WhatsApp and Messenger products to support increasing usage of such products. Historically, the company has monetized messaging in only a limited way.

Data privacy laws: This ties up with the regulatory oversight mentioned above. The privacy laws direct companies to ensure that user data is secure and not shared without consent. In fact, Facebook has taken its own privacy initiatives which allows users to choose how their data is being used. This could have a negative impact on ad pricing and revenue growth.

Conclusion:

Facebook is a money printing machine, and it will be for a long time thanks to its strong moat, high margins, pristine financials and vast growth opportunities. The recent coronavirus sell off provides an attractive entry point, in our view. And while Facebook pays zero dividend, its ongoing growth and price appreciation potential will likely provide significant long-term spending cash for investors (i.e. selling some of your winners). Further still, for diversification and risk management purposes, it can be helpful to add a few “Income via Growth” stocks (like Facebook) to your long-term portfolio. Especially following the recent market decline, the share price is quite compelling for long-term investors.