At Blue Harbinger, we make it a point to diversify our holdings across attractive opportunities among different styles and sectors. This diversification not only reduces risks, but it opens up more attractive opportunities. This article focuses on a cloud-based payroll processing company that can provide investors powerful long-term income through price appreciation. We’ve owned this stock since 2015, and believe the current market selloff makes the upside potential (i.e. income via growth) extraordinarily attractive if you can stomach some volatility in the quarters and years ahead.

Paylocity (PCTY), Yield: 0.0%

Paylocity is in the right business, at the right time, and with the right strategy. This is a cloud-based, payroll processing company that has been (and will continue) benefiting tremendously as an increasingly number of businesses move towards digital cloud-based automation for simplicity and cost-savings purposes. And the current share price is very attractive relative to the valuation.

More specifically, Paylocity Holdings Corporation (PCTY) offers Software-as-a-Service (“SaaS”) based payroll and human capital management solutions to US-based middle market businesses. By competitively pricing its products and services and investing in product innovation, the company has been able to garner market share from more established players and deliver strong growth. In this report, we analyze the company’s business model, its growth trajectory, risks (including the coronavirus outbreak) and current valuation.

Paylocity’s target market includes organizations that have 20 to 1,000 employees, with the typical client averaging around 100+ employees. Incorporated in 1997 as Ameripay Payroll Ltd., the company later changed its name to Paylocity and went public in 2014. The products and services offered by Paylocity cater to basic human resource needs such as facilitating automatic payroll adjustments and payments, managing employee schedules and time tracking, tax-filing, employee performance evaluation, providing learning platforms and on-demand pay facilities for employees, recruiting as well as applicant tracking. The company had 20,200 clients as of fiscal year end June 2019. None of the clients accounted for more than 1% of revenue.

Paylocity Generates Revenue from 3 Sources:

Recurring Revenue: This consists of contractual fees that Paylocity earns for providing payroll, timekeeping, and other HR-related services. Please note that the majority of the service agreements are cancellable by clients on 60 days notice. However, Paylocity also enters into long-term contracts which generally last for 2 years. Recurring revenue accounts for 93% of company revenue.

Implementation services: The company receives one-time setup revenue for loading up client data on Paylocity’s cloud database. These are nonrefundable upfront charges.

Interest on funds held for clients: Paylocity collects funds from its clients in advance for the payment of employee payroll as well as taxes to authorities. Until these funds are remitted, Paylocity keeps these funds as demand deposits or invests a portion in highly liquid investment-grade marketable securities and earns interest income from it.

Recent Market Turmoil (Coronavirus) Impacts:

We expect Paylocity’s business to be impacted by the current (coronavirus) market distress, particularly considering its focus on small and mid-sized businesses (these businesses are generally more vulnerable to economic conditions). For a little perspective, Paychex (a Paylocity peer) CEO Martin Mucci recently explained:

“And I'm seeing right now, at least leading indicator, is that small businesses are trying to hold it together, maybe lay off or furlough a few people but maintain their business model. So, that kind of depending on how long this is going to go. And if it doesn't go too long, they'll be able to bounce back.”

Federal Government Stimulus

The federal government is taking dramatic actions to soften the impacts of the current market turmoil/shutdown. For example, the recently passed $2 trillion stimulus package includes $350 billion earmarked for small businesses that have less than 500 employees in the form of forgivable credit program which is designed to ensure that the organizations do not lay off employees. Each business can borrow up to $10 million depending upon certain conditions. Additionally, a 50% refundable payroll tax credit on worker wages has also been announced in an effort to support small businesses. It’s very encouraging to see the government’s swift actions.

Regardless, the slowdown will have an impact on Paylocity’s business, albeit a manageable one, in our view. Since Paylocity was not yet a publicly-traded company, we reviewed Paylocity peer Paychex’s performance during the 2008-2008 financial crisis and found that while client numbers declined in the low single digits in 2009 and 2010, service revenue essentially stayed flat from 2008 to 2010. This is especially significant considering Paychex’s target client segment is essentially the same as Paylocity’s.

We do expect an additional small negative impact on Paylocity’s float income (i.e. interest that is earned on client funds parked with Paylocity (before client employees are paid). Since Paylocity last announced earnings in February (before the dramatic market impacts began), we look to Paychex for inferences. Paychex announced at the end of March, and provided guidance for 2020 implying a 2-3% decline in interest income. Assuming a similar decline for Paylocity translates into around a 1% hit to adjusted EBITDA (assuming a 100% flow though to earnings), not a dramatic impact.

Long-Term Structural Growth Drivers in Place

Paylocity’s business has gained tremendous traction in recent years (as organizations move towards digitization/automation), and it has a lot of room to keep growing rapidly. For example, Paylocity’s products and services are designed for the medium-sized organization, and this represents a large total addressable market. Specifically, there are more than 638,000 businesses in Paylocity’s wheelhouse (i.e. organizations which have between 20 and 1,000 employees). As a reminder, Paylocity had just over 20,000 clients at the end of 2019.

For perspective, assuming Paylocity generates $400 per client employee, the addressable market is around $18 billion. And considering the company currently has market penetration of less than 4%, there is a lot of room for growth. Especially considering Paylocity has been taking share from peers and consistently posting strong double digit growth.

Source: Paylocity

Superior Products and Pricing versus the Competition

As the graphic below, Paylocity has significant competions. And although each of the competitors have slightly different client segments, there are certain areas where the markets overlaps and fierce competition is observed.

However, the comments below, from HR managers at mid-sized companies (posted on Trust Radius) helps underscore Paylocity’s strengths.

Below is a comment from an HR manager at a mid-sized firm posted on Trust Radius that underscores the point we are making.

“For the cost of the product I really don't think Paylocity has competition. All the bigger vendors can't compare since they have little to offer that they (Paylocity) do not do.” – Director, HR, Food Production Company

“I have used ADP for payroll and time keep and Paylocity is better by far. The price is reasonable as well.” – Payroll & Accounting Executive at a Non-Profit

“As a mid-sized company, we need an enterprise-style system but without the cost and development associated with custom software. Paylocity gives us the functionality of many of the enterprise-level systems out there but at a more reasonable price and without the development requirements. With that said, there are some unique situations for our business that the system cannot handle and Paylocity will not adopt them because of their unique nature.” – HR manager at a mid-sized pharmacy

In many regards, Paylocity has simply managed to build a superior product, thank to its continuous investment in R&D and a user-friendly interface. Specifically, we accessed independent reviews on G2 (a business software and services review website) to understand the product differentials between Paylocity and legacy players. As the table below shows, Paylocity beats Paychex and ADP in most key categories.

Not surprisingly, ~50% of the clients that Paylocity adds are poached from ADP or Paychex. Additionally, Paylocity has a strong referral network that consists of benefits brokers, 401k advisors and workers compensation brokers (this network is responsible for 25% of Paylocity’s new client revenue). Further, the company continues to invest heavily in growing its sales force to further expand its client base.

Impressive Track Record of Growth

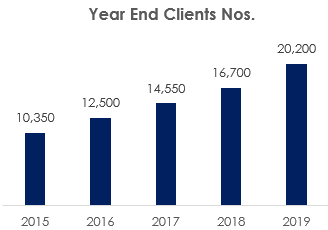

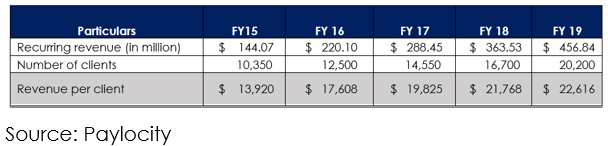

Paylocity’s revenue has grown at a CAGR of 33% from FY 2015 to FY 2019. And the number of Paylocity clients has almost doubled in that timeframe (to 20,200). And client growth has been accompanied by increases in revenue per client. Worth mentioning, Paylocity follows a dynamic pricing model (i.e. the pricing of its products and services differs from client to client depending on the number of employees and modules subscribed to). While some growth can be attributed to size of the clients being added, a significant portion of this growth in revenue per client has been a function of selling more products and services to existing and new clients.

Research & Development is Driving Revenue:

Given the competitive nature of the industry, Paylocity has been consistently investing a significant amount of capital in research & development (15-16% of revenues) to develop newer and updated modules (in addition to its traditional payroll and HCM applications). These additional modules are being offered to existing and new clients, which in turn is helping Paylocity charge more fees per employee on an annualized basis. The maximum revenue per employee per year (if the client opts for the complete solutions package) has gone up from $260 in 2016 to $400 in the latest fiscal year, which represents a CAGR of over 15%.

Margin Expansion due to Economies of Scale

Paylocity’s EBITDA margin has expanded as revenue has grown due to economies of scale. Since 2015, the company’s adjusted EBITDA margin has expanded from 6% to 29%. Worth noting, Paylocity’s margins still lag peer Paycom. The main reason being that Paylocity currently clocks 36% lower revenue than Paycom. As the Paylocity grows its revenue from $468M to over $700M (as the coronavirus recovery begins), we believe it can achieve at least 35% EBITDA margin, as a result of expense leverage on SG&A.

Strong Balance Sheet and Liquidity Provide Cushion in a Protracted Slowdown:

Paylocity has a pristine balance sheet with no pending financial obligations. Further, it has consistently reported expansion of Free Cash Flow over the years because of a combination of increasing number of customers as well as margin expansion. In FY 2019, Paylocity reported FCF of $83.7 million. Additionally, it has a cash balance of over $150 million as of the end of the latest quarter. With no upcoming financial obligations, strong positive free cash flows and substantial cash reserves, we think that the company has enough liquidity cushion available to manage its business through turbulent times.

Comparative Valuation

Given the superior growth profile relative to legacy players such as ADP and Paychex, SaaS based HRM companies (such as Paylocity) trade at a justifiable premium to their legacy peers. Having said that, Paylocity’s valuation discount to Paycom has expanded considerably since 2016 and presents a better risk reward for investors in our view.

Risks

Competitive activity: The company faces competition from much larger companies with bigger balance sheets that are looking to maintain and grow their share. As such, increased competitive activity could put pressure on the company’s sales momentum and margins. Having said that, the company’s superior product and sharp pricing coupled with continued investments in product innovation put Paylocity in a strong position to effectively compete.

Prolonged Economic Slowdown: Another risk is simply that a protracted economic slowdown (due to the coronavirus) could impact Paylocity more dramatically that expected, especially considering its focus on small and mid-sized business, which can be more vulnerable that large companies. However, given Paylocity’s strong financial position (and the ongoing monetary and fiscal stimulus), we view Paylocity in a position of strength.

Conclusion

While we are cognizant of the impact of unemployment trends on Paylocity’s business, we believe the company is well positioned (from a product and organizational capability standpoint) to take share from legacy players in the payroll and human resource services segment in the years ahead, as well as benefit from winning business from newer small and mid-sized companies too.

The stock is down nearly 40% since February 2020 and we believe it presents a highly attractive investment opportunity for investors seeking powerful long-term income via growth. We believe the shares will eventually recover far beyond their previous all-time highs, and if you are a disciplined long-term investor, Paylocity is worth considering for a spot in your portfolio, especially at its current price.