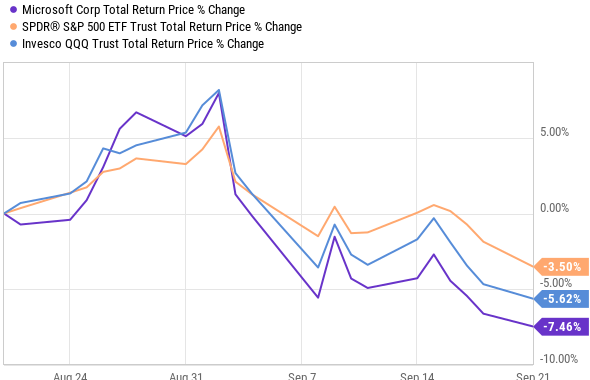

The tech sell off is continuing this week, and cloud stocks continue to be among the very hardest hit. Microsoft has been rapidly growing its cloud business on a massive scale, and the shares have sold off considerably harder than the rest of the market in recent weeks. And this morning’s small news (Microsoft is paying $7.5 billion cash for game developer, Bethesda Softworks) has created more jitter among investors—perfect for this trade because to prevent Microsoft shares from eventually going higher in the long-term has about a snowflake’s chance in Gahenna. In report, we revisit the high-income-generating opportunity that currently exists in bullish vertical put spreads on Microsoft (not as scary as it sounds). Our previous implementation of this strategy expired (quite successfully) on Friday, and the opportunity is again very attractive.

For a little primer, we like this trade because it lets you generate attractive upfront income, giving you the chance to pick up shares of this attractive business at an even lower price, while also limiting your downside risk (and limiting the amount of cash you need to set aside to secure the trade as compared to simply selling naked put options—which by the way we believe is also attractive, if you have the cash). Importantly, we believe this is a very attractive trade to place today, and potentially over the next few trading sessions.

The Trade: “Bullish Vertical Put Spread” on Microsoft (MSFT)

Sell AND Buy Put Options on Microsoft (MSFT) with a strike price of $175.00 (sell) and $125.00 (buy), and an expiration date of October 16, 2020 (just 1-month away), and for a net premium (upfront cash in your pocket) of at least $1.38 (or $138 because options contracts trade in lots of 100). You’re broker will make you keep $5,000 cash on hand (($175 - $125) x 100. The trade generates ~33% of extra income on an annualized basis ($138/$5,000 x (~12 months—annualized). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of attractive blue chip cloud-tech juggernaut Microsoft at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own MSFT, especially if it falls to a purchase price of below $175 but above $125 (if it falls below $125 (i.e. below its recent pandemic low) we’d take the cash difference between our $125 strike put and the market price at expiration—this is basically insurance). The trade may sound complicated, but it’s not, and your broker likely makes all the calculations and execution easy as you can see in the graphic below.

Note: If you are comfortable with setting aside a higher amount of cash in your account to secure this trade, consider only one leg of the trade—selling puts. This requires you keep more cash on hand (in case you have the shares put to you), but it also generates significantly higher upfront income. You won’t have the insurance piece of the trade (i.e. the ability to put the shares if the price completely falls out of bed, but this is blue chip Microsoft—it’s worth owning at just about any price—especially a considerably lower price).

Your Opportunity:

We believe this is an attractive trade to place today and potentially over the next few days as long as the price of MSFT doesn't move too dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) that you feel adequately compensates your for the risks (currently ~33%, annualized).

Our Thesis: Microsoft (MSFT)

Our main thesis is basically that we like Microsoft as a long-term investment, but we also like high income and we know the shares have been volatile in recent trading sessions. Rather than buying shares outright—and rather than selling naked puts (which requires a much higher amount of cash on hand to secure the trade), this bullish vertical spread lets us generate attractive upfront income, it gives us the chance of owning the shares at a lower price, and it gives us a little insurance against a dramatic stock price decline. Your worst loss on the trade is limited to ~$4,862 (i.e. ($175 - $125) x 100 - $138 (upfront cash premium). This may sound like a large loss but it is unlikely to occur (the chance of blue chip Microsoft falling below $125 in the next month is extremely low), and relative to the income you can earn by executing this strategy over and over again, month after month—the trade is quite attractive. Furthermore, you can adjust the amount of capital you are risking by changing the strike prices (or even selecting a different expiration date for the trade). Again, the most likely situation is you get to simply keep the upfront cash premium if the share don’t fall below the strike—and if they do fall to somewhere between $175 and $125 you’ll likely end up owning a very attractive long-term stock, as we wrote about recent Microsoft article here:

Microsoft: Growth, Cash Flow and Perhaps Tik Tok

Important Trade Considerations:

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the share price and thereby impact your trade. In this particular case, dividend payments are not an issue because MSFT doesn’t go ex-dividend until after this options trade expires, and earnings is not an issue because MSFT is not expected to announce again until late October—well after this contract expires. Even new news on the Bethesda Softworks acquisition is not overly concerning to us considering Microsoft’s business is so healthy with or without it.

Conclusion:

Microsoft is a rapidly-growing, cash-rich, blue chip, cloud-tech company that is currently trading at an increasingly attractive price as the current cloud-tech sell-off is dragging the share price lower. There are far more attractive long-term qualities to Microsoft’s business than there are risks, and we view the shares as very attractive.

If you’d like to own shares, but are waiting for a slightly better price—you may get it over the next few trading sessions based on current market volatility. One way to play this is by simply selling out-of-the-money put options on Microsoft (this generates attractive upfront premium income—because the market is so volatile—and if the share price falls below your put strike before expiration, you’ll get the shares put to you at an even lower price). Going a step further, implementing a bullish vertical put spread on Microsoft (as described in this article) get’s you mostly the same benefits of selling naked puts (i.e. attractive upfront income and a chance to buy at a lower price), but it also gives you a little insurance on the downside and requires a lower amount of cash be set aside to implement the trade. Overall, we view Microsoft as attractive, and the current market volatility is creating some increasingly attractive buying opportunities. We implemented this trades successfully a little over 2-weeks ago (and that options contract expired—quite successfully) and this trade provides another attractive income-generating opportunity for you to consider.