In addition to the healthy 7.9% dividend yield, there are lots of things to like about this attractive business development company (“BDC”), including its low exposure to cyclical industries, its impressive portfolio quality, extensive industry relationships and its conservative balance sheet, to name just a few. In this report, we review the business model, portfolio characteristics, strategies and advantages, portfolio performance, dividend yield and safety, financial position, risks and finally conclude with our opinion on the stock’s risk-reward opportunity at the current valuation.

Overview: Ares Capital (ARCC)

Ares Capital is an externally-managed, high-quality BDC trading at an attractive yield of 7.9%. It invests primarily in debt securities of private middle-market companies. The stock saw a drawdown of over 50% during early 2020 due to the cloud of uncertainties led by the Covid-19 slowdown. However, the stock found its way back up and broke to new highs supported by Ares’ fundamentals and diversified, defensive portfolio. The stock is still a solid long-term investment for income-oriented investors despite the recent rally due to various factors we will cover in this report.

What Is A Business Development Company (BDC)?

If you don’t know, a business development company, or BDC, is a closed-end investment company that invests in privately owned, middle market companies, providing them capital to grow or recapitalize. BDCs were created by congress in the early 1980’s as a way to help smaller businesses. A few BDC advantages are described below:

High dividend yield as BDCs are required to distribute 90% of their profits to shareholders as per the governing law.

Being a regulated investment company, a BDC is not required to pay corporate income tax on profits.

They offer diversification as the portfolio consists of companies belonging to varied industries.

Experienced Investment management teams.

Fair amount of liquidity and transparency as BDCs are traded on public exchanges, unlike venture capital funds which are privately placed.

As they are traded on stock exchanges, periods of volatility can lead to shares of BDCs trading at attractive discounts to NAVs.

Business Model:

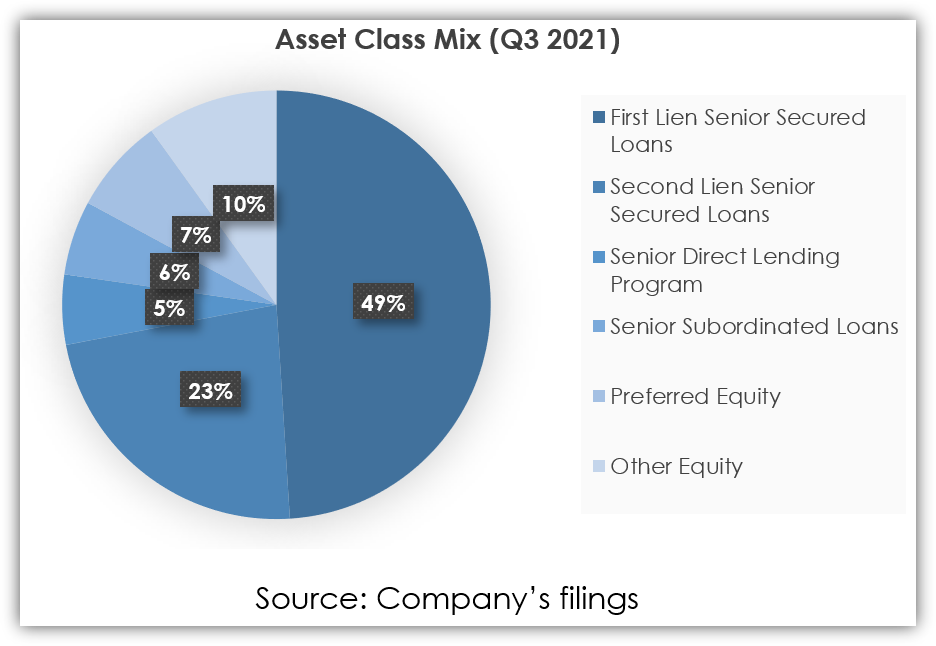

Ares Capital is the largest BDC in the US with a portfolio value of $17.7B as of September 2021. It was founded in 2004 and completed its IPO in the same year. Ares Capital primarily invests in first lien senior secured loans and second lien senior secured loans (together comprising 72% of the portfolio). It also makes non-controlling equity investments and invests in senior subordinate loans, which may include an equity or preferred equity component.

Its portfolio comprises of 371 companies across 24 industries. These are primarily private middle-market companies with EBITDA ranging between $10M to $250M. The average portfolio company EBITDA was $111M as of Q3 2021. In general, Ares invests between $10M to $500M in debt and up to $20M in equity per company. As per the company’s filings, the portfolio investments usually do not have a credit rating but they would be below investment grade if rated. 80% of the portfolio at fair value has floating interest rates, 9% has fixed interest rates, while 10% are non-interest-bearing equity holdings.

Ares Capital is structured as an externally managed BDC. The company is managed by Ares Capital Management and Ares Operations who serve as the company’s investment advisor and administrator respectively. Both are the subsidiaries of Ares Management (ARES). Administration expenses paid by Ares Operations are reimbursed by Ares Capital, while Ares Capital Management charges a base fee and an incentive fee in line with the industry standards for externally-managed BDCs.

Below is the portfolio’s asset class mix as of Q3 2021. Please note, the Senior Direct Lending Program (“SDLP”) mentioned below is a joint venture with Varagon. SDLP in turn has lent first lien senior secured loans to 17 different borrowers.

Well-diversified, Quality Oriented Investment Portfolio

Ares Capital has a well-diversified portfolio with a low issuer and industry concentration. Below are the top ten investments by Ares:

Source: Company’s filings

Please note that Ivy Hill Asset Management is a wholly owned subsidiary of Ares Capital with AuM of $6.6 billion. Apart from Ivy Hills and the joint venture SDLP, no other investment accounts for more than 1.5% of the total portfolio, thereby leading to significantly low issuer concentration risk.

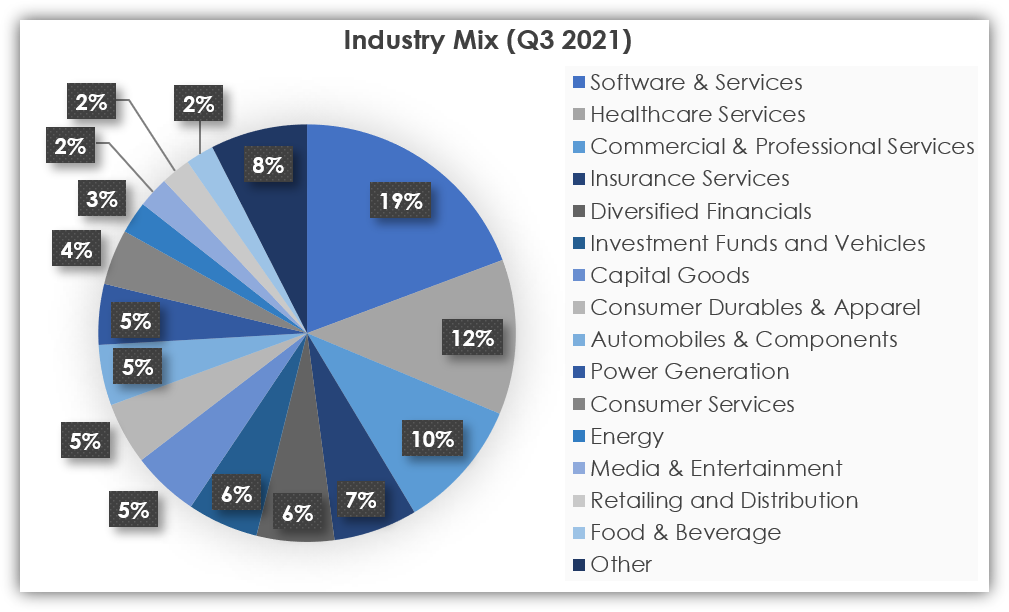

The chart below represents the industry mix of Ares’ portfolio holdings as of Q3 2021.

Source: Company’s filings

It is important to must note here that the company has deliberately chosen to remain underweight cyclical industries to mitigate risks. The Hotel and Gaming, and Media and Entertainment industry accounted for less than 1% of the portfolio. Similarly, the weighting of Retailing and Distribution, and the Energy industry are also low, and there is no exposure to airlines or the construction industry. In contrast, Ares has been significantly overweight industries such as Software and Services, Healthcare Services, and Commercial & Professional Services which together account for 41% of the portfolio. The portfolio companies within these top 3 industries have delivered 30% more EBITDA growth than the overall portfolio as per the Ares’ Q3 earnings call.

Also, the portfolio companies’ weighted average net-debt-to-EBITDA stood at 5.8 times, in line with the last ten quarters. In comparison, the portfolio’s weighted average interest coverage ratio improved from 2.3 times in Q3 2019 to 2.8 times in Q3 2021. Similarly, the weighted average loan-to-value ratio improved from the mid-50s before Covid to 43% as of Q3 2021.

Impressive Portfolio Performance

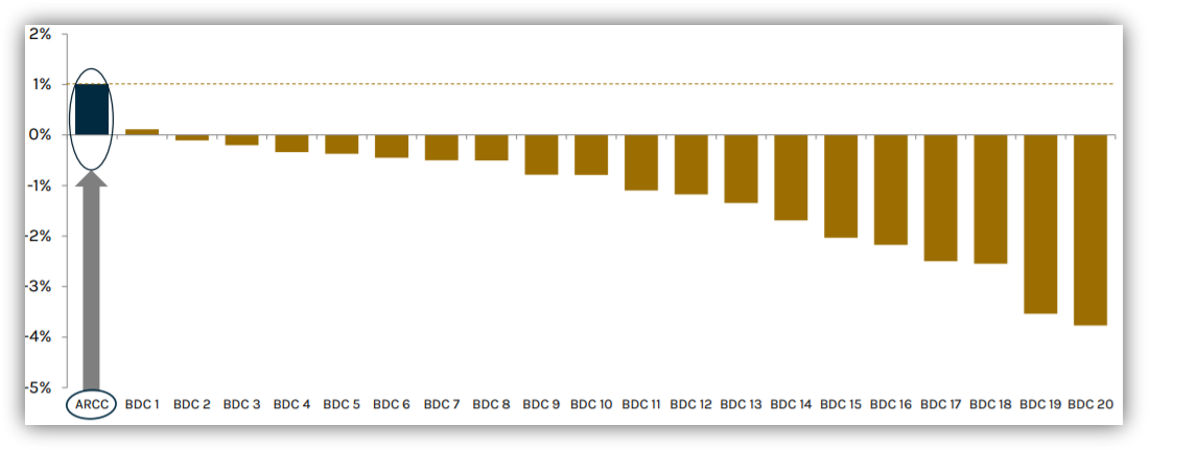

Ares Capital has historically delivered solid portfolio performance. Below, we have reproduced a chart from Ares’ Investor presentation that describes its outperformance since its IPO in 2004 relative to its BDC peer group that includes BDCs with a market cap of more than $500M or a combined market cap of more than $700M if under common management. The company has a positive annualized net realized gain/loss rate vs most other peers that are in the negative territory. The annualized net realized gain/loss rate is equal to the net realized gains or losses for a period divided by the average quarterly investments at amortized cost.

Annualized Overall Net Realized Gain/Loss Rates (incl. equity gains)

Source: Ares’ Q3 Investor Presentation

Ares’ loss mitigation performance has also been strong based on an asset class basis. The realized loss rates for first-lien loans have been less than 10 bps since inception. Similarly, Second Lien & Subordinated, which are considered riskier, have shown a slightly higher loss rate of <20 bps but is still materially below industry averages.

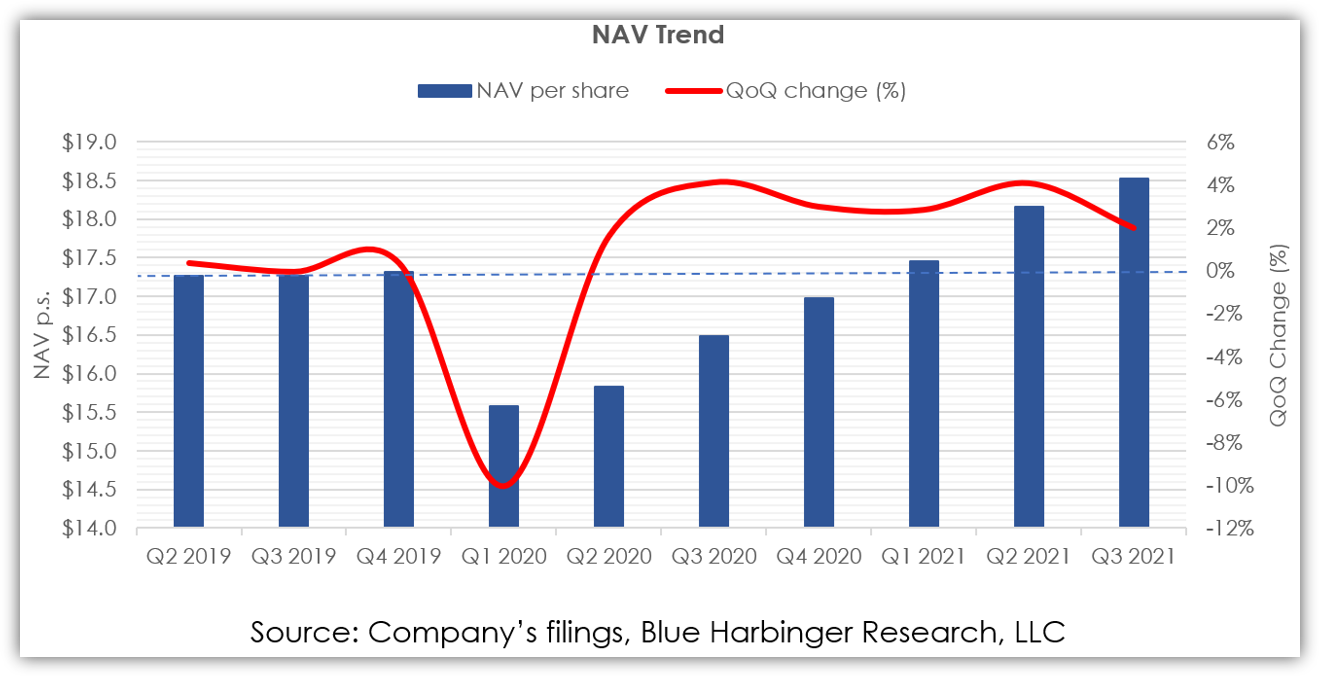

The company is now successfully past the pandemic-led slowdown. It recently reported a record high NAV of $18.52 per share, up nearly 7% from the pre-pandemic level. It saw a significant decline in its NAV per share in Q1 2020 primarily due to large unrealized losses resulting from widened credit spreads (credit spreads are a big factor in accounting-based valuation reporting). However, the NAV went up gradually as spreads narrowed and the portfolio quality improved. We believe management’s industry and individual company selection has played an important role in the portfolio’s remarkable resilience during an economic slowdown. Below is the company’s NAV trend in the last ten quarters.

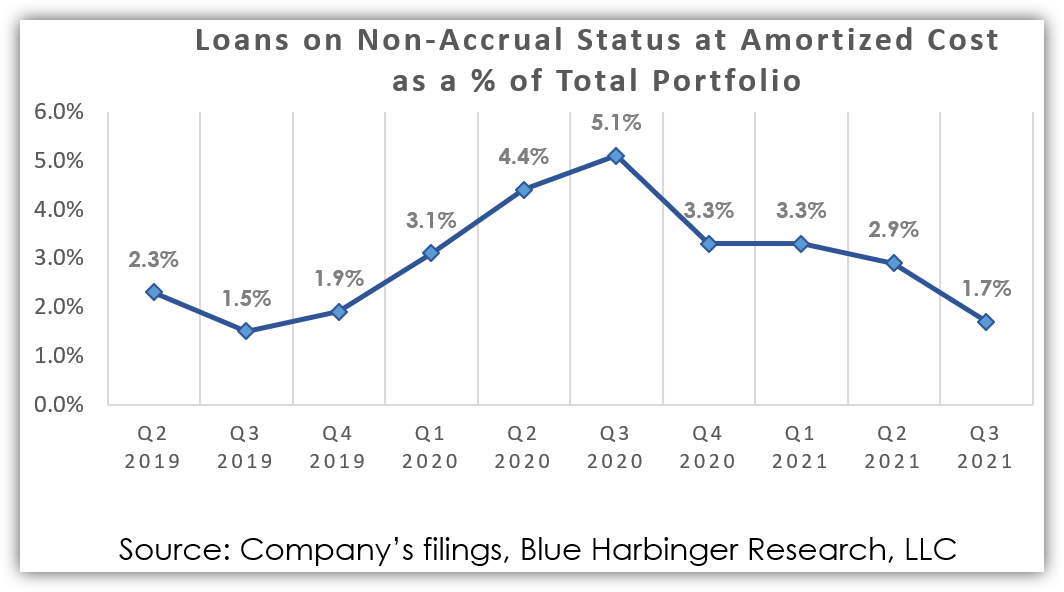

Loans on non-accrual status are loans where the principal or interest payments are due for more than 30 days or are unlikely to be collected in full. Loans with non-accrual status at amortized cost have notably declined from a peak of 5.1% in Q3 2020 as a % of total portfolio to just 1.7% in Q3 2021, which is below even the pre-Covid level and historical averages.

Ares Management Patronage and Advantages of Scale

As mentioned previously, Ares Capital is managed by a subsidiary of Ares Management, a global alternative investment manager which manages $282B in AUM across credit, private equity, real estate and strategic initiatives investment groups. Ares Capital (ARCC) leverages Ares Management’s robust investment platform to analyze and monitor investments for its portfolio. The company also benefits from Ares Management’s relationships with PE sponsors which help Ares Capital tap attractive investment opportunities before other less resourceful players in the industry.

Ares Capital is the largest BDC in the US and it alone accounts for nearly 16% of the total market cap of the BDC Universe that consists of 49 companies. The large investment platform and strong patronage has allowed the company to assemble some of the best investment management professionals in the industry to manage the portfolio. It has a team of over 160 investment professionals which it believes to be the largest investment team in the industry. This enables it to have dedicated specialized teams for individual industries which in turn leads to more conviction and an in-depth understanding of the business models and trends at portfolio companies.

Ares’ Investment committee is comprised of nine members. All the members have been part of the company for more than 10 years and have successfully spearheaded the company across various business cycles (including the global financial crisis and covid-led economic slowdown). Members have more than 20+ years of investing experience and prior to Ares have held leadership roles in companies such as RBC Capital Partners, Indosuez Capital, EY, and Morgan Stanley.

The best-in-class platform also enables Ares to invest in companies that are “undiscovered” and not sponsored by PE firms. Since non-sponsored companies are not owned or backed by PE firms, they can offer much better deal terms with desirable covenants and may also offer better pricing as non-sponsored companies have fewer capital sourcing options. In fact, non-sponsored companies may not be suitable for smaller BDCs as transactions involving them are more time-consuming and need greater expertise given the excessive due diligence required before any investment can be made. Nearly 15% of Ares’ portfolio is non-sponsored as per the Q3 earnings call and the company aims to expand this number further overtime.

Robust Balance Sheet and Liquidity

The company has a conservative balance sheet with a net debt-to-equity ratio of 1.04x as of Q3 2021, well below the permitted limit of 2.0x. The company aims to maintain the ratio between 0.9x to 1.25x. The buffer enables it to be opportunistic and increase leverage to bring in more investable funds in case lucrative opportunities emerge. Moreover, unsecured debt was 83.5% of the total debt as of Q3 2021, which further bolsters the company’s borrowing capability.

Due to the solid balance sheet and portfolio, Ares has an investment-grade rating of “Baa3” from Moody’s and “BBB-” from S&P Global. The investment-grade rating, solid capital market relationships, along with stellar reputation have enabled the company to raise funds at low borrowing costs. It issued $700Mn 3.2% unsecured 2031 notes in October 2021 to repay debt maturing in 2022.

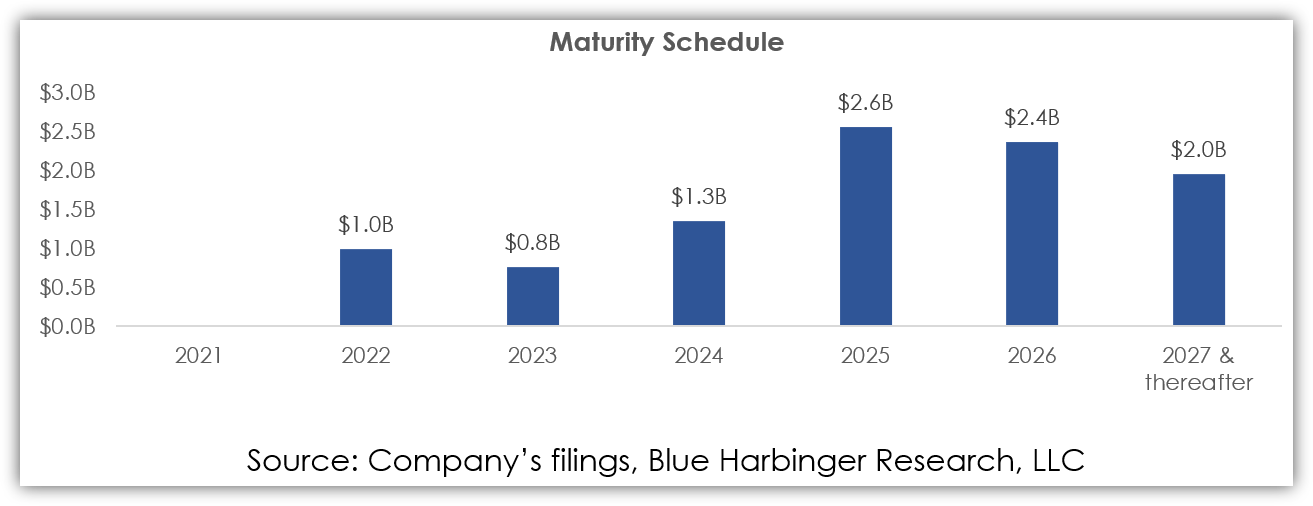

Below is the company’s maturity schedule:

While nearly $1.0B of debt is maturing in 2022, the company has an adequate liquidity position of $7.0B comprised of $1.16B in cash, $5.1B in revolving credit facility, as well as $0.7B unsecured notes issued in October 2021. We believe the strong liquidity position is sufficient to service near term liabilities as well as fund the existing investment backlog and pipeline which amounted to nearly $2.0B as of October-end 2021.

Sustainable Dividends

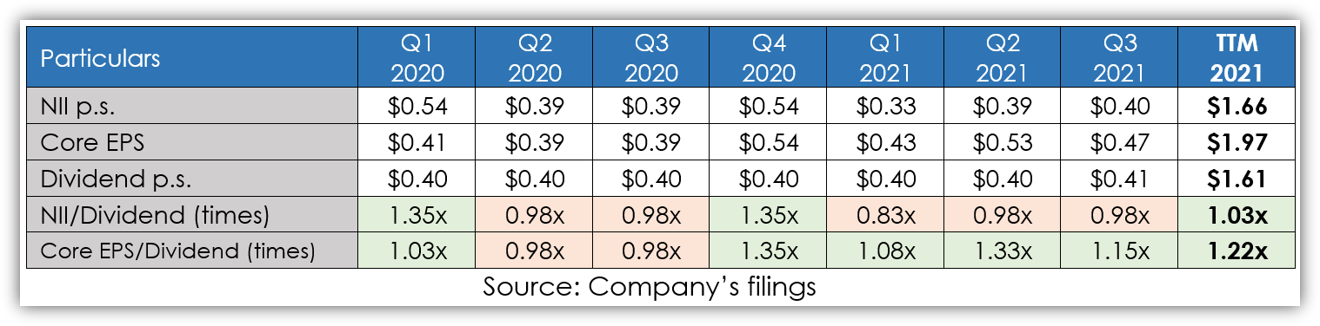

The company has a 10 year+ history of consistently paying attractive dividends. It recently announced a quarterly dividend increase in Q2 2021 of one cent, from $0.40 per share previously to $0.41 given the positive business outlook. This was the first increase after year-end 2018. Please note that the only dividend cut announced in the company’s history was during the global financial crisis and is evidence of the sustainable, quality-oriented mindset of the management team.

The company survived the covid-led slowdown without announcing any changes to dividend payments. Dividend coverage (Core EPS/Dividend per share) remained close to or above one at all times and helped sustain dividend levels during the slowdown. Given the healthy core EPS dividend coverage ratio, strong industry expertise, defensive and diversified investment portfolio, we believe the company can comfortably sustain its dividend levels. The below table shows core EPS dividend coverage and NII dividend coverage since Q1 2020.

Ares Capital trades at a dividend yield of 7.9%. Even though the yield is marginally below pre-COVID levels, it is important to note that in the context of a low interest rate environment that is likely to persist for a long time, we consider this yield highly attractive, especially considering the defensive and quality portfolio the firm manages.

Risks:

Lack of attractive reinvestment opportunities: The large AUM of ARCC makes it more difficult to deploy assets in attractive opportunities given the law of large numbers. Having said that, Ares operates in a tremendously large $1.5 trillion market with just a 1% share and thus the opportunity set is massive.

Macroeconomic Uncertainty: A potential slowdown in the economy would impact Ares negatively. And while macroeconomic conditions are beyond the control of the company, the portfolio has demonstrated resilience, and any share price declines would likely present an attractive opportunity to buy more shares of this big-dividend payer.

Conclusion

Since its inception, Ares Capital has delivered impressive performance and has shown strong resilience during economic slowdowns. The company benefits greatly from its massive scale and robust industry relationships. We also like the company’s conservative balance sheet, ample borrowing capacity, defensive & diversified portfolio strategy, highly experienced investment committee, and consistent/stable dividends. The dividend yield of 7.9% provides investors an attractive income generating opportunity without taking on disproportionate risks. If you are a long-term income-focused investor, you might want to consider shares as a portfolio staple. We are currently long shares of Ares Capital.