If you like to own well-managed, high-growth, industry leaders that will likely make you a lot of money over the long-term, this cloud and subscription based Customer Relationship Management (“CRM”) company is a no brainer. The is so much to like about this business, including it large total addressable market and digital transformation trajectory, its impressive top and bottom lines, its powerful cash flow, the constant innovation, impressive acquisition track record and compelling valuation, to name a few. In this report, we review the business model, market opportunity, financials, valuation, risks, and finally conclude with some important takeaways for investors.

Overview: Salesforce (CRM)

Founded as a Software-as-a-Service (SaaS) company in 1999 with a primary focus on streamlining sales processes (including tracking leads and producing automated sales reports), Salesforce has grown to become one of the leading and most broad cloud-based CRM solutions providers. The company’s solutions help consolidate data from numerous applications and devices enabling organizations to connect with their customers seamlessly and serve them intelligently through its advanced analytics services. While a significant portion of the company’s growth has come from product innovation and global trends including the ongoing digital transformation, its frequent acquisitions have also contributed to the overall growth. The company has been ranked the number 1 CRM services provider globally based on revenue by IDC for 8 consecutive years. Furthermore, the company caters to almost 90% of the Fortune 500 companies.

Salesforce sells its services mainly through its direct sales force and to a lesser extent through partners. It earns revenue primarily by charging its customers for accessing its enterprise cloud computing services for managing a variety of critical functions such as sales, marketing and commerce, services, and others. Salesforce follows a subscription-based business model which leads to more predictability and stability in the company’s cash flows. The company also provides Platform-as-a-Service (PaaS) for its customers who need its multiple products on a single “direct-to-market” platform. A few of its PaaS offerings include its latest “Customer 360” and “Digital 360” offerings. Geographically, it derives the majority of revenue from the Americas followed by Europe and the APAC region. It is important to note that, Salesforce has been successful in diversifying its geographical mix as opposed to many other growth SaaS firms that are still mostly US centric.

Leveraging the Global Digital Transformation

Even before the pandemic, businesses were looking to enhance their existing technology infrastructure to connect with customers more dynamically, however, the coronavirus outbreak has considerably accelerated this transformation. In fact, research conducted by McKinsey concluded that global organizations moved 20 to 25 times faster post pandemic than before when it came to digital transformation. In fact, IDC in a recent report estimated that digital transformation spending will eclipse other IT spending by 2022. The same report stated that digitally transformed enterprises will drive a larger portion of nominal GDP globally as compared to other enterprises by 2023. Salesforce, with its integrated enterprise cloud offering, is well positioned to leverage this growth.

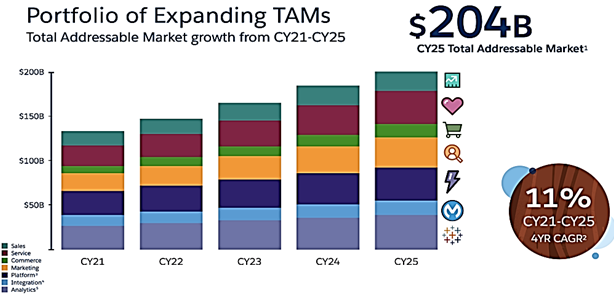

Large and growing Total Addressable Market (TAM)

According to the company’s estimates, its TAM for CY 2021 stood at almost $135B which is expected to grow at a 4-year CAGR of approximately 11% to reach $204B by the end of 2025. It is important to note that, since 1999, the company has been able to grow its TAM significantly not only because of market growth but also due to several acquisitions in adjacent product categories. At present, company’s legacy sales, service, and marketing and communication cloud segments contribute 50% of the TAM while its largely inorganically developed platform, analytics and integration services bring the other half. Going forward, we expect salesforce to not only expand its TAM by adding more products and services but also by penetrating more industries and customer segments.

M&A – an important piece of the puzzle

Salesforce’s growth strategy has involved both investment in internal research and development as well as acquisitions. The strategy has helped broaden the portfolio and position the company as a one stop shop for cloud-based application services. In fact, since 1999 the company has made over 60 acquisitions including Slack, Tableau, and MuleSoft being its latest, large ticket additions. Despite a clear rationale for these acquisitions, Salesforce has long been criticized for its aggressive M&A strategy. In fact, it paid almost 26 times forward sales for acquiring Slack which some considered steep especially considering competition from Microsoft Teams. Additionally, it paid a premium of 45% over Tableau’s market value before the acquisition announcement. Having said that, it is important to note that two of its biggest acquisitions in the past including Tableau in 2019 and MuleSoft in 2018 have led its “Platform and Other” segment to grow at a 2-year CAGR of almost 44% and now together contribute almost 13% of consolidated revenue. Moreover, both acquisitions remained key tools for the company to grow its wallet share among its customers as explained by Marc Benioff, CEO, during the Q1 2022 earning conference call.

“We're seeing more and more inclusion of Tableau and MuleSoft in our large deals as customers accelerate their digital transformations. I mean, I'm sure it will shock everyone that Tableau, Tableau, was part of eight of our top 10 deals. That really is evidence and the integration we've had with Customer 360 of its success. And MuleSoft was included in five of these top 10 deals.” – Marc Benioff, CEO

While it is too early to comment on Slack’s consolidation, we believe Slack will strengthen Salesforce’s Customer 360 platform by adding a collaboration tool for use with a variety of Salesforce’s offerings.

Customer 360 – Creating a single view of the customer

In software, creating an integrated experience drives both value and impact. As per an article by McKinsey, personalized customer communication can reduce acquisition costs by almost 50%, increase top-line by 5-15%, and improve marketing spend efficiency by 10-30%. Given customers today interact with businesses through different means, it becomes difficult for organizations to get a single customer view. To combat these challenges, Salesforce recently launched its holistic “Customer 360” platform. Customer 360 enables businesses to receive and consolidate data from several disparate platforms, eliminating data-silos, analyzing data with the help of AI, and integrate everything regarding a customer under a unique customer ID on a single platform. This allows for a clear view of a customer’s end-to-end journey. Here is a small video that illustrates Customer 360’s capabilities.

Source: Salesforce Ben

Consistent growth in top-line and bottom-line

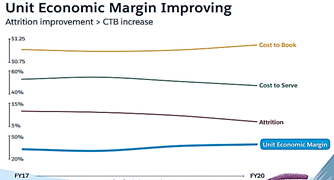

The company reported revenue of $5.96B in Q1 2022, up almost 23% YoY from $4.86B in Q1 2021. The growth is primarily attributable to the increased adoption of the company’s service and analytics cloud. In fact, its revenue from service cloud grew 20% YoY to $1.5B in Q1 2022. Service cloud consists of tools that help organizations deliver a more personalized customer service across multiple channels and devices such as email, social network and phone. Service cloud also provides organizations access to a single centralized platform for managing field agents, dispatchers, and mobile employees. Platform and others including integration and analytics also grew 28% YoY due to increased implementation of analytics cloud powered by Tableau and its “go-to-market” platform. It is worth noting here that Tableau was present in 8 out of the 10 large deals and in over 60% of seven-figure plus deals in Q1 2022. Excluding the impact of recent acquisitions, Salesforce delivered strong organic growth of 18% on a YoY basis. It is also important to note, the company has been able to improve its unit economics margin by almost 500 bps overtime through steady declines in its revenue attrition rate.

Source: Company’s 10-Qs, Investors Presentation

On the profitability front, Salesforce reported a gross profit of $4.4B for Q1 2022 which was up largely in-line with revenue. Non-GAAP Operating Income stood at $1.2B, translating into a 20% operating margin as compared to Non-GAAP Operating margin of 13% the same quarter last year. The improvement was primarily driven by growing top-line, higher operational efficiencies, and realized and unrealized gain on its strategic investment portfolio. Going forward, the company expects its non-GAAP operating margin for the year to stay flat due to expected 160 bps headwind from Slack and Acumen acquisitions, increased investment in its core business, and a slight increase in travel-related expenses as restrictions ease. We believe this guidance may prove to be conservative.

Robust financial position and strong free cash flow generation

Salesforce's balance sheet includes $8.5B in cash and cash equivalents and $6.5B in marketable securities. The company reported approximately $7B in total long-term debt including operating lease and other non-current liabilities. The company is also generating significant levels of cash from its operations every year. In fact, its Cash Flow from Operations (CFO) jumped by 74% YoY from $1.86B in Q1 2021 to $3.23B in Q1 2022. Capital expenditures as a percentage of revenue remained low, leading to $3.1B in Free Cash Flow (FCF). We believe the company’s recurring revenue model coupled with strong cash flow generation in a growing market make Salesforce a highly attractive large cap tech play.

Source: Investors Presentation

Attractively priced

Salesforce currently trades at an attractive forward Price-to-Sales ratio of 8.4x which is inline with its pre-pandemic level however the company’s valuation is at a significant discount to its high growth SaaS peers. We believe the discount is due to its lower operating margins however, the company’s valuation should expand as it digests some of the recent acquisitions and achieves operating leverage.

Risks

Large M&A: While we believe Salesforce’s acquisitions have helped the company further cement its customer relationships and drive higher customer wallet share, large sized M&A also comes with integration risks. As such, investors in Salesforce should closely monitor the progress of the company’s M&A integration efforts, especially as they relate to Slack. Despite some risks, we believe company’s founder and CEO Marc Benioff is a seasoned tech leader who understands the market and his interests are well aligned with shareholders.

Conclusion

If you are truly a long-term investor, that likes to own powerful businesses, with lots of long-term compound growth potential, Salesforce is a no brainer. Everything from its business, the massive market opportunity, financials valuation and leadership, is attractive. We currently own shares, and have no intention of selling anytime soon. You can view all of our current holdings here.