Income-hungry investors flock to PIMCO’s fixed-income closed-end funds for multiple reasons, including the big yields (often in excess of 9.0%), monthly payments, and sometimes even the ridiculously low prices (as we wrote about here and here). And while some investors are reassured by PIMCO’s track record of no distribution cuts in several of their most popular funds (for example (PDI), (PCI) and (PKO)), there is a lot more going on under the hood, and the recently proposed merger between these funds could be a little window dressing by the firm as the track of no distribution cuts may be in jeopardy. In this report, we pull back the curtains on these funds to reveal a little bit about how the sausage is made, and then conclude with our opinion on whether they still make for good investments, or if it is time to move on to new opportunities.

Overview:

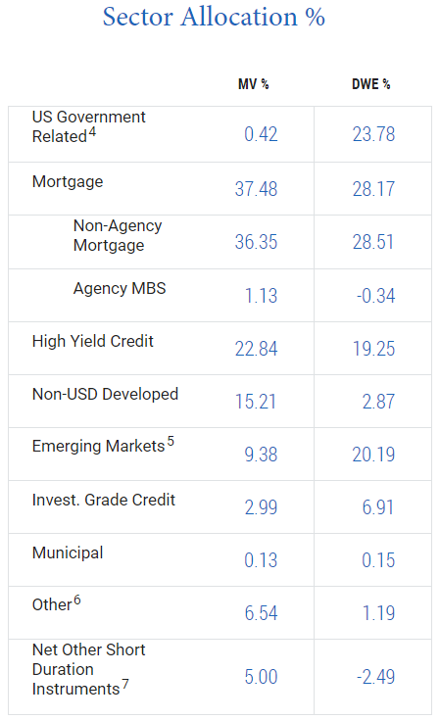

If you don’t know, a closed-end fund in a single investment vehicle that holds a basket of underlying investments. In the case of the PIMCO funds we review, the underlying investments are generally fixed-income securities, as shown in the following graphics:

PDI Holdings

PCI Holdings

PKO Holdings

Closed-end funds are similar to mutual funds and exchange-traded funds in the sense that they hold a basket of underlying investments. However they are unique because unlike mutual funds and ETFs, CEF market prices are determined by supply and demand (i.e. there is no mechanism in place to ensure the market price stays very close to the net asset value (“NAV”) of the underlying holdings). And for this reason, CEFs can trade at wide discounts and premiums to their NAVs. This can create opportunities and risks.

Premiums and Discounts to NAV:

Trading at a discount can be a very good thing because it means you get access to the underlying holdings (and all their glorious dividends, interest and income payments) and a discounted price. However, just because something trades at a discount (or premium) isn’t necessarily a determinative factor in investing because both discounts and premiums can get bigger and smaller. That said, we prefer to buy CEFs trading at a discount (or at least at a premium that is small relative to history).

With regards to these three PIMCO CEFs, they all currently trade at premium market prices versus their net asset values. Specifically, PDI is +13.8%, PCI is +8.4% and PKO is +12.7%. Further, these premiums are near the higher end of the historical premium ranges for each of these funds, respectively. Nonetheless, many investors continue to feel comfortable with these funds because they trust PIMCO, and premiums for PIMCO funds are the norm.

Leverage (Borrowed Money)

Another important factor to consider when investing in a CEF is the amount of leverage. Some CEFs use leverage and some do not. In the case of PDI, PCI and PKO, there leverage ratios were recently 42.13%, 43.97% and 39.92%, respectively (according to CEF Connect). Leverage can magnify returns and income payments, but it can also be a risk factor that increases volatility. In the case of these three PIMCO CEFs, we like that they’ve historically used a healthy amount of leverage, especially considering the types of fixed-income investments they hold are generally less risky that stocks, and some leverage can be prudent. However, the fact that two of these CEFs were recently above 40% is somewhat concerning (more on this later).

Management Fees and Expenses

Another important consideration when investing in CEFs is the management fee and the total expense ratio because they can be significant. In the case of PCI, PDI and PKO, they are significant. According to CEF Connect:

PDI Expense ratio was recently 3.72%, consisting of 1.96% in management fees, 1.72% interest expense and 0.03% other).

PCI Expense ratio was recently 4.18%, consisting of 2.12% in management fees, 2.03% interest expense and 0.03% other).

PKO’s Expense ratio was recently 2.73%, consisting of 1.60% in management fees, 1.11% interest expense and 0.02% other).

Important to note, the interest expense is related to the cost of borrowing (i.e. the leverage), so before anyone goes off the deep end about how a total expense ratio so high is unacceptable, bear in mind a significant portion of it is related to borrowed money (and this makes it more palatable, in our view). Specifically, PIMCO can borrow at a lower cost and manage leverage more efficiently that most individual investors could do on their own. Plus PIMCO has the ability to invest in a wide variety of fixed income investments that most individuals cannot access on their own, and because of PIMCO’s scale they can also buy and sell them at better prices. Overall, PIMCO’s fees are not low by any stretch of the imagination, but they are acceptable if your goal is to achieve steady high income, something PIMCO is very good at delivering.

Are the Distributions Safe?

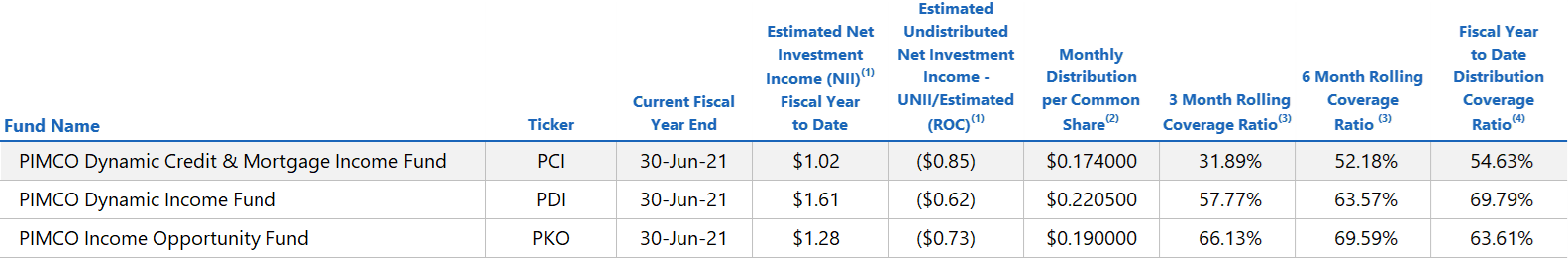

These PIMCO funds have very strong track records of never reducing their distribution payments (only increasing them), and also occasionally paying additional special distributions. And interestingly, it is this long track record of no dividend cuts (only increases) that leads many income-focused investors to PIMCO CEFs. However, a look under the hood reveals that PIMCO appears increasingly challenged in maintaining these distribution payments, for a variety of reasons. For example, here is a table showing the recent distribution coverage ratios for these three funds, and they are not encouraging.

Granted, there is volatility to these numbers, and PIMCO has historically come from behind to cover the distributions, but these three funds have among the worst coverage ratios on any PIMCO CEFs, as you can see here.

Why the Curious Merger?

A couple months ago, PIMCO announced the potential for a merger of these three CEFs later this year, as you can read about in this document.

At first, this merger might seem odd consider the strong track records and investor interest in these three funds. For perspective PDI, PCI and PKO have $1.75 billion, $3.09 billion and $0.49 billion in assets under management, respectively. These are very big CEFs.

At this point, we don’t know the exact reason for the merger, but we speculate that there is an increasing risk of distribution cuts and PIMCO is trying to save some face by doing a little window dressing. Specifically, the largest fund with the highest yield of these three (PCI) will be merged into the second largest with the second largest yield (PDI), and this may allow PIMCO to reduce the distribution on PCI but hide it from investors through a survivorship bias (i.e. PCI won’t exist any more, only PDI and PDI’s dividend won’t be cut).

You might be thinking this merger won’t account to a hill of beans in terms or reducing the cash payouts because the yields are so close, but remember the massive size of PCI (it is the biggest). Further, there will be additional savings through economies of scale (reducing some of the cost of running the funds as separate vehicles). Lastly, PKO may be being thrown into the mix as a talking point. Specifically, PIMCO people can argue that they are actually increasing the distribution payment on one of the funds (PKO) but remember PKO is miniscule is size as compared to the other two. There may be some benefits to throwing PKO into this mix, but it may arguably just be a positive spin talking point for PIMCO.

More Clues about the Proposed Merger

Two more things that stick out about this proposed merger are the higher leverage ratios (PDI and PCI are both above 40%—pretty high for this type of fund), and the underlying holdings trade at a discount to par in aggregate (per CEF Connect, PDI and PCI are $95.52 and $95.44, while PKO is $100.45). To us, the combination of these two factors, suggest that PIMCO may have made some really big bets on fixed-income investments that have not paid off as quickly as they might have hoped. Specifically, if those discounted prices were to have recovered back to par then the leverage ratios wouldn’t be quite so high and PIMCO might have had better opportunities to reposition the portfolios in light of our new rising interest rate / rising inflation environment. In fact, given the interest rate exposure of the fund, it may simply be that PIMCO was betting on inflation and interest rates staying lower for longer than the market now expects. Whatever the case may be, this proposed merger seems odd and it is a bit of a red flag.

PIMCO Plays the Steady Distribution Game

PIMCO intentionally conflates a subset of income investors’ love for dividend-growth stocks, with the notion that a steady growing fixed-income CEF distribution is safer, smarter and better. However, it’s not necessarily the case. As an example, some fixed-income CEFs offer variable yield—paying out whatever income the underlying holdings of their funds generate. However, from a marketing perspective, PIMCO knows it’s easier to get people to invest in a steady (or growing) distribution than a variable one. Even the occasional “special distributions” play into this game as PIMCO stays conservative and holds back income payments in order to put a positive spin in the minds of investors. In reality, this is a bit of shenanigan. Some investors don’t realize it, and others know it and just don’t care. As long as the funds keep paying big steady distributions (without ever cutting—only increasing) then the funds must be good, or so the narrative goes.

The makeup of the distributions is more nuanced, including a mix of income payments, long-term capital gains, short-term capital gains and sometimes a return of capital, all of which can have different tax consequences and differing implications about the health of the fund. In these regards, PIMCO has a solid track record of minimizing ROC and short-term gains, but they did pay some ROC shortly after the bond markets froze up right after the onset of the pandemic in 2020—not good, as you can see in the following PCI table, for example.

PCI Distribution Composition, Source: CEF Connect

Further, the proposed merger may enable PIMCO to extend its strong track record in this regard (or at least better explain away any immediate-term aberrations and risks). But at the end of the day, these funds simply hold income-paying securities with some price volatility and that change over time (as securities mature or are traded away and replaced with different ones). The notion of this steady growing distribution is a game and a fruitful marketing gimmick. PIMCO is just playing along.

What About the Actual Investments?

We’ve reviewed a lot of the mechanics and characteristics of CEFs, but what about the attractiveness of the underlying investments in these funds? For example, we saw the current asset allocation of these funds in the earlier graphics near the start of this report. But are these good places to invest your money, now?

One of the first things to note about these funds is that they are so big and have so many holdings (for example PKO recently held 861 securities), that individual security-selection is less important because each position is so small that it won’t make as much of a difference as a more concentrated fund. Nonetheless, PIMCO can add some value when it trades individual securities by being efficient and getting good prices—which they have the resources to do. What matters more is asset allocation (as we saw in the earlier charts), and specifically what these allocations say about interest rate risks, credit risks and asset class risks.

All three funds (PDI, PCI and PKO) have large allocations to mortgage-related securities and then high yield credit. With regard to the mortgage-related securities—they have interest rate expose (risk), which means when rates rise—the value of these holdings can fall. For example, PIMCO’s website reports that PDI’s total leverage-adjusted effective duration (a measure of interest rate risk) in years was recently 5.95. This is a good indicator of the risk this fund faces when rates rise. However, 5.95 duration is not exorbitant (it could be significantly higher), and we are comfortable with this level.

Regarding, high yield credit, these bonds are riskier and have more price volatility (based on the variable credit worthiness of the underlying bond issues). High yield credit also adds higher yield, and we are comfortable with the exposure level of these funds.

Overall, all three of these funds have well-diversified exposure to high-income producing securities that would be essentially impossible for any individual investor to match (because you don’t have the same resources and scale as PIMCO). And if you are looking for income, we like the holdings and asset allocation within these three funds.

The Bottom Line

PIMCO is a very experienced, top-notch, fixed-income shop, with tons of valuable resources and many of the best and brightest people in the industry. The proposed merger and the facade of steady-growing distributions appear to simply be marketing gimmicks that fixed-income CEFs are forced to play if they want to earn the approval of investors. In reality, all three of these funds will continue to pay big monthly distributions going forward, albeit they may be slightly lower in aggregate if/when the proposed merger comes to fruition. However, as compared to the underlying holdings of fixed income CEFs managed by other companies, PIMCO will continue to be top-notch and hard to beat.

The question most investors should be asking is not whether they should lose faith in PIMCO (don’t—they’re really good), but rather are you comfortable with the asset allocation of these funds and the large premiums they trade at (the premiums can be volatile, as mentioned and going forward). We continue to own PCI (the only PIMCO CEF we own), and we also own a few other attractive high-income CEFs (including BIT, BTZ and DLY) that we like also like because they are well managed and trade at attractive prices relative to their NAVs (it’s hard to buy PIMCO’s interest payments at $1.10 on the dollar (or whatever the premium may be) when you can get the same general opportunities at a discounted $0.95 on the dollar). PIMCO is good, but there are also other attractive opportunities out there. We share many attractive ideas within our current holdings / portfolio tracker tool.