The 8.5% yielding Business Development Company (“BDC”) we cover in this report is relatively new, but well established and large, and it has a strong balance sheet and ample access to attractive deal flow. Like other BDCs, it faced challenges during the pandemic, but has come through relatively unscathed, and continues to use market dislocation to optimize its investments. And while the dividend payout has not been adequately covered by Net Investment Income in recent quarters, the solid investment grade balance sheet enables the company to easily support the dividend payments through these challenges. Importantly, management expects the dividend coverage to improve (including the return of special dividends), and based on recent portfolio optimization efforts, we believe them. Overall, this particular BDC presents an attractive investment opportunity, as near-term nervousness still keeps the price below the book value, something we expect the change in the quarters ahead as dividend coverage (and the overall business) strengthens. If you are a long-term high-income-focused investor, this one is worth considering.

Overview:

Owl Rock Capital Corporation (ORCC) is an externally managed business development company (“BDC”) focused on providing debt financing and other investments, primarily to US based middle-market companies, usually generating annual EBITDA between $10 million-$250 million and/or annual revenue between $50 million-$2.5 billion. It was founded in 2016 and went public in 2019. In a relatively short span of time, ORCC has grown into the second largest publicly traded BDC in the US with an $11.2 billion investment portfolio. It has immensely benefited from being a part of the BDC platform of its external manager Owl Rock Capital Advisors, which consists of five BDC’s, including ORCC, and had $27.8 billion in assets under management as of March 31, 2021.

Attractively Diversified Portfolio Optimizing

ORCC’s investments have typically been oriented toward senior secured loans, which have a higher level of safety, as defaults on these loans are generally very low and the recovery levels are very high (in cases where a loan does default). Senior loans currently account for 94% of ORCC’s total portfolio, and include ~78% in first lien investments.

Source: Investor Presentation, May 2021

However, the percentage of ORCC’s investments in first lien loans has been declining over the past few quarters, while unitranche investments have been increasing. This is primarily due to a shift in focus by the BDC from building the portfolio to optimizing it (as it grows in scale and to achieve its targeted portfolio size). According to CEO Craig Packer, during the Q1 earnings call:

“As we now approach the targeted fully ramped size of our portfolio, our focus is shifting from portfolio construction to portfolio optimization. We expect to see repayments increase and as we get repayments, we will look to redeploy that capital in unitranche or on occasion select second lien investments.”

While unitranche investments are comparatively riskier than senior loans, they tend to generate relatively higher returns. ORCC generally makes these investments to businesses that are very stable, have substantial equity commitments and tend to be bigger companies on average than the first lien portfolio companies. ORCC follows a highly selective investment process, evaluating hundreds of opportunities before closing on companies that typically maintain conservative credit metrics (for example, loan-to-value (LTV) ratios of less than 50%). In fact, ORCC has evaluated over 5,000 opportunities since its inception in 2016 and closed investments on only 165 companies, representing a selection rate of less than 5%. As a result, it has been able to build a strong portfolio that has held up well, even during the pandemic challenges of 2020. Also, the majority of ORCC’s portfolio companies are backed by financial sponsors, who typically tend to provide ongoing financial and operational support, helping them weather operational challenges during tough times (and thus preserving long-term value).

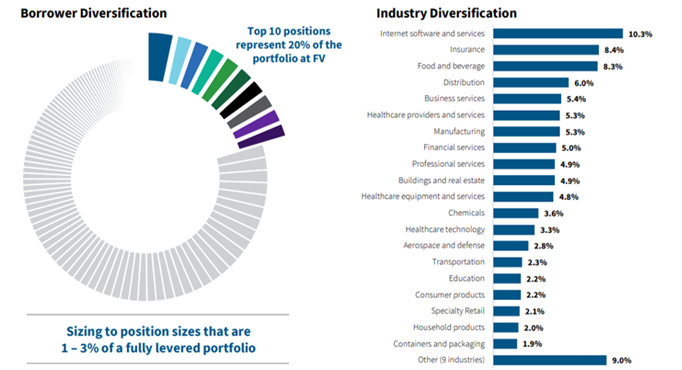

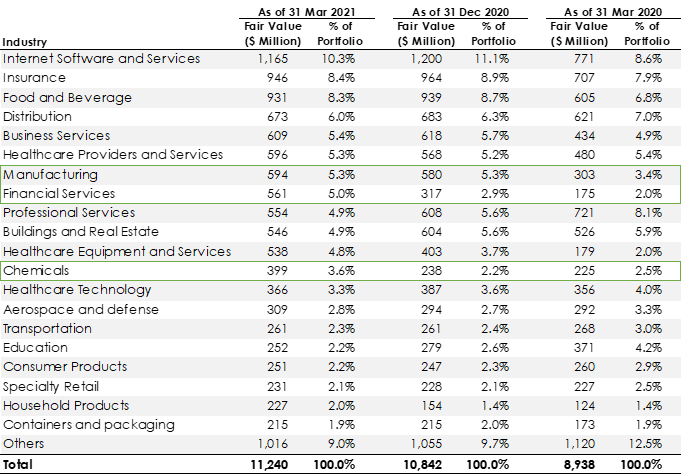

Moreover, ORCC has limited its potential loss exposure by diversifying its investments across 120 companies in 29 industries, with no single company representing over 3% of the total investment portfolio at fair value. A large majority of these companies operate in defensive sectors, which provide downside protection against the risks related to economic cycles. In fact, ~48% of ORCC’s investments are allocated to sectors including software, healthcare, insurance, food and beverage, distribution and professional services, which are known to hold up better than others during times of adverse economic cycles.

Source: Q1 Earnings Presentation

Yet while ORCC’s core focus is on investments in non-cyclical, recession-resistant sectors, it does opportunistically invest in sectors expected to perform well during economic recovery, as noted by its CEO during the Q1 earnings call.

“I think we would be very open minded about doing those where we might not have been six months ago. So, we'll certainly adjust the dial there. But you shouldn't expect to see us really make any significant changes in the sectors we do.”

And an analysis of ORCC’s portfolio in recent quarters reveals it has been investing opportunistically as companies come out of the pandemic and economic activity continues to gather pace. For example, it has increased exposure to sectors such as financial services, chemicals and manufacturing, which are known to perform well during times of economic growth. Worth noting, it has also been increasing equity investments in companies in some of these sectors, notably in financial services and manufacturing.

Source: Company Filings

Portfolio Performance Remains Strong, Encouraging Outlook:

ORCC went into 2020 with no defaults, non-accruals or losses, but had to realize a loss of principal on one investment which went bad during the year. However, on an overall basis, the realized loss was very small, representing an annual loss rate of less than 11 bps. Presently, ORCC has only one name in non-accrual status, representing an aggregate fair value amount of ~$25 million, or just 0.5% and 0.2% of the debt portfolio at cost and fair value, respectively.

Further, ORCC’s investment portfolio has been performing increasingly well recently, as measured by its internal 5-tier rating system. As can be seen in the table below, the percentage of investments with the top 2 ratings have been gradually improving, and at the end of Q1, over 90% of ORCC’s investments have garnered ratings in the top 2 tiers (i.e. a larger percentage of ORCC’s investments are either meeting or exceeding performance expectations).

Source: Q1 Earnings Presentation

In fact, ORCC’s portfolio companies have seen nearly 10% EBITDA growth over the last 12 months and their current average annual EBITDA stands at $104 million. And going forward, as economic conditions continue to improve, sectors that were meaningfully impacted during the pandemic should experience continuing recovery, which, we believe will further improve performance. ORCC has already been seeing encouraging strength in some of these sectors, as noted during its Q1 earnings call.

“For sectors which were more meaningfully impacted including consumer products, education and childcare, we're now seeing a nice recovery. And the outlook is strong as these businesses are expecting meaningful growth in 2021. Certainly, a small number of sectors have been more acutely impacted including travel, leisure and aerospace. We have a few investments in these sectors, although they are a small portion of the portfolio. Still, even here, we have seen recent outperformance versus the revised forecasts and are seeing reasons to be cautiously optimistic given the pace of reopening trends and improved travel industry performance matrix since the beginning of the year.”

Additionally, there is an increasingly healthy demand environment for leveraged loans amid improving economic activity. ORCC is seeing robust new deal opportunities from a variety of sponsors across some of its core focus sectors, including across the technology, healthcare and insurance, as well as in consumer sectors. We believe ORCC’s strong sourcing capabilities (thanks to its scale) will enable it to close on some of the most attractive deals.

Conservative Balance Sheet with Ample Liquidity:

ORCC maintains a conservative balance sheet with a controlled level of leverage (0.92x net debt to equity as of Q1). The balance sheet has been well-capitalized with equity funding and a diverse range of debt financing structures (including unsecured debt, collateralized loan obligations (CLOs), and secured debt facilities). The unsecured debt, which forms 62% of ORCC’s funded debt capital, is particularly attractive in view of the inherent benefits it brings by generating significant amounts of unencumbered assets, which allows for meaningful over-collateralization of secured debt, thereby amplifying overall liquidity. CLOs, which are constructed by collateralizing a subset of ORCC’s investment portfolio, are also very attractive as they provide a highly cost-efficient way to finance the balance sheet. And considering CLO's are issued at floating interest rate, thee also act as a hedge against inflation and rising interest rates, as their underlying asset, the collateralized loan portfolio, is also on floating rates (99.9% of ORCC’s debt investments are on floating rate), meaning both the income and expense components float simultaneously.

ORCC also has well laddered debt maturities, with a (weighted average maturity of ~6 year (and well matched to assets from a duration perspective). ORCC has no debt maturities until 2023, which puts it in a robust liquidity position, which is further accentuated by ~$2.5 billion in cash and undrawn debt. It also has $0.9 billion in undrawn commitments (including $0.5 billion in revolving credit facilities) to its portfolio companies, but the strong liquidity implies that it can fund them by over ~2.6x.

Source: Investor Presentation, May 2021

Further, ORCC has four “investment grade” credit ratings, which have remained unchanged by all of the rating agencies through the pandemic in 2020, and also despite its announcement in April last year to decrease the asset coverage ratio to 150% from 200%.

Source: Investor Presentation, May 2021

We believe ORCC’s ability to maintain these credit ratings supports its ability to fund its capital requirements at low costs and is a reflection of its conservative investment portfolio.

One example of the benefit ORCC derives from its investment grade credit rating is its recent offering of $450 million unsecured notes, which are priced at an attractively low coupon of 2.875%. ORCC intends to use this offering to pay down its existing secured indebtedness, including under the Revolving Credit Facility and the SPV Asset Facility 4, which are on floating rates. The cost of the new offering is effectively lower than what ORCC is paying on the secured debts that it intends to pay down, essentially implying that it will reap the dual benefits of reduction in interest cost and enhanced liquidity from the switch to unsecured from secured debt, without actually increasing its leverage.

The Dividend: Strong Compelling Yield

ORCC has paid stable quarterly dividends since its IPO in 2019, and has sometimes topped it off with an additional special dividend. However, as you can see in the following chart, in recent quarters Net Investment Income (“NII”) has not been enough to cover the dividend payout, and special dividends have been halted.

Source: ORCC Earnings Releases

The recent NII shortfall is due mainly to pandemic challenges, and is largely short-term, as the company and the economy continue to improve. And ORCC has plenty of financial wherewithal (see balance sheet section, above) to cover the dividend in the interim. Additionally, special dividends have been halted in the most recent quarter as a result of the recent expiration of fee waivers. Per this May press release:

The fee waiver put in place in conjunction with the Company's IPO expired on October 18, 2020 and as a result, the first quarter results reflect the impact of the full fee structure for the full quarter.

Nonetheless, the 8.5% dividend yield is compelling given the strong balance sheet and improving conditions. In fact, from a contrarian investor standpoint, it’s better to invest now (as the company continues to strengthen), rather than later (when the valuation gets too rich).

Source: Q1 Earnings Presentation

Important to note, ORCC has been working to offset the impacts of the fee waiver expiation by improving its NII. Specifically, ORCC is increasing leverage (to a targeted range of 0.90 to 1.25), which will be supported by the strong originations and repayment levels in the current environment. In fact, we expect it is only a matter of quarters, before the regular dividend is again covered by NII, and special dividends resume. For perspective, ORCC’s management highlighted the following during the Q1 earnings call:

“Based on the net effect of the pipeline, barring something unexpected, we believe we will continue to modestly increase our leverage level as well as improved earnings in the second quarter. As a result, we expect Q2 earnings to grow and to make solid progress toward covering our $0.31 per share dividend which we ultimately expect to occur in the second half of this year.”

Lastly, it’s important for investors to keep in mind that the overall dividend is variable. Rather than getting over-stretched by sticking to a certain dividend level, ORCC wisely admits that it would adjust the dividend (it’s variable) if need be. For example, management explained the following on the most recent quarterly call:

“While the company continues to have strong performance, its dividend is variable and may fluctuate based on operating results and seasonality.”

Expanded Platform Benefits:

ORCC’s external manager, Owl Rock, recently combined with Dyal Capital (a capital provider to institutional private equity and hedge fund managers) to form Blue Owl Capital (OWL). Blue Owl is a much larger platform than the standalone Owl Rock BDC platform, with ~$52.5 billion in AUM (~91% is permanent capital) as of 31 March 2021. With Blue Owl, ORCC has access to expanded platform resources, which will further enhance its sourcing capabilities and help drive strong long-term performance.

Valuation:

ORCC’s NAV (or book value) at the end of 1Q21 stood at $14.82, which is a significant improvement from the lows of 1Q20, when it had dropped sharply because of unrealized losses across the portfolio (that occurred due to significant spread widening at the height of the COVID pandemic at end of March 2020). Since then, spreads have seen significant compression, resulting in a reversal of unrealized losses, which combined with the improvement in the fair value of investments, has led to unrealized gains and thus an improved NAV.

From a valuation standpoint, ORCC’s shares currently trade ~2% below NAV at a Price to Book Value (P/B) ratio of 0.98x. This is well below its pre-covid P/B range of 1.0x to 1.3x, as well as the average of other large BDCs.

Source: BDC Investor.com

In our view, the current valuation discount provides investors an attractive opportunity to buy into a high-quality BDC at a discounted price, while also locking in a highly-compelling 8.5% dividend yield.

Risks:

Underwriting Risks Associated with the Investment Portfolio: ORCC primarily invests in privately held middle-market companies which generally tend to carry higher risks relative to publicly traded securities. Poor underwriting of any of these investments can possibly lead to heavy losses.

Conflicts of Interest with External Investment Manager: Being externally managed, ORCC is inherently exposed to conflicts of interest with its external manager, OWL, which will have certain obligations towards its own shareholders that might not be in the best interests of ORCC’s shareholders.

Interest Rate Risk: The majority of ORCC’s credit portfolio generates interest income based on floating rates, which means its investment yields are tied to market interest rates such as LIBOR. While the majority of its liabilities are also based on floating rates, it does have certain liabilities that have fixed interest rates, meaning that in a declining interest rate scenario, the decline in investment yields will not be offset by a commensurate decline in ORCC’s interest costs, and this can negatively impact its NII.

Conclusion:

Overall, ORCC is an attractive business, offering a compelling high yield, and providing investors a discounted price. We don’t believe the discount (versus NAV) will last long (as the business improves and optimizes, and as the economy also strengthens, the discount will likely turn to a premium), but we do believe the big dividend payment will likely persist and increase (via the return of special dividends). In a relatively short period of time, ORCC has grown to one of the largest and strongest BDCs, with a prudently diversified strategic investment portfolio, whereby Net Investment Income can continue to increase. If you are looking for an attractive high-yield BDC, ORCC is worth considering. We currently own shares.