Celsius Holdings offers fitness-focused energy drinks, and the business has been experiencing dramatic growth as the pandemic serendipitously led the company to shift its marketing strategy from gyms to mainstream. Investors are optimistic as the company has serious momentum but currently holds just over 1% market share (suggesting a lot of room for continuing growth). However, Celsius faces formidable competition (such as Red Bull, Monster and Rockstar). In this report, we consider the business model, market opportunity, financials, valuation and risks, and then conclude with our opinion on investing.

Overview: Celsius Holdings (CELH)

Celsius Holdings Inc. was formed in 2007 when Vector Ventures, Inc. took over Celsius beverage business from a Florida based functional energy drinks provider named Elite FX, Inc. Celsius uses its proprietary, thermogenic, “MetaPlus” formula in its beverages that stimulates metabolism at an average of 12%, leading to fat loss. In fact, as per the company’s clinical research, a single serving of Celsius can burn up to 140 calories while providing sustained energy for 9 hours. Further, when consumed prior to exercise, the drinks can improve cardiovascular health, fitness, and accelerate fat loss and muscle gain.

Celsius pitches itself as a healthy alternative to traditional energy drinks such as Monster and Red Bull that have high sugar content. In fact, Celsius drinks are artificially sweetened by sucralose, which is considered to be healthier than traditional sugar. Additionally, it also contains natural ingredients which are rich in vitamins and nutrients such as green tea, ginger, calcium, and various others. However, Celsius has caffeine content of over 200mg per serving, significantly higher than its traditional peers (for example, a can of coke has 34mg and a cup of coffee has around 90mg).

Initially targeting fitness enthusiasts, Celsius’ strategic initiative to shift its focus towards mainstream retail beverage distribution channels has proven to be a catalyst, leading to strong top and bottom line growth. Its drinks are now available at 90,000 retail locations including supermarkets, convenience and drug stores, health centers and gyms, to name a few. Geographically, North America continues to be the largest market for the company contributing 75% of total revenue, however, with the acquisition of Nordic based wellness company “Func foods”, the company is taking initiatives to expand its footprint in the international markets. In China, it has entered into a licensing agreement with Qifeng to make its products available to the masses. For Q1 2021, Amazon remained a key customer for the company contributing 16% of the top-line. However, with the opening of retail locations, customer concentration is likely to reduce.

Growing TAM driven by increasing health consciousness

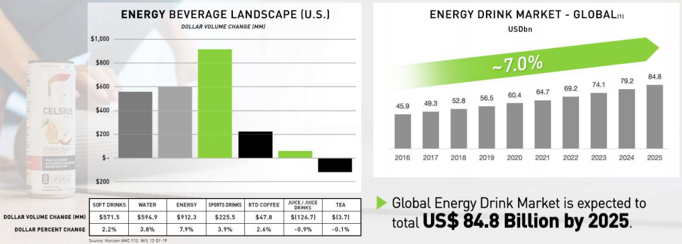

“Energy Drinks” is the fastest growing sector in the food and beverages industry. And high-caffeine drinks are increasingly gaining popularity, especially among the adult demographic. Many adults have begun to include these drinks in their daily routine as a substitute for regular coffee or meals to improve their work performance amid a hectic lifestyle. Other factor driving the industry expansion is the increasing presence of energy drinks in several distribution channels such as convenience stores, supermarkets and e-commerce platforms. As per the company’s estimates, the global energy drink market size stood at $60B in 2020 and is expected to reach $85B by 2025 thereby growing at a CAGR of around 7%.

Gaining popularity following strategic shift to retail

Celsius initially targeted its products to health-conscious fitness enthusiasts. With health clubs and gyms closed and facing operational uncertainty during the pandemic, the company shifted its focus to expand into mainstream channels. The company significantly expanded its distribution channels to cater to non-gym goers or general consumers who wanted to remain fit while stuck indoors, especially millennials. The company moved its marketing initiatives from offline to online by sponsoring live workouts on various social media apps. As a result, Celsius turned “pandemic challenges” into a catalyst for growth. The company increased its US store count by almost 13,500 YoY and now covers almost 85% of major metropolitan markets with a presence in over 92,000 retail locations which include convenience stores, conventional grocery stores, fitness studios, and many others.

As per a recent Nielsen report, Celsius sales were up by almost 218% YoY for the two-week period and 220.3% for the four weeks ending on April 24th, 2021. The next fastest growth company in the space, Red Bull grew its sales by 29% and 37.2% during the two- and four-week time frame. Online sales also increased significantly making Celsius the second most sold energy drink on Amazon, behind only Monster. While the pandemic might have had a positive impact on the energy drink market as people shifted to healthy beverage alternatives, we believe that Celsius’ growth is also a function of its recent strategic initiatives to evolve beyond gyms and health clubs.

Sustained top-line growth led by growing volumes

In Q1 2020, Celsius reported total revenue of $50M which represents a growth rate of 78% on a YoY basis. This impressive top-line number was primarily driven by increasing sales volume during the quarter as company expanded its physical retail distribution channels along with more sales on e-commerce platforms through better online marketing initiatives. While North American sales doubled to $39M, international sales also increased by 25% to $11M because of improved sales volume in Nordic geographies which is where Func Foods (acquired by Celsius in 2019) is based.

Expanding margins along with enough liquidity cushion to pursue growth investments

As is the case with several other high-growth companies, Celsius’ margins are currently constrained as it continues to invest in brand awareness to garner increasing market share in a highly competitive beverage industry. Additionally, inflation is also a negative factor. Despite strong top-line growth, the company’s EBITDA margin remained flat at around 10% primarily due to a shortage of aluminum cans in the US and higher freight costs due to transportation difficulties during the pandemic. Going forward, we expect operating margins to expand as challenges related to can sourcing are resolved and Celsius starts to enjoy economies of scale due to growing volumes.

The company ended the recent quarter with $32M in cash. Further, it has recently raised $63M through a public offering, bringing its total liquidity position to $95M. With zero-debt on its balance sheet, we believe the current cash levels will provide Celsius with enough liquidity cushion to pursue investments to grow its brand.

Fiercely competitive industry remains a long-term concern

The Energy Drink market is intensively competitive and highly mature, with a few key players controlling the majority of global market share. As per t4.ai, Red Bull is the largest player in the industry with 43% of the market, followed by Monster that controls 39% of the market. Rockstar brand, which was acquired by PepsiCo in 2020, now holds 10% market share, making it the third largest player globally. While pitching itself as a healthy alternative to traditional energy drinks with zero calories and essential vitamins and nutrients, has helped Celsius gain prominence, it still remains significantly smaller than its larger peers with just 1% market share.

Further, the already crowded market space has very limited barriers to entry. While Celsius has patents on blends, it does not on ingredients used which are easily available in the market. In fact, Red Bull and Monster have already launched their versions of zero sugar, high nutrients drinks that have lesser caffeine content. These drinks have also become highly popular and are currently in the top 5 most sold energy drinks in the US. With fierce competition from regional players as well as financially stronger, larger peers, it is not going to be an easy ride for Celsius despite the company gaining initial momentum.

Premium Valuation

Celsius shares currently trade at a premium EV/Sales valuation multiple as compared to peers, as you can see in the following table.

However, it’s important also to recognize the higher expected growth rates for Celsius versus its peers. Monster Beverage may be closer to a true peer, and you can see the evolution of valuation metrics (price to sales) over time for these two companies in this next chart.

Despite Celsius’ strong expected growth, we continue to view the shares as “on the expensive side.” That’s not to say the shares can’t be carried dramatically higher by momentum (they can be), but this business model is not as “sticky” as other high growth businesses. For example, Celsius’ valuation metrics are as high as many popular high-growth Software-as-a-Service businesses with subscription-based (very sticky) business models. Again, these shares can still go dramatically higher, especially if the sales growth trend stays impressively high. However, these shares will be volatile and should be watched closely.

Risks

Intense competition: Celsius faces intense competition from much larger peers such as Red Bull, Monster and Rockstar that control 90% of the market. Besides, due to low barriers to entry, the energy drink industry attracts new entrants.

Negative health impacts: Energy drinks in general and Celsius’ drinks in particular contain a high amount of caffeine. While it promotes metabolism and helps in weight loss, excessive intake of caffeine may lead to negative side effects such as high blood pressure, anxiety, restlessness and troubled sleeping patterns. As such, negative press coverage could also lead to consumers switching to low caffeine brands.

Conclusion

Celsius is an impressive high growth business. It wisely transitioned its business model from gym-focused to mainstream during the pandemic, and now enjoys massive growth and a very large total addressable market opportunity. That said, the shares are not cheap, and the business is not “sticky” (i.e. this isn’t a long-term technology subscription model, and consumer preferences can change quickly). We may end up kicking ourselves down the road, but we do NOT currently own shares of Celsius. We’ve added Celsius to our watchlist, and we will continue to watch the shares/business closely for potential highly-attractive buying opportunities.