Business Development Companies, or “BDCs,” basically provide financing (debt and equity) to private companies that are usually a bit too risky for ordinary banks to work with (due especially to stringent post-financial crisis regulatory rules). However, by building a portfolio of these companies, BDCs can reduce risks, and pay income-focused investors the big dividend yields that they love. This report provides an overview of current BDC valuations, and then reviews five of our favorite BDCs, currently yielding 6.0%, 9.1%, 8.2%, 8.1% and 8.5%, respectively.

Before we get into our favorites, here is a look at some relevant data on 40 big-dividend BDCs.

For starters, you can see that almost all of these BDCs offer very big dividend yields (something that is generally tempting to income-focused investors).

Next, you can see that almost all of these BDC’s have posted strong returns over the last year. However, keep that in perspective as they were all trading at depressed prices 1-year ago during the depths of the covid sell-off. And interestingly, most of them have stronger 1-year performance than 2-year performance (again caused by the volatility of the pandemic).

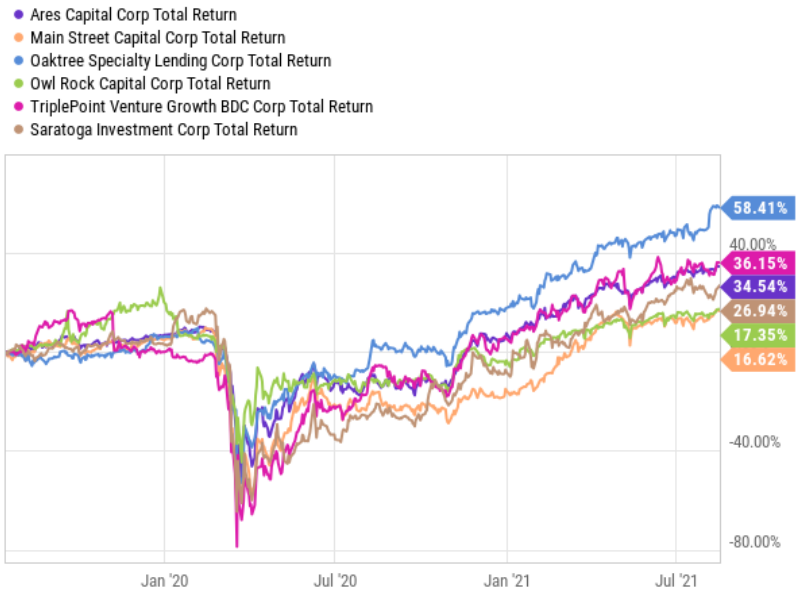

For perspective, here is a quick look at the performance of some top BDCs. It was a volatile ride through the pandemic, but for the most part—if you held on—you did very well.

To add some color to BDC performance during the pandemic, recall that BDCs generally make higher risk loans (to lower credit quality businesses), and the uncertainty of default during the pandemic exacerbated the volatility. However, for the most part, they’ve all rebounded very strongly as market conditions have improve with social-distancing requirements easing.

Price to Book Values are also included in the table, and this is an important BDC valuation metric. For a little more perspective, here is a look at the recent price-to-book values for a few select BDCs.

A lot of investors like to buy at a discount to book value (instead of a premium), but premiums are okay too as long as the BDC is attractive, and as long as the premium is consistent with historical levels (relative to the quality of the business). For example, Main Street Capital (MAIN) pretty consistently trades at a premium.

And of course dividend yields are important (they’re the reason a lot of income-focused investors invest in BDCs in the first place). Here is a look at the historical yields of these same popular BDCs.

You’ll not Saratoga (SAR) in the table above temporarily suspended its dividend during the pandemic, but has since resumed. We currently own all of the BDCs in the above chart (except Not Saratoga). And you can access links to our previous full reports on these BDCs in our portfolio tracker spreadsheet.

The Bottom Line

We have three key takeaways with regard to the current state of the BDC market. First, despite the extreme volatility of the pandemic—if you had simply just held on (and not panicked and sold) you’d have done very well over the last 18 months. Specifically, you’d have kept receiving big dividend payments, and the value of your investments would have recovered and increased.

Second, BDCs are currently fairly priced, in our opinion. That means don’t expect huge price returns going forward, but do expect continuing big dividend payments.

Finally, select your BDCs carefully, the business models are quite different, and not all BDCs are attractive. You can view our current BDC holdings (and access our previous full reports on them) here. Being selective matters. And disciplined, goal-focused long-term investing is a winning strategy.