Energy stocks have been top performers this year as inflation and post-pandemic demand both rise, while supply falls (and is disrupted by geopolitics). This article shares a few quick reminders about how you may want to play this sector going forward.

US Petroleum Reserve

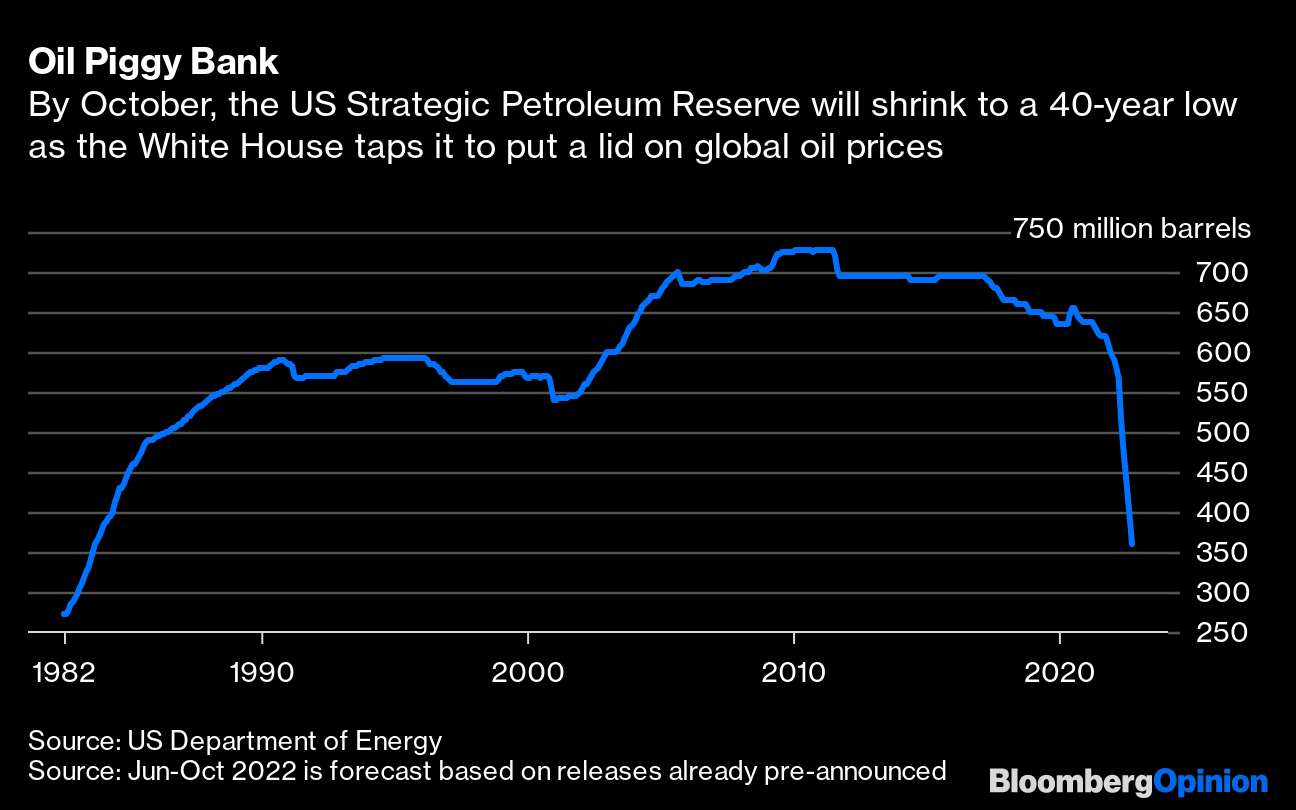

For starters, here is a look at the recent drop in the US Strategic Petroleum Reserve as the White House taps it to keep prices down (for political reasons, mainly—ahead of the upcoming elections).

However, as the reserve is set to reach dangerously low levels, its likely the White House will restock the reserve following the November elections. This will create higher demand and likely remove the constraint so oil and gas prices will go higher.

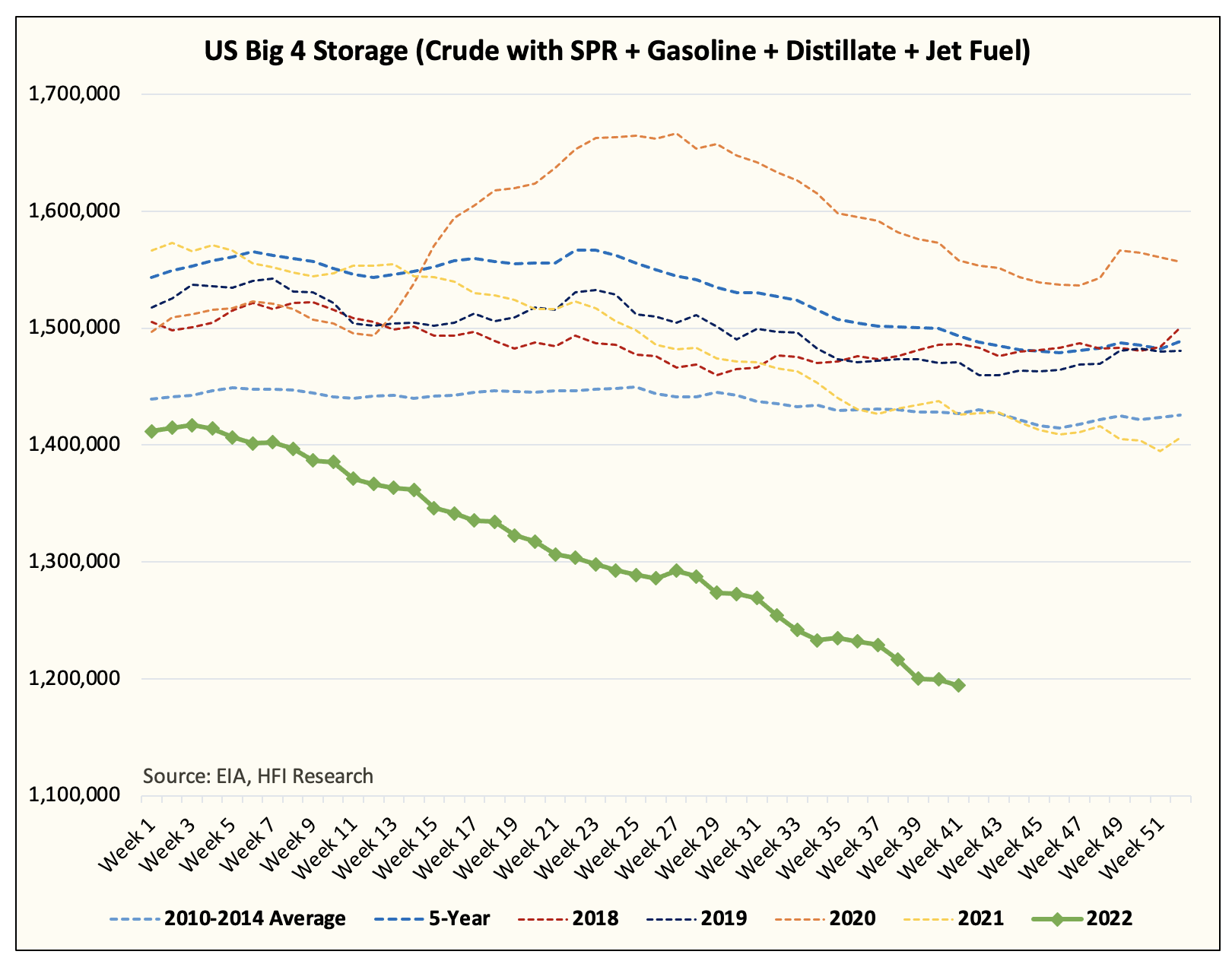

For a little more perspective, here is a similar look at the alarming decline in oil reserves.

OPEC+ Supply Reduction:

Compounding the issue, OPEC+ recently announced a big supply cut, which will add pressure to increasing prices:

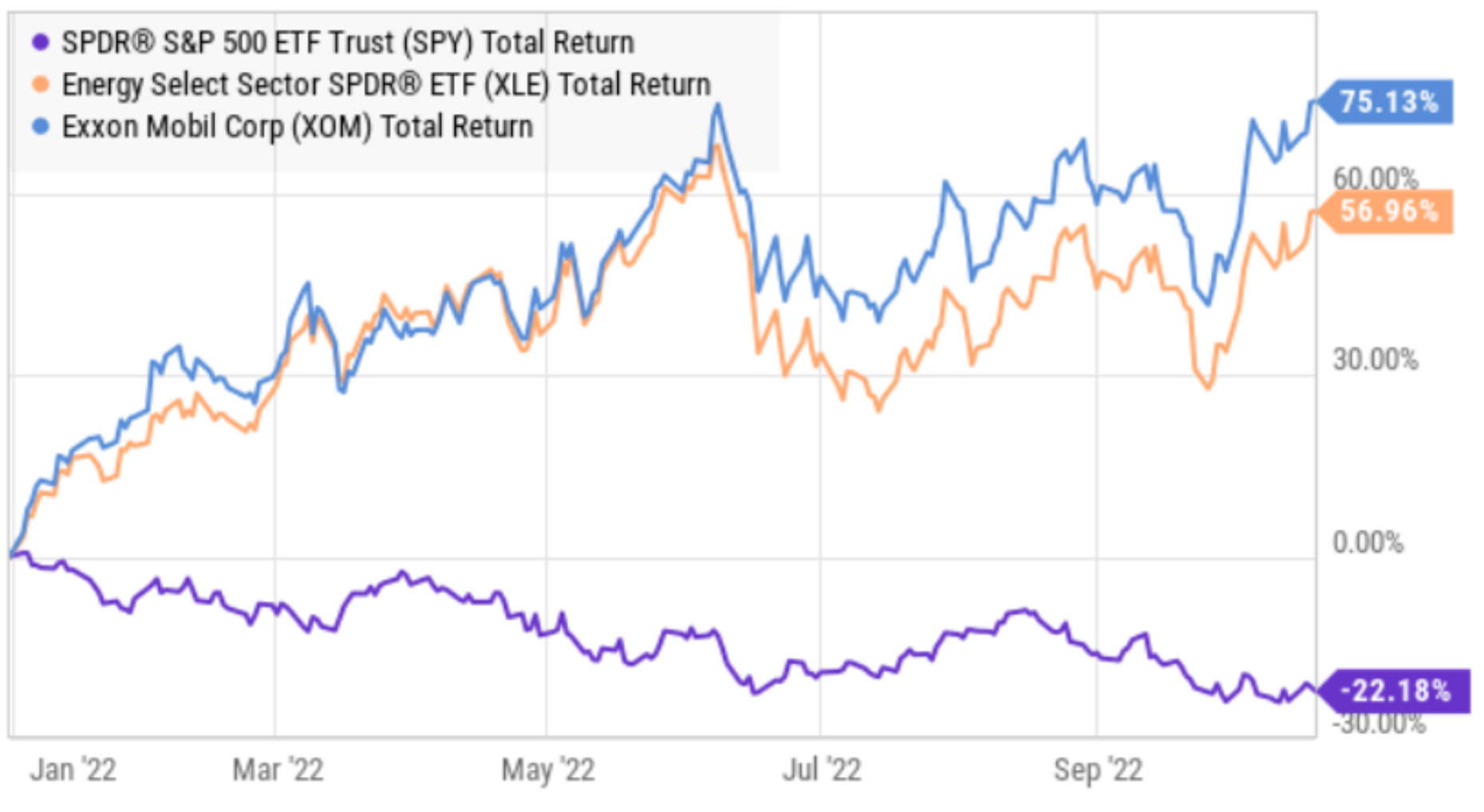

The Energy Sector’s Contribution to 2022 Market Performance

As a reminder, the energy sector has performed extremely well, but it still only makes up about 4.6% of the S&P 500 (SPY) (a small percentage compared to other sectors).

The Bottom Line

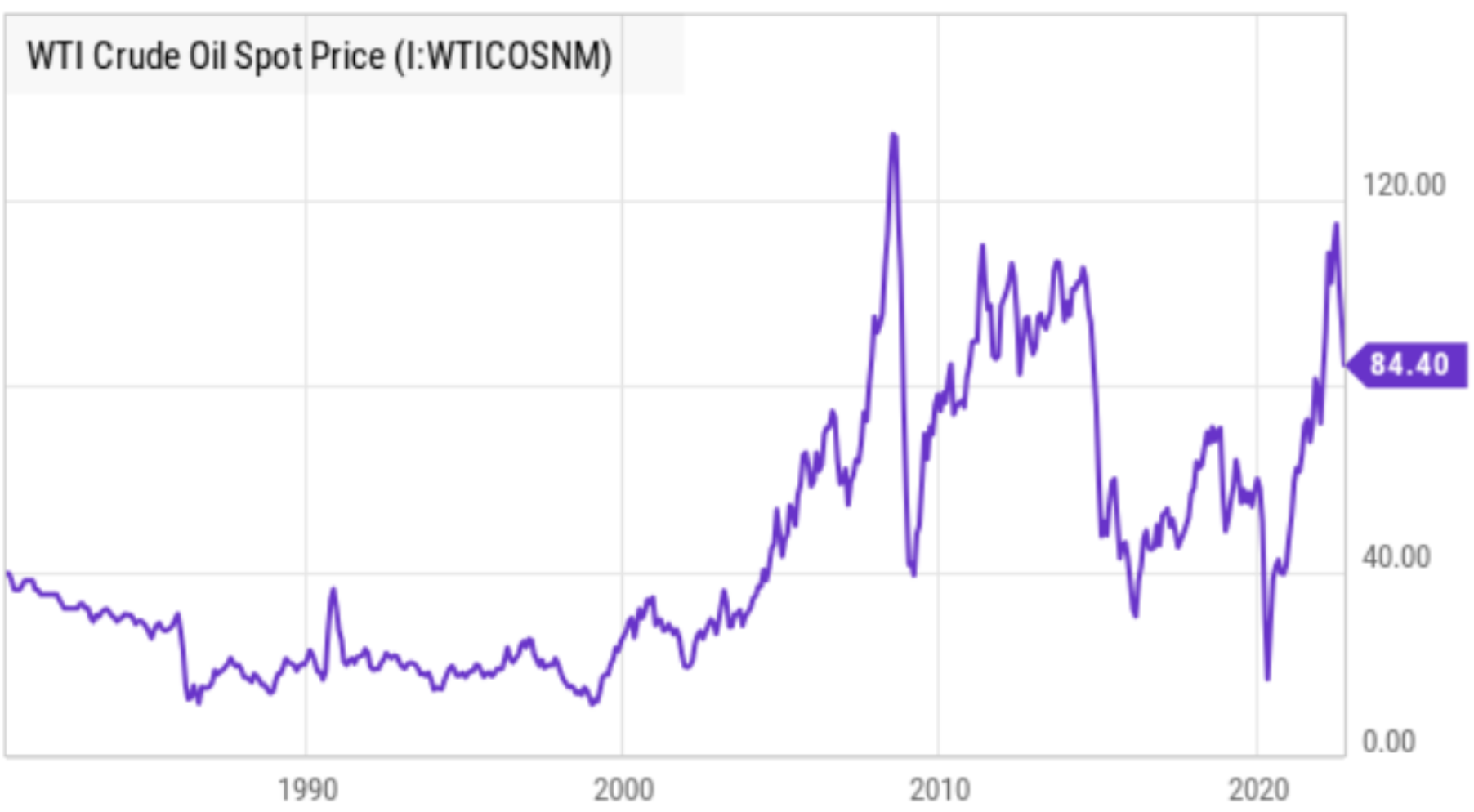

No one can predict the price of oil, but given the current supply-demand dynamics—it looks to be headed higher. Three good ways to play this are:

Exxon Mobil (XOM): The share price is highly correlated to the price of oil.

Alerian MLP ETF (AMLP): If you don’t mind paying the fee (0.85% pe year), then this is a great way to play the oil and gas midstream sector (where the businesses are less sensitive to short-term oil prices, but ultimately strengthened by strong oil and gas companies…i.e. the MLP customers). It offers a 7.5% dividend yield, and there is no K-1 tax filing with this ETF.

Energy Sector ETF (XLE): As energy makes up about 4.6% of the S&P 500 index, you might want to consider adding a similar weight of this low cost (0.11% annual fee) ETF to you portfolio so you are at least “market neutral” (if you have no other energy exposure.

Again, no one can predict the price of oil, but it looks set to go higher. Adding at least a few energy sector stocks to your portfolio may be worthwhile to reduce risks (the risk of missing out) and to allow you to benefit from the potential gains ahead.

Current WTI (oil) spot rate ($)