This has been a terrible year for bonds. As interest rates have risen sharply, bond prices have fallen sharply (and lending in general has been tumultuous). Both Bond Closed-End Funds (“CEFs”) and Business Development Companies (“BDCs”) have been impacted dramatically (i.e. their prices have plummeted as rates have risen). However, this has created select opportunities offering bigger than normal yields and higher than normal price appreciation potential. In this report, we offer an overview of Bond CEF and BDC opportunities, we share important data on over 50 of them, and then we countdown our top 10 big-yield Bond CEFs and BDCs.

Some Background on Bond CEFs and BDCs

Bond CEFs are closed-end funds that invest in fixed income instruments (i.e. bonds), whereas BDCs are business development companies that basically make loans to smaller “middle market” businesses. They both are impacted dramatically by interest rate changes, and they both have important “uniquenesses” and nuances.

For example, CEFs can trade at wide premiums and discounts to the net asset value of their underlying holdings (because they trade based on supply and demand, and unlike other mutual funds and ETFs there is no mechanism in place to immediately “correct” the price discrepancies), and CEFs are allowed to use varying degrees of leverage or borrowed money (up to 50% for bond CEFs) which can magnify returns and yield in the good times, but magnify pain in the bad times (like this year so far).

BDCs are similar to Bond CEFs in the sense that they are investing in loans, but unlike Bond CEFs (where the loans are usually neatly packaged into a large bond issuance that is traded publicly), BDCs generally underwrite the loans (and financing terms) themselves thereby creating significant risk and reward opportunities. BDCs also are eligible for RIC tax treatment for U.S. federal income tax purposes (meaning they can basically avoid corporate income tax if they pay out their income as dividends), and their dividends can be ordinary or qualified (a good thing for tax purposes).

Importantly BDCs and Bond CEFs are very different investment vehicles, and within each group there are very different sub-categories. However, they are cousins in the sense that they are both basically investing in lending, they are both impacted dramatically by interest rate changes, and they have both sold off very hard this year.

50 Big-Yield Bond CEFs and BDCs

To help facilitate this discussion, here is a look at 50+ big-yield BDCs and Bonds CEFs, including a variety of important data points.

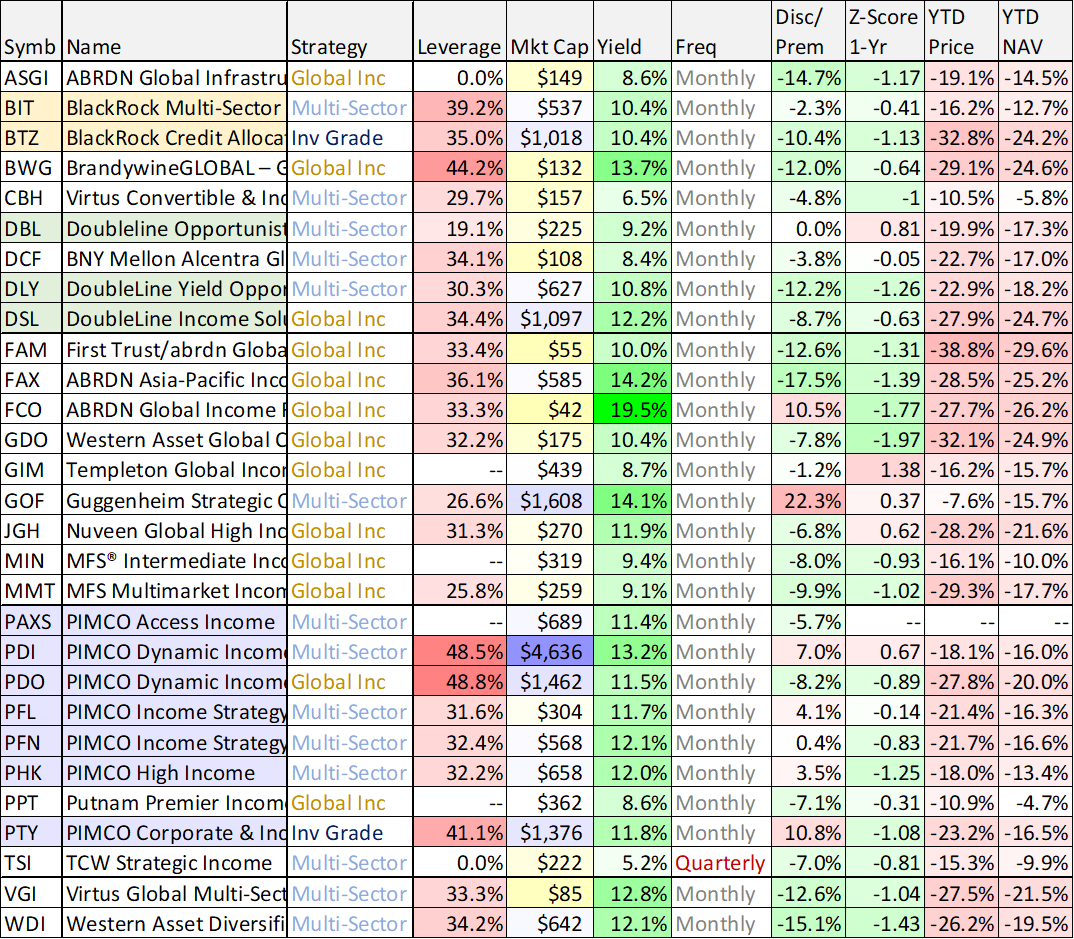

Bond CEFs:

source: CEF Connect. data as of Friday, October 28th

You likely recognize at least a few of the popular bond CEFs in the table above, such as those offered by PIMCO, BlackRock and Doubleline. The table also includes important data on year-to-date returns (based on price and NAV), current leverage levels (leverage brings risk and opportunity), distribution yield, discount or premium to NAV (we generally prefer to buy things at a discount), 1-year Z-score (how does the discount or premium compare to the 1-year average—lower is generally better, ceteris paribus), distribution frequency, market cap and more. We’ll return to this Bond CEF later as we countdown our top 10.

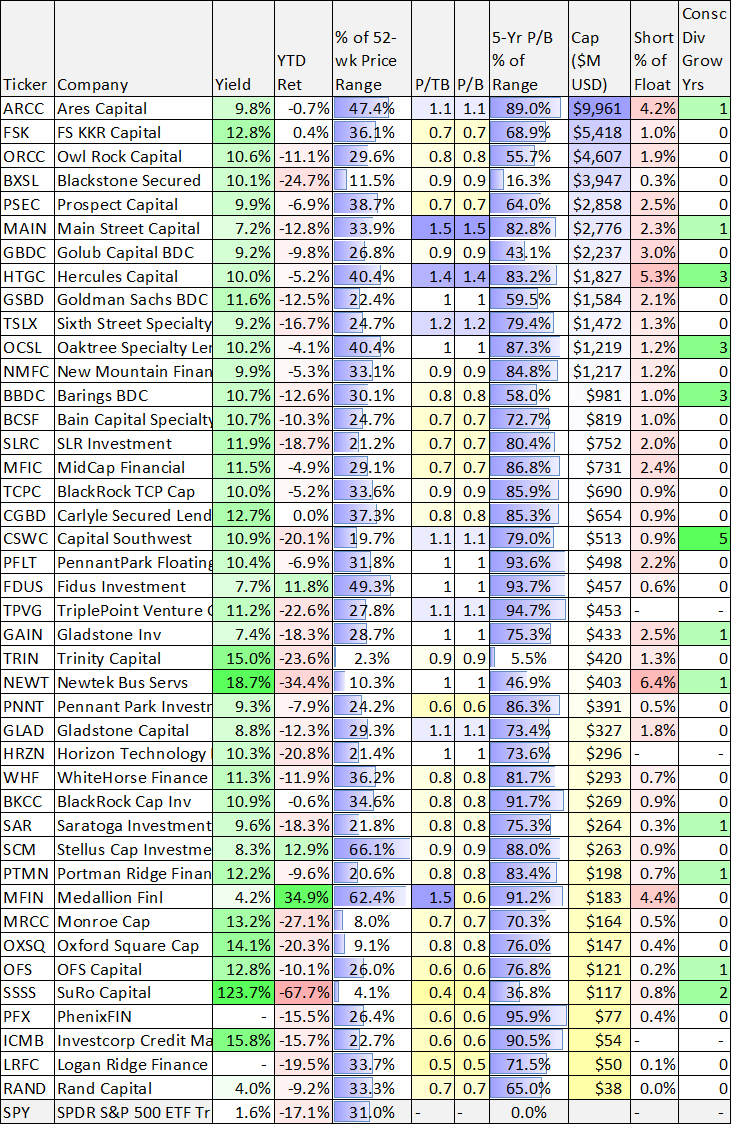

Business Development Companies:

source: StockRover. data as of Friday, October 28th

The above table is organized by market cap, and you likely see at least a few of your favorites at the top of the list. The list also includes important data on price-to-book value, market cap, year-to-date returns, dividend yield and more.

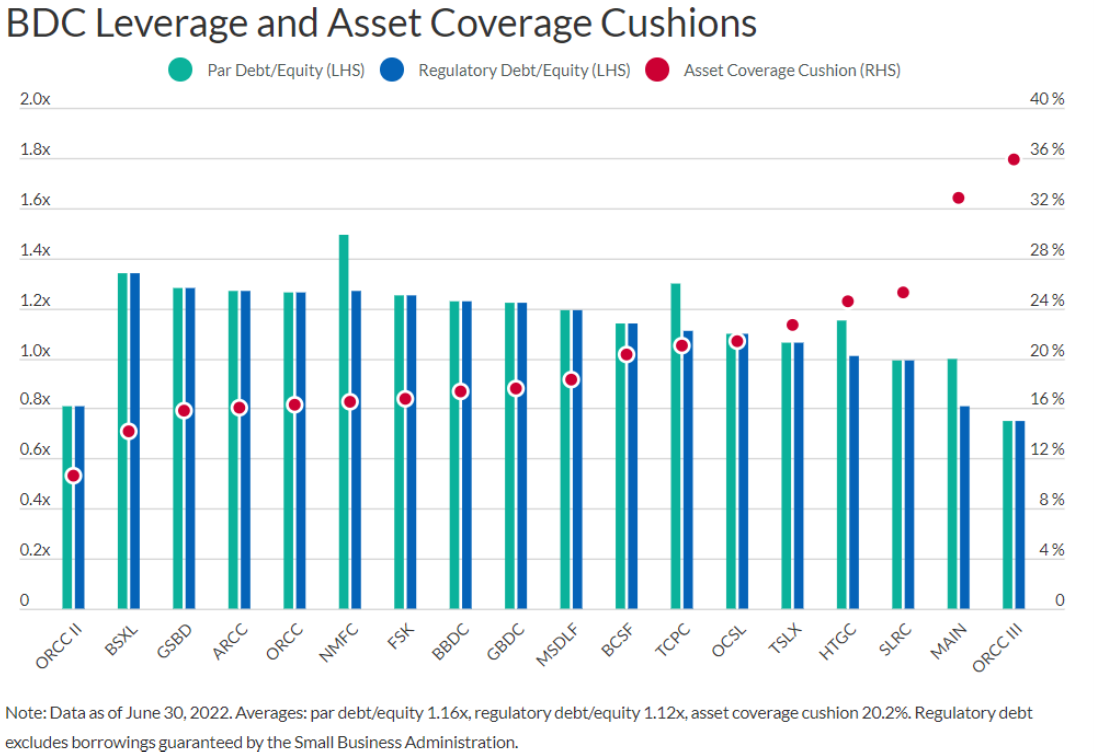

Similar to Bond CEFs, BDCs are also subject to regulatory leverage limits. Specifically, the debt-to-equity limit was raised to 2x in 2018, but as you can see below most BDCs remain well below that limit.

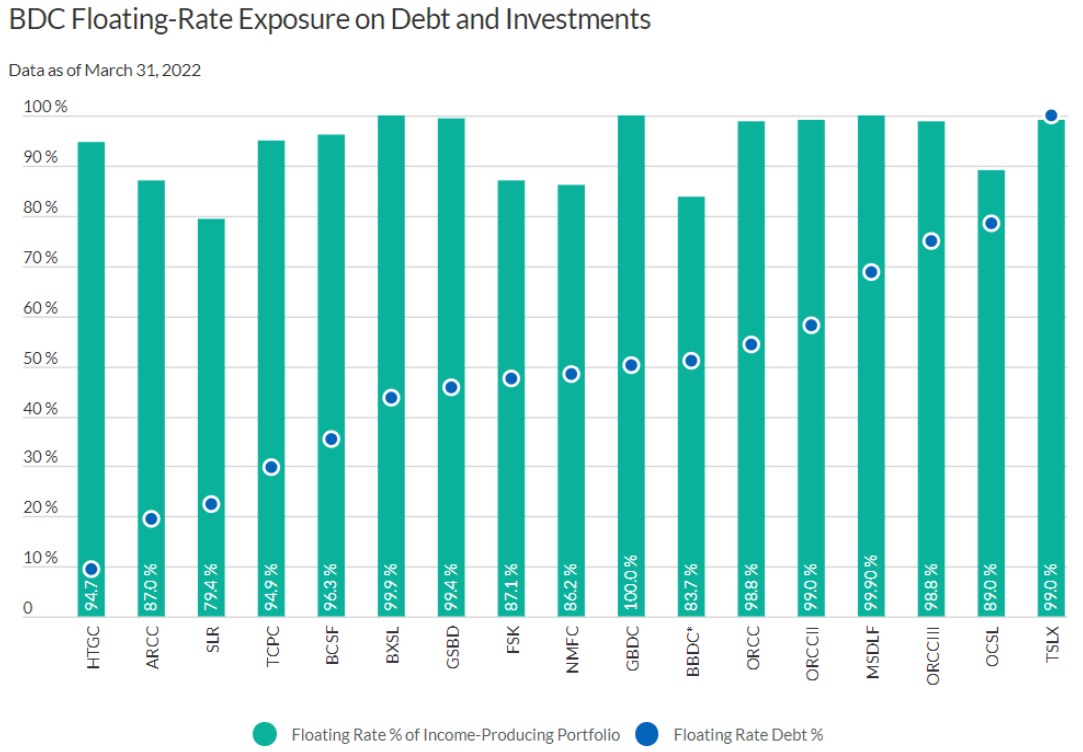

Another important BDC consideration is how much of their investments are fixed or floating rate, and how much of their own debt is fixed or floating rate. This makes a very big difference as interest rates keep rising. And you can get some perspective for the differences among BDCs in the following graphic from earlier this year.

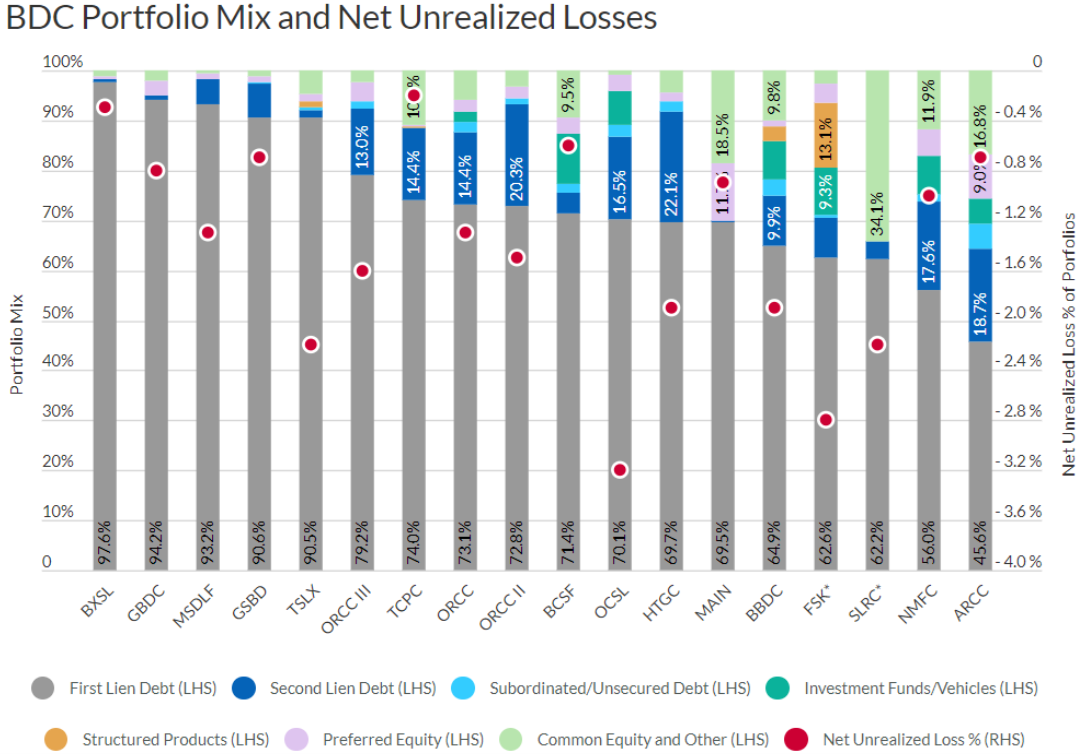

Also critical to understand is how moving interest rates (and market conditions) can impact the book value of a BDC. For example, this next chart shows the type of debt and financing different BDCs have, as well as giving you an idea of how this impacts losses in challenging market conditions (this data is as of the end of Q2, but still provide important perspective).

The Top 10 Bond CEFs and BDCs:

So with that backdrop in mind, let’s get into the ranking, counting down from #10 to our top BDC and Bond CEF ideas.

10. PIMCO Corp & Inc Opp Fund (PTY), Yield: 11.8%

Coming in at number 10, this PIMCO fund falls into the “investment grade” category, but it basically invests in the lowest investment grade and the highest non-investment grade categories, mostly in the US (and some globally) and across sectors. One attractive quality (aside from the big monthly distribution payments to investors) is that it has not been returning capital as part of the recent distribution payments (we view this is a good thing because ROC can reduce your cost basis thereby giving you some surprise capital gains taxes if/when you do actually sell shares). The fund uses a healthy does of leverage (or borrowed money) which we view as a good thing considering interest rate hikes are expected to slow and/or stop early next year (as per CME fed funds futures). And if rates do keep rising, the duration (or interest rate risk) is relatively low (recently at 3.26 years) and the fund holds around 18.4% of its assets in things maturing in 0 to 1 years, meaning if rates do keep rising, it has liquidity to manage its leverage (without exceeding the 50% regulatory limit—which can result in ugly forced sales at firesale prices—yuck!). We’re willing to overlook the 10% price premium versus NAV because this is low by 1-year historical standards (see the z-score) and because it is managed by industry leader, PIMCO, which gives us added confidence.

9. BlackRock Multi-Sector and Credit Allocation (BIT) (BTZ), Yields: 10.4%, 10.3%

While some view BlackRock as “second class” to PIMCO in this space (especially considering BlackRock’s growing firmwide tilt toward “ESG” investing and away from their actual fiduciary responsibility to protect investor assets), we view both of these funds as highly attractive. BlackRock has massive firmwide resources to support the strategies, and the funds both trade at a discount to NAV (something we like) and have negative z-scores (another thing we like).

And despite this year’s terrible returns for fixed-income and bond funds, we believe these funds are both positioned to benefit as interest rate hikes cease, considering they’ve been able to add new investments to the strategy that offer higher yields. BlackRock is a bit more conservative on the use of leverage (versus PIMCO) which some investors prefer. We have owned both of these funds in the past, but sold them (earlier this year and late last year) as the Fed ramped us its interest rate hike trajectory. BTZ offers a little higher credit quality, and a bigger discount to NAV, but it also has a bumpier distribution payment history—something some investors don’t mind, but others simply cannot tolerate. Both funds are attractive here.

8. PIMCO Dynamic Income Fund (PDI), Yield: 13.3%

PDI is the gigantic $4-billion-plus gorilla in the room. And there is a lot to like about this one. For example, it offers a very high yield (paid monthly), it’s never reduced its distribution (it also has paid additional special distributions in the past), and it hasn’t been returning capital or using cap gains to support the dividend. This fund was already big, but got bigger as two other PIMCO funds were merged into it around the turn of 2021-2022.

The fund has been playing hard defense this year as its has reduced its duration (interest rate risk) from over 5 to around 3.4 as it has been bumping up hard against the regulatory 50% leverage limit. The defensive repositioning has been far less than ideal, but PDI now has roughly 28% of its holdings maturing in 0 to 1 years, and it is increasingly well positioned to benefit from higher rates once the fed stops hiking so aggressively (hopefully soon, but slated for early 2023 as per CME fed funds futures). The one drawback on this one (besides the very high leverage and aggressive defense this year) is that it trades a premium to NAV (not unusual for a PIMCO fund, but still relatively less desirable as compared to some peers in the current environment).

7. Main Street Capital (MAIN), Yield: 7.2%

Switching gears from CEFs to BDCs, Main Street is a perennial favorite for its internal management team and long track record of success. Its dividend has grown dramatically over time, and it has a history of paying special dividends too. Main Street is particularly well positioned to benefit from the changed macroeconomic environment as higher interest rates means higher net interest margins and more earnings for MAIN. Main Street also offers a conservative level of leverage (as compared to peers and as per regulatory limits) and it has an attractive mix of first lien loans down through equity investment opportunities too. As an important note, Main Street consistently trades at a higher price-to-book value than almost all peers (because of its attractive differentiated business) so don’t necessarily let that deter you. Main Street is an attractive, long-term, big-dividend investment currently trading at an attractive price as compared to its value.

6. Triple Point Venture Growth (TPVG), Yield: 11.2%

Triple Point Venture Growth (TPVG) is an externally managed Business Development Company (“BDC”) focused primarily on providing customized debt financing (typically with warrants and often some direct equity investments) to venture growth stage companies in technology and other high grow industries). This is a unique niche strategy in the BDC space and it currently represents an attractive contrarian opportunity, especially for income investors, as growth has fallen sharply out of favor this year.

Specifically, we have entered a lower point in the market cycle—particularly for growth companies (such as those TPVG provides capital to)—and that can be a good time to buy low. Especially considering TPVG remains financially healthy, and the shares no longer trade at a large premium to book value. Not to mention the dividend has mathematically risen to 11.2% (as the share price has fallen) and the dividend remains well covered by net investment income.

Further, TPVG is poised to benefit from portfolio companies’ shift from equity to debt financing, and from rising interest rates (better net interest margins) so long as a dramatically prolonged recession does not occur. If you are an income-focused investor, TriplePoint Venture Growth is absolutely worth considering for a spot in your prudently diversified long-term investment portfolio. We do not currently own shares, but it is high on our watchlist.

5. PIMCO Income Strategy (PFL), Yield: 11.7% Yield

PFL offers a very large distribution, it hasn’t reduced its dividend, it’s not been funding the dividend with capital gains or return of capital, it uses a slightly more conservative leverage and its premium to NAV is not enormous (and slightly low as compared to its 1-year history). Its duration is relatively conservative recently at 3.25 and it has approximately 16.7% of its assets maturing in 0 to 1 years, in case rates keep rising more than expected. The shares are down a lot this year (the price more so than the NAV), and once rates stabilize (hopefully in a matter of months) this fund is in very good shape for a rebound.

4. Capital Southwest (CSWC), Yield: 11.2%

CSWC is an internally-managed (good because it reduces conflicts of interest) middle-market lending firm focused on supporting the acquisition and growth of companies across the capital structure. It is unique for its focus on smaller companies than many of its BDC peers. For example, CSWC’s core lending business is focused on lower middle market (“LMM”) in what it terms “CSWC led or Club Deals.” These are typically companies with EBITDA between $3 MM and $20 MM, and typical leverage of 2.0x – 4.0x Debt to EBITDA (through CSWC’s debt position). They make commitment sizes up to $30 MM (with hold sizes generally $10 MM to $25 MM), including both sponsored and non-sponsored deals.

Shares of CSWC had been priced very expensively to start the year because of its attractive unique strategy, but have come down significantly (in terms of price and in terms or price to book value). In our view, this has created a compelling entry point going forward. CSWC is worth considering for a spot in your long-term high-income portfolio.

3. Owl Rock Capital (ORCC), Yield: 10.6%

Owl Rock enjoys the benefits of being one of the larger publicly-traded BDCs, but trades at a lower price to book value, as recent credit spread widening has put pressure on portfolio valuations. Importantly, Owl Rock focuses on larger middle-market companies (safer), it has a high-level of first lien debt (safer) and more floating rate investments than debt (a good thing as rates have been rising). ORCC has also been very conservative with its debt to equity level, thereby leaving it some extra “dry powder” for growth going forward as compared to peers. In a nutshell, Owl Rock offers a big growing dividend, it trades at an attractive valuation, and it has room to continue growing going forward.

2. Doubleline Yield Opportunities (DLY), Yield: 11.2%

Returning to the Bond CEF theme, DLY has a lot of attractive things going for it. Specifically, it is a “go anywhere” bond strategy (managed by famous bond investor, Jeffrey Gundlach) that has never reduced the distribution, and it has not been sourcing the distribution from capital gains or ROC. It also uses conservative leverage compared to others, it trades at a wide discount to NAV (wider than normal—a good thing). The Fund’s investment objective is to seek a high level of total return, with an emphasis on current income.

Portfolio manager, Jeff Gundlach, recently noted in a P&I article that now is the time to get back into bond investing. Bonds have suffered sharp declines this year, however DLY is positioned to benefit from the rebound (hopefully coming sooner than later as the Fed rate hike cycle approaches its end in the months ahead).

1. PIMCO Dynamic Income (PDO), Yield: 11.0%

We’re putting PDO at number one simply because it has so many attractive qualities right now. For starters, it trades at a wide discount to NAV (a good thing, especially for a PIMCO fund) in absolute terms and relative to its 1-year history. It’s never reduced its distribution, and it has been paying distributions entirely from income (not capital gains or return of capital).

According to PIMCO “The fund utilizes an opportunistic approach to pursue high conviction income-generating ideas across credit markets to seek current income as a primary objective and capital appreciation as a secondary objective.” It currently has a high level of leverage, which positions it well for a rebound, but it also has low duration (3.27) and nearly a third of its assets maturing in 0 to 1 years, in case interest rates stay volatile. The fund is relatively new (inception date is January 2021), and it can quickly become an investor favorite (thereby attracting a lot of new assets and turning the big discount into a big premium) if anything happens to one of PIMCO’s larger funds (such as a dividend reduction).

We also like that the fund is managed by PIMCO and believe the CEF structure provides added safety (versus BDCs, for example) and because PIMCO has access to a lot of bond markets that you as an individual do not. Overall, there is just too much to ignore the attractiveness of this fund.

The Bottom Line

The market will get better. We don’t know when, but it is coming eventually (hopefully sooner than later) and when it does many investors will be left wishing they had invested now. Importantly, the high-income opportunities in this report can make waiting for the rebound much easier (because they pay high income now), and they can be an extremely valuable addition to a prudently-concentrated, long-term, income-focused portfolio. Disciplined long-term investing has been a winning strategy throughout history, and it will be this time too.