You know the story. Brick-and-mortal retail was dying, and covid accelerated its death spiral. However, not all retail properties are created equally. For example, the A-class retail property owner we review in this report is financially strong and so is its 6.1% dividend yield. In particular, we review the business, growth potential, dividend safety, current valuation and risks, and then conclude with our strong opinion on investing.

Simon Property Group (SPG), Yield: 6.1%

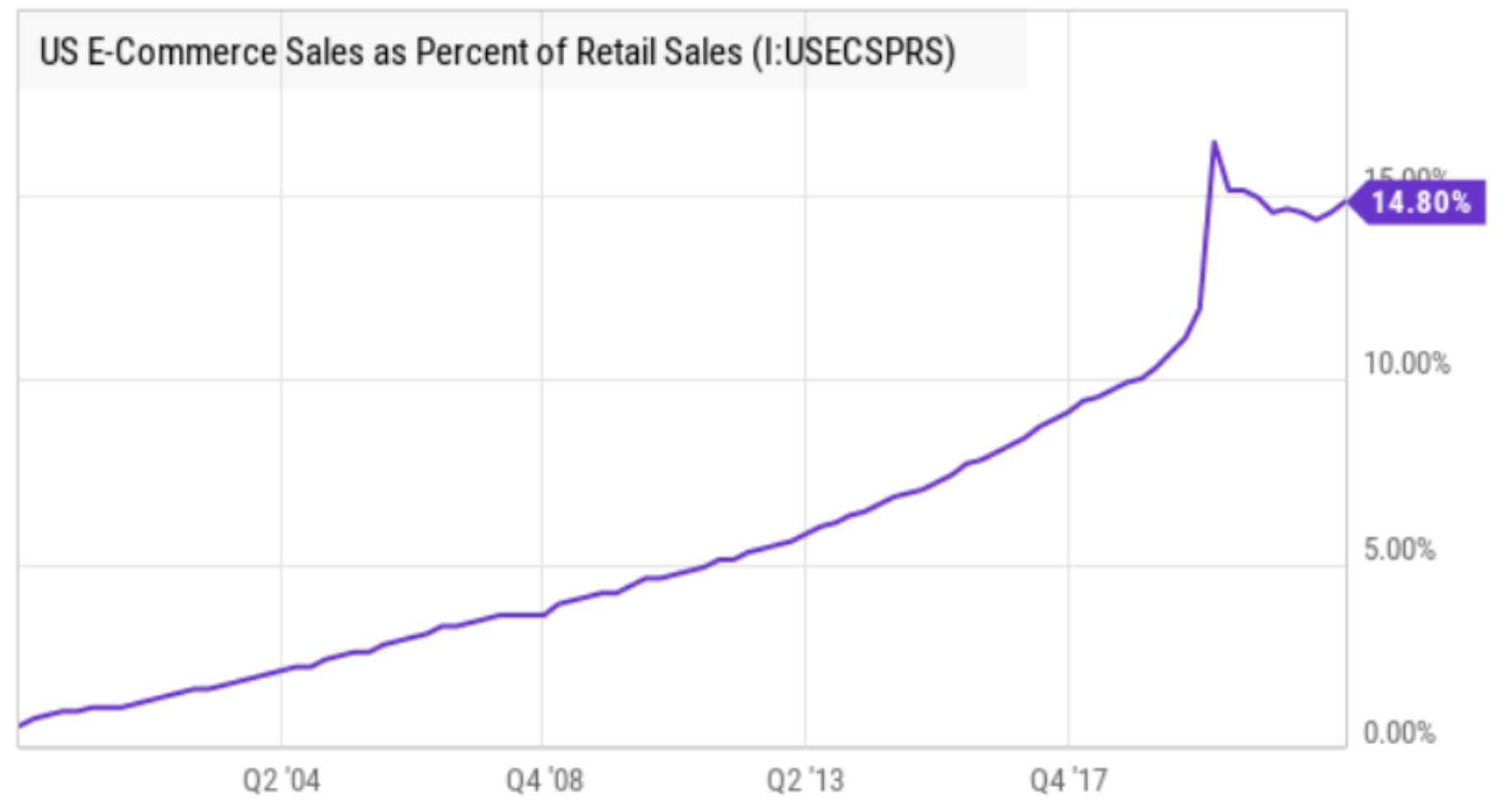

Simon is the largest retail mall REIT (shopping malls and premium outlets) in the US. It is focused mainly on A-class properties (more than 80% of operating income), whereas B-class constitutes ~15% of NOI and C-class (and below) less than 1.0%. Without doubt, the ongoing growth of online shopping is disrupting the retail industry, but it is our view that A-class properties will not only survive, but also thrive, whereas C-class and lower will become largely extinct over the next decade.

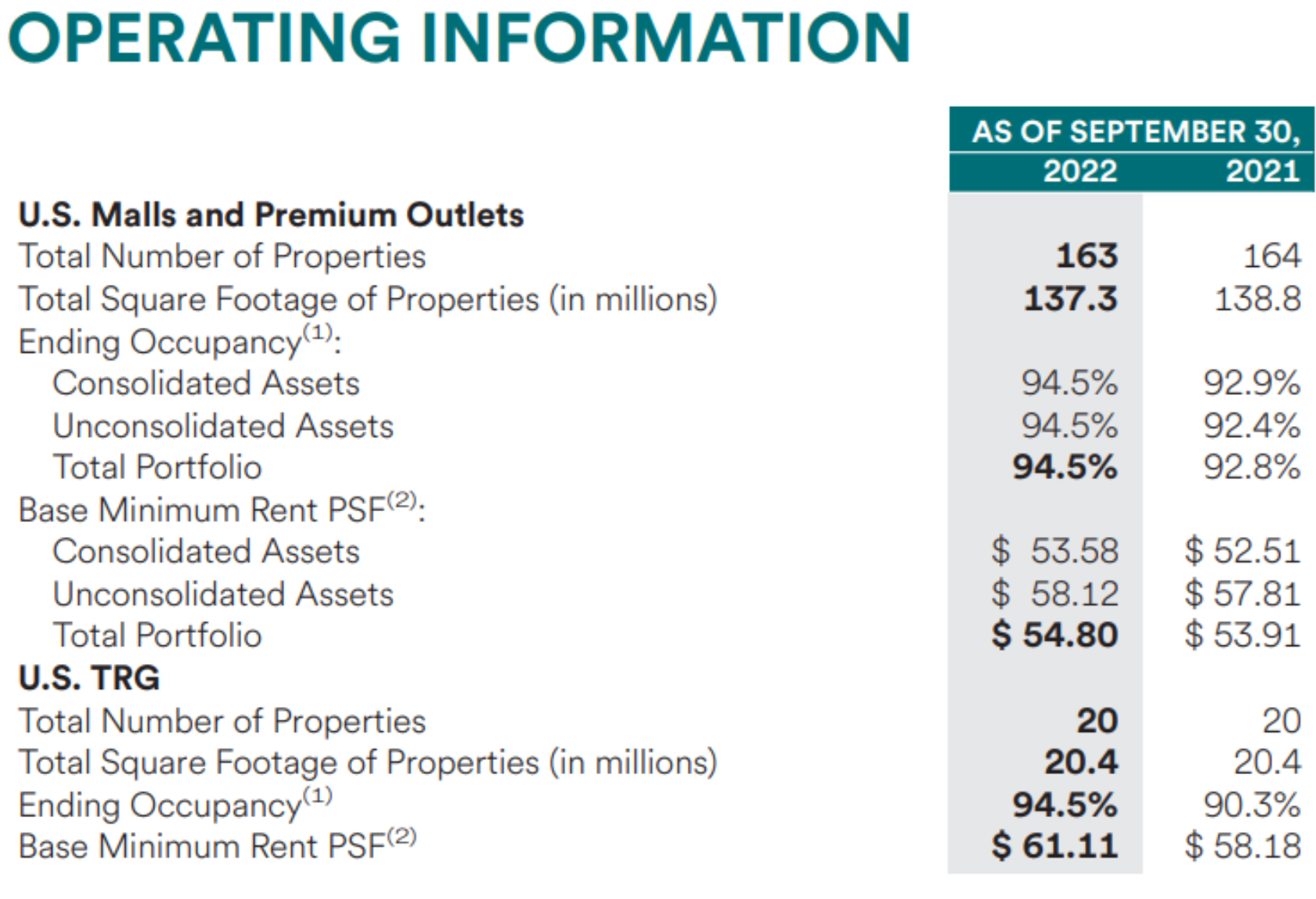

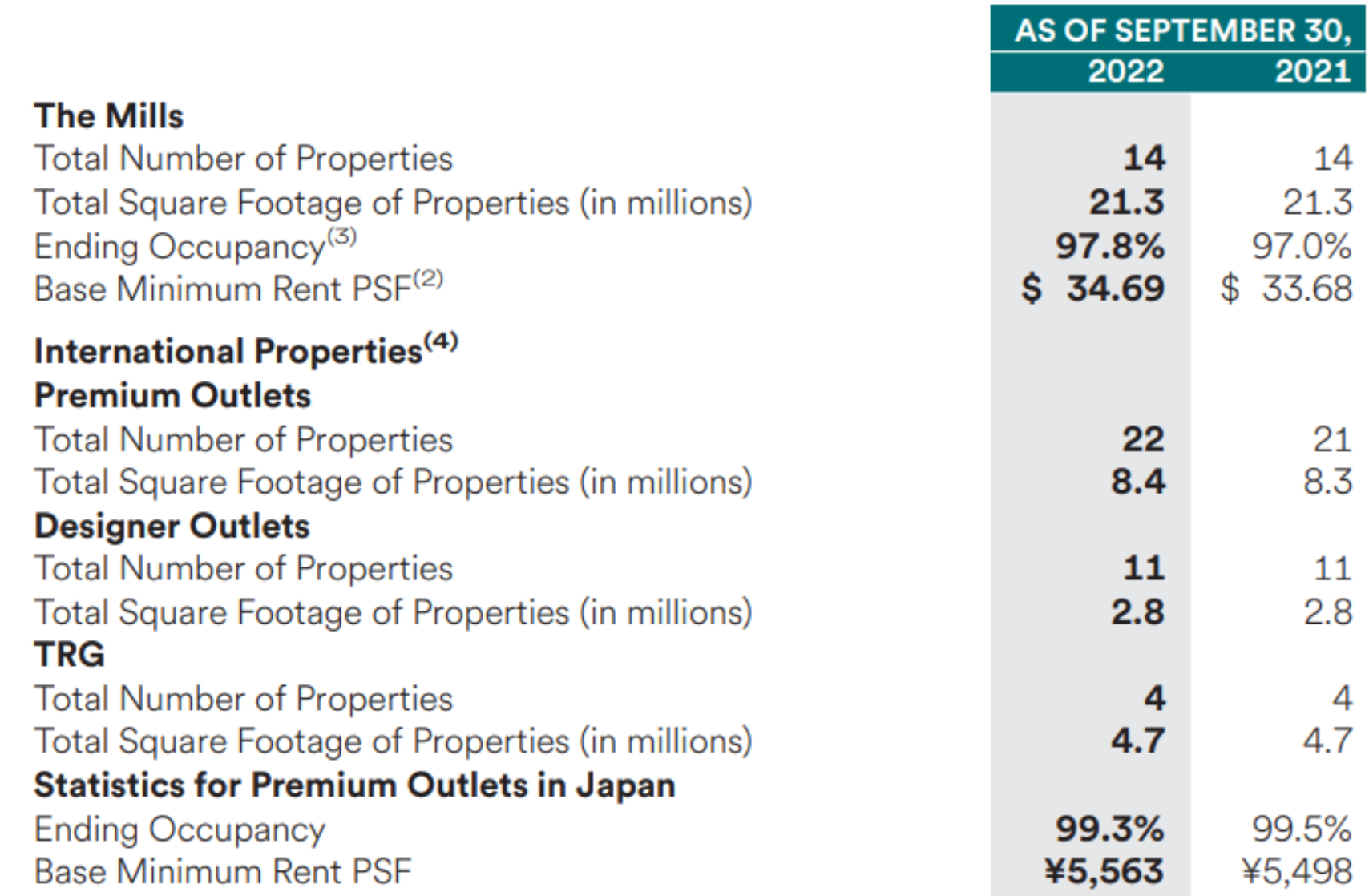

For some perspective, Simon currently owns 163 malls and premium outlets, 20 premium properties in the US from its Taubman Realty Group (“TRG”) acquisition, 14 “The Mills” properties and 35 international properties, as you can see in the following graphic.

And despite the challenging market environment (slowing economic growth, coronavirus effects, growing ecommerce) Simon remains financially healthy with a strong investment grade balance sheet (this is something most/all non-A-class property owners cannot say).

Importantly, A-class property owners (like Simon) have been growing and are expected to keep growing. For example, according to Morningstar Senior Analyst, Kevin Brown:

While we believe that online sales will continue to grow at a significant spread over brick and mortar, we also believe physical retail sales growth will still be positive over the next decade. Retailers are becoming more selective with their physical locations, opting to locate storefronts in the highest-quality assets that Simon owns while closing stores in lower-quality malls. Additionally, many e-tailers are beginning to open stores in Class A malls to take advantage of the high foot traffic, as a physical presence provides additional marketing, a showroom for products they want to highlight, and another source of sales.

You may have also noticed that many retailers that started out as online only, have been expanding into brick-and-mortar retail locations, and they have been doing this is A-class locations (such as Amazon (AMZN) for example).

Also encouraging Simon just beat quarterly FFO estimates and raised forward guidance.

Dividend Strength

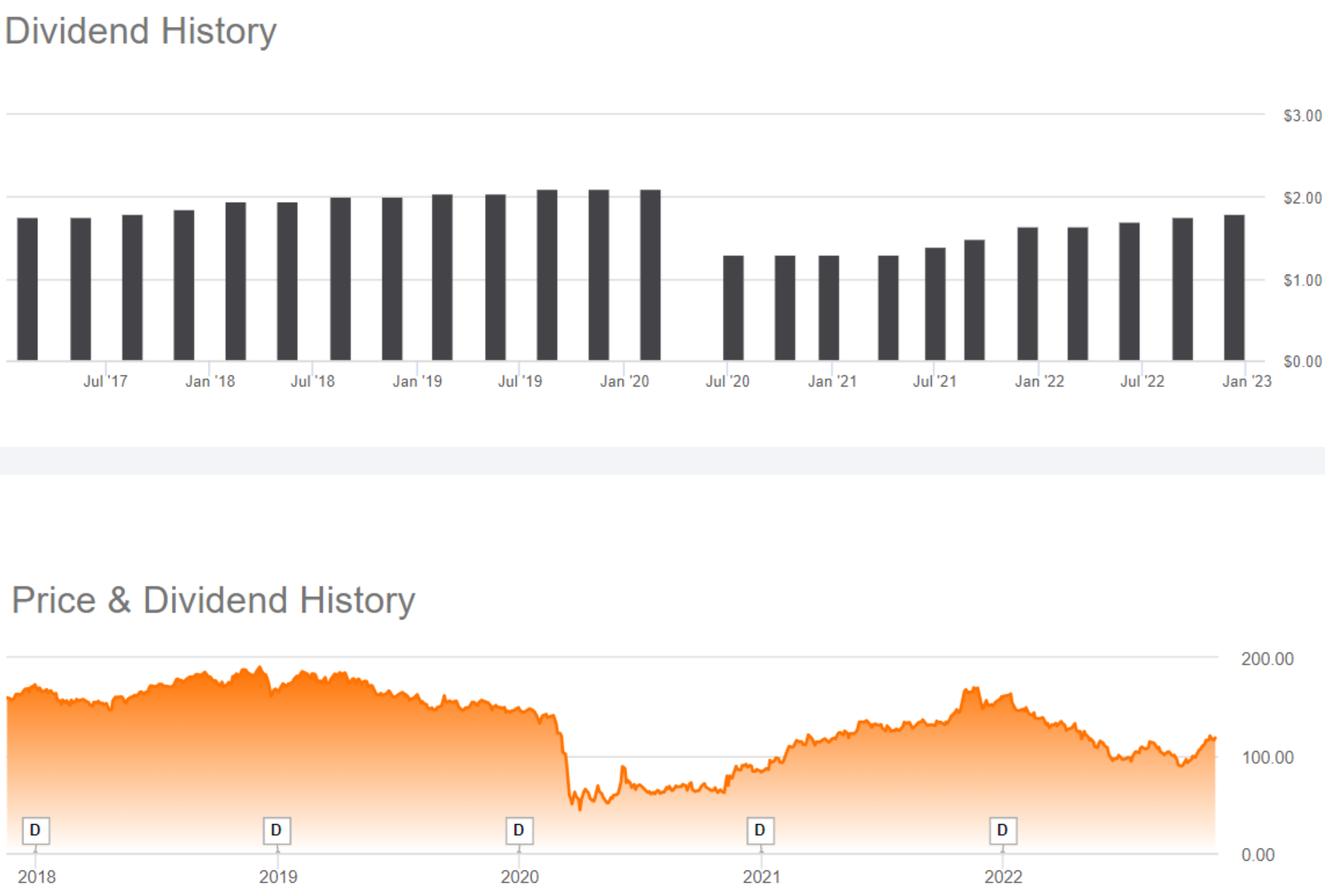

Simon reduced its dividend as a precautionary measure when the pandemic hit, but has been increasing it since then (for example, SPG just announced another dividend increase, effective in December) as you can see in the chart below.

For some perspective on the dividend strength, the following table shows SPG pays out just 59% of its FFO per share in dividends.

This payout ratio is still low by SPG’s historical standard (historically the payout ratio has been closer to 70% or more), and leads us to believe there is room for continuing dividend increases ahead. And not only is there a lot of payout cushion, but the company’s investment-grade balance sheet gives us added confidence.

Worth mentioning, and in addition to SPG common shares (which currently yield 6.1%), the company also has preferred shares outstanding (SPG.PJ) which offer a larger 6.8% dividend yield. And despite the fact that preferred shares are ahead of common in the capital structure, these preferred shares have less long-term price appreciation potential considering the company can call them (redeem them) at only $50 per share (they currently trade at around ~$61) beginning on 10/15/2027. Assuming SPG calls them as early as possible, you’d be locking in about an 18% price loss over the next 5 years (and this would offset a large portion of the preferred share dividends that will be paid over that period).

Valuation:

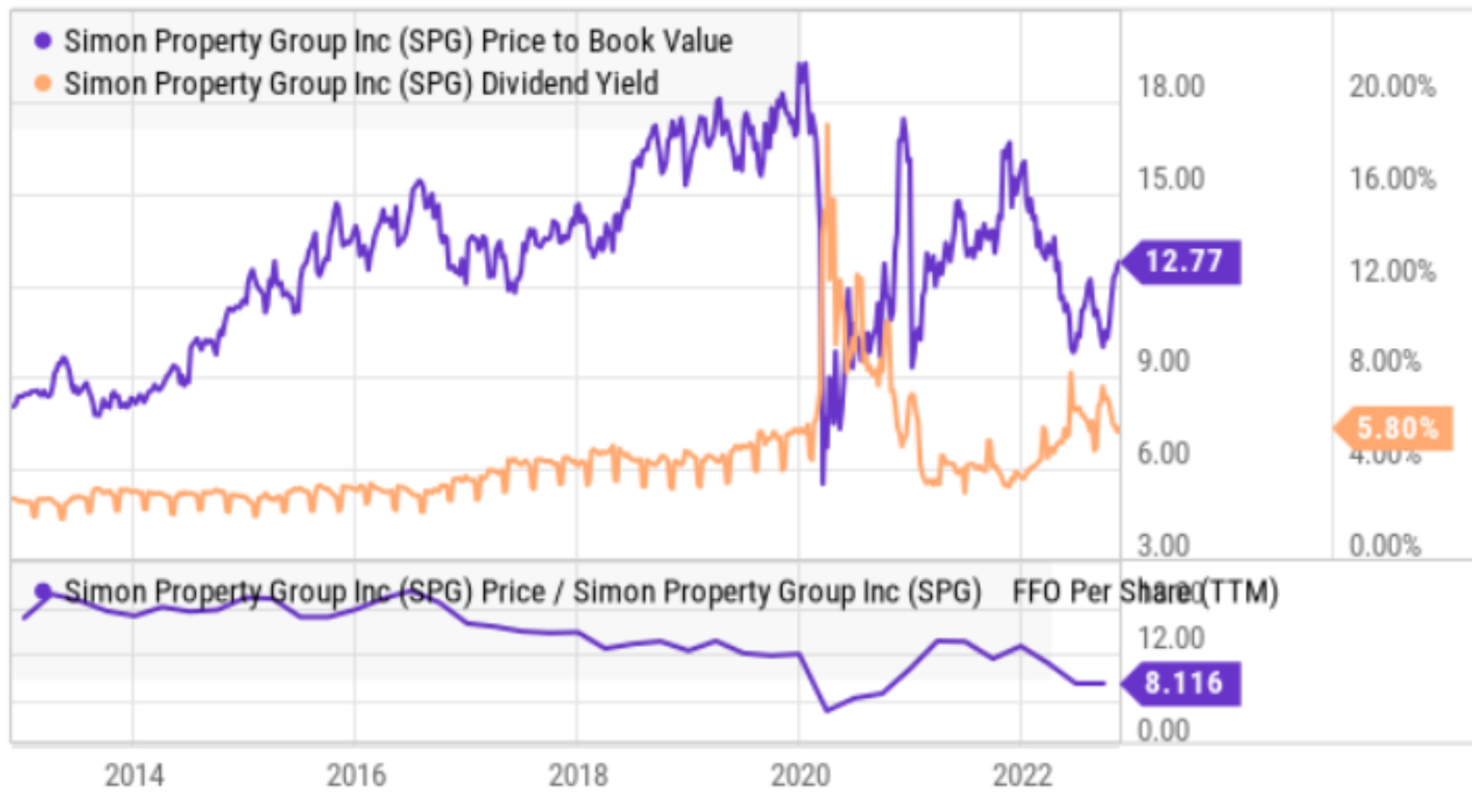

Simon’s current 6.1% dividend yield is high by historical standards, suggesting risks but also suggesting the shares have upside. And considering: (1) the dividend is so well covered (as discussed) and (2) we will likely see continuing dividend increases in the quarters ahead (to bring the payout ratio back to historical levels); the shares have upside in our view (especially also considering the ongoing long-term growth potential).

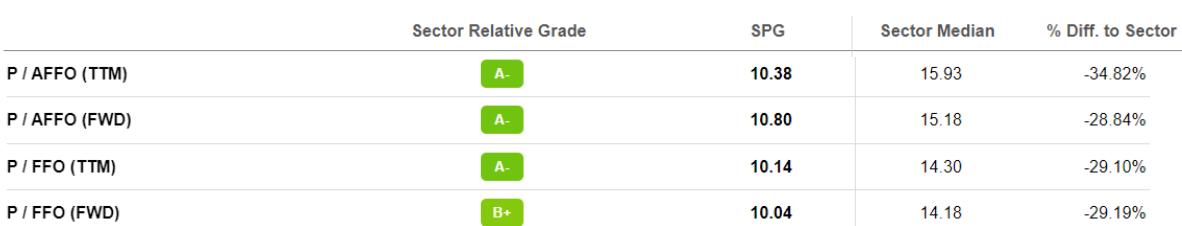

In addition to its low dividend payout ratio (i.e. a lot of dividend cushion), SPG also trades at a low price-to-Adjusted-FFO ratio (around only 10.4x). For one, this P/AFFO ratio is low compared to the overall real estate sector because of fear surrounding retail real estate in general (but it perhaps should not be this low considering Simon’s “A-class” advantages versus retail REIT peers).

Simon’s valuation ratio is also low compared to its own history, and in our view this is a sign of attractiveness. Specifically, SPG is being overly discounted (a baby being thrown out with the bathwater) because the market is so negative on retail real estate in general (without giving proper consideration to SPG’s premium advantages). Specifically, whereas many below A-class retail properties are now entering a “death spiral,” Simon’s premium A-class properties will continue to grow thereby enabling the company (and the shares) to thrive.

Risks:

Simon faces a variety of risk factors that should not be overlooked. For example, the US has a large amount of retail space per capita, which suggests declines and challenges ahead (for example, store closures). However, Simon is in a much better position than peers considering it owns mostly A-class properties (a group that will remain in demand, especially as retailers increasing look to an A-class presence for their multi-channel retail businesses for marketing, sales returns and other operational reasons). Nonetheless, Simon will face challenges if any big tenants leave (such as Macy’s, which is closing stores).

Losing a big anchor tenant can negatively impact foot traffic, thereby negatively impacting other retailers in the same mall.

Another risk is simply the challenging macroeconomic environment. As the fed continues to increase interest rates (to fight inflation) it slows the economy and increases the risk of entering an ugly recession, which could be particularly negative for retailers.

Further still, as interest rates rise, investors that had been looking to REITs as a “bond proxy” source of income, may increasingly be lured back to bonds as interest rates are now significantly higher.

Conclusion:

The retail real estate sector is hated. Not only is competition from online shopping growing, but the threat of a looming recession makes this sector even less appealing to some. However, not all retail real estate is created equally. And Simon Property Group trades a too low of a valuation considering its strong balance sheet, powerful growing dividend, and distinct A-class advantages versus peers. If you are looking for a steady, growing, long-term dividend that also has some attractive share price appreciation potential, Simon Property Group’s 6.1% dividend yield is worth considering for a spot in your prudently-diversified long-term income-focused portfolio.