If you are looking for an investment opportunity that is attractive in every direction, you might want to consider this professional services consulting company. It’s classified in the information technology sector, but benefits handsomely from the massive opportunities that exist across the many compelling industries it serves. In this report, we review the company’s healthy growing dividend, share repurchases, massive cash flow, strong balance sheet, powerful earnings and revenue growth trajectories, and the attractive valuation for this very impressive business model.

Overview: Accenture (ACN):

Accenture is a difficult business for many people to understand because it provides such a wide range of professional services across many industries and around the globe. It employs approximately 700,000 people and has a market cap of approximately $200 billion. It’s essentially an Information Technology company providing services across just about every single industry worldwide. Said differently Accenture employs a lot of smart people that can lead innovative change at enterprises (large and small), and this allows the company to stay at the forefront of attractive large opportunities as they arise and evolve. If that is not specific enough for you, here is a list of specific things the company offers:

“The company offers application services, including agile transformation, DevOps, application modernization, enterprise architecture, software and quality engineering, data management, intelligent automation comprises robotic process automation, natural language processing, and virtual agents, and liquid application management services, as well as program, project, and service management services; strategy consulting services; critical data elements, data management and governance, data platform and architecture, product-based organization and skills, business adoption, and value realization services; engineering, and research and development digitization; smart connected product design and development; product platform engineering and modernization; product as-a-service enablement; products related to production and operations; autonomous robotics systems; the digital transformation of capital projects; and digital industrial workforce solutions. It also provides data-enabled operating models; technology consulting and artificial intelligence services; services related to talent and organization/human potential; digital commerce; infrastructure services, such as hybrid cloud, network, digital workplace and collaboration, service and experience management, infrastructure as code, and managed edge and IoT devices; cyber defense, applied cybersecurity, managed security, OT security, security strategy and risk, and industry security products; services related to technology innovation; and intelligent automation services. In addition, the company offers cloud, ecosystem, marketing, supply chain management, zero-based budgeting, customer experience, finance consulting, mergers and acquisitions, and sustainability services.”

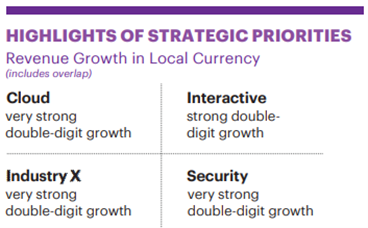

The summarize a little bit more, Accenture’s strategic priorities (i.e. large TAM high-growth areas) are some of the most lucrative areas in business today, including:

Cloud: this is huge as the massive worldwide enterprise digital revolution continues to move data and functionality to the cloud.

Interactive: the digital agency arm of the company, part of a larger trend of consultancies branching out into advertising (Accenture has been growing its ad and marketing agency business in recent years).

Industry X: The use of advanced technologies to restructure existing products and services from design and engineering to manufacturing and support that speeds up operational efficiency and enterprise-wide growth.

Security: Security is a very big deal as protecting digital assets in the cloud is ever increasingly critical.

Overall, Accenture’s agile business model is attractive because it is able to quickly transform and grow its workforce to serve the needs of varying yet attractive industry opportunities across the globe (we’ll provide more examples later in this report).

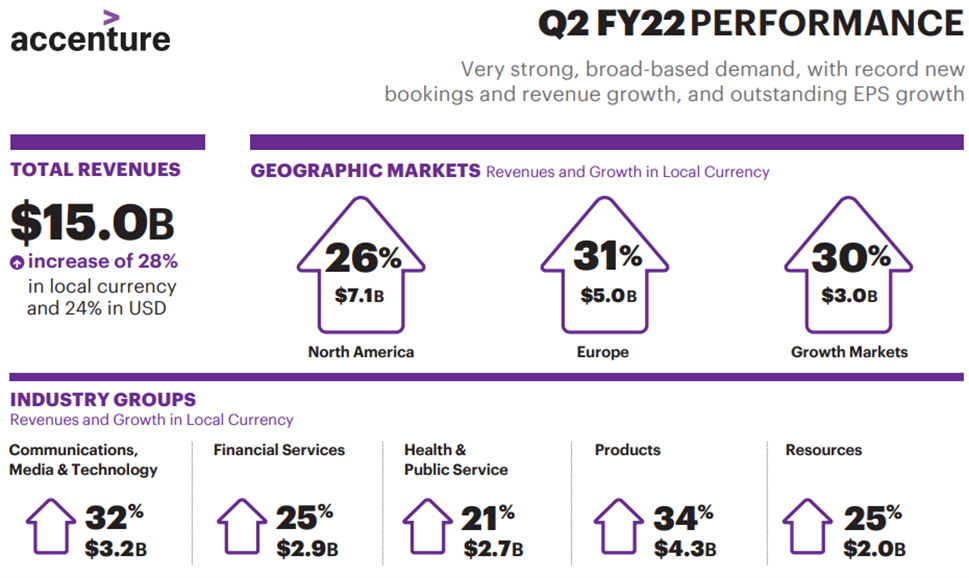

Massive Revenue and Earnings Growth

Another attractive quality of Accenture is its massive revenue and earnings growth. For example, in the most recent quarter, revenues grew 28% (year-over-year) and earnings is expected to grow at approximately 22% for fiscal year 2022.

To add a little color to this growth, Accenture’s business (and especially it’s strategic priority areas) have massive opportunity and trajectory for future growth and the digital revolution and cloud transition continues.

Also worth mentioning, Accenture has very strong margins (the business is very profitable on both a gross and net basis). For example, gross margins are around 30% and net margin was recently 13.7%. This profitability is important because at a time when non-profitable high-growth stocks have fallen sharply out of favor, Accenture has remained highly profitable and it continues to achieve a healthy high growth trajectory.

Attractive Valuation

Accenture’s valuation remains highly attractive. As mentioned, Accenture continues to maintain a high revenue growth trajectory (thanks to its attractive strategic priorities) that rivals many of the most highly valued growth stocks across the market. However, while many top large cap revenue growth stocks still trade at 20 times sales and above (even AFTER the market’s recent sell off), Accenture trades at only around 3.25 times sales.

Furthermore, Accenture is already extremely profitable and has impressive net margins that other high growth stocks are not yet capable of achieving (despite the fact that Accenture has just as much growth potential, and in some cases even better). For reference, Accenture trades at a forward price-to-earnings ratio of around 29 times, which is not unreasonable (actually quite attractive) given all the attractive qualities of the business.

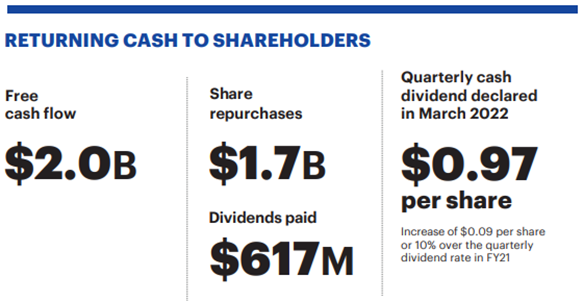

Powerful Cash Flow, Dividends and Share Repurchase

Another attractive Accenture quality is its powerful cash flows, growing dividend and ongoing share repurchases. As you can see below, in the most recent quarter, the company generated $2 billion of free cash flow and was able to buyback $1.7 billion in shares (an indication the company believes the shares are undervalued) and payout $617 million in dividends (the company also has ample cash on its balance sheet, around $5.5 billion).

Another important thing to note is that Accenture has a long history of growing its dividend that many screeners don’t correctly capture. It’s gone from a $0.30 annual dividend (back in 2005) to an increased and increasing semiannual dividend in 2009 – 2019, to an increased and increasing quarterly dividend starting at $0.80 in 2019 to now $0.97 in 2022. Dividend growth is one of the most under-appreciated value generators in the market as investors often don’t realize the powerful income generation which is often hidden by the lower (currently 1.2%) dividend yield. However, the yield is relatively low because the share price keeps climbing so much over time (mathematically this makes the yield low), but the actually dividend continues to grow powerfully and this continues to be an incredible wealth creator for investors over time.

Healthy Balance Sheet

Also worth mentioning more explicitly, Accenture maintains a very healthy balance sheet with few long-term liabilities and lots of cash. This adds to safety for the company (especially in a rising interest rate environment) and helps the firm to safely grow its dividend. Additionally, the strong balance sheet allows the company to complete a wide variety of strategic company acquisitions. Accenture often acquires small businesses and consulting companies to capture the revenue streams they generate from their clients, but also to capture the client relationships which allow Accenture to growth new revenue streams over time (its another way of “landing and then expanding” lucrative customer relationships). The company expects to complete approximately $4 billion of acquisitions in fiscal year 2022. In Accenture’s case, this is an attractive part of the business model.

Risks:

As with any company, Accenture faces risks. However, we view Accenture’s risks as low for a variety of reasons. For starters, the revenue streams are widely diverse which means they’re not at risk if they lose 1 (or even many) customers simply because they have so many widely diversified customer relationships.

Also, because the balance sheet is so healthy and there is minimal long-term debt, Accenture is in a much better position as interest rates rise (particularly considering the company generates to much cash and is highly profitable already).

Another risk is that the company does not have a lot of physical assets. This isn’t a capital intensive business, but rather a services business. Accenture’s most important asset is its people. That said, if something highly negative were to happen to Accenture’s brand—that could have a strong negative impact on its business. However, Accenture ranks very highly worldwide with regards to its attractiveness in terms of employee satisfaction and community contributions. This helps reduce risks.

Conclusion:

Overall, Accenture is an attractive business trading at an attractive price. The shares have sold off recently (as high growth stocks in general have sold off hard), but the business remains very attractive and growing (and it continues to be cash rich and highly profitable—unlike many other high revenue growth stocks). If you are looking to add some powerful, attractively-valued, blue-chip growth (including revenue growth, earnings growth and dividend growth), Accenture is worth considering. We have owned a few shares since 2001, and have no intention of selling anytime soon.