If you have been paying attention to the Fed’s abrupt monetary policy shift this year (from pandemic doves to inflation hawks), you’ve likely noticed a variety pain points, ranging from a sputtering stock market to falling bond prices (and it’s all to address record high inflation). You may have also noticed a lot of “income and value” equities have performed much better than “growth equities” this year as the pandemic “growth stock” trade now sits firmly in the doldrums (for example, the Blue Harbinger Income Equity portfolio is positive this year while the overall market is down, and growth stocks are down even more). However, one type of income security that has been experiencing significant short-term pain this year, is the mortgage REIT.

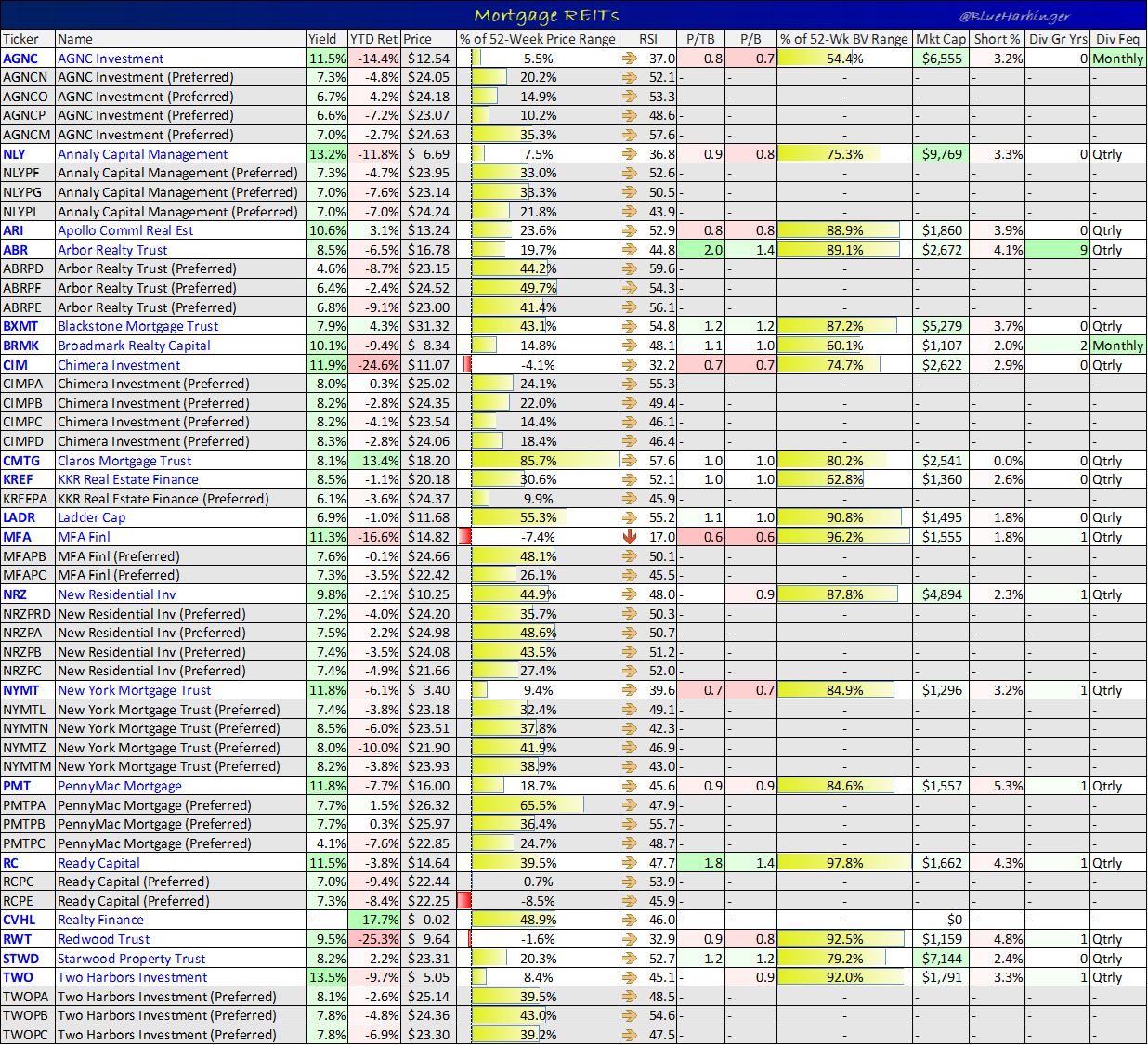

Unlike property REITs (that own physical property), mortgage REITs own mortgage related assets, such as mortgage-backed securities, and these securities have suffered mightily from rising interest rates. In particular, as interest rates rise, bond prices fall (such as the mortgage bonds that mREITs own). And as such, mREITs as a group are down this year (see table below).

data as of 07-Apr-22

To add a little more perspective on the mREIT business model, they typically use significant amounts of leverage (or borrowed money) to magnify the returns of the mortgage-related assets they invest in. The investment thesis says that many mREITs typically invest in lower-risk agency securities (such as those issued by US government agencies), and then they are justified in applying leverage to these securities to magnify the otherwise lower returns (however the amount of leverage that is appropriate is debatable).

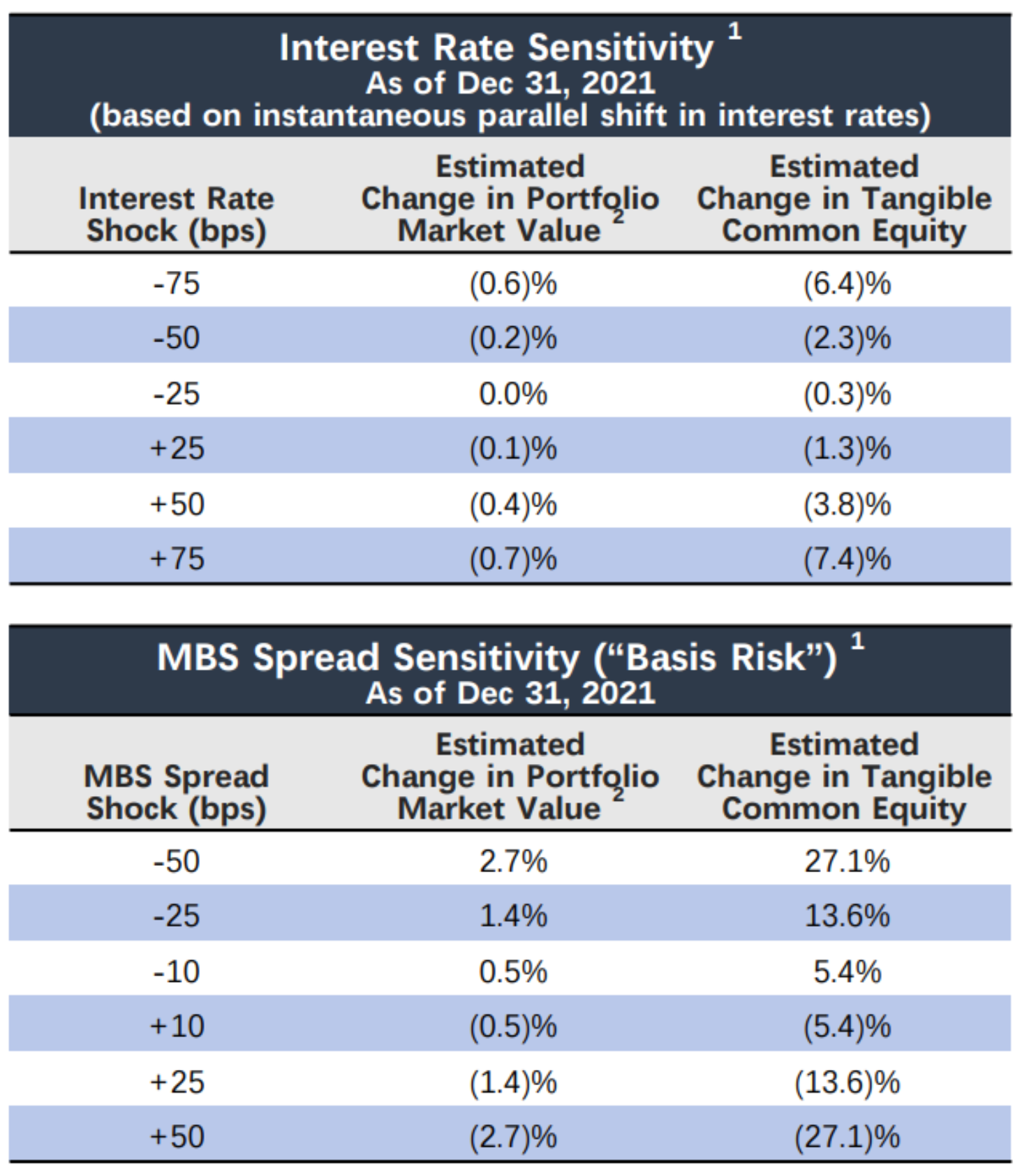

Further, mREITs also reduce their risk exposures by hedging their investments against interest rate moves. However, extreme moves in interest rates in either direction can still have significant negative impacts on mREIT book values. For example, here is a graphic from the most recent quarterly presentation from mREIT AGNC Investment Corp (AGNC) explaining.

And a couple things are interesting and important about AGNC. First, AGNC’s book is almost entirely Agency securities (i.e. securities issued by US government agencies, thereby making them extremely safe). And second, the short-term pain being experienced my some mREITs (such as AGNC) is temporary and it actually sets them up for stronger long-term returns. For example, here is what AGNC CEO Peter Federico recently had to say about it:

"This abrupt shift by the Fed led to an uptick in interest rate volatility amid greater monetary policy uncertainty… [and] Against this backdrop, agency mortgage-backed securities underperformed in the fourth quarter as spreads to benchmark rates widened moderately and valuations declined relative to interest rate hedges."

He also explained that:

“the spread widening hurts book value in the short term but improves expected return on new investments and cash flows on higher coupon specified pools through slower prepayment speeds. "Thus, the spread widening that occurred in 2021 and accelerated in January of this year is beneficial to our business over the long term," Federico said. With market conditions likely to stay challenging, the company plans to operate with a more defensive position.”

And very important to note, while the common equity shares of many mREITs (including AGNC) have experienced pain in the short-term, the preferred shares have also been dragged lower, which makes them a more attractive long-term investment in our view because they are ahead of the common shares and remain supported by a business that is now arguably stronger in the long-term.

For some perspective, preferred shares are a stock-bond hybrid whereby they typically have a par or call value of $25 per share. And while rising interest rates (and MBS-spreads) have dragged many mREIT preferred shares below $25 (see our earlier table) they remain healthy over the long-term and present a more compelling investment opportunity considering also that their yields are significantly higher than the yields you can earn on other lower-volatility securities available in the market.

Mortgage Bonds Risks

Critically important to note, the risks in the bond market (including agency-backed mortgage bonds) is dramatically lower now than it was after the initial onset of the pandemic. Back then, there was such intense fear and risk-aversion that liquidity in the bond market dried up, and that is what caused mortgage-REITs to get in trouble back then (many of them were forced to cut their common share dividends, although preferred shares fared much better). On the other hand, right now, the bond market is very orderly and liquidity is very high—these are good things for mREITs and their safety. For more perspective, bond market fear (as measured by credit spreads) is dramatically lower now than it was back then (as you can see in the following chart).

The dramatically lower market risks for mortgage-related assets (such as the Agency MBS bonds AGNC holds) makes mREITs far less risky now—especially mREIT preferred shares, which have seen their share prices inappropriately dragged lower (thereby creating an increasingly attractive buying opportunity).

The Bottom Line:

We currently own shares of mortgage REITs AGNC and Annaly Capital (NLY), and have no intention of selling at this time. However, the preferred shares are increasingly compelling, especially for those that prefer lower-volatility high yields. For example, even if the common stock shares are forced to reduce their dividends (as some mREITs did after the initial onset of the pandemic in 2020), this actually makes the preferred share dividends more safe (because the mREITs will have even more available cash flow available to support those preferred dividends).