The basic materials stock we review in this report has increased its dividend for 28-years in a row. It also has newfound growth opportunities related to dramatically increasing lithium demand and pricing (courtesy of exploding demand for lithium-based batteries in electric vehicles, for example). Not to mention, the basic materials sector can continue to be a highly attractive inflation hedge. In this report, we review the details and then conclude with our opinion on investing.

Albemarle Corp (ALB)

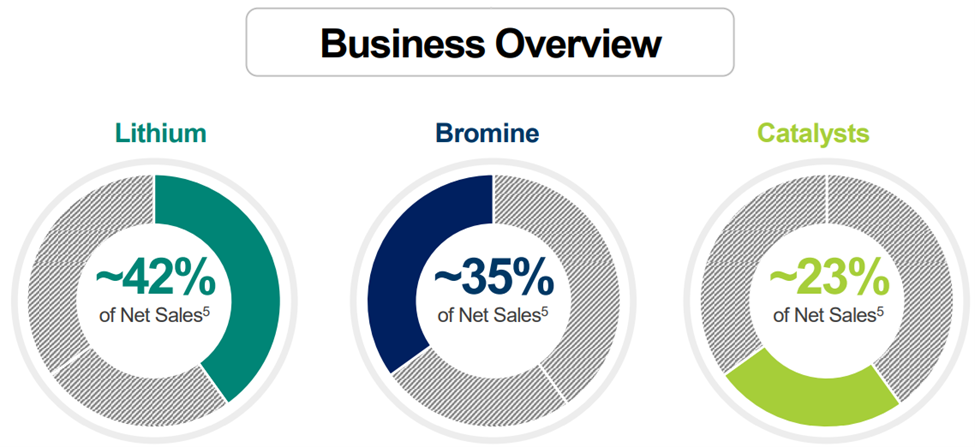

Albemarle Corporation, headquartered in Charlotte, NC, is a global specialty chemicals company with leading positions in lithium, bromine and refining catalysts.

For your reference, here is more information on each business segment in particular:

The Lithium segment offers lithium compounds, including lithium carbonate, lithium hydroxide, lithium chloride, and lithium specialties; and reagents, such as butyllithium and lithium aluminum hydride for use in lithium batteries for consumer electronics and electric vehicles, high performance greases, thermoplastic elastomers for car tires, rubber soles, plastic bottles, catalysts for chemical reactions, organic synthesis processes in the areas of steroid chemistry and vitamins, life sciences, pharmaceutical industry, and other markets. It also provides cesium products for the chemical and pharmaceutical industries; zirconium, barium, and titanium products for pyrotechnical applications that include airbag initiators; technical services for the handling and use of reactive lithium products; and lithium-containing by-products recycling services.

The Bromine segment offers bromine and bromine-based fire safety solutions; specialty chemicals, including elemental bromine, alkyl and inorganic bromides, brominated powdered activated carbon, and other bromine fine chemicals for use in chemical synthesis, oil and gas well drilling and completion fluids, mercury control, water purification, beef and poultry processing, and other industrial applications; and other specialty chemicals, such as tertiary amines for surfactants, biocides, and disinfectants and sanitizers.

The Catalysts segment provides hydro-processing, isomerization, and akylation catalysts; fluidized catalytic cracking catalysts and additives; and organometallics and curatives. The company serves the energy storage, petroleum refining, consumer electronics, construction, automotive, lubricants, pharmaceuticals, and crop protection markets. Albemarle Corporation was founded in 1887 and is headquartered in Charlotte, North Carolina.

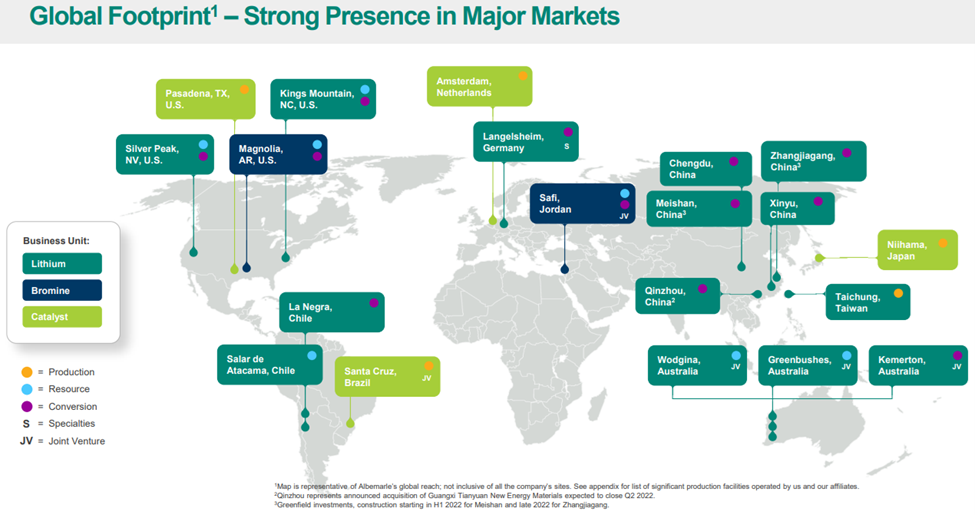

And one of Albemarle’s competitive advantages is its existing strong footprint in the major global markets.

Explosive Growth in Demand for Lithium

And one of the major catalysts to growth this business (and drive the share price much higher) is the explosive growth in demand for lithium, due in large part to electric vehicles.

A Healthy Financial Position

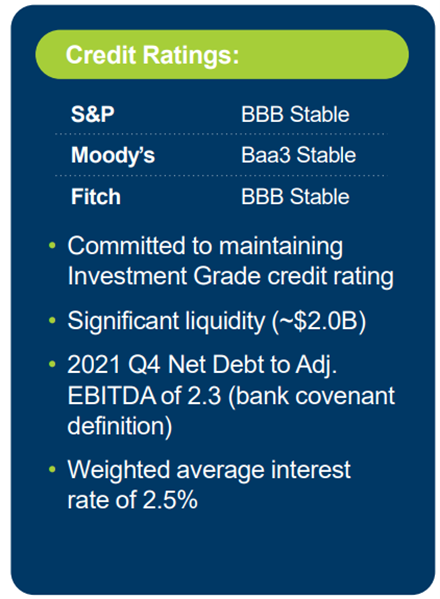

Albemarle is in a healthy financial position, including its balance sheet, cash flows and growing net income. For starters, it has been able to increase its dividend every single year for the last 28 years. That kind of consistency can help instill confidence in investors. And it has been able to do that due to the steady nature of its existing business segments. Further, maintaining its investment grade balance sheet is also a priority as it moves forward to capitalize on new opportunities.

Albemarle also has a low interest expense on its debt (a good thing) as it looks to take advantage of dramatically growing lithium opportunities. In fact, the company is not focused on share repurchases at this time because it has so much opportunity to reinvest in its own business growth. For example, management recent

Further, the company recently announced strong earnings, demonstrating the growth opportunities are very real. Specifically, Albemarle…

“raised its FY 2022 adjusted EPS guidance to $9.25-$12.25 from $5.65-$6.65 previously, far above $6.22 analyst consensus estimate, on revenues of $5.2B-$5.6B from its earlier outlook for $4.2B-$4.5B, also easily beating $4.4B consensus.

The company also forecasts full-year adjusted EBITDA of $1.7B-$2B and adjusted EBITDA margin of 33%-36%, citing continued strength in pricing.”

Those are very strong earnings numbers and guidance, and the market seems to not yet be fully recognizing it.

Buy Under Price:

At this time, we are assigning Albemarle a $275 “buy under” price (the shares currently trade at around $240), based on strong expected earnings growth (driven largely by higher lithium prices and volumes), but the shares can go dramatically higher if the quarterly earnings numbers stay on track or even improve. The shares currently trade around 21 times earnings, which is conservative for a profitable business with strong margins and a very high forward revenue growth trajectory (forward revenues are expected to growth at 25.5%, and the demand for lithium could keep this high trajectory intact for a while). Not to mention, the 28 consecutive years of dividend growth adds a certain degree on confidence for some investors.

Risks:

Albemarle’s business does face risks. For example, as EV adoption expands, new lithium suppliers may come online. However, Albemarle already has access to some of the best locations in the world, and it will take time for competitors to ramp up new businesses.

Also, Albemarle’s newfound growth (in lithium from EVs) can place new strains on the business. For example, the company has already stated is will not be repurchasing shares in the near future (so it can direct cash to growth opportunities). Albemarle will need to balance its cash flow needs responsibly to maintain its investment grade credit ratings (and thereby keep its cost of capital low).

Conclusion:

It’s unusual to find a high-growth opportunity in the basic materials sector, but new demand for lithium has put Albemarle in that position. Additionally, basic materials stocks can be an attractive inflation hedge, especially when they are in high demand. What’s more, Albemarle has a long track record of success as it has increased its dividend for 28 years in a row. If you are looking to add a little diversified growth and income to your portfolio, shares of Albemarle are worth considering. We recently added a few shares to our Disciplined Growth Portfolio.