Business Development Companies, or BDCs, make the loans that big banks generally will not (or cannot, due to regulatory rules). However, like big banks, BDC bottom lines usually come down to simply net interest margins (i.e. the margin between the rate they borrow at and the rate they lend at), assuming they can survive any macroeconomic turmoil, considering they have much higher sensitivity than do the big banks. Interest rates are trending sharply higher (as the Fed fights inflation), and this can be very good (or very bad) for big-dividend BDCs (like Owl Rock). In this report, we share our opinion on whether Owl Rock’s big 9.1% dividend yield is attractive and worth considering, or whether the risks are simply too great and if investors should avoid the shares.

Overview:

Business Development Companies were created by an act of congress (in the early 1980s) in order to encourage and facilitate financing for smaller businesses. To incentivize BDCs, these specialty finance companies can avoid income taxes if they pay out at least 90% of their profits as dividends. Thus BDCs are incentivized to help smaller businesses, and they can make highly attractive investments for income-focused investors (because they can offer compelling big dividends, like Owl Rock).

In the case of Owl Rock, the company focuses on upper middle-market companies (middle market generally means businesses with annual revenues of $10 million to $1 billion). More specifically, Owl Rock currently invests in 157 different portfolio companies that are diversified across industries and consist of primarily first-lien loans (first lien is safer than second lien). Despite the well-managed portfolio, Owl Rock’s main risk (like most BDCs) is simply macroeconomic conditions (i.e. things the company cannot control). And as you are likely aware, we are currently in a shifting macroeconomic environment, considering the market is down, interest rates are up (and expected to keep rising) and some analysts believe the Fed’s rate hikes could push us further towards recession.

Owl Rock’s Recent Performance

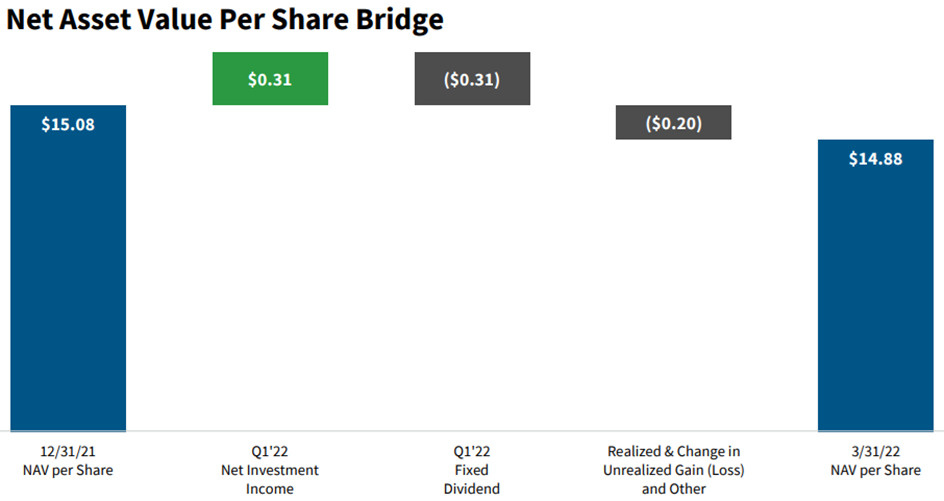

Not surprisingly, Owl Rock’s business and share price have faced challenges this year as the market has sold off as many investors increasingly fear the possibility of a recession. For example, the shares currently trade at around $13.69, down from a 52-week high of $15.33, and the net asset value per share has fallen by $0.20 in the last quarter.

Dividend History and Strength

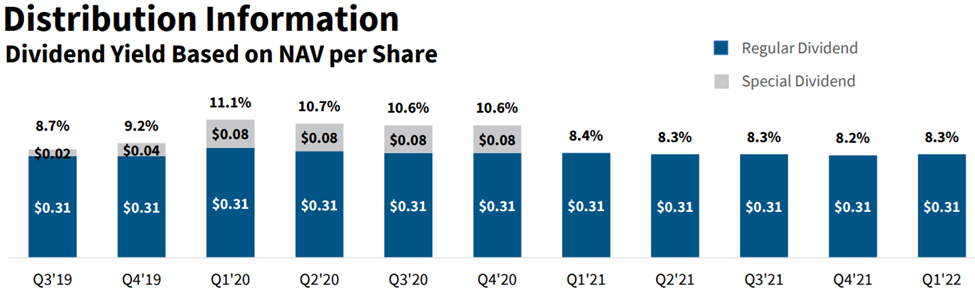

As you can see in the chart above, Owl Rock’s Net Investment Income (“NII”) exactly covered its big dividend in the most recent quarter. This is generally a good thing, but keep in mind there are a lot of behind-the-scene moving parts to the dividend, such as prepayment income (which is out of Owl Rock’s control, but was required this last quarter to help cover the dividend). As the CFO said on the most recent call:

“This was our third consecutive quarter of covering our dividend, but it was a notable one, because we were able to generate $0.31 per share of NII despite very little repayment income, primarily due to a seasonally quieter M&A environment in the first quarter.”

Here is a look at the BDC’s historical dividend payments (when things are strong, they also pay special dividends—not currently the case though):

Valuation:

One of the most common ways to value BDCs (as well as big banks, for that matter) is to consider current price-to-book value multiple. Here is a look at the metric for Owl Rock (as well as a variety of additional BDCs, sorted by market cap).

As you can see, Owl Rock currently trades at a slight discount to book value (0.9 is below 1.0). We’ll explain more about why in a moment (see credit spreads), but from a high level--a discount can be both a reflection of opportunity (to buy low) and risk. Worth noting, ORCC has also traded at a larger premium to book value over the last 5 years (see 5-Year Price / Book Range column, above).

Credit Spreads

According to Owl Rock’s CFO, Jonathan Lamm, during the most recent quarterly call:

“Our NAV (or book value) per share was $14.88, down modestly from the fourth quarter, reflecting a decline in the fair value of our portfolio due to the impact of wider credit spreads in the market.”

Because of perceived risk in the market (as reflected in widening credit spreads—the generic valuation metric Owl Rock uses to mark its book of private company loans), the aggregate value of the investments on Owl Rock’s balance sheet has decreased. And while this is a reflection of higher macroeconomic risk in the market (rising rates could drive us into recession thereby negatively impacting Owl Rock’s portfolio companies), it is also an opportunity to buy low (assuming the company survives any forthcoming economic turmoil relatively unscathed). Here is how Owl Rock’s CEO, Craig Packer described it (in the May earnings call):

“This quarter was clearly an inflection point in the economy and in the credit markets. Investor concerns around geopolitical uncertainty, inflation, and the shift in Fed policy led to increased volatility across the broader market.”

Rising Interest Rates:

In theory, rising interest rates are a good thing for BDCs (including Owl Rock). At the end of the day, BDCs are just finance companies that make profits based on net interest margins (i.e. they borrow money at a lower rate, and then lend it out at a higher rate; they also apply leverage to magnify the spread). And aside from various nuances, as rates rise, the net interest margin increases—and BDCs make more profits.

However, due to various asset versus liability duration mismatches, volatility can increase in the short-term as macroeconomic conditions shift (i.e. right now—as interest rates rise). And in the case of Owl Rock, this has caused pain in the first half of 2022, but is expected to provide more handsome rewards starting in the second half of 2022. Here is what CFO Jonathan Lamm had to say on the most recent quarterly call:

“We expect to benefit materially from rising rates in the second half of the year. As I discussed last quarter, once rates rise through the floors on the asset side, and are reflected in our borrowers' interest rate elections, we expect investment income to increase meaningfully. LIBOR started the year at 21 basis points and increased roughly 80 basis points over the course of the first quarter. The majority of our borrowers have 100 basis point floors, so this increase did not benefit our interest income in the first quarter.”

Further, he concluded his prepared remarks on the call by explaining:

“To summarize, given almost all of our assets are floating and only 29% of our capital structure is floating, we expect rising rates may have a slightly negative impact in the second quarter, but will result in a meaningful net positive impact on NII starting in the second half of 2022. For example, all else equal, a 100 basis point rate increase would generate approximately $0.04 per share in quarterly NII after considering the impact of income-based fees.”

All else equal, if rates keep rising (as they are expected to), Owl Rock is well positioned to benefit.

Conclusion:

Investing in Owl Rock is riskier by definition because it provides financing to more macroeconomically sensitive middle market companies (and we could be on the verge of a recession). However, Owl Rock is also potentially more rewarding because its levered net interest margin is increasingly compelling (given the strength and positioning of its current book of business).

Anyone investing in Owl Rock should recognize that the majority of gains will come from dividends and not long-term price gains (although the current discount to book value provides opportunity for some price gains as well). In our view, if you are looking to add a big-dividend payor to your investment portfolio—Owl Rock is worth considering (especially under in the current macroeconomic environment). We are currently long shares of Owl Rock in our Income Equity Portfolio.