Top semiconductor businesses (including Intel, Micron, Nvidia and AMD) have a few things in common, such as strong margins and ugly year-to-date performance. However, their underlying businesses and growth rates are very different. This report focuses on Intel, the leader in PC and server chips, and then compares it to competitors Nvidia, AMD and Micron. We conclude with our opinion on investing.

About Intel:

As mentioned, Intel is the leader in PC and server chips. However, its growth rate has diminished dramatically in recent years as it has failed to keep up with the ongoing digital revolution, particularly with regards to the ever growing demands of smart phones and data centers. Nonetheless, the business continues to maintain high margins and healthy profits, as you can see in the following chart.

Intel has been able to grow over the years through a large R&D budget and timely acquisitions, but as you can see in the graph above—its future revenue growth rate looks bleak as compared to other chip stocks, particularly AMD and Nvidia. In particular, Nvidia and AMD continue to lead through innovation, while Intel’s claim to fame is simply its legacy stronghold on PC and server markets, combined with its foundry Hail Mary pass (i.e. Intel is basically hoping the US government mandates more domestic chip manufacturing, which could dramatically boost its growing foray into low cost foundry manufacturing).

For reference, according to PC mag, a foundry is:

A semiconductor manufacturer that makes chips for other companies. Also called "fabs," semiconductor foundries make most of the chips in the world for hundreds of "fabless" companies that design but do not manufacture, including some of the largest and well-known tech leaders such as Qualcomm, NVIDIA and Apple. However, a large company that designs and makes its own chips may sell excess manufacturing capacity and function as a foundry from time to time.

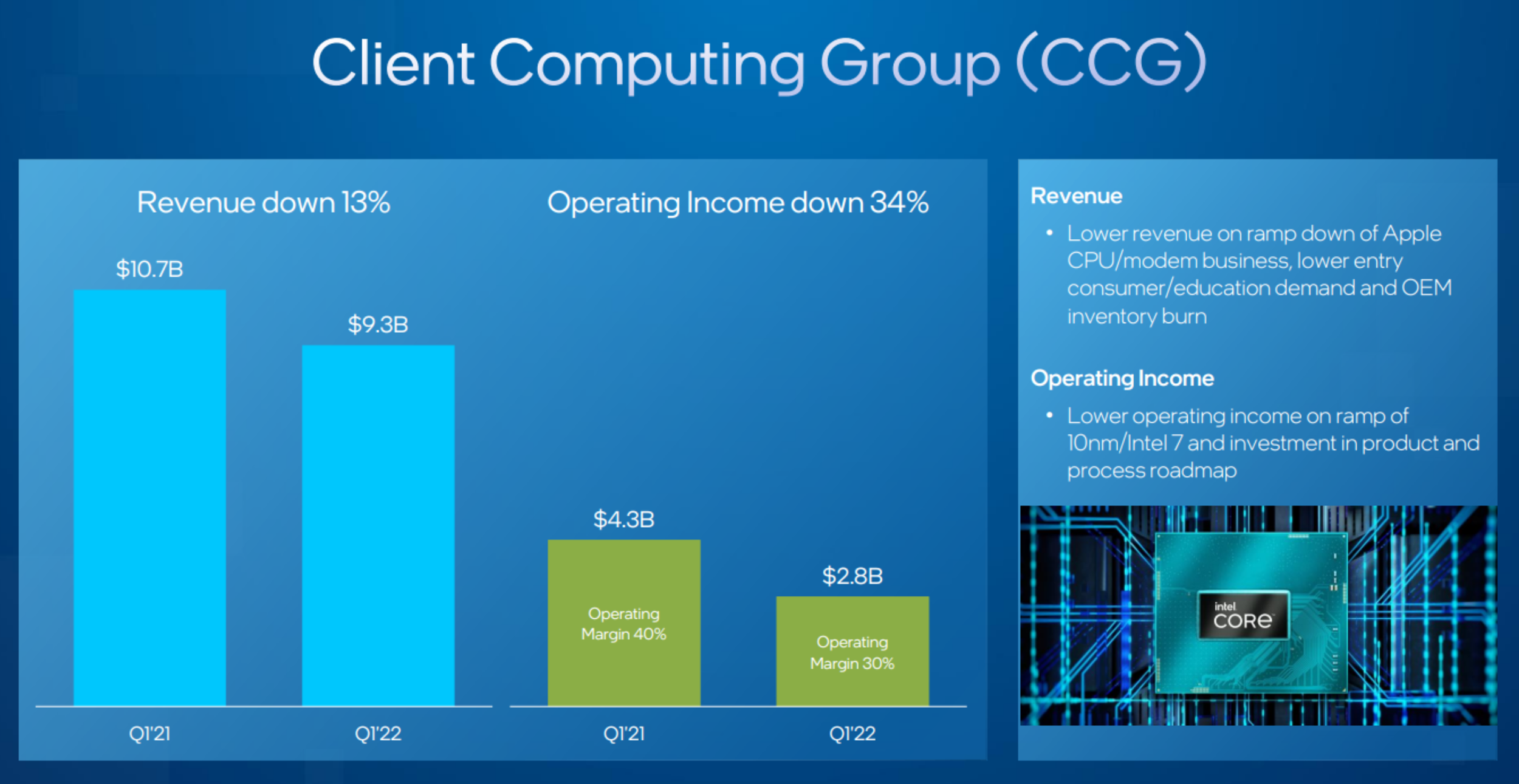

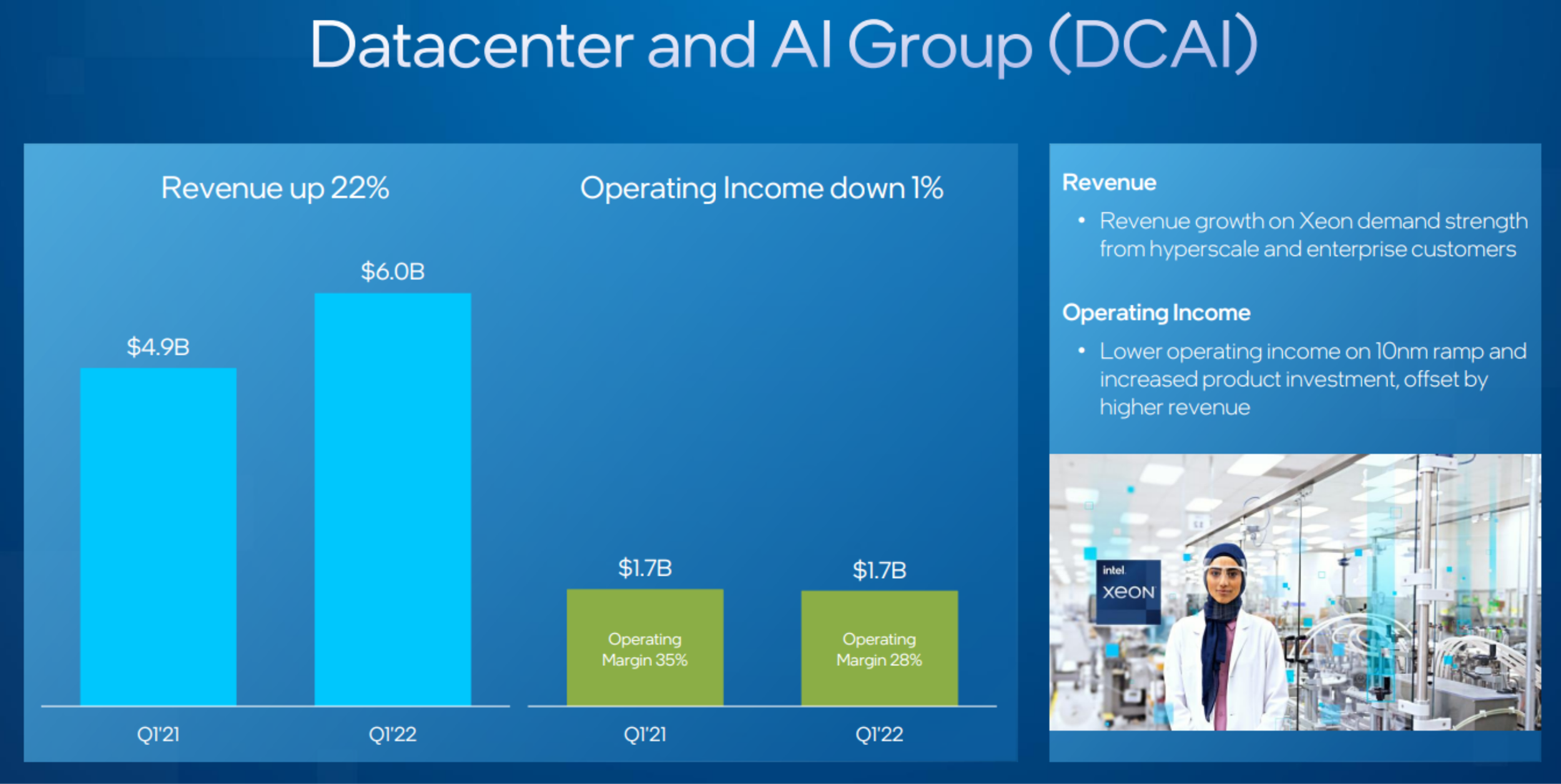

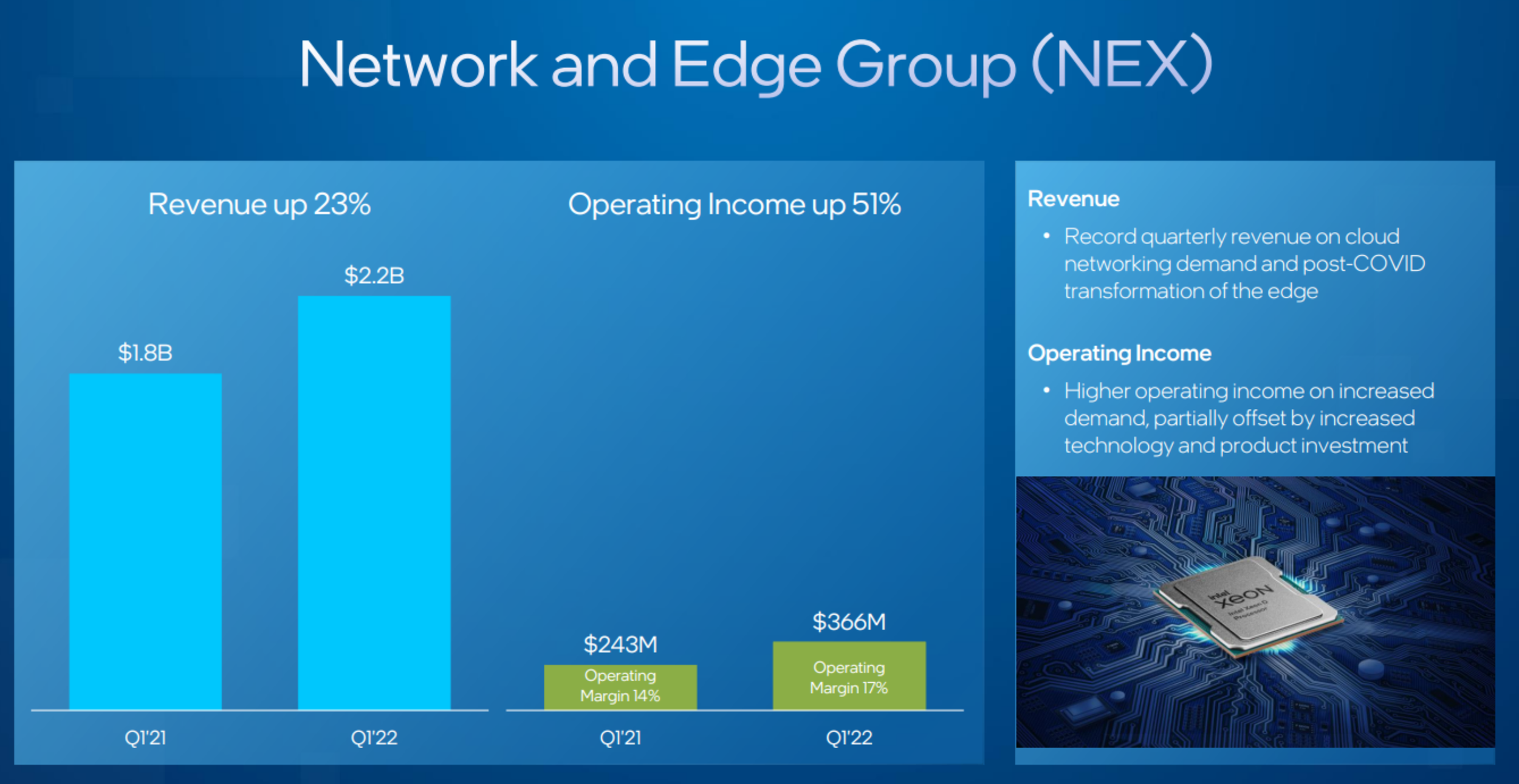

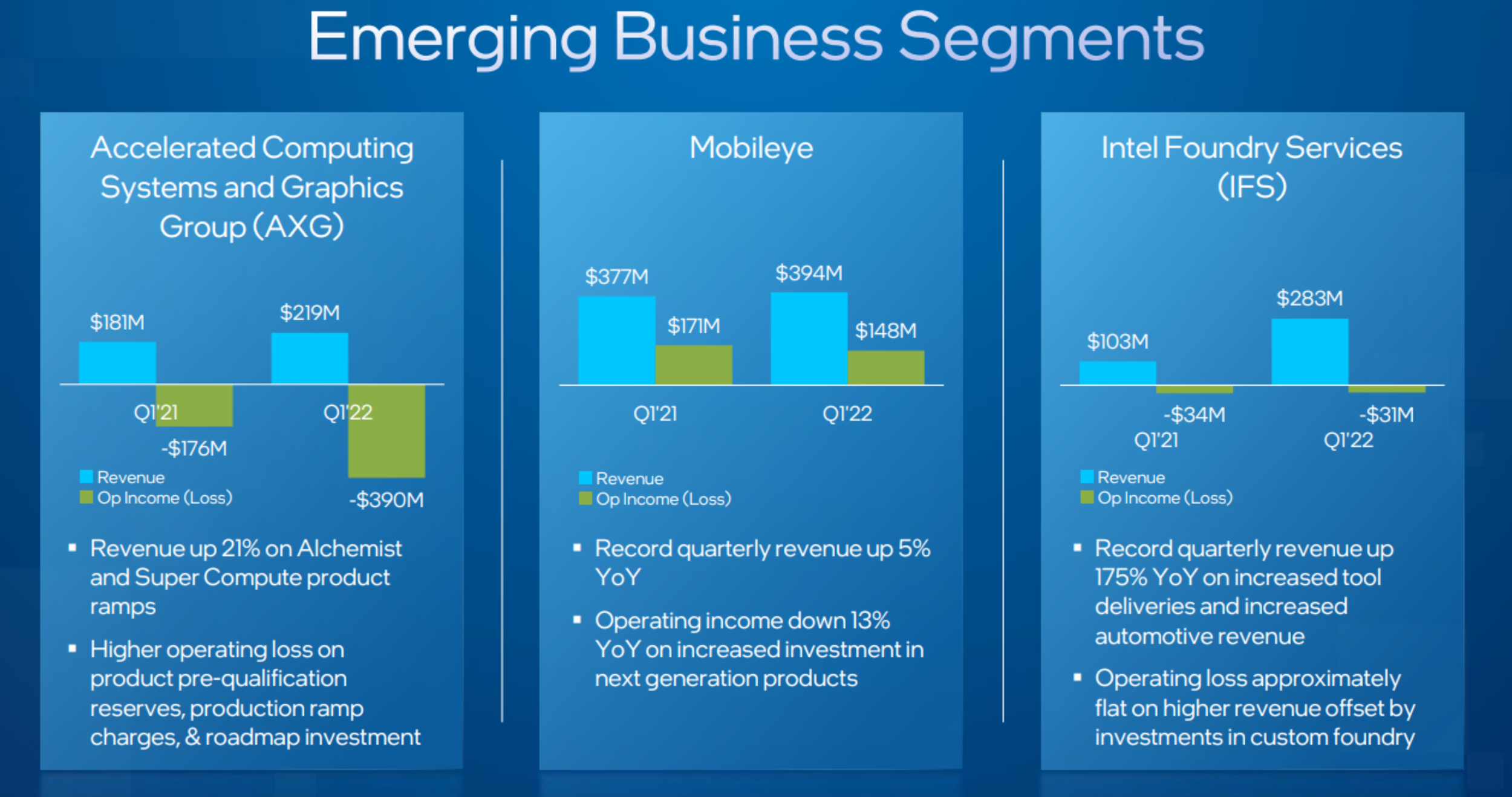

And for some perspective on the size of Intel’s businesses, here is a look at Intel’s growth trajectory by business segment (as you can see, the legacy Client Computing Group is the largest but slowing (secular trend), and the Emerging Business Segments group shows how tiny Intel’s foundry business is right now).

Opportunities:

Even though foundry is only a very small percentage of Intel’s business now, it creates an opportunity for significant (albeit uncertain!) growth. For example, even though PCs and servers are by far the largest business for Intel, that business is shrinking as the industry moves towards the cloud and mobile. And even though Intel’s data center (cloud) business is growing, it still falls far short of the growth of better innovators like AMD and Nvidia. The one big differentiator for Intel is its lofty goal of growing its foundry business. According to CEO, Pat Gelsinger, on the last earnings call:

“Following our announcements in Arizona, New Mexico and Ohio, we recently announced a series of investments in Europe, spanning our existing operations as well as our new investments in France and Germany, the Silicon Junction. These investments position Intel to meet the future growth and represent a significant step toward our moonshot goal of having half the world’s semiconductor manufacturing located in the U.S. and Europe.”

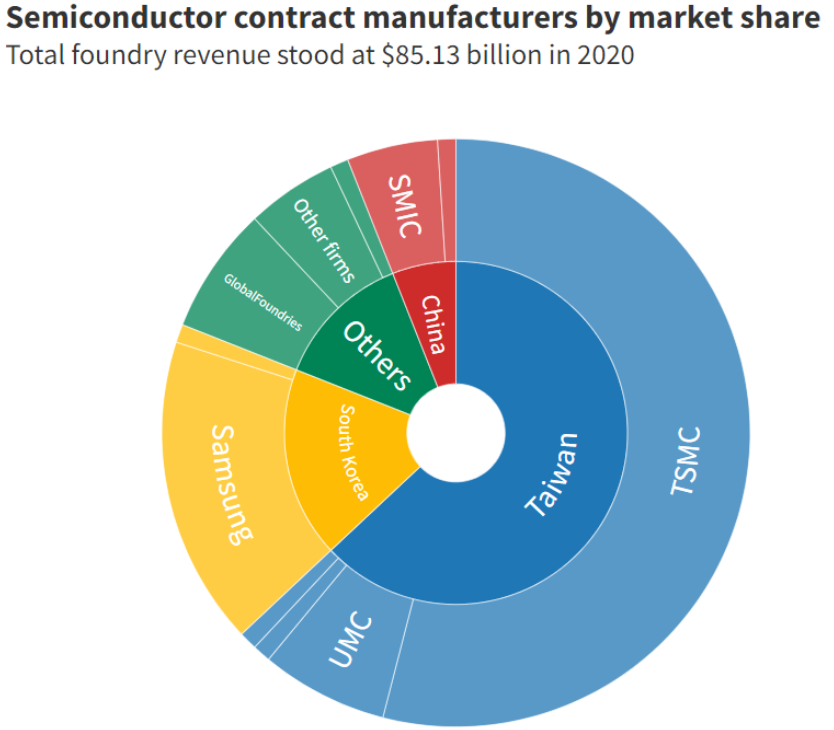

And for an idea of just how lofty that goal is, here is a look at recent chip manufacturing by geography (the inner circle).

source: CNBC

In a nutshell, Intel is hoping the ongoing pandemic-related chip shortages will prompt Congress to pass laws requiring more domestic manufacturing, which would benefit Intel dramatically (given their low cost manufacturing advantage and foray into foundry).

Valuation:

Our course, when valuing a business, high growth is not the end goal—high earnings is. And even in the absence of high growth, Intel already does have healthy high earnings (from its existing businesses). Let’s have a look at some Intel valuation metrics to get an idea if the current high earnings are being appropriately valued by the market, or if the fearmongering “no-growth” narrative has caused the shares to trade too cheaply (i.e. is there a buying opportunity here?).

Here is another look at our earlier valuation graph (below), and as you can see, Intel trades at a lower valuation multiple than peers in terms of price-to-earnings ratio and price-to-sales ratio. Specifically, Intel trades at around 6.2 times earnings (very low) and 10.2 times forward earnings (higher because earnings growth is temporarily negative), and it trades at only around 2 times sales. These are not only low compared to peers, but low by Intel’s historical standards (especially considering the company will likely return to some revenue and earnings growth in the longer-term, as per the market cycle and the company’s competitive advantages).

Regarding competitive advantages, Morningstar sector strategist, Abhinav Davuluri, recently wrote:

“We believe Intel’s wide moat emanates from its superior cost advantages realized in the design and manufacturing of its cutting-edge microprocessors and intangible assets related to its x86 instruction set architecture license and chip design expertise. While the firm has endured significant delays in deploying its latest 10-nanometer process technology, which has allowed foundry Taiwan Semiconductor Manufacturing (TSMC) to leapfrog Intel and AMD to become more competitive via TSMC’s 7-nm process, Intel’s manufacturing advantage over virtually every other chip designer and manufacturer is still intact and durable.”

Taking into consideration, Intel’s “wide moat,” strong earnings, and projected return to some growth, the current valuation is compelling. For example, if the forward price-to-earnings multiple were to expand to only 15 times (not unreasonable by historical standards, and still quite conservative) the shares have significant upside.

Intel’s Dividend:

You may have noticed that Intel’s share price has fallen less than the competitors listed above. Part of the reason for that is because Intel’s is the only one that pays a significant dividend. In fact, Intel currently offers a 3.8% dividend yield, which has mathematically increased as the shares have fallen, and it’s higher than the historical norm (perhaps a signaling indication from management that they believe the long-term share price should be higher).

Another indication of strength, the dividend has been paid for 29 years in a row, and it has grown in each of the last eight. Plus the company generates plenty of free cash flow to cover the dividend (i.e. dividend safety) and research & development (a good sign).

Intel Versus Nvidia, AMD and Micron:

We’ve already seen the stark differences in valuation multiples and growth expectations for these companies, but it is worth considering the businesses.

For starters, Nvidia and AMD garner a lot of attention for their high growth rates. Their chips are correctly seen as more innovative and more cutting edge, and this will enable them to remain at the forefront of the ongoing massive digital revolution which includes the cloud (data centers) but also smart cars, virtual reality, artificial intelligence, smart homes, smart cities and virtually anything else that uses data. The total addressable market opportunity is truly massive.

In particular, for example, Nvidia is basically eating Intel’s lunch in the data center space, as Nvidia GPU chips are better suited for processing work loads faster, and this is not likely a trend that will abate soon. Also, AMD’s latest EPYC CPU chips have caught up with Intel thereby creating new competitive pressures. The cutting edge innovation of Nvidia and AMD have created dramatic headwinds for Intel in capturing newly available digital revolution market share. However, it’s also worth noting that AMD and Nvidia already trade at dramatically higher valuations than Intel.

Micron differs from the others in that it is focused on memory and storage. And while Micron also benefits from explosive growth in digitization (e.g. cloud, data centers, AI, smart devices) it competes with Samsung and SK Hynix. Unlike the others, Micron doesn’t have much in the way of differentiating competitive advantages, but it will continue to benefit from the digital revolution and it currently trades at a dramatically lower price and valuation than previously. The challenge with Micron is that is can suffer dramatic oversupply issues within market cycles, and if we are heading for an ugly recession that could bode negatively for Micron.

Conclusions:

The two big competing forces in the chip industry are the ongoing digital revolution (which dramatically expands market opportunities for chip makers) and valuation multiples (which can get dramatically ahead of themselves and be subject to significant cyclicality). However, given the recent share price declines across the industry, investment opportunities are currently more attractive than they have been in the past.

The question for investors is which type of chip stock may or may not suit you. For example, if you like steady higher income, Intel is currently attractive for its big dividend and lower share price. We don’t currently own shares of Intel, but we are considering adding shares to our Income Equity portfolio in the near future (not only is the dividend and valuation attractive, but the foundry initiative ads an element of possible dramatic upside depending on the longer-term regulatory direction of the government to thwart off future international supply chain challenges—such as the one we’re experiencing now due to covid).

If you are looking for a more volatile opportunity (more growth but without the dividend), we like Nvidia. After selling those shares last year at around $270, we recently bought them back (in our Disciplined Growth Portfolio) at about $100 lower.

At the end of the day, disciplined, goal-focused, long-term investing is a winning strategy. Markets have been ugly this year (especially for Intel, Nvidia, AMD and Micron), and that is often a much better time to buy.