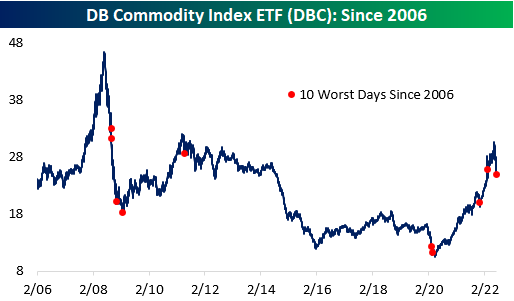

S&P futures are hovering around flat to slightly negative so far this morning, as we head into a day where the upcoming release of last week’s fed meeting minutes may already be outdated. Both treasuries and commodity prices have been trending lower, a sign that the fed’s inflation fight may be less dire than last week’s minutes convey. Markets tend to recover long before recessions end. This report shares data on past recessions, chip stock valuations (e.g. Nvidia, AMD, Micron and Intel) and an update on the market’s technical position.

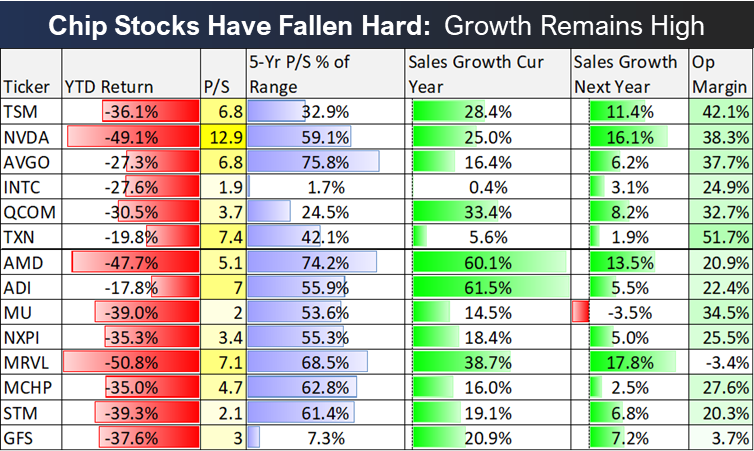

Chip Stock Valuation

If you believe in the growth stories, names like AMD and Nvidia warrant higher valuation multiple, and those multiples have come down this year as growth estimates remain high.

However, if you are a value investor, names like Micron (MU) and Intel (INTC) are hard to ignore). We are currently long NVDA in our Disciplined Growth Portfolio (we previously sold them, last year, around $273, but added them back this year about $100 lower).

Timing Markets versus Recessions

Markets tend to recover long before recessions end. And as the S&P 500 has hovered around 20% decline this year (that’s one bright line for recognizing a recession) many believe we’re already in a recession. But with small glimmers of of slowing inflation (gas prices are down at the pump, interest rates are ticking lower, and commodity prices in general are off the highs finally), and considering the market is already down significantly. Now is a more compelling time to buy, if you are a long-term investor, than the start of this year.

source: Bespoke

The Tea Leaves: Technical Downtrend Intact

Technical analysis prognosticators may suggest the market remains in the same downtrend since the start of this year, as you can see in the following 20-day and 50-day moving average chart.

I tend to take technical analysis with a grain of salt, simply because it’s the underlying fundamentals (earnings growth and multiple expansion) that drive stock prices in the long-term. Nonetheless, many market participants follow these simple moving averages, and they prefer to see a breakthrough to the upside before they feel more comfortable with the markets. And considering the positive signs from interest rates and commodity prices, we could see a breakout to the upside soon. However, depending on the level of uncertainty in the fed’s tone in the minutes released today—the market could face more near-term bumps.

In the long-term, many attractive business remain. Earnings growth remains intact and valuation multiples have come down. No one can predict with absolute certainty what will happen to the markets in the short-term, but long-term the markets will go higher.