With futures pointing higher, the market is set to rise for a third day in a row. And some investors are starting to think these gains are different than the dead cat bounces we’ve repeatedly experienced this year because this time commodity prices are down, the dollar is strengthening and the fed may finally be ahead of inflation.

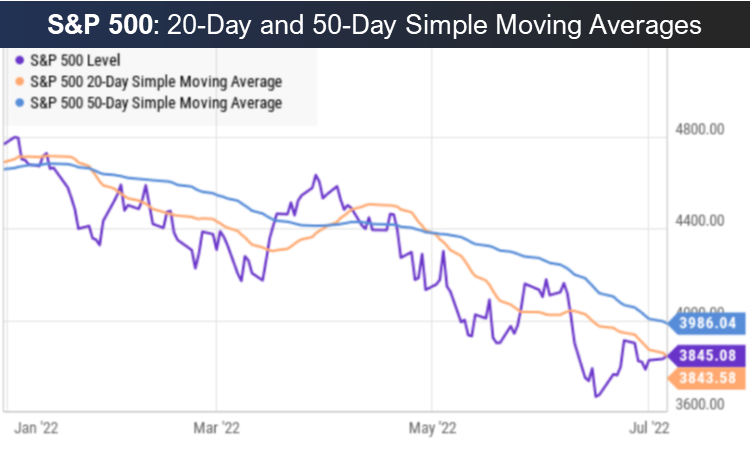

As you can see in the chart above, the year-to-trend trend for the S&P 500 remains to the downside, as markets have continued to lower after each dead cat bounce so far this year.

And with the Fed’s very hawkish tone in the June meeting minutes that were released yesterday, why wouldn’t this just be another dead cat bounce on the markets way lower as we seem to head into an economic recession?

What’s different this time (those are dangerous words) is that there are finally some indications that inflation may be slowing. And that’s a good thing because the big reason the market has been falling this year is because the fed has been fighting inflation (and their hawkish interest rate policy has had the pronounced side effect of slowing the economy and driving markets lower).

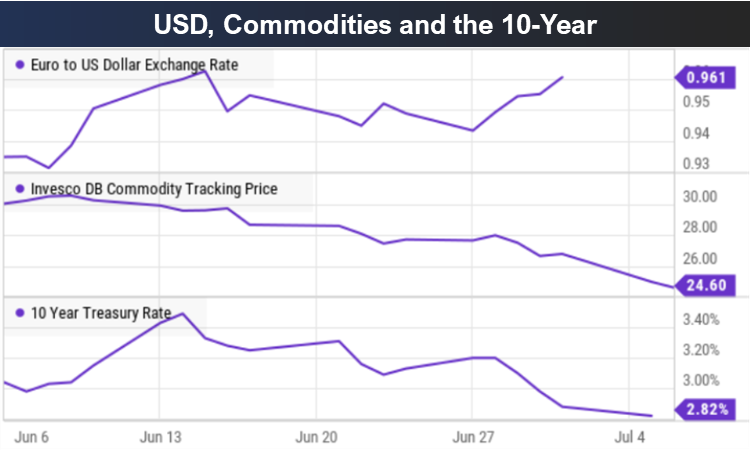

However, as you can see in this next chart, the US dollar is recently strengthening, commodity prices are finally falling (after a rocket ship ride up in the first 4 months of the year) and the 10-year treasury rate continues to decline, all indication that inflation may be slowing.

Particularly interesting is that the 10-year rate has kept falling in recent weeks, even though yesterday’s newly released hawkish fed minutes were from weeks ago. This is a sign that the fed may finally be ahead of inflation—also a good sign for stocks.

The Bottom Line

At the end of the day, no one can predict the markets short-term moves, and the recent three-day gains for stocks may just be another hope-crushing dead cat bounce. However, there are signals that this time is different (dangerous words) such as falling commodity prices and treasury rates plus a strengthening US dollar. Importantly, the market is considerably lower than it started the year, and the saying is to “buy low” (not high). And from the forward P/E multiple on the S&P 500 is now five points lower than it was 6-months ago (for reference, when the multiple has fallen by 4 points or more over a six-month span, the S&P 500 climbed by double digits in the next 12 to 24 months). We are not panicked and we are not selling our stocks now. We remain disciplined long-term investors, and look forward to continuing long-term, compounding, gains in the market.