The popular mortgage REIT we review in this report offers huge dividends on both its common and preferred shares. And while some investors are drawn to these big income payments, we believe it is an absolute junk investment. In this report, we explain why it should be avoided, and then offer two better big-dividend opportunities for you to consider.

Rithm Capital (RITM), Yield: 10.2%

Formerly known as New Residential Investment Corp (NRZ), Rithm Capital is a big-dividend mortgage REIT that should be avoided. Its balance sheet consists of a hodgepodge of difficult-to-manage legacy mortgage-related assets that have are of little importance to the financial system, its CEO has a history of bad behavior, the business just lost its credible external management team, and its opportunities are limited going forward. It’s basically dead money walking, as we will explain below.

Rithm History

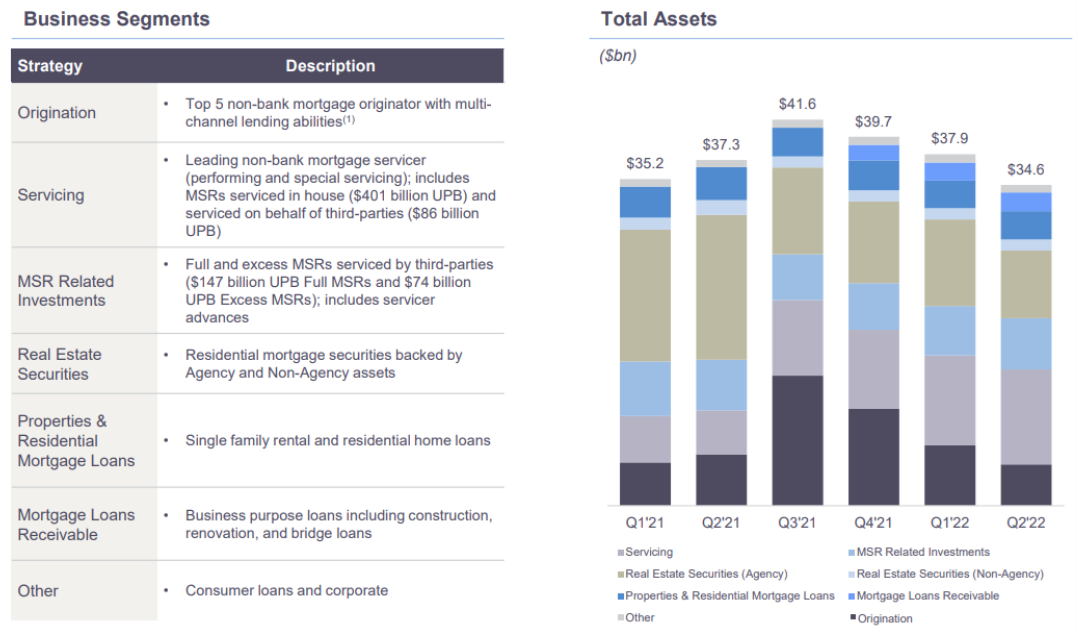

To provide some history, Rithm was initially founded around the time of the 2008-2009 financial crisis. It was a cleverly opportunistic business that benefited from the mortgage-related distress of the crisis. Specifically, it first owned Mortgage Servicing Rights (which became unexpectedly important when the housing bubble burst) and then Excess Mortgage Servicing Rights. In fact, it still owns many of these assets on its balance sheet, but the tremendous growth opportunity in the asset class that emerged during/after the financial crisis is now long gone. And since the opportunities were already gone, Rithm has been grasping for new opportunities (none of which are nearly as attractive as the ones that existed shortly after the 2008-2009 financial crisis began). As a result, Rithm’s balance sheet now consists of a hodgepodge of mortgage-related assets that are risky and hard to manage, such as those in the graphic below.

Fortress Just Dumped Rithm

Rithm recently changed it name (it was formerly known as New Residential Investment Corp) following the departure of its external management firm, Fortress Investment Group (FIG). Fortress is a large, savvy and highly respected financial company that dumped Rithm because they recognize the opportunities are now limited and the risks are high. The risks are high Rithm’s balance sheet is such a mess of varying mortgage related assets (that are difficult to manage operationally) and because there is arguably a new housing bubble today that may be bursting as high inflation drove home prices very high and now increasing interest rates makes them even more unaffordable. In our view, the Fortress departure is not a good sign. Rithm’s management is trying to spin the Fortress departure as a good thing (claiming they save costs and eliminate conflicts of interest by becoming internally managed), but we’re not buying it. They stuck between a rock and a hard place, and they don’t have a lot of attractive options.

Rithm CEO Blew Up Bear Stearns

If you remember back to the distress of the 2009-2008 financial crisis, it was largely set off when Wall Street bank, Bear Stearns (followed by Lehman Brothers), collapsed. And a look under the hood reveals Rithm’s current CEO (Michael Nierenberg) worked at Bear Stearns and his risky behavior contributed very significantly to the collapse. And along these lines, considering Rithm’s currently risky assets. For reference, here is more color on what Nierenberg has been up to lately.

Rithm’s Assets: Dangerous, Not Systemically Important

When the covid pandemic broke out, Rithm was hurt badly because of its risky balance sheet assets. Critically important to note, the fed was working overtime to bail out the financial markets at this time (by buying all kinds of assets to pump liquidity into the system), but they were NOT bailing out Rithm’s various and exotic MSRs.

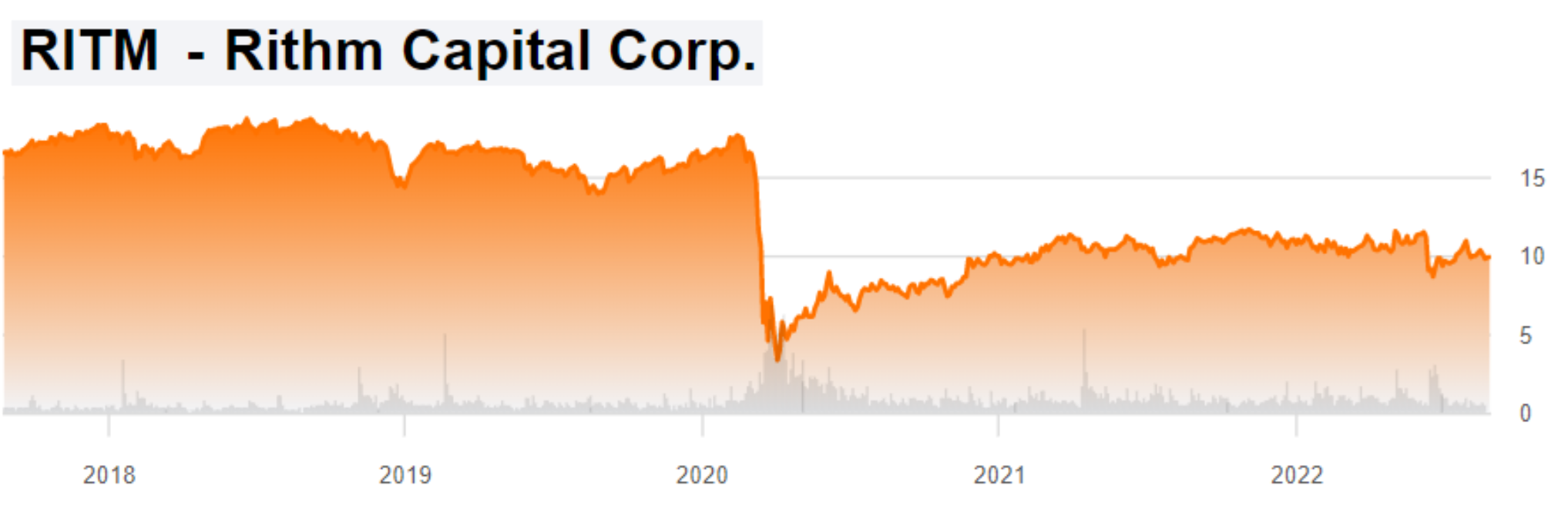

We went into great detail to warn investors of the dangers of Rithm (formerly known as New Residential) back in December of 2019 (right before the pandemic hit) and unfortunately we were right (see below) as the shares sold off extremely hard when the pandemic hit and they still haven’t (and may never) recover:

2 Better Big-Dividend Opportunities

In our view, Rithm is simply dead money walking, whereby it’s just a matter of time before some localized market turmoil drive it into financial distress. Of course it could pull a rabbit out of its hat and put itself on a path to miraculous recovery and gains, but that seems unlikely and investing in Rithm is not an attractive risk in our view, regardless of the temping big dividend yield. Instead, we offer two better big-dividend opportunities below.

AGNC Investment Corp (AGNC)

like Rithm, AGNC is also a mortgage REIT that offers big-dividend common and preferred shares (yielding upwards of 11.8%). However, unlike Rithm, AGNC’s balance sheet assets are systemically important as increasingly demonstrated by the Federal Reserve’s clear commitment to supporting them. Specifically, the overwhelming majority of AGNC’s balance sheet assets are Agency Mortgage-Backed Securities (Agency MBS), which are essentially backed by the government. For example, the fed bought massive quantities of Agency MBS quickly when the pandemic was hitting in order to pump liquidity into the system. This is a clear demonstration of the systemic importance of AGNC’s assets.

Of course AGNC has a variety of its own risks, including a high amount of leverage or borrowed money (which is increasingly expensive to maintain as interest rates rise), and AGNC Agency MBS securities also fall in value as interest rates rise (a phenomenon we are already seeing clearly this year). The good news for new AGNC investors is that as rates rise, the opportunities going forward improve (i.e. AGNC can earn higher returns on its assets). And the turmoil of this year has already driven the share price of AGNC lower.

Of course interest rate volatility and housing market challenges also create challenges for AGNC’s business (i.e. less new mortgage originations and fluctuating mortgage pre-payment speeds, for example). But the actual assets AGNC holds are far easier to manage (and more systemically important) than those held by Rithm, and for these reasons we believe AGNC is a better investment.

AGNC currently trades at an small discount to its book value (98 cents on the dollar—a good thing), and we believe the business has a long future (unlike Rithm). AGNC common, and particularly the preferred, shares are attractive and worth considering if you are an income-focused investor (as we recently wrote in this report). We do not currently own shares of AGNC (common or preferred), but we have owned them in the past, and they are currently high on our watchlist as a potential new investment for our Income Equity Portfolio.

Medical Properties Trust (MPW), Yield: 7.3%

Another big-dividend investment that we like more than Rithm, and one that we currently do have a small position in, is Medical Properties Trust. Medical Properties Trust owns the real estate that is currently occupied and operated by hospitals. And the hospital real estate is extremely important to the communities in which they operate. Like AGNC, MPW’s assets are much more systemically important than the assets Rithm owns.

As mentioned, MPW owns hospital real estate. The basic business model is that MPW provides critical capital to hospitals by buying their real estate. This is a win-win because it gives MPW ownership of hospital properties that are extremely important to the communities in which they operate, and its gives the hospital operators access to capital so they can improve their operations.

MPW is not without risk, but we believe the risks are outweighed by the potential rewards. We recently wrote up a detailed report on MPW called “Medical Properties Trust: 50 Big-Dividend REITs, Down Big” and you can access that report here.

The Bottom Line

Despite the fed’s increasing interest rate trajectory, yields are still very low by historical standards (especially as compared to our current extremely high level of inflation). Investing in higher income-producing investments (such as the three reviewed in this report) involves risks. However, by selecting attractive opportunities (we prefer MPW and AGNC) and owning them in a prudently-diversified portfolio, you can reduce risks and keep expected returns (and expected income) high.