This big data stock went public in late 2020. And after some incredible post-IPO gains in 2020-2021, the shares came crashing down as the high-growth pandemic bubble burst. However, the company’s massive revenues have continued to grow an incredible pace, it just announced impressive quarterly results last week, and it is about to turn EPS positive (a great thing in this environment). And critically important—there is still a lot more room to run (in terms of sales growth that will lead to massive profits in the relatively near future.

Snowflake (SNOW)

Snowflake (SNOW) is a cloud-based big data company. It basically combines company data into a single source thereby allowing them to garner valuable insights about their businesses. Its largest customers include leading cloud computing whales Microsoft (MSFT), Amazon (AMZN) and Alphabet’s Google (GOOGL). More specifically, Microsoft, Amazon and Google allow their customers to use Snowflake software, which amounts to roughly 40% of fortune 500 companies using Snowflake today. Snowflake is a big deal.

Strong Business Trajectory

Snowflake announced earnings last week, whereby revenue was $497.25 million, representing 82.7% y/y growth and beating expectations by $29.94 million. The company also raised its full-year product revenue guidance, topping analysts' estimates (a very good thing).

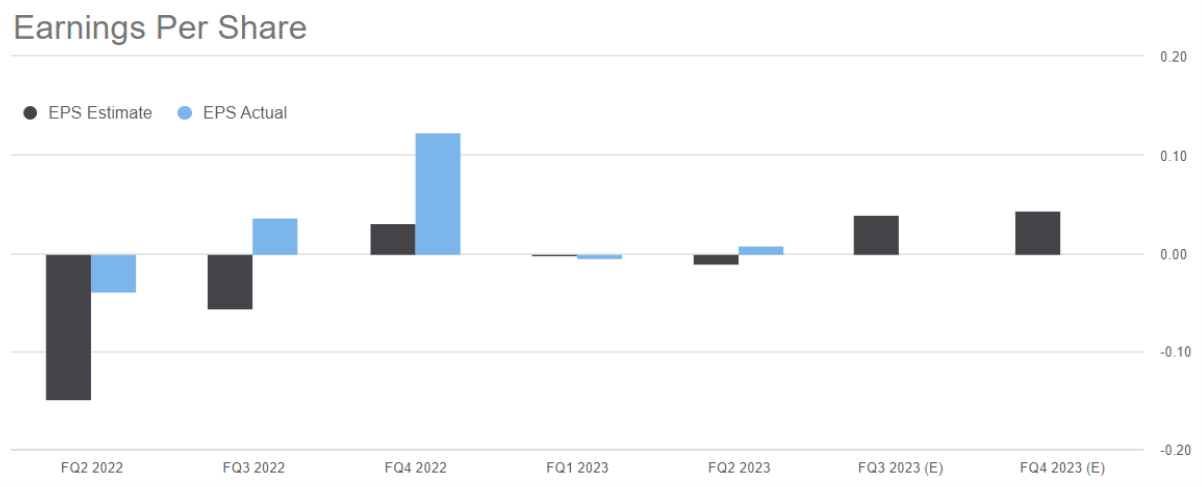

Importantly, despite the massive growing revenue, the company is finally expected to achieve positive earnings in the upcoming quarters, as you can see in the following graphic.

Even though Snowflake is NOT currently focused on profits (it’s a growth stock, so they are basically forgoing earnings now so they can reinvest in their own business in order to maximize future profits—in theory), it will still be very helpful psychologically for many investors to see the company turn a profit, especially in this rising interest rate environment, whereby future earnings are assigned a lower value than current earnings.

Massive TAM

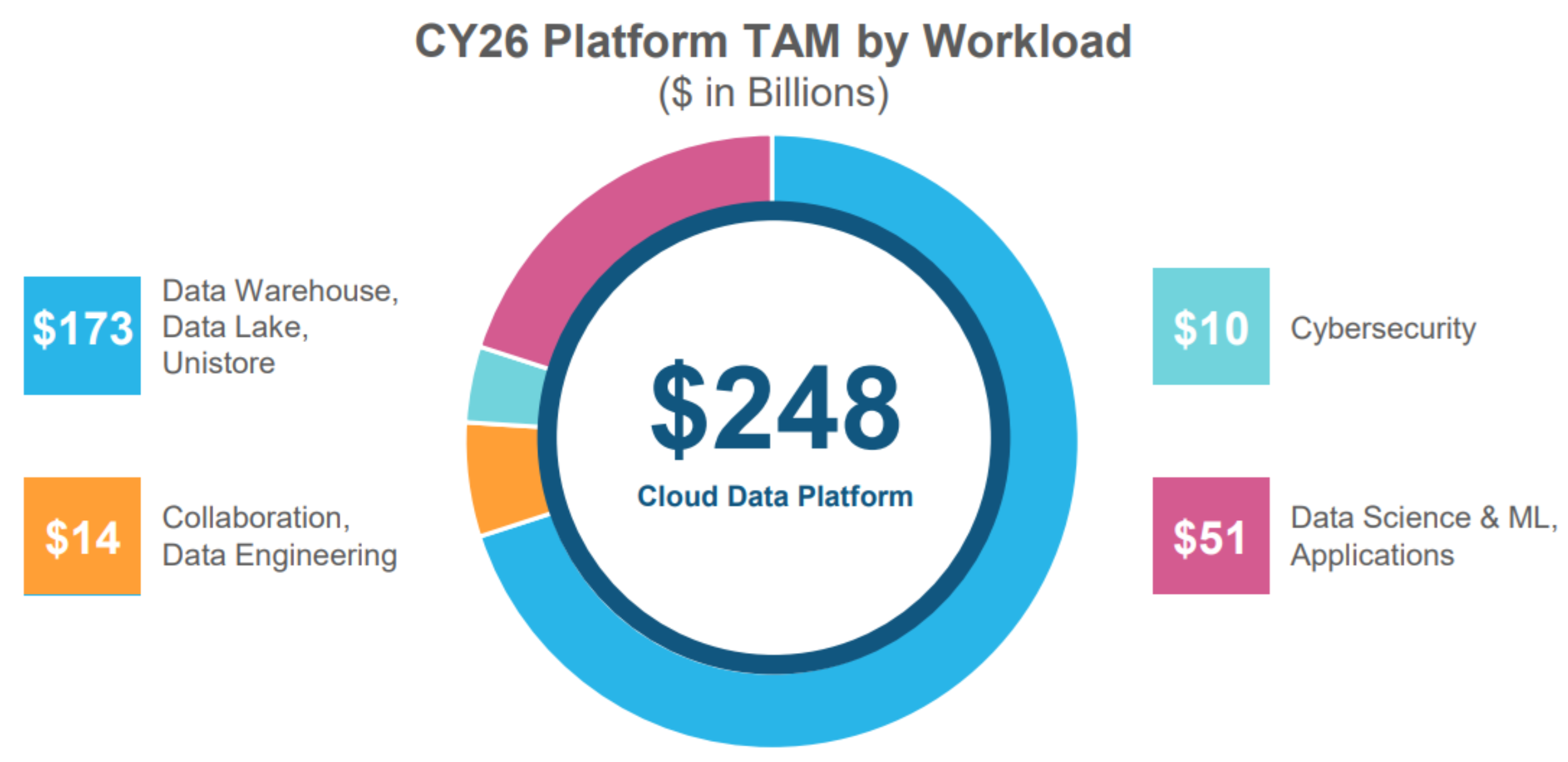

Total Addressable Market (“TAM”) is one of the most important things to look for in a growth stock, and in Snowflake’s case the TAM is absolutely enormous.

TAM is so important because it determines home much more future growth opportunities are available. And because Snowflake is a leader, it can capture a lot more future revenue growth and ultimately earnings growth. As you can see in the graphic above, Snowflake estimates it cloud data platform TAM to be $248 billion by 2026—huge considering the company’s most recent quarterly revenues were just shy of half a billion.

The cloud transition is basically one of the biggest secular trends in the economy today, and Snowflake is on a trajectory to benefit tremendously in the quarters, years and decades ahead.

Valuation:

Snowflake currently trades at around 35 times sales (TTM) and 29 times forward sales (the price-to-earnings ratio is not meaningful because Snowflake has no earnings yet, nor is it focused on earnings at this time). This may seem expensive, but it is really not as compared to the company’s leadership position, massive revenue growth trajectory and massive TAM opportunity. Furthermore, the valuation has come down dramatically last since last year (before the pandemic bubble started to burst) when it traded closer to 100 times sales (which is truly one of the highest price-to-sales ratios you’re ever going to see!).

Risks

The main risks for Snowflake at this time are growing pains and the market cycle. Regarding growing pains, it has growth company accounting characteristics that make the shares less attractive to many investors (such as no earnings, a lot of unearned revenues, the potential for new share issuance/shareholder dilution, and of course no profits). Regarding the market cycle, growth stocks have been out of favor, but it can still get worse. Despite the amazing growth trajectory, a 35x TTM price-to-sales ratio is a difficult pill for many to swallow—especially as interest rates rise thereby putting pressure on high growth stocks in particular.

The Bottom Line

If you are investing because you think Snowflake’s share price could increase dramatically over the coming weeks—don’t bother (that’s too short of a timeframe). But if you are investing because you think the share price can go dramatically higher over the next decade—that is a good idea. That is our thesis. We own shares of Snowflake in our Disciplined Growth Portfolio because of the potential long-term compound growth potential. Despite the market cycle, near-term volatility and risks—Snowflake is a very attractive long-term investment.