Industrial REITs have sold off particularly hard this year, but one name in particular is attractive if you can handle its strategy and risks relative to industrial REIT peers. In this report, we review this particular REIT’s business, industry outlook, valuation, dividend and risks. We conclude with our opinion on investing in this 4.4% dividend yielder.

About Plymouth

Plymouth Industrial REIT, Inc. (PLYM) is a real estate investment trust focused on the acquisition, ownership and management of single and multi-tenant industrial properties, including distribution centers, warehouses, light industrial and small bay industrial properties.

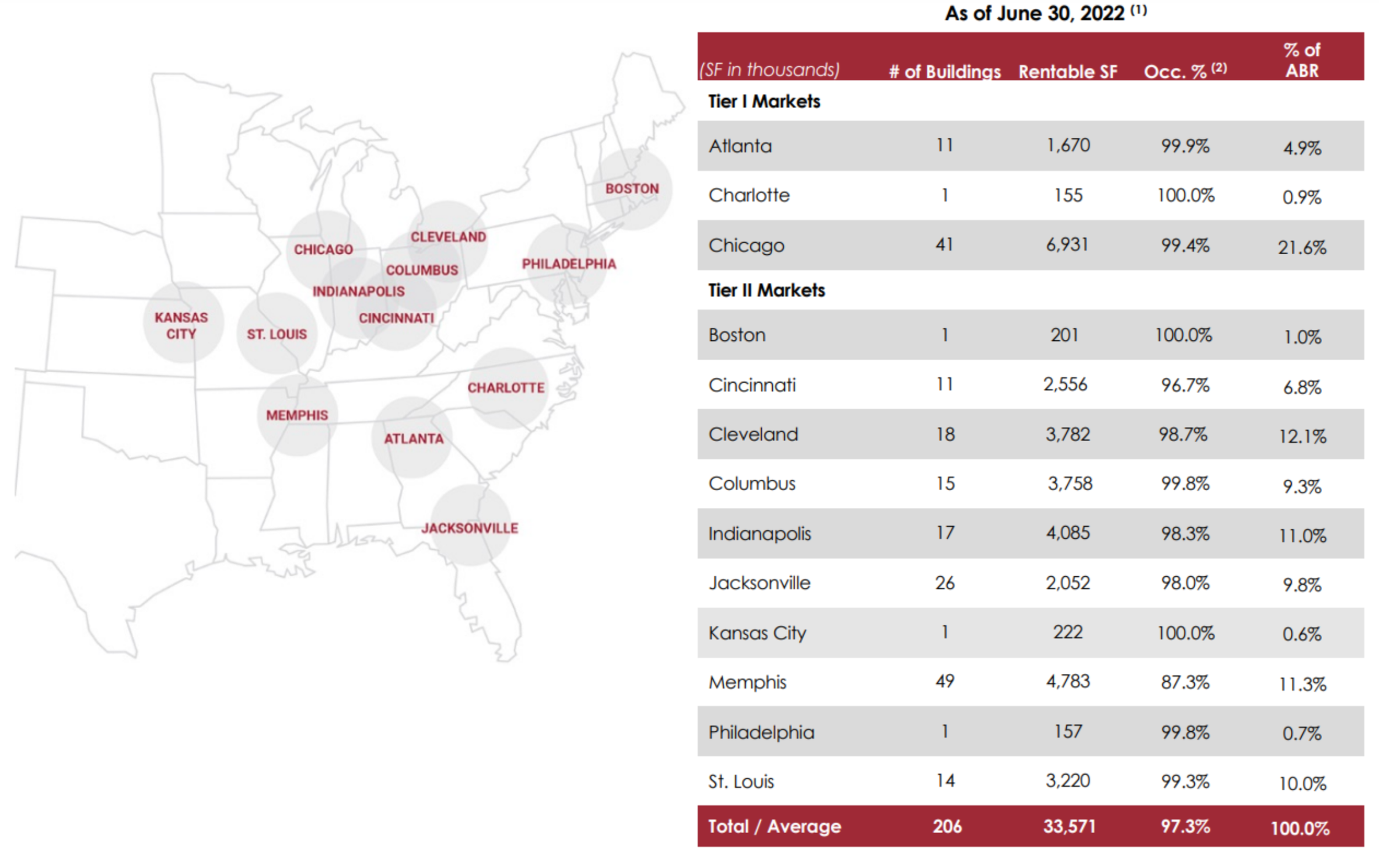

Plymouth’s properties are located in primary and secondary markets within the main industrial, distribution and logistics corridors of the United States. In particular, Plymouth currently owns and manages 207 buildings containing over 34 million square feet in 13 markets.

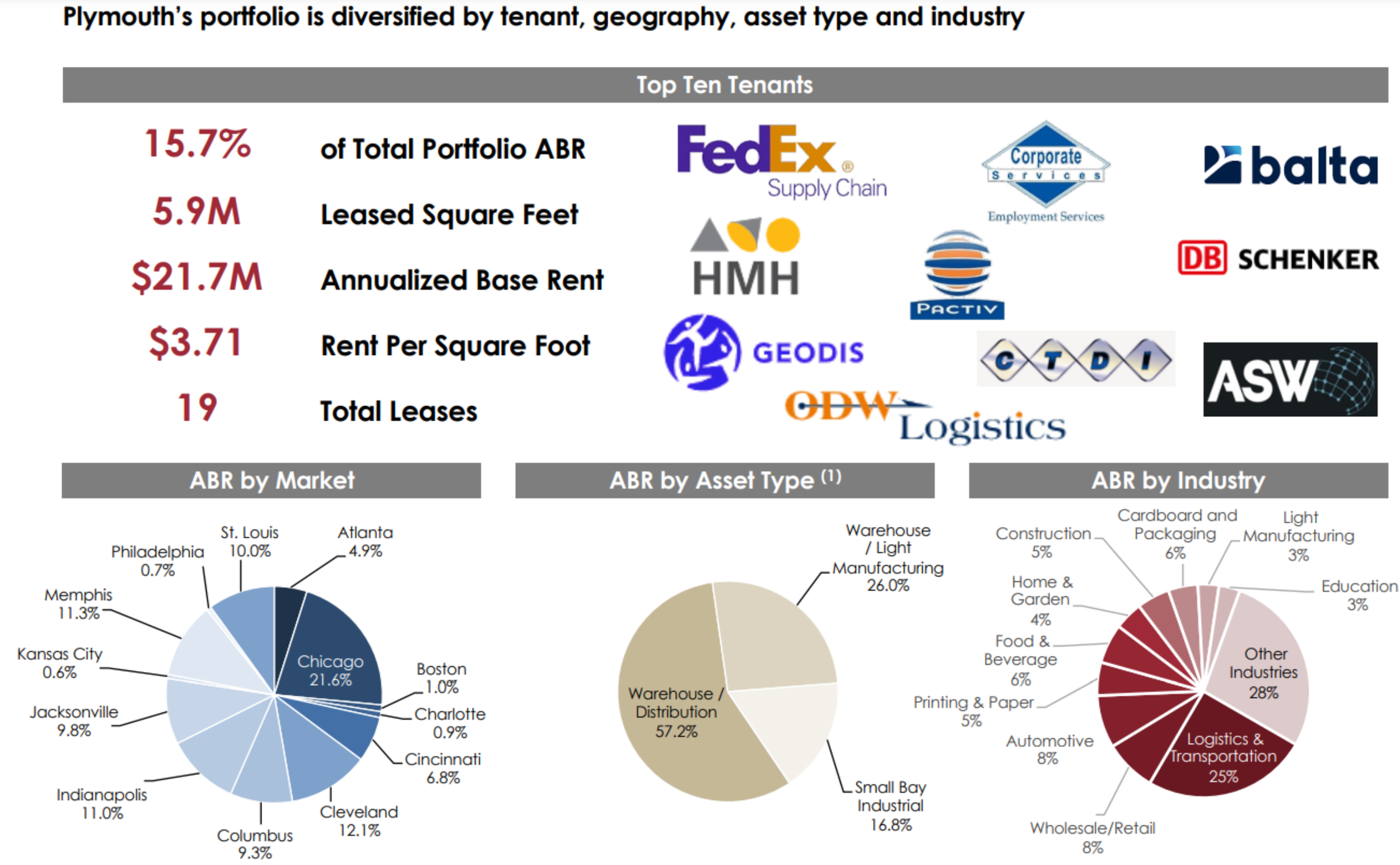

And Plymouth’s property portfolio is well diversified across tenants, geographies, asset types and industries.

Industrial Real Estate Outlook: Healthy

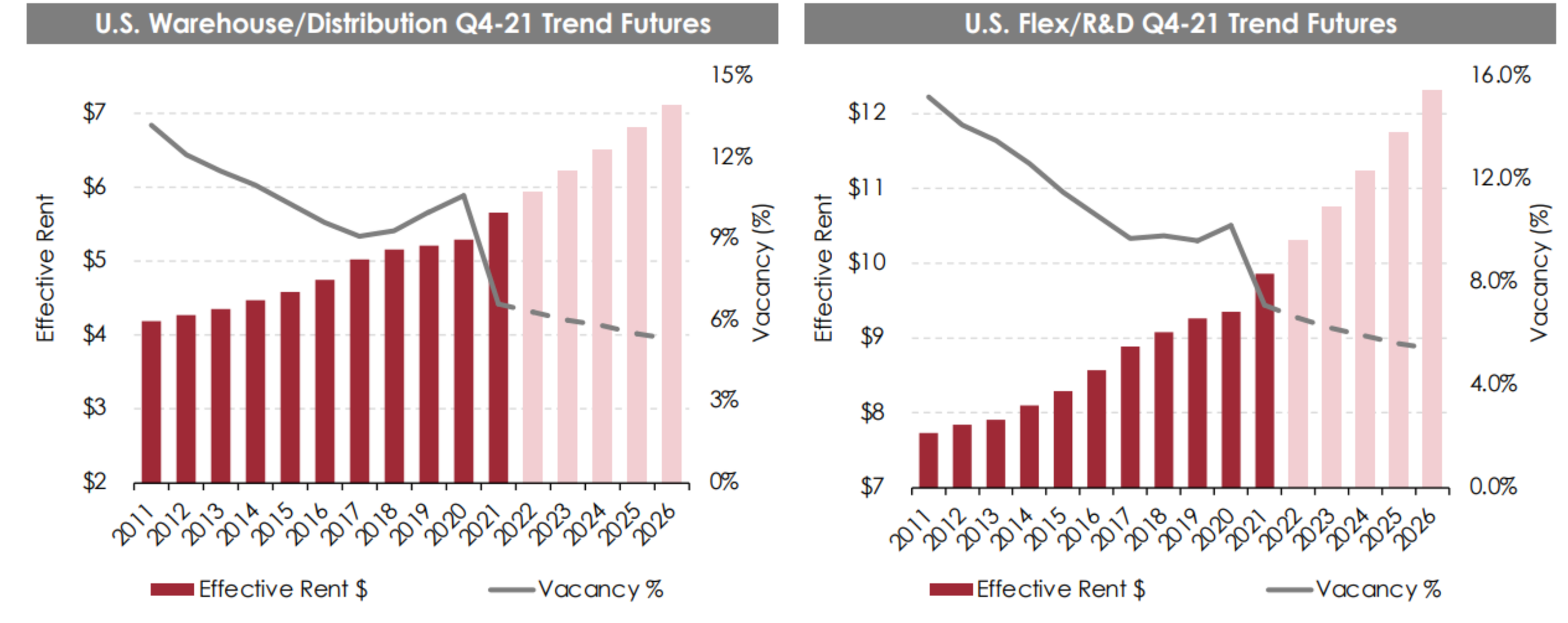

Industrial real estate continues to have a healthier outlook than other industries (such as retail, office) thanks to secular market trends. For example, as retail real estate demand declines (because people continue to shop more online) industrial real estate demand increases (as part of the online shopping infrastructure).

Plymouth believes the industry will remain strong for a variety of reasons, including (1) limited new construction and growing demand, (2) positive economic tailwinds (e.g. trade growth, inventory rebuilding and increased industrial output), (3) growth of e-commerce (transfer of retail tenants to warehouses) and (4) a resurgence in domestic manufacturing

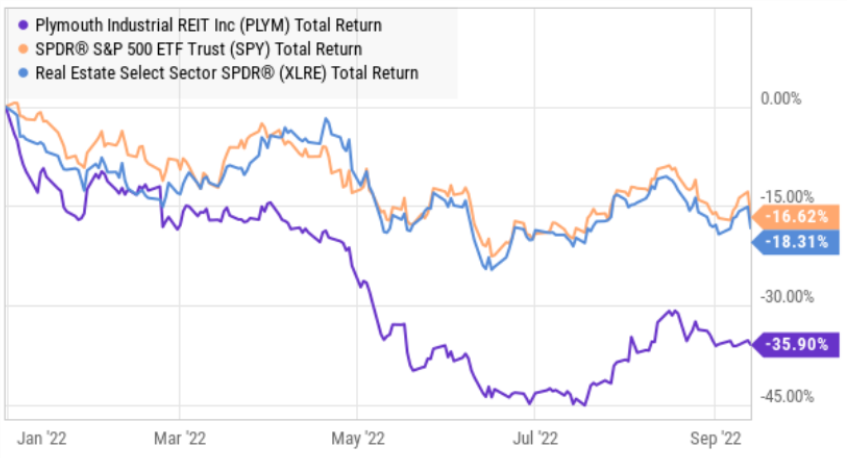

Interesting to note, after years of very healthy performance, industrial REIT share prices have been hit particularly hard this year (as compared to other REITs) as the temporary accelerated growth due to pandemic supply chain needs recede. However, the long-term outlook for the industry remains strong (and share prices in general are now lower, including Plymouth).

Strong Leasing Rates

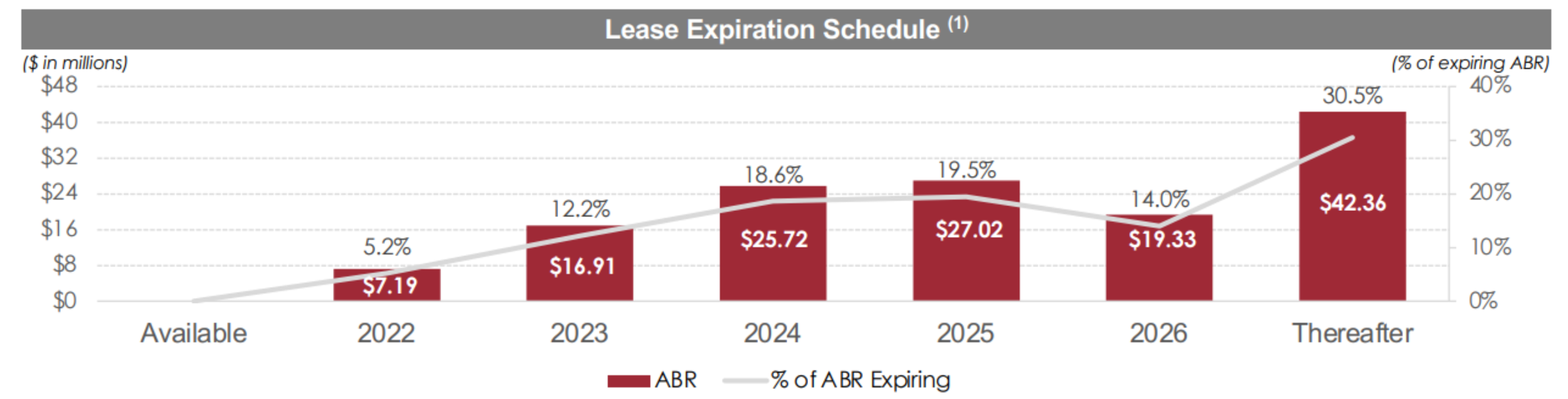

Also compelling to note, releasing rates have been increasing significantly (a good thing for Plymouth). For example, in the first quarter of 2022, Plymouth retained 73% of its expiring leases and increased rent by an average of 12.6%. And the other 27% of leases to new tenants saw rent increases of 29.7% on average. What’s more, there is more room for leasing rate increases as a steady flow of expirations will be up for new (higher) rents in the years ahead.

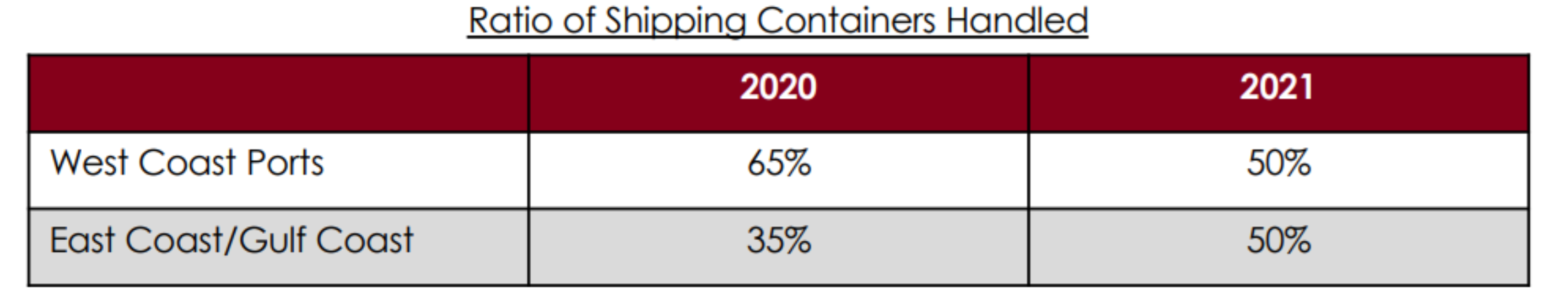

Also interesting to note, Plymouth is benefiting from the strategic shift of increasing shipping containers handled on the East Coast and Gulf Ports.

Valuation:

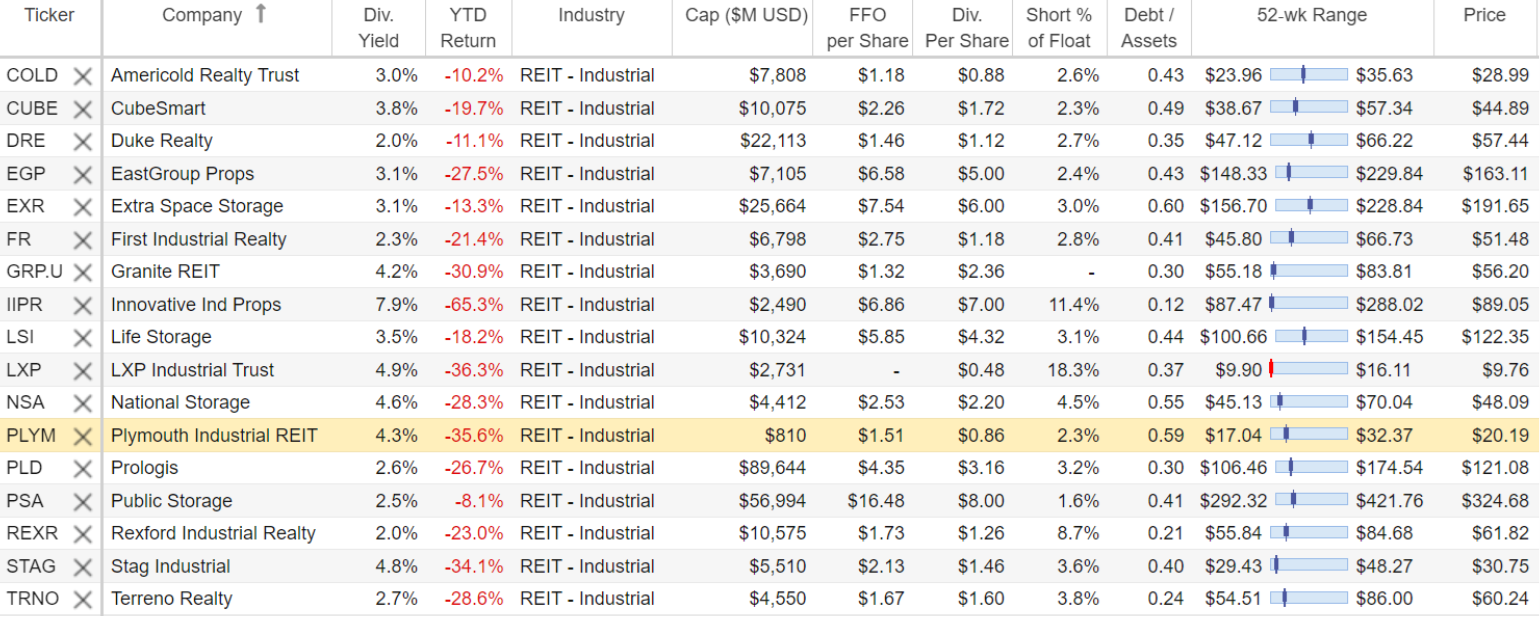

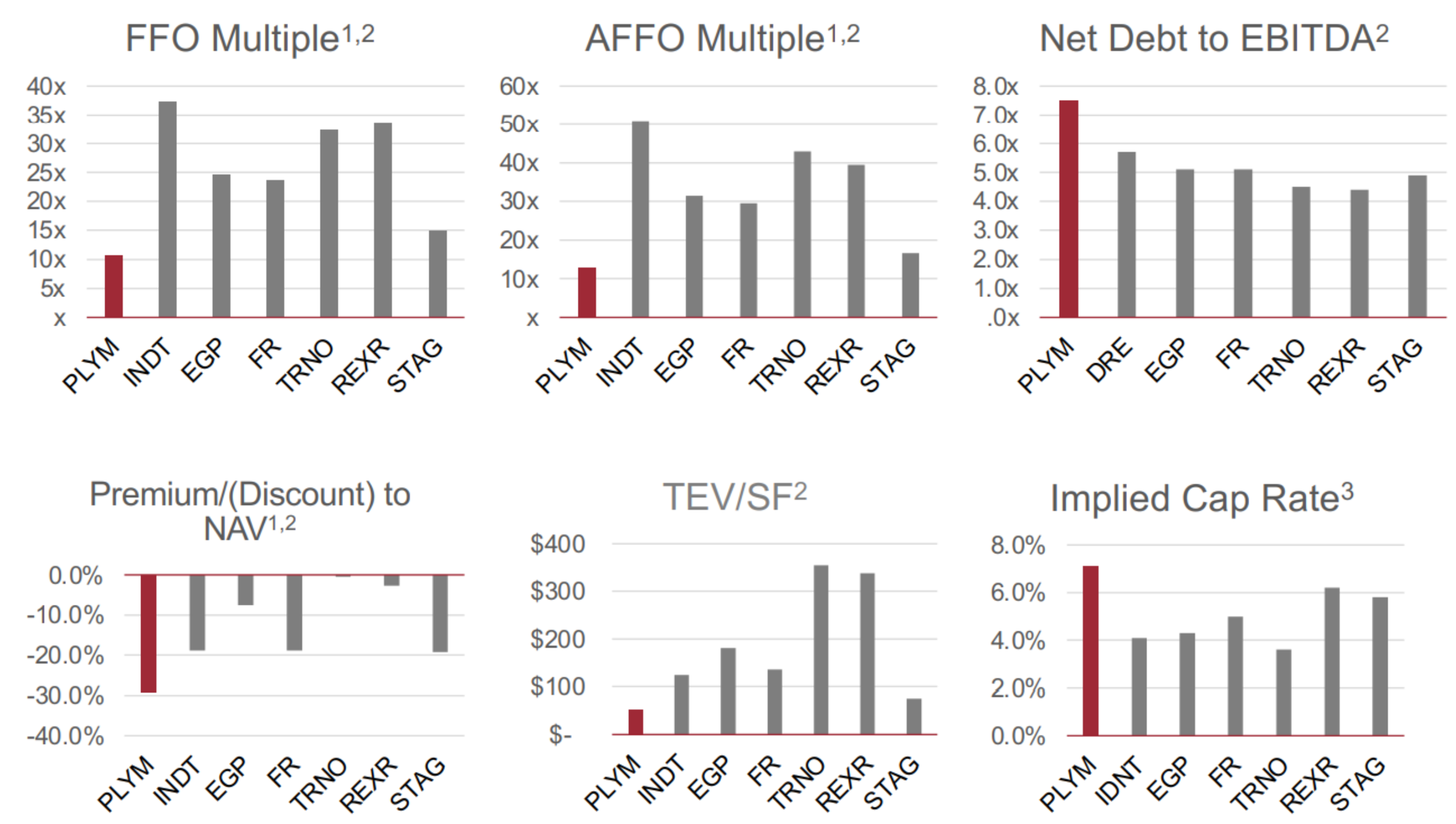

As you can see in the following graphic, Plymouth trades at a significant valuation discount versus industrial REIT peers. For example, its price to (adjusted) funds from operations (“(A)FFO”) multiple is significantly below peers. Further, Plymouth’s debt ratio is higher (risky), its discount to NAV is wider (a sign of perceived risk) and its implied cap rate is a higher (an indication that it is earning higher returns because the properties are perceived to be riskier).

In a nutshell, Plymouth’s valuation discount exists mainly because of differences in perceived risks (stemming from Plymouth’s secondary “tier 2” location properties) and its higher debt load. And these risks are particularly concerning to some as the US economy increasingly sputters as the Fed keep hiking interest rates aggressively (and slowing the economy further in the process).

Balance Sheet Debt

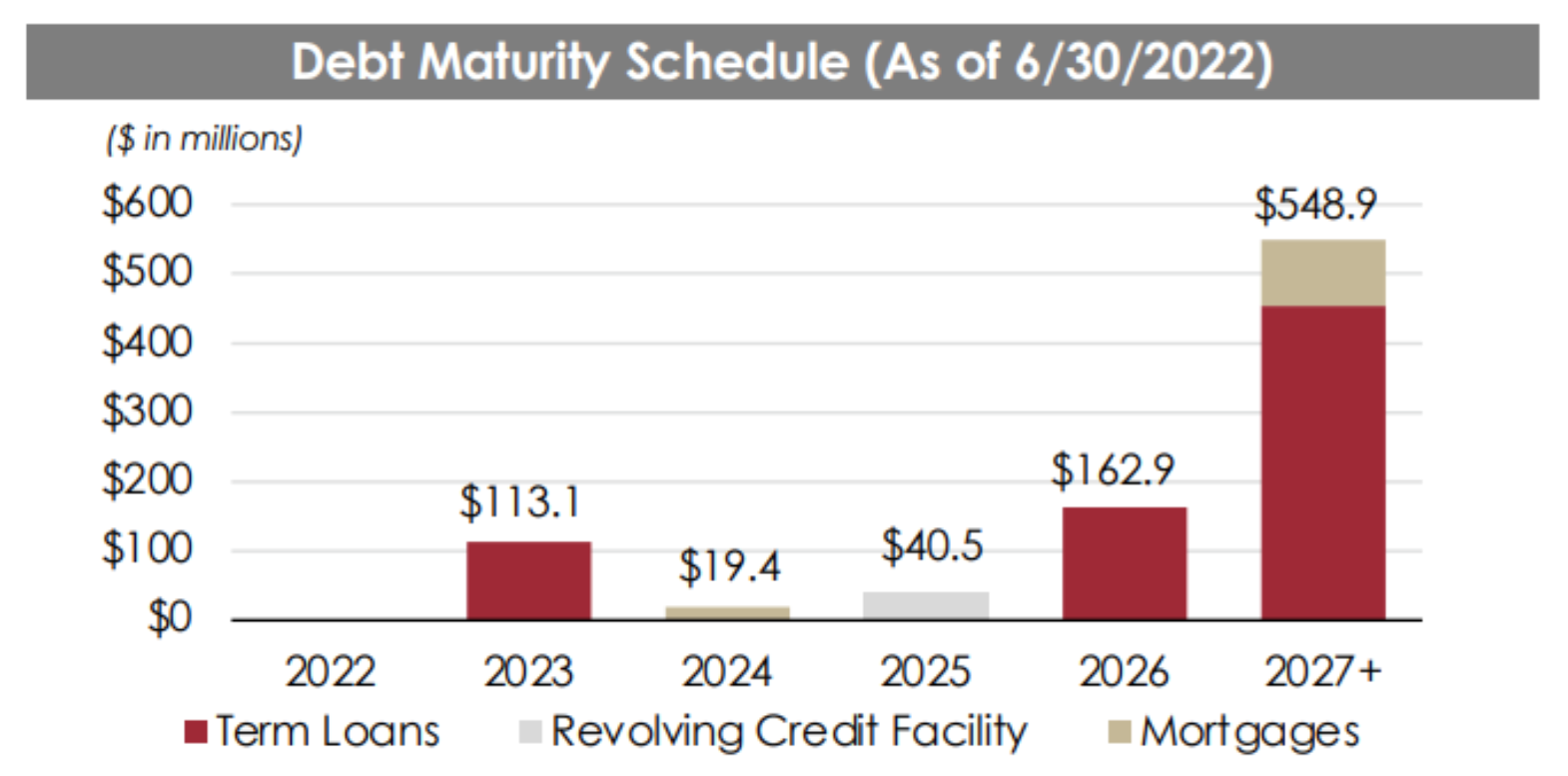

Plymouth has continued to strengthen its balance sheet and improve its liquidity position. For example, the company recently announced the terms for a conversion of a large amount of preferred shares for common shares (and some cash). This puts the company in a stronger position financially (the common dividend is less than the preferred dividend). Further, roughly 95% of the company’s debt is now fixed rate, which can be particularly attractive (and reassuring for investors) in a rising interest rate environment (such as now). For reference, here is a look at the company’s well laddered upcoming debt maturity schedule.

Dividend Strength:

Also important to note, Plymouth does have a history of reducing its dividend. For example, after Covid hit, the company reduced its dividend payment by 47% in mid 2020 to account for tenants that were struggling.

However, the dividend coverage ratio is currently strong. For example, in the most recent quarter Plymouth posted FFO of $0.47, which exceeds the quarterly dividend amount of $0.22. This wide coverage ratio is reassuring considering the economy appears to be increasingly challenged this year. Plymouth FFO has risen from $0.43 to $0.46, $0.47 and $0.47 over the last four quarters.

Risks:

As mentioned, the main risks for Plymouth are high debt (for example, as compared to peers) and properties that could be more negatively impacted if the economy gets worse (for example, Plymouth reduced the dividend the last time the economy was challenged in mid-2020 due to the pandemic). However, Plymouth continues to strengthen its balance sheet (for example by converting preferred shares to common), it has well-laddered fixed-rate debt and the properties themselves are in high demand and have been releasing at higher rates.

The Bottom Line:

The industrial REIT sector continues to be appealing for secular reasons, and because it has sold off creating a bit of a ”buy low” opportunity. And if you are willing to take on a higher level of risk, Plymouth is particularly appealing. Not only do the shares have significant share price appreciation potential (as the market re-rates the risks and assigns a higher FFO valuation multiple), but it may even be attractive as a buyout target (considering it is small—the market cap is only $824 million) and it is currently undervalued in our opinion versus its long-term value (if it gets bought out, it would likely be at a significant premium to its current price).

We do not currently own shares of Plymouth (we somewhat recently added shares of STAG Industrial REIT instead), but Plymouth is increasingly compelling and absolutely worth considering. It is high on our watchlist.

For reference: you can read our previous reports on STAG here, and you can view all of the holdings in our Income Equity Portfolio here.