Closed-End Funds, or CEFs, can be an income-focused investor favorite because of their big steady distribution payments to investors (often yielding in excess of 6% to 10%, frequently paid monthly). However, not all CEFs are created equally (in fact they can be widely different). In this report, we offer up a quick review of what a CEFs is, we share current data on over 150 high-income CEFs (including strategies, leverage, yield, distribution frequency and discount/ premium versus net asset value), and then finally conclude with a ranking of our top 7 CEFs that are particularly attractive right now and worth considering for investment (if you are an income-focused investor).

CEF Overview:

Closed-end funds, or CEFs, are basically a basket of stocks (often hundreds) that trade through a single vehicle—the CEF. However, there are a variety of unique characteristics about CEFs that investors should be aware of—before they invest (as we will review in the following paragraphs). To help explain, let’s first have a look at important current data points for over 150 high-income CEFs.

150+ High-Income CEFs:

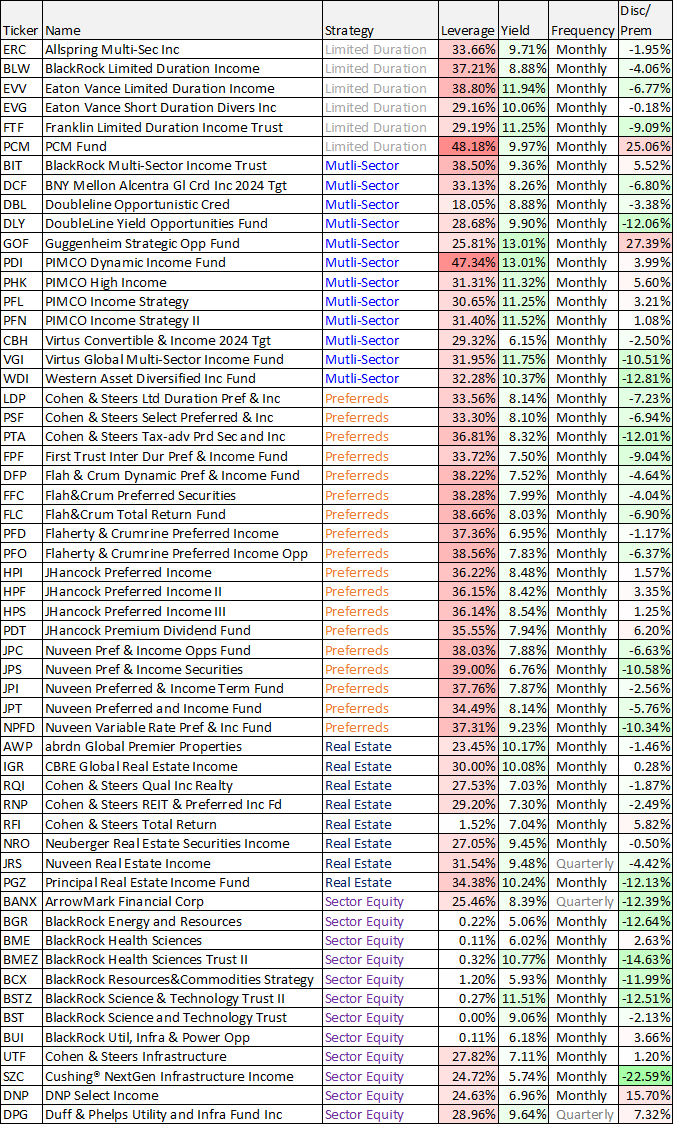

The following table contains current data on over 150 closed-end funds. The individual CEFs are sorted first by strategy and then alphabetically by name. You can see the big yields, use of leverage and big discounts-premiums versus net asset value (plus the frequency of distribution payments to investors: monthly, quarterly or annually).

You probably recognize at least a few of the CEF names in the table above. But before we get into specific names and opportunities, let’s first review more details on the mechanics of CEFs.

Discounts and Premiums to NAV

Perhaps the most important characteristic of a closed-end fund is that they are closed-end, which generally means they generally cannot create or eliminate new and existing shares. This is different than most mutual funds or ETFs, and it is important because it results in CEFs trading based largely on supply and demand instead of based on the underlying value of the things they hold (i.e. their NAV). This means, unlike most mutual funds and ETFs, CEFs often trade at wide premiums or discounts to their NAVs, and this creates unique risks and opportunities for investors.

Generally speaking, we greatly prefer to buy CEFs at a discount to NAV because it means we are gaining access to the underlying holdings at a discounted price. It’s like buying something on sale—and as long as what you are buying is quality—that can be a very good thing.

High Distribution Yields

The next important thing to understand about CEFs is that they often offer very high yields, but these yields aren’t based totally on the dividends (or income payments) of the underlying holdings. Rather, CEFs often pay out some of their capital gains as distributions, and this allows them to keep their yields high.

Paying out capital gains (in additions to dividends) as part of a CEF distribution can be a very good thing (because it provides steady income for income-focused investors), but it needs to be monitored. For example, the distribution can consistent of dividends, long-term capital gains, short-term capital gains and return of capital. All may have different tax consequences (which will be conveniently reported to you (at least annually) in form 19-a (here is an example). The one thing to pay attention to is “return of capital” because this is when a CEF is returning your own initial investment dollars as part of the distribution, and this can act to reduce your cost basis so you will have a bigger (potentially unexpected) taxable capital gain when you do sell your shares. Also, it’s good to see a fund paying distributions from its excess gains instead of just returning your own capital.

Leverage (Borrowed Money)

Leverage (or borrowed money) is another thing you have to watch for with CEFs. Prudent leverage can be acceptable, but just know if can increase returns in the good times but also increase losses in the bad times. For reference, equity CEFs generally don’t go much above 30% leverage for regulatory reasons and bond CEFs are generally limited to 50% leverage.

Expenses and Fees

It is important to note, unlike an individual stock or bond, CEFs charge management fees and other expenses. We generally like to avoid investments that charge high fees, and we’ll have more to say about specific fee levels when we review specific CEFs later in this report.

Top 7 High-Income CEFs

So with that backdrop in mind, let’s get into our countdown of 7 attractive high-income CEFs worth considering for investment, starting with #7 and counting down to our top ideas:

7. Nuveen Real Estate Fund (JRS), Yield: 9.5%

The objective of the Nuveen Real Estate Fund is high current income and capital appreciation. The Fund invests primarily in income-producing common stocks, preferred stocks, convertible preferred stocks and debt securities issued by real estate companies. To give you an idea, ~68% of the funds assets are invested in common stocks (such as REITs) and the top holdings (as of 7/31/2022) were:

Prologis Inc $33.18M, 7.93%

Equinix Inc $20.49M, 4.90%

Public Storage $16.78M, 4.01%

Equity Residential $16.29M, 3.89%

Simon Property Group Inc $16.15M, 3.86%

American Homes 4 Rent Class A $15.13M, 3.62%

Highwoods Properties, Inc. 8.63% $14.94M, 3.57%

AvalonBay Communities Inc $13.45M, 3.21%

Alexandria Real Estate Equities Inc $12.82M, 3.06%

Apartment Income REIT Corp $11.29M, 2.70%

Two big reasons to invest an a CEF in general, and to invest in JRS in particular, is if you like the assets it holds and you like the current price. Regarding JRS we like the assets. Specifically, we believe the real estate sector remains an attractive space—if you are investing in high quality real estate. And in the case of JRS, it is required to invest at least 75% of the its managed assets in securities rated investment grade (Baa/BBB or better by S&P, Moody's or Fitch), and as you may be able to recognize from the top 10 holdings list (above) JRS holds a lot of blue chip real estate stocks.

The second reason we like JRS is the price. Not only is the market (including REITs) down a lot this year (a “buy-low” opportunity based on the fact that we expect the real estate market to recover, eventually), but we also like that JRS trades at an attractive discount versus its current NAV (a 4.42% discount, per our earlier table above).

Furthermore, we are comfortable with the relatively higher leverage (this can work to eventually magnify returns) and Nuveen is a well-established and trusted company with adequate resources to support the strategy. Further, the 1.54% annual expense ratio is a little on the high side, but still tolerable considering the other attractive qualities of this fund. And if you are looking for an instantly-diversified way to play the real estate sector—that also offers a high distribution and a discounted price—JRS is absolutely worth considering.

6. Adams Diversified Equity Fund (ADX), Yield: 6.0%+

One of the biggest long-term mistakes some income-focused investors make is to concentrate their assets in only conservative sectors of the market and thereby missing out on some of the best long-term investment opportunities. The Adams Diversified Equity Fund can help investors solve this because it offers a big annual distribution yield of at least 6% and usually more, and it gives investors exposure to market sectors that don’t usually pay big dividends (ADX is diversified across market sectors, but also has large exposure to traditionally non-high-income sectors, such as technology and consumer discretionary, to name a couple).

ADX typically uses close to zero leverage (something a lot of investors prefer) and it has been paying its big distributions for over 80 years. Furthermore, it trades at a wide discount to NAV (currently ~14.1%) which means as an investor you are getting exposure to its underlying assets at a discounted price. And its management fee ( ~0.56%) is very reasonable. One thing to keep in mind about this CEF is that it pays three smaller distributions in calendar quarters one through three, followed by a bigger distribution in the fourth quarter (which is still coming up this year) to bring the aggregate annual yield to at least 6% (and usually more). If you are a long-term investor, that wants exposure to attractive market sectors at a discounted price and offering a big annual yield, the Adams Diversified Equity Fund is absolutely worth considering for a spot in your portfolio.

5. Royce Value Trust (RVT), Yield: 8.9%

4. Royce Micro-Cap Trust (RMT), Yield: 9.8%

We reviewing the Royce Value Trust and the Royce Micro-Cap Trust together, because they’re managed by the same company and offer somewhat similar strategies. We have invested in these two together in the past in our Income Equity Portfolio, and we are considering investing in them again (they’re high on our watchlist) because of their current attractiveness.

What we really like about these two funds (besides the attractive management team with a very successful long-term track record) is that small cap stocks are particularly compelling as a contrarian play right now and because they both trade at attractively discounted prices. We explained this is great detail in our recent members report here. If you are a long-term income-focused investor, both RMT and RVT are currently very attractive.

3. BlackRock Health Sciences II (BMEZ), Yield: 10.8%

We are adding the BlackRock Health Sciences Trust II to this list because of its unique healthcare-specific strategy, the strong management company (BlackRock), its very reasonable fees (1.3% expense ratio) and its significant price discount (~14.6%).

This is a relatively new fund (the inception date is 1/29/20) that has never reduced its distribution (which is paid monthly), and it has never sourced any part of its distribution from a return of capital (this is a good thing). Further, it uses no leverage or borrowed money. For reference, here is a look at the fund’s current top holdings:

Vertex Pharmaceuticals Inc $66.38M, 3.12%

Alcon Inc $51.45M, 2.42%

ResMed Inc $41.25M, 1.94%

Argenx SE ADR $39.52M, 1.86%

Daiichi Sankyo Co Ltd $37.00M, 1.74%

Waters Corp $36.40M, 1.71%

LHC Group Inc $36.39M, 1.71%

Quest Diagnostics Inc $34.68M, 1.63%

Alkermes PLC $34.65M, 1.63%

Sarepta Therapeutics Inc $34.45, M1.62%

Approximately 84% of this fund is invested in the healthcare sector, which can be an attractive defensive sector when the market is facing volatility (and potentially an economic slowdown), and approximately 74% of the holdings are in the US.

If you are looking for a defensive, large-distribution (paid monthly), well-managed sector-specific (healthcare) CEF, trading at an attractive discount to NAV, the BlackRock Health Sciences Fund II is absolutely worth considering for a spot in your income-focused portfolio.

2. Tekla Healthcare Opportunities (THQ), Yield: 6.9%

Sticking with the defensive healthcare sector strategy, the Tekla Healthcare Opportunities fund is arguable even more defensive considering its top holdings include a variety of steady pharmaceuticals companies (which are known for being relatively more consistent when the market declines because people don’t generally stop using their medicine—it’s often one of the last things to be cut from a budget). Here is a look at the top holdings of this fund, which includes many blue chip names you have likely heard of:

UnitedHealth Group Inc $100.02M,11.25%

Johnson & Johnson $64.18M, 7.22%

AbbVie Inc $48.10M, 5.41%

Abbott Laboratories $37.25M, 4.19%

Pfizer Inc $36.42M, 4.10%

Eli Lilly and Co $35.10M, 3.95%

Thermo Fisher Scientific Inc $32.30M, 3.63%

Merck & Co Inc $30.17M, 3.39%

Bristol-Myers Squibb Co $27.90M, 3.14%

THQ also trades at a wide discount to NAV (~8.52%). The fund does have a bit higher total expense ratio (recently 1.66%), but that is arguably more acceptable considering the fund does use leverage (recently ~20.2%).

*Honorable Mentions:

Sticking with our healthcare sector theme, investors may also want to consider investing in individual healthcare stocks (as an alternative to CEFs). For example, we currently like (and own) shares of both:

Baxter International (BAX), Yield: 2.0%

Medtronic (MDT), Yield: 3.0%

Both of these businesses are focused on medical devices (which can offer steadiness during economic turbulence), they both have a strong leadership position in their product areas of focus, and both have strong and growing histories of increasing their dividends. They are both highly rated holdings in our Income Equity Portfolio.

1. BlackRock Credit Allocation (BTZ), Yield: 9.6%

We’re adding BTZ at out top spot, and that may come as a bit of a surprise to some readers considering the shares are down significantly so far this year. The strategy is focused on investment grade bond investing, an asset class which has fallen hard as interest rates have continued to rise (as rates go up, bond prices go down).

However, the hard sell off has led to these shares also trading at a very wide discount to NAV (~8.9%), and we believe the Fed’s recent aggressive interest rate hikes (that have caused BTZ to decline) will slow thereby leading to a bit of a contrarian rebound in these shares.

Further, as an investment grade fund, managed by BackRock (a well established firm with lots of resources) and a low management fee (especially considering the fund’s prudent use of ~33.7% leverage) this fund is attractive. It gives you exposure to bonds that you cannot easily get on your own (because you are too small compared to BlackRock) and leverage (that would be more expensive and risky for you to manage on your own). In our view, BTZ is a steady income play, trading at an attractive discount to NAV, and the price declines will eventually stop as the market may already be pricing too many interest rate hikes in the near future). If you are looking for steady high income, with contrarian price appreciation potential, BTZ is absolutely worth considering for a spot in your portfolio

The Bottom Line

Income-focused investing has been a challenge as central banks kept interest rates artificially low for years. And now with interest rates finally rising, income-generating investments have been falling significantly in price because, for example, as interest rates rise—bond prices fall. However, there remain a variety of attractive high-income opportunities, particularly in the closed-end fund space, if you know where to look, and of course depending on your own individual needs and tolerance for volatility.

At the end of the day, it is critically important for you to choose an investment strategy that is right for you. Disciplined goal-focused investing is a winning strategy.

For reference, you can view all of the current holdings in our Income Equity Portfolio here.