Pure Storage provides high-capacity storage for data centers using software and hardware technologies that are extremely well rated by customers (Pure Storage has top 1% Net Promoter Score in the B2B industry). What’s more, the company is growing rapidly, and will continue to do so, as the digital revolution and migration to the cloud (data centers) are the biggest secular trends in the world today. We like the shares because they are positioned to benefit from many years of high growth and because they currently trade at an attractive price.

About Pure Storage

Pure delivers a modern data experience that helps customers put data to use and allows them to run their operations as a true, automated, storage as-a-service model seamlessly across multiple clouds. According to the company, the top 10 reasons customers purchase Pure Storage are:

Simplicity - Easy to buy, install and operate

Innovation – 8x leader in Gartner Magic Quadrant

Reliability - Six 9s of reliability

Leadership - 1st flash that costs less than hybrid disk arrays

Flexibility - Differentiated unified as-a-service offering

Trust - Top 1% of NPS of industry B2B scores

Enterprise Proven - Expanding in Global F500 & key verticals

Cloud Chosen - Trusted by the largest and most demanding

Green - Evergreen Storage = less waste

Fair - Transparency & pay as you go

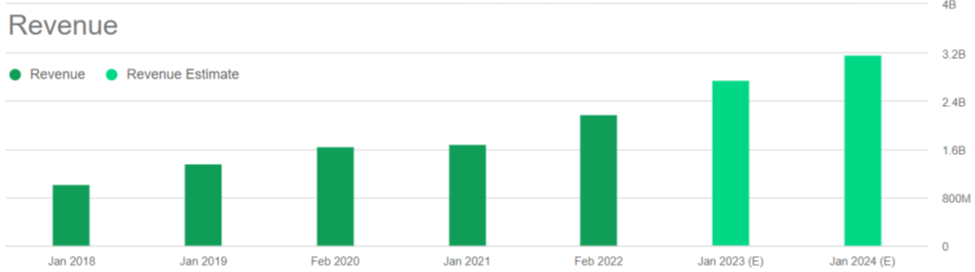

High Revenue Growth Trajectory

As mentioned, we like Pure’s high revenue growth trajectory as you can see in the following chart (and is the graphic above).

As a example of Pure’s legitimacy and attractiveness, it recently announced a partnership with Snowflake (SNOW) one of the biggest hottest most rapidly-growing big-data companies in the world.

Mountain View, Calif. and No-Headquarters/BOZEMAN, Mont. – May 11, 2022 — Pure Storage (NYSE: PSTG), the IT pioneer that delivers the world’s most advanced data storage technology and services, and Snowflake (NYSE: SNOW), the Data Cloud company, today announced a partnership to develop a solution that increases data accessibility for global customers with on-premises data.

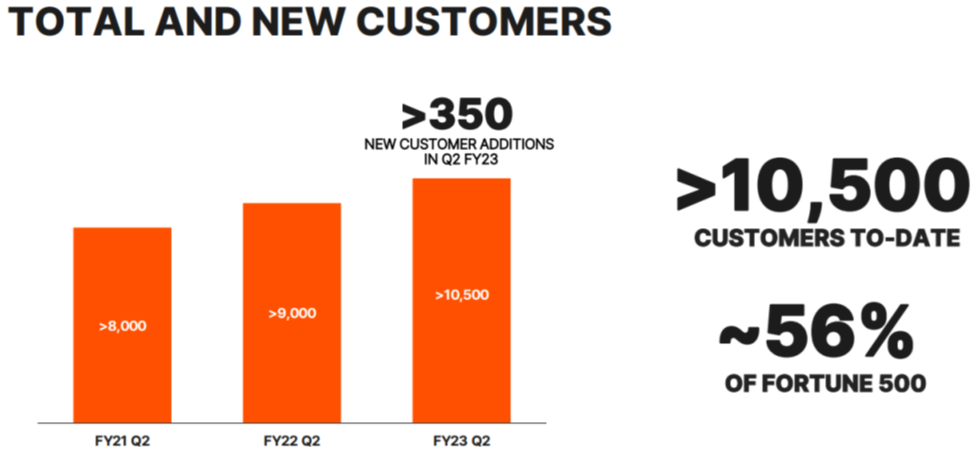

Also, Pure continues to grow its customer base significantly, a very good sign.

Profitability

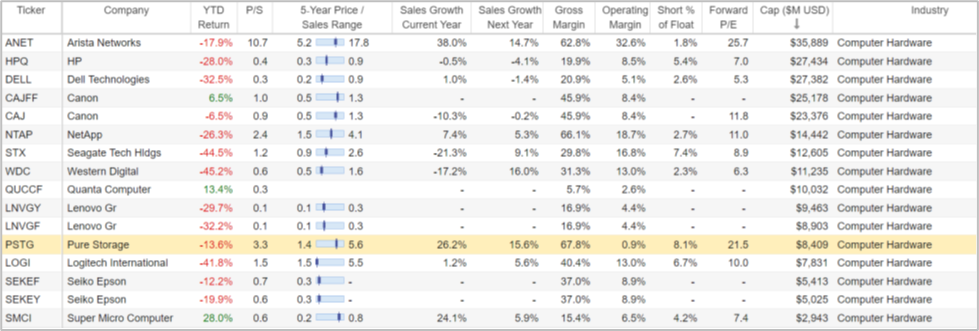

Pure Storage is not GAAP profitable. This is concerning to some investors, but less so if you understand the business model. Specifically, Pure Storage is focused on growing revenue as quickly as possible to capture valuable market shares and to maximize future profitability. For example, Pure Storage could be profitable today if it wanted to (its gross profit margin is 67.8% and its operating margin is 16.4%), but its net income margin (-0.57%) is still slightly negative as it spends heavily on growing the business.

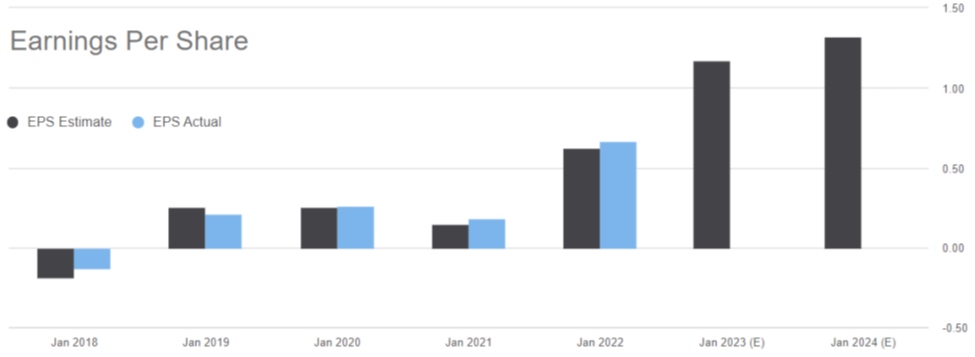

Pure Storage is profitable on a non-GAAP basis (unlike GAAP, non-GAAP figures do not include non-recurring or non-cash expenses).

And non-GAAP EPS has been moving in the right direction.

Also important, Pure’s free cash flow continues to grow, as you can see below.

Free cash flow is an ideal source to fund future growth. For example, it’s good to be free cash flow positive so you don’t necessarily have to go to the capital markets (through debt or equity issuances) to fund ongoing growth). Worth mentioning, Pure does have $757.8 million of debt on its balance sheet, a relatively conservative amount considering its high growth, healthy free cash flow and $1.36B of cash (and marketable securities) on its balance sheet.

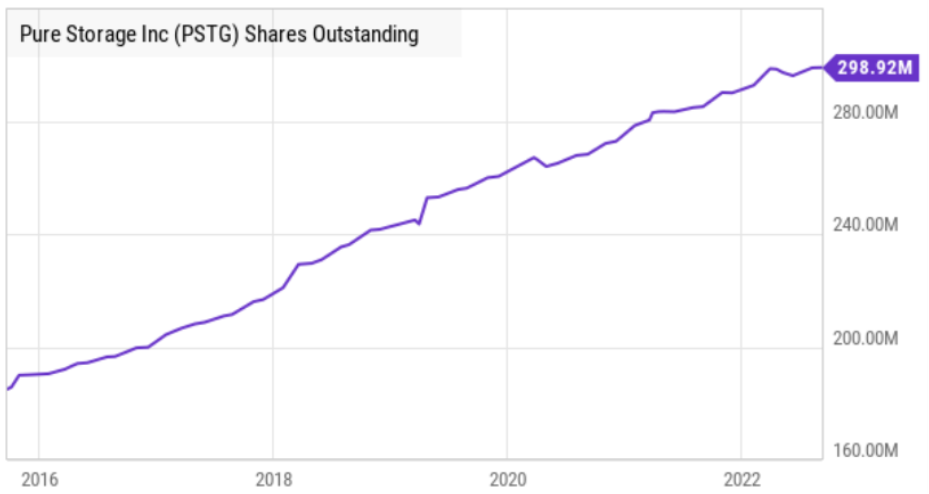

Shares Outstanding

Common for high-growth technology companies, but still dilutive to existing shareholders, Pure’s shares outstanding has continued to grow over the years, as you can see in the following chart.

And while the company did return approximately $61 million in Q2 to stockholders (by repurchasing 2.4 million shares), Pure’s stock-based compensation has been very significant. For example, according to macrotrends:

Pure Storage stock-based compensation for the quarter ending July 31, 2022 was $0.158B, a 20.01% increase year-over-year.

Pure Storage stock-based compensation for the twelve months ending July 31, 2022 was $0.727B, a 18.24% increase year-over-year.

Pure Storage annual stock-based compensation for 2022 was $0.287B, a 18.41% increase from 2021.

Pure Storage annual stock-based compensation for 2021 was $0.242B, a 6.9% increase from 2020.

Pure Storage annual stock-based compensation for 2020 was $0.227B, a 7.62% increase from 2019.

Valuation:

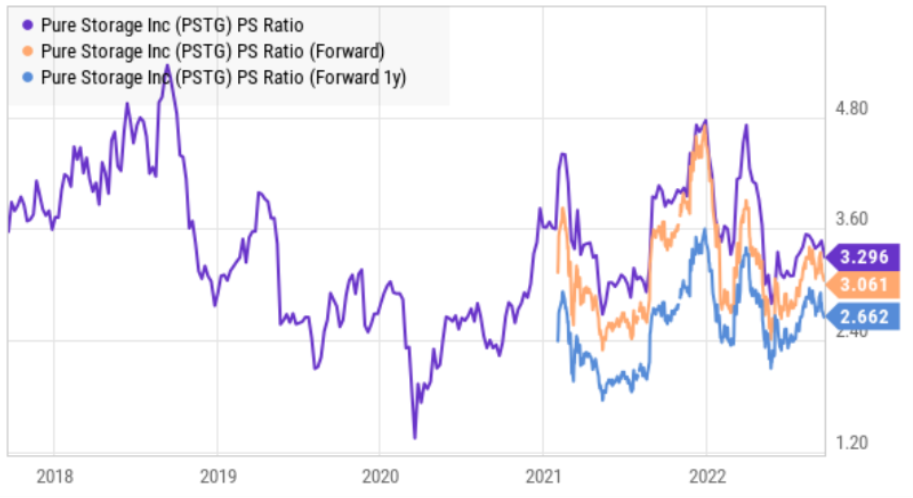

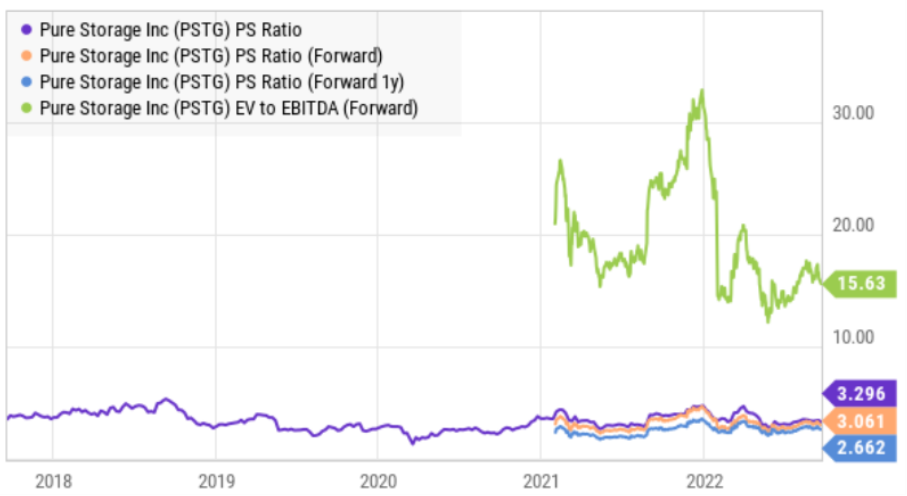

From a valuation standpoint, shares of Pure Storage are very inexpensive (at approximately 2.66x 1-year forward Sales), especially considering the very high margins, high growth rate and large total addressable market opportunity.

Further, the shares are also attractive at only 15.6x EV to EBITDA (forward).

For comparison purposes, most computer hardware companies (Pure’s industry) have either much lower growth or much higher valuation multiples. For example, the following table includes computer hardware companies sorted by market cap, and as you can see most companies cannot even come close to Pure’s high gross margins and truly impressive growth rates. Perhaps only Arista Networks (ANET) is in Pure’s league on these metrics, and Arista is priced dramatically higher on a p/s level.

The Bottom Line

Pure Storage is an attractive business and an attractive investment. The business will continue to grow rapidly as it is a leader benefiting from the cloud migration secular trend. And the shares have significant room for appreciation from both a multiple expansion and an earnings (and revenue) growth standpoint. To help summarize, we’ll leave you with a quote from Pure Storage CEO, Charlie Giancarlo, during the quarterly earnings call on August 31st:

“Overall, I remain confident in our ability to take market share and to grow faster than the market. As reported last quarter, our hiring remains strong. Our attrition rates are below the rest of our industry peers and are reduced from the highs experienced this past spring. As companies around the world adjust to a post-COVID normal, we believe that investment in critical data infrastructure will remain central to their growth plans and that the dedication of our talented technology, sales, customer success and other core teams will enable Pure to outperform the market.”

We do not currently own shares of Pure Storage, but we may add it to our Disciplined Growth Portfolio soon.