Futures are pointing to a lower market open today, as the S&P 500 is set to re-test the June low of 3,636. Having closed Friday at 3,693, and with pre-market futures trading around 3,688, technical analysts are left wondering if the market will take out the prior lows—and does that mean there is more pain ahead?

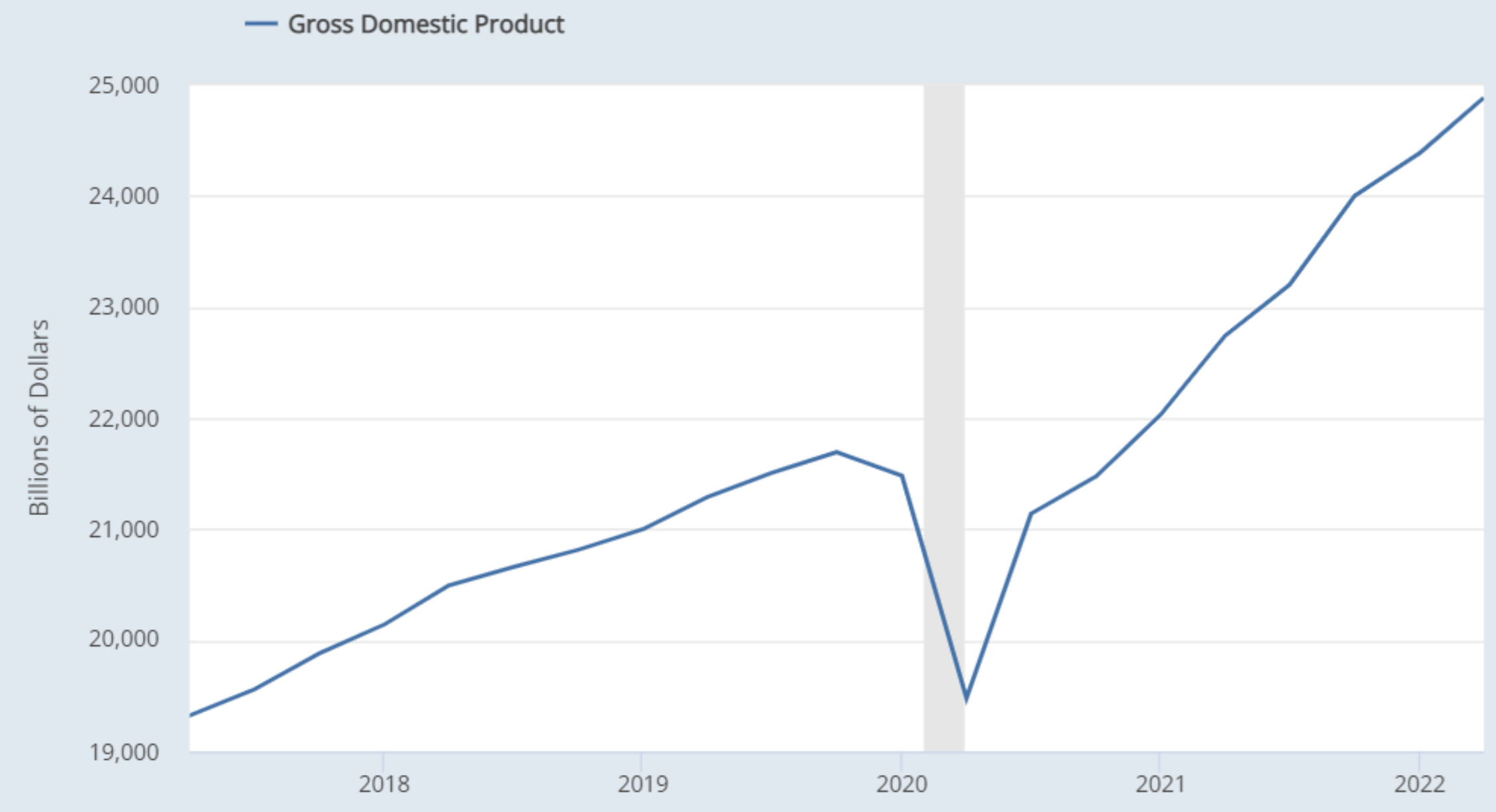

The reality is the economy continues to strengthen, as measured by gross domestic product (see chart below). For example, GDP is now dramatically higher than it was before the pandemic.

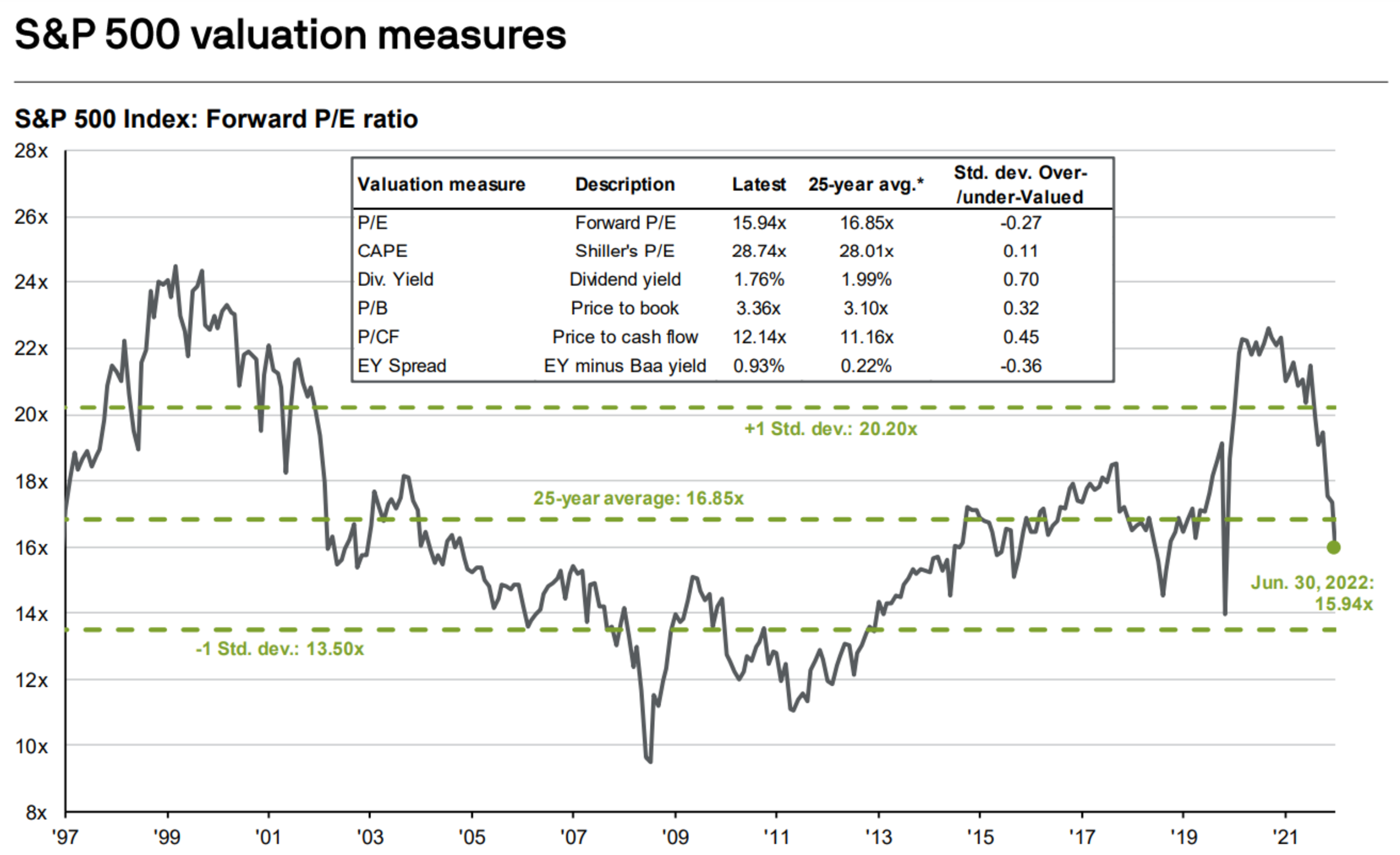

And market valuation metrics are now lower (a good thing) than they were prior to the pandemic and prior to the start of this year. For example, the following chart shows the S&P 500 forward P/E ratio below the 25-year average, back on June 30th, and the S&P 500 has now fallen even further since then.

The point is simply that despite all the “gloom and doom” and the pain of this year’s declines, the market and the economy are still relatively healthy and attractive. Things will get better.

And while some investors have fallen into the trap of attempting to buy and sell based on all the latest market headlines, the real money is made in the long term. Disciplined long-term investing has been a winning strategy throughout history and it will be this time too.

Long-term compound growth is the eighth wonder of the world.

We don’t know if the market will fall further in the short term, but in the long term it will follow the economy higher.

The Fed’s draconian rate cuts are likely already working in a major way, and as the economic data roles in in the months and quarters ahead—inflation will slow and the market will recover.

The bigger risk right now is NOT the threat of the market falling further in the days ahead. The bigger risk is that you panic—sell all your holdings—and miss out on the eventual recovery

We don’t know when the market will recover (no one does), but you don’t want to be sitting on the sidelines when it happens because by the time you get back into the market—you will likely have already missed the biggest and best returns.

While the market may fall further in the short term, now is not the time for long-term investors to sell. Rather, stick to your long-term strategy. Your future self will thank you.