The market is turning ugly again. Stocks are down as investors fear higher rates, and the fed remains petrified over inflation. However fear brings opportunity, especially as a few massive secular trends (such as digitization, the great cloud migration and Artificial Intelligence) remain fully intact. In this report, we share data on over 50 high-growth stocks (many of which are recently down big), and then briefly review the macroeconomic environment (including rates, monetary policy and secular trends). Finally, we rank our top 10 growth stocks, starting with #10 and counting down to our top ideas.

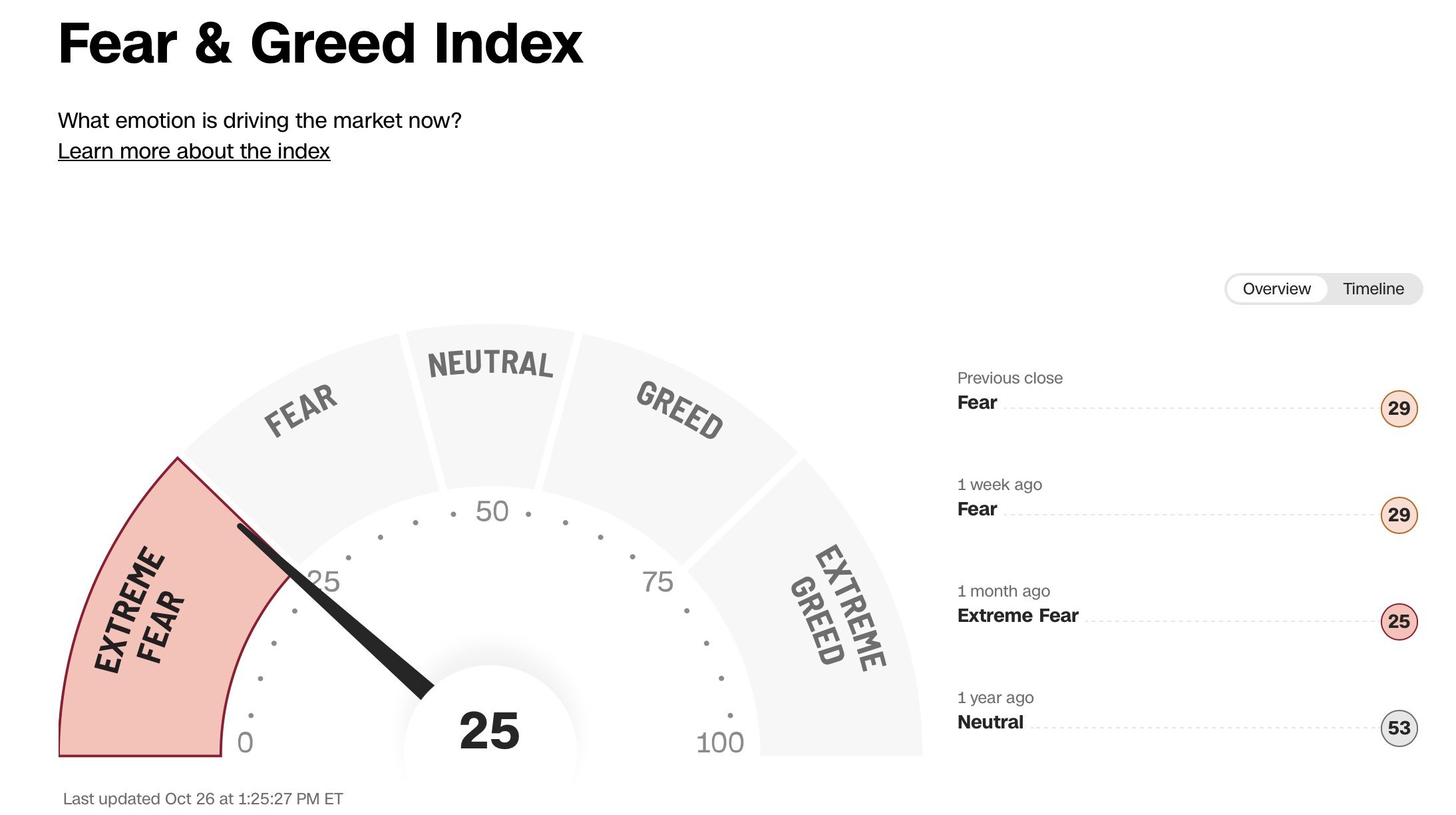

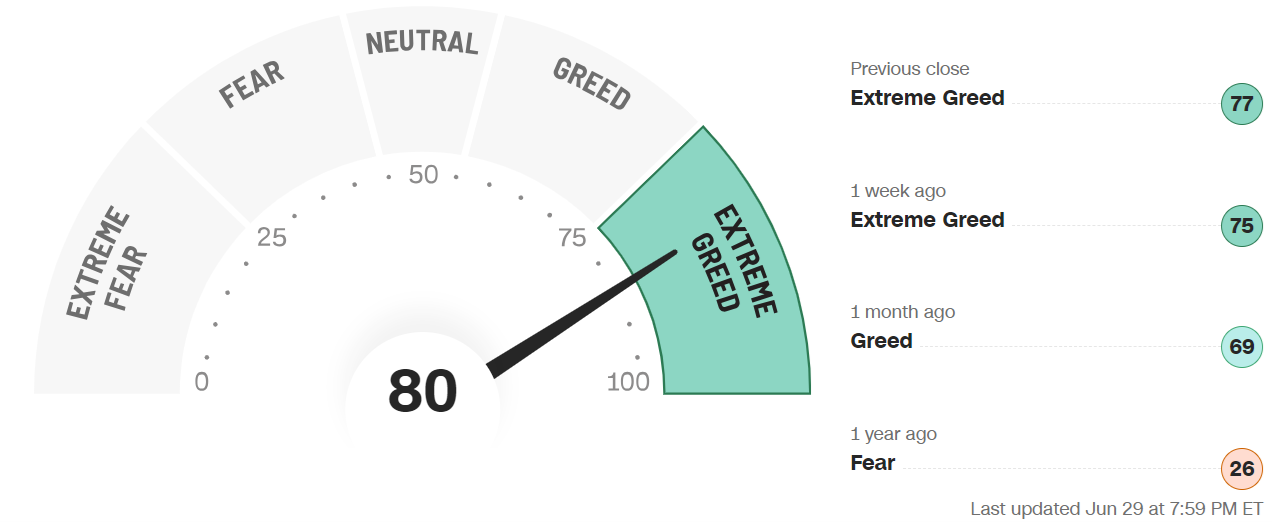

For reference, as you can see above, the current market “Fear and Greed Index” is showing “Extreme Fear.” And this is quite different than just four short months ago (on June 29th), when the index was showing “Extreme Greed.”

So what happened? Well, the index is based on a variety of factors (such as market momentum, volatility and stock price breadth), and they’ve all been trending south. And interest rates and monetary policy are a big part of the reason, as we will consider next.

Interest Rates and the Fed

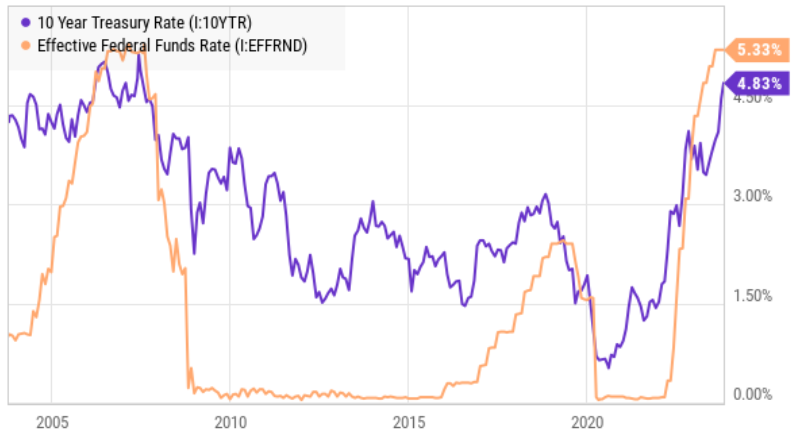

Here is a look at the current and historical yield on the 10-year US treasury bond, now essentially at its highest level in over two decades (we’ve also included the fed’s target federal funds rate).

And the problem with this increased yield, and increased interest rates in general, is that it slows the economy. Specifically, it makes it more expensive to borrow money to fund growth. And it makes it more expensive for companies that have already taken on debt (as bonds mature and refinancing occurs at higher rates). Further still, it causes some investors to shift assets from equity investments to bonds (because yields are now more attractive—even slightly positive after factoring in inflation).

Yet interestingly, this is exactly what the US fed is trying to do—slow the economy. Specifically, low rates (during the pandemic) fueled historically high growth rates, and historically high inflation. But now as growth is slowing, investors are left with the giant sucking sound of inflation. Fighting high inflation is why the fed has been hiking rates so rapidly.

A lot of unknown things are going to “break” now that rates are higher. For example, we saw a little mini banking crises earlier this year, as certain banks that focused on lending to aggressive-growth companies basically became insolvent. We’re also seeing the interest payments on US government debt rise (because interest rates are higher). Further still, we’re seeing a historically odd housing market, certain commercial real estate industries suffering (such as office properties, in particular) and more unforeseen challenges are likely on the horizon. More things will break as a result of higher interest rates.

50 Top Growth Stocks Just Pulled Back

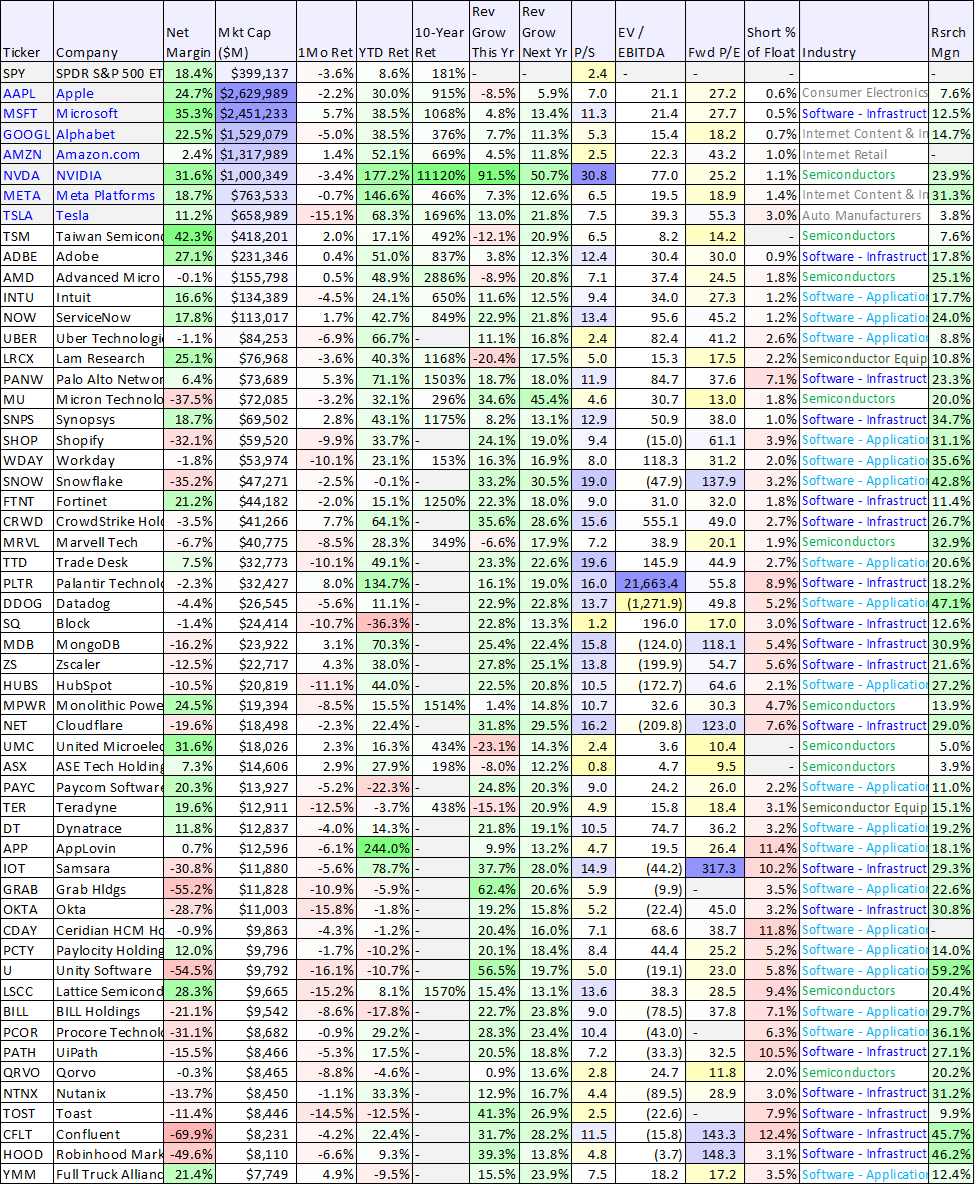

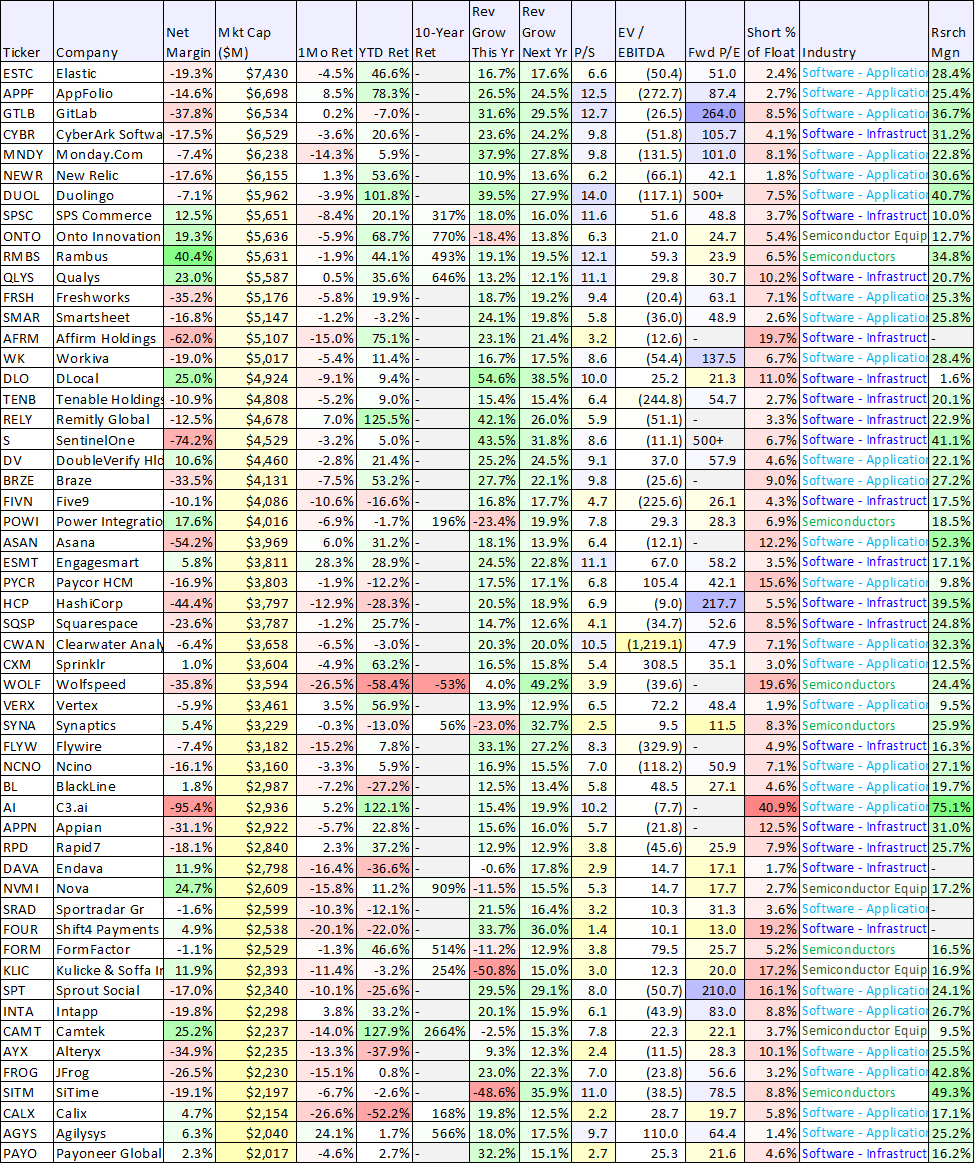

Also worth mentioning, the fed’s recent actions (and concerns for the overall economy) have caused a lot of top growth stocks to give back some of their gains from this year’s rebound. Specifically, a lot of top growth stocks have sold off over the last month (as you can see in the table below), thereby creating more attractive price entry points for long-term investors. For example, you likely recognize many of the top growth stock names in the table below.

data as of Friday’s close, Oct 27th. Source: StockRover.

data as of Friday’s close, Oct 27th. Source: StockRover.

The data in this table can be valuable, however it is also very important to consider the secular trends behind the high revenue growth rates (as we consider in the next few sections of this report).

Note: the data in the table above is from two industries (semiconductors and software) that benefit from “the great cloud migration” secular trend (plus it also includes the S&P 500 and the “Magnificent 7” large caps for reference).

The Great Cloud Migration (Secular Trend)

One thing that will likely not break for many years (and decades) to come is the great cloud migration secular trend, whereby enterprises are moving all of their data from onsite servers to the cloud (i.e. offsite servers) so it’s easier for data to be accessed from anywhere. Certainly some companies will come and go, but the business of digitization and cloud storage will continue, and companies that can harness it will thrive (we’ll give multiple specific company examples and top ideas later in this report).

Artificial Intelligence (Secular Trend)

Another related secular trend is artificial intelligence (“AI”). AI is rapidly growing as a direct result of the massive digital secular trend discussed above. Specifically, because there is so much more easily-accessible data now, Artificial Intelligence is being used to analyze it in ways that extract highly valuable information. For perspective, according to Google’s CEO, Sundar Pichai:

"AI will be the biggest technological shift we see in our lifetimes… It's bigger than the shift from desktop computing to mobile, and it may be bigger than the internet itself."

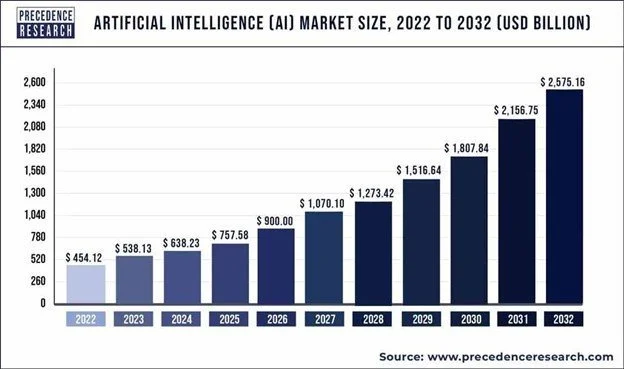

For more perspective, here is a look at one estimate of expected AI growth in the coming years.

Companies that can harness the power of AI stand to benefit dramatically in the years head, and we review a handful of specific top AI opportunities later in this report.

Secular Trend Naysayers

A lot of investors believe the AI secular trend is over-hyped. For example, many AI stocks have higher levels of short interest (i.e. investors betting against the shares). However, this naysayer mentality is very similar to when investors said smartphones would never gain much traction, for example.

Of course, the smartphone naysayers were very wrong, and companies that got ahead of the smartphone secular trend reaped huge rewards. For example, despite naysayers, Facebook (META) shifted its entire advertising efforts from desktop to mobile back in 2012, and the company ended up reaping huge rewards for taking this risk.

Similarly, back in the 1990’s, a lot of investors thought the internet would never turn into anything meaningful. Obviously, the naysayers were wrong, and companies that were able to get ahead of the internet secular trend (like Amazon (AMZN) and Google (GOOGL)) have reaped incredible rewards for taking the risks they did back then.

Of course, not all “internet” companies became great (a lot went bust with the tech bubble), which is why we consider only specific top secular trend beneficiaries throughout this report. In particular, we have a special focus on (and preference for) companies that have the financial wherewithal (or financial backing) to survive broader macroeconomic challenges (such as higher interest rates, as discussed earlier) as they ride the secular trend tailwinds (most of the internet companies that went bust after the dot-come bubble had no actual financial resources). And of course, we also like specific companies, with specific idiosyncratic advantages.

Secular Beta, Plus Select Idiosyncrasies

Having the right “beta” exposures to burgeoning secular trends (i.e. the cloud, AI and the whole digital revolution) has the potential to carry beneficiary companies dramatically higher over the years and decades ahead. However, some opportunities are better than others, both within the secular trends and outside of them. This is a major part of how we selected the stocks that made our top 10 list (i.e. leading beneficiaries of secular trends and/or specific idiosyncratic advantages).

Top 10 Growth Stocks

So with that backdrop in mind, let’s get into our top growth stock countdown, starting with an honorable mention.

*Palantir (PLTR): Honorable Mention

Palantir shares have been on fire this year (they’re up more than 140%), but still sit dramatically lower than their pandemic-era highs. Palantir is a big-data software company that is benefiting dramatically from the the burgeoning AI secular trend. And as per CEO Alex Karp (in his most recent shareholder letter from August):

“The scale of the opportunity in front of us has never been more significant.

We announced the release of our Artificial Intelligence Platform (AIP), which allows large language models to operate within the confines of the enterprise and on privately held data, less than three months ago.

The platform already has users across more than one hundred organizations, including some of the largest enterprises in the world from the healthcare, finance, automotive, and energy sectors…

…We have built the integration platform that they require, and the traction we are seeing, only months after its release, has been transformative for our company.”

Palantir’s share price has been contentious and volatile since first trading publicly in early 2020 (during the early onset of the pandemic bubble). The company has already proven naysayers wrong once with regards to successfully expanding from government clients to commercial clients, and now sits poised to prove them wrong again with regards to rapid expansion in AI.

From a fundamental standpoint, Palantir continues to add new clients at a rapid pace (they’re up to 421, representing 38% YoY growth), and forward revenue growth estimates remain near 20% (impressive!). Furthermore, the global AI market opportunity is very large (as explained earlier), and the company’s share price (and valuation) remain well below their pandemic highs. Further still, Palantir has achieved GAAP profitability in recent quarters, and may become eligible for S&P 500 inclusion.

We currently own shares of Palantir, and you can view our recent full write-up on the company here:

10. Enovix (ENVX)

This is the most speculative name in the top 10 (it currently has very little revenue and no profits), but potentially the most lucrative (considering it could disrupt an enormous market). Specifically, Enovix designs and manufactures advance lithium-ion batteries—a market that hasn’t changed much in many years, and is ripe for disruption (considering new cost-efficient technologies) and the massive demand for smart-device and Internet-of-Things batteries. Furthermore, the share price has recently declined (they trade near the bottom on their recent trading range) thereby making a purchase more compelling in some investors eyes. However, the long-term upside (if this company can continue to achieve wins) is enormous. We previously wrote Enovix up in detail, and you can access that full report here:

9. Rivian Automotive (RIVN):

You’re likely aware electric vehicle (“EV”) sales are on a high-growth trajectory. And you may also sense the growing popularity of Rivian trucks, SUVs and electric-delivery Vans (for example, Amazon has ordered 100,000 Rivian vans).

But did you also know the company has a strong balance sheet, expanding gross profit margins and it trades at an increasingly compelling share price (especially after the most recent convertible bond offering). We recently wrote up Rivian in great detail, and you can access that full report here:

*IonQ Inc (IONQ): *Honorable Mention

IonQ harnesses the power of atomic ions found in nature to develop quantum computing systems that are widely regarded as surpassing traditional computer technologies in both quality and scalability. Founded in 2015 and first trading publicly in late 2021, the company is relatively small, but growing rapidly and supported by very large long-term secular disruption opportunities.

We’re including IonQ as an “honorable mention” because we don’t yet own shares (as the technology’s uses are still nascent) however the upside is potentially enormous if this superior technology becomes more viable and catches on (which it appears on track to eventually do so). IonQ investors include Google Ventures and Amazon Web Services.

IonQ shares are increasingly tempting as the price has pulled back hard over the last month. You can read our full report on IonQ here:

8. Monolithic Power Systems (MPWR):

A lessor known beneficiary of the recent AI boom, Monolithic Power Systems designs semiconductor-based power electronics solutions for the computing and storage industry, as well as automotive, industrial, communications, and consumer markets. And from our standpoint, we like the company’s diversified, economically less-sensitive and growing business (especially as it benefits from large secular trends, including automotive and the cloud/AI). Further still, MPWR is a founder-led company with incredibly strong profit margins and cash flow generation (very attractive in uncertain economic times, especially with interest rates rising). We previously wrote up MPWR is great detail, and you can access that full report here:

*Lithium Americas (LAC): Honorable Mention

Lithium Americas explores for lithium deposits in North America. And of course lithium is so important because it’s used to make batteries for electric vehicles. To put that into perspective, here is a look at expected demand for lithium in the years ahead (i.e. it’s expected to grow significantly).

Interestingly, Lithium Americas just recently split off its South American operations (into Lithium Americas Argentina (LAAC)), so Lithium Americas is left basically with its Nevada-based Thacker Pass (an asset that is expected to ramp up production dramatically in the years ahead), plus some exploration properties in the US and Canada.

Most analysts expect there to be a shortage of lithium assets in the years ahead (which would drive up prices to the benefit of Lithium Americas). However, one recent outlier Wall Street analyst call for an oversupply of lithium recently caused a sell off across virtually all lithium stocks. We liked LAC before the sell off, and we like it even more now. We don’t currently own shares of Lithium Americas yet (because we own a different lithium stock, as you will see later in this report), but at some point in the not-so-different future we expect Lithium America shares to soar dramatically higher based on supply land demand, and considering LAC is basically the only pure-play North American lithium company). You can read our previous write-up on Lithium Americas here:

*Confluent (CFLT): Honorable Mention

We don’t yet own shares of Confluent (that’s why we’re including it only as an honorable mention), but the company is very interesting from a growth standpoint (that’s also why were including it as an honorable mention).

Confluent is on a mission to “set data in motion.” It provides a data platform which is designed to help businesses manage and process data in real-time from various sources. Traditional database technologies typically focus on storing and retrieving data that is at rest, meaning data that has been persisted to disk or stored in databases. In contrast, Confluent's platform is built around Apache Kafka, an open-source distributed streaming platform, which enables the processing of data in motion or data streams.

Confluent has plans to integrate its platform with popular AI systems, further expanding its product offerings and strengthening its position in the industry. In the following report (link below), we analyze Confluent’s business model, its market opportunity, financials, valuation, risks, and then conclude with our opinion on investing.

7. Nvidia (NVDA):

Perhaps the best-known beneficiary of the AI boom, Nvidia’s GPU chips are used in data centers that house massive amounts of artificial intelligence data and processing. For example, here is a look at Nvidia data center revenue growth versus the less technologically-advanced incumbent, Intel (INTC). The large spike in Q2 2023 shows just how rapidly AI demand has driven growth for Nvidia GPUs.

And perhaps even more impressively, despite the steep share price increase so far this year, Nvidia shares are actually now LESS expensive than 4 months ago on a simple P/E basis, as we wrote about here.

And what some investors fail to realize is just how massive the market opportunity is, considering the great cloud migration (whereby data everywhere is being digitized and stored in the cloud), now boosted by the increased amounts of data due to AI-advancements.

For grins, here is a podcast I did for a client back in 2020 when Nvidia shares had just recently doubled, and the host laughed at me for suggesting they were likely to double again over the next 2-3 years (I was right). What’s more, Nvidia still has a ton of long-term upside based simply on the fact that it is the leader in a space where demand is growing rapidly.

We currently own shares of Nvidia in our long-term Disciplined Growth Portfolio, and have no intention of selling.

Top Ideas Data:

data as of Friday’s close, Oct 27th.

6. Celsius Holdings (CELH)

Celsius (CELH) is an impressive grower and industry disruptor. The company is involved in the creation, promotion and distribution of functional beverages and liquid supplements (Celsius also provides a powdered version of its energy drink and protein bars too).

What is most impressive about Celsius is its rapid revenue growth and very large total addressable market (i.e. room for a lot more growth compared to industry incumbents, Monster (MSTR) and Red Bull. For a little perspective, in Q2 2023, Celsius’ total revenue increased 112% YoY to $326M. Celsius’ management attributes the accelerated growth to the successful integration into the Pepsi (PEP) distribution system. We recently wrote up Celsius in great detail, and you can access that report here.

5. Alphabet (GOOGL):

Google (formerly Alphabet) shares just took a small hit following the company’s latest earnings announcement whereby cloud revenue came in below expectations. To be clear, however, cloud revenue growth was absolutely massive, and still grew rapidly. And Google is one of the widest-moat companies in the world, with lots of ways to keep winning for a very long time.

For example, Google is a major beneficiary of AI, considering there are so many ways for the company to benefit from it (for example, the massive data Google receives from its users). Google competitor (in many regards) Microsoft CEO recently explained how hard it is to break into search, where Google dominates. And for more perspective, as we shared earlier, according to a recent blog post by Google CEO Sundar Pichai:

Over time, AI will be the biggest technological shift we see in our lifetimes. It’s bigger than the shift from desktop computing to mobile, and it may be bigger than the internet itself. It’s a fundamental rewiring of technology and an incredible accelerant of human ingenuity… Our search for answers will drive extraordinary technology progress over the next 25 years.

Google has been spending heavily on AI, a strategy we believe is wise considering the truly massive size of the opportunity and the importance of not getting left behind by the competition. The recent share price pullback provides some additional margin of safety for buyers. We’ve owned Google for years, and have zero intention of selling anytime soon.

*Snowflake (SNOW): Honorable Mention

Snowflake provides a cloud-based data platform, which enables customers to consolidate data into a single “source of truth” to drive meaningful business insights. To get into some detail, Snowflake’s “data lakes” and “data warehouses” are an innovative advantage, and Snowflake’s cloud partners include Amazon Web Services (AMZN), Google Cloud (GOOGL) and Microsoft Azure (MSFT).

Snowflake shares have pulled back over the last month (and currently sit dramatically below their pandemic-era highs), but the business remains healthy and growing. For example, Snowflake has a strong balance sheet (zero debt, plus nearly $4 billion in liquidity), impressive revenue growth and a truly massive secular trend (i.e. the cloud and AI).

We currently own shares of Snowflake, and you can read our previous note on the company here:

4. Super Micro Computer (SMCI):

Super Micro Computer is a big beneficiary of the dramatic increase in AI demand, and the shares have just recently pulled back a bit (while the secular trend remains intact).

More specifically, Super Micro Computer is a developer and manufacturer of high-performance servers and storage systems, and is benefitting dramatically from explosive secular growth in artificial intelligence (“AI”) and high-powered computing (including its special relationship with Nvidia). The total addressable market opportunity is enormous. We recently wrote this one up in detail (see link below), and the recent price pullback makes the shares hard to ignore. We currently own shares.

3. PureStorage (PSTG)

PureStorage is a lessor known beneficiary of the AI secular trend. After an impressive year-to-date rally, the shares have pulled back (like the rest of the market) and now trade a bit below recent highs. Nonetheless, the business continues to grow rapidly. PureStorage announced earnings on August 30th, whereby they easily beat expectations (for the second quarter in a row) and raised guidance based on demand related to AI.

To provide some detail, Pure Storage provides high-capacity storage for data centers using software & hardware technologies that are extremely well rated by customers. For example, it has won awards in AI and Cloud-Native Software (AIRI//S, Pure's next-gen AI-ready infrastructure, was recognized by AI Breakthrough Awards as the Best AI Solution for Big Data).

Per CEO Charles Giancarlo on the most recent quarterly call:

As we discussed last quarter, Generative AI and ChatGPT have brought artificial intelligence to the top of mind for all customers. And AI creates two sets of opportunities for Pure. First, we can supply products for AI training environments, such as the creation of large language models or LLMs short. And second, we can support enterprises to prepare their data architecture for AI inference, meaning the use of LLM's on their own data.

PureStorage is profitable, currently trading at only 4.1x sales (and 19.5x forward earnings) and has a long runway for high growth based on the AI secular trend. We currently own shares of PureStorage and you can read our previous notes and reports using the following link.

2. ServiceNow (NOW):

Service NOW reported impressive quarterly results at the end of October (beating on earnings expectations), and the business is ideally positioned to benefit from “the great cloud migration” and artificial intelligence

“ServiceNow's long-term trajectory is being supercharged by Generative AI.” That’s how CEO Bill McDermott put it on the previous earnings call, and we agree. This Software-as-a-Service (SaaS) business was already benefiting dramatically thanks to its leadership position in helping companies around the globe transform to meet the demands of the massive digital revolution megatrend. And the company is now perfectly positioned to accelerate its growth further through AI.

Broadly speaking, the ServiceNow platform digitizes and automates previously siloed data and processes from across organizations to make life easier for employees and customers. ServiceNow is the industry leader (as evidenced by its growing customers and the very high renewal rates on its subscription offerings). There are now more than 1 trillion workflows running through ServiceNow each year (and growing at 40% annually), and the data from these workflows makes the company an absolute gold mine for implementing value-add AI technologies.

And with revenues expected to grow at over 20% this year and next, plus a net profit margin at around 17.8%, this company is impressive. It currently trades at 14x sales and 44x earnings, which may seem expensive to some, but considering the massive secular trend market opportunity, and sticky customer base, these shares are worth owning. We are long ServiceNow (with no intention of selling), and you can view our previous report on the company here:

Three (3) Number Ones (a, b and c):

We are including three names at number one (parts a, b and c). Each of these three stocks has sold off very hard, as if the businesses are dying. However, each business is profitable, growing and now trades at an attractive price relative to value.

Investors are overly fearful and not recognizing the stocks are down in large part because of the market cycle (they’re economically sensitive “high beta” stocks that we believe will rebound hard). More specifically, fear has created attractive “buy low” investment opportunities in each business. We currently own all three stocks in our Blue Harbinger Disciplined Growth Portfolio, and have no intention of selling any time soon.

1 (c). Paylocity (PCTY)

Paylocity provides cloud-based human capital management and payroll software solutions. Revenues are growing at 20% per year (and this is especially impressive considering the company is very profitable with a 12% net margin), but still spending heavily on growth (the company’s research margin was recently 14%). Further, the shares are down 10% this year as investors fear how slower overall economic growth will impact this economically sensitive, higher-beta (1.5x) business.

Paylocity trades at 25x forward earnings and under 9x sales, both impressive for such a profitable company that continues to grow rapidly and has a large total addressable market opportunity.

For some background, Paylocity is a cloud-based Software-as-a-Service company that got its start in payroll for small businesses, but has expanded to more HR functions and continues to attract mid and larger companies too. Paylocity is special because of its sticky customer base (once a company sets up payroll, they tend to leave it in place).

Paylocity shares have been weak because the economic growth is slowing, but as the economy picks up again, Paylocity’s growth will continue to accelerate and the valuation can go much higher.

We have owned shares of Paylocity since 2015 when they were trading below $30 (they currently trade at ~$175, but have traded above $300 during the pandemic bubble). In our view, the business has significantly more growth in the years ahead, and the shares have significantly more upside ahead too. You can access our previous Paylocity reports here:

1 (b). Enphase (ENPH)

Enphase shares have been an absolute falling knife this year, and things just got worse following its latest earnings announcement. The company beat earnings estimates, but came in light on revenues, and market fear accelerated (the shares sold off hard).

Enphase is a leading manufacturer of semiconductor-based microinverters (used in solar energy panels), and the company is extremely sensitive to this latest economic cycle for a couple reasons.

First, it’s a high-beta stock (1.7x) to begin with, but its business is concentrated in California, and California has been hit particularly hard by the slowdown in growth (there are a lot of high-growth tech companies in the state thereby impacting the state’s economy). Further still, California reduced tax incentives on solar installations which compounded challenges for the company.

Nonetheless, Enphase remains profitable, revenue is growing and the business is supported by a long-term secular trend (i.e. alternative energy). Trading at only 15x forward earnings, 5x sales, and with a 20% net margin, Enphase is attractive.

Enphase is extremely hated by investors, and thereby presents a particularly compelling long-term contrarian opportunity. We currently own shares, and you can read our previous report on the company here.

1 (a). Albemarle (ALB)

Albemarle is a mining company, and its main focus is lithium. As mentioned earlier, lithium demand is expected to dramatically increase in the years ahead due to demand for lithium batteries for electric vehicles.

However, Albemarle shares have sold off hard recently following a Wall Street Analyst’s forecast for an oversupply of lithium (he is an outlier, most analysts believe lithium will remain in short supply relative to demand). Further, Albemarle recently chose to walk away from its Liontown mine acquisition in Australia which put pressure on the shares. Albemarle now trades ~60% below its 52-week high.

Despite the selling pressure, Albemarle’s business is healthy and growing. For example, it has a high net profit margin, a high revenue growth rate, and it has even raised its dividend (which is well covered) for 28 consecutive years. It trades at only 6.3x forward earnings and 5.1x EV/EBITDA.

We believe fear has created opportunity, and Albemarle now presents a particularly attractive contrarian opportunity (we expect the share price can double over the next 2-3 years). We currently own shares of Albemarle and you can read our recent report on Albemarle here.

The Bottom Line:

Our bottom line for this report is that fear creates opportunity. We believe all of the names included in this report have attractive long-term upside potential, and they are currently trading at lower prices because the market is fearful. There is no guarantee that the market won’t go lower (it most certainly might), but over the long-term we believe the market will go higher and the stocks ranked in this report are likely to go significantly higher still.

Stock market returns are lumpy, and sadly many investors get fearful and emotional, thereby causing them to miss out on the best long-term returns. Long-term compound growth is the eighth wonder of the world (nearsighted investors often don’t properly conceptualize just how powerful it can be in terms of building wealth). We believe in disciplined, goal-focused, long-term investing, and you can view all of our current portfolio holdings and weights here.