As inflation slows, the fed gets less hawkish and the market builds momentum heading into 2024, the shares of some high growth stocks remain depressed despite the fact that business is accelerating rapidly. The specialty chemicals company we review in this report has a healthy “energy industrials” business (servicing oil producers, refiners and the like), but it is the company’s tie in to electric vehicles (thermal barriers used in battery packs) that make the disruptive upside potential most compelling (for example, the shares have nearly 90% upside compared to the consensus Wall Street price target, and they’re rated “strong buy”). In this report, we review the business, the growth potential, the valuation and the risks, and then conclude with our strong opinion on investing.

Aspen Aerogels (ASPN):

Based out of Northborough, MA, Aspen Aerogels is a small ($777 million market cap) specialty chemicals company that optimizes the performance and safety of electric vehicles and energy infrastructure assets through its proprietary Aerogel Technology Platform. As a high level explanation:

“Aerogels are a class of synthetic porous ultralight material derived from a gel, in which the liquid component for the gel has been replaced with a gas, without significant collapse of the gel structure. The result is a solid with extremely low density and extremely low thermal conductivity.”

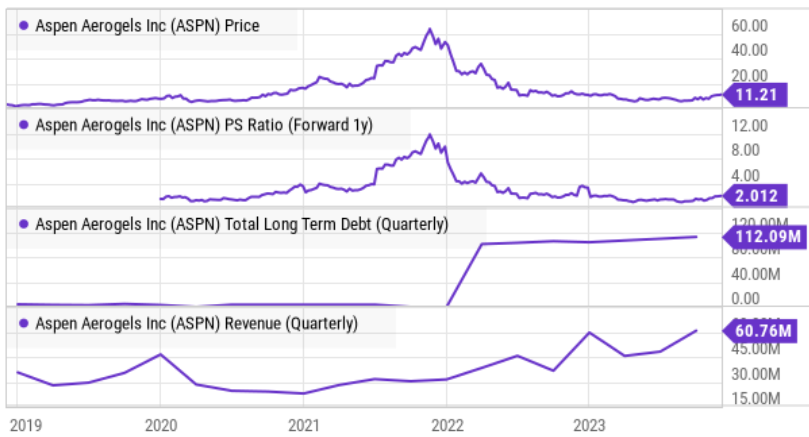

Aerogel technology has been around for many decades, but it became more commercially viable in the early 2000’s, around the time when Aspen Aerogels spun off (as a tiny startup) from Aspen Systems. Aspen Aerogels went public in 2014, the shares had an amazing run up during the pandemic bubble, only to collapse in 2022, and the company is just now regaining significant momentum.

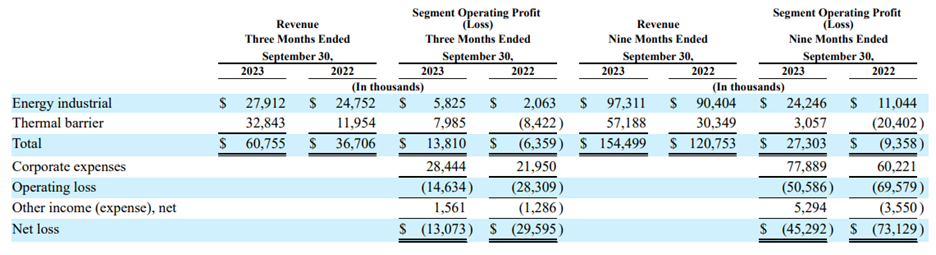

Aspen Aerogels divides its business into two segments, Energy Industrial and Thermal Barrier. And it is the Thermal Barrier segment (the segment with the tie in to electric vehicle batteries) that is gaining significant momentum.

In its most recent annual shareholder letter, the company describes the two segments as follows:

Energy Industrial: We design, develop and manufacture innovative, high-performance aerogel insulation used primarily in the energy industrial and sustainable insulation materials markets. We believe our aerogel blankets deliver the best thermal performance of any widely used insulation product available on the market today and provide a combination of performance attributes unmatched by traditional insulation materials. Our end-user customers select our products where thermal performance is critical and to save money, improve resource efficiency, enhance sustainability, preserve operating assets and protect workers. Our insulation is used by oil producers and the owners and operators of refineries, petrochemical plants, liquefied natural gas facilities, power generating assets and other energy industrial. Our Pyrogel and Cryogel product lines have undergone rigorous technical validation by industry leading end-users and achieved significant market adoption. Our Spaceloft sustainable insulation materials are increasingly used by building owners to improve the energy efficiency and to enhance fire protection in buildings ranging from historic brownstones to modern high rises.

We also derive revenue from a number of other end markets. Customers in these markets use our products for applications as diverse as military and commercial aircraft, trains, buses, appliances, apparel, footwear and outdoor gear. As we continue to enhance our Aerogel Technology Platform, we believe we will have additional opportunities to address high-value applications in the global insulation market, the electric vehicle market and in a number of new, high-value markets, including hydrogen energy, filtration, water purification, and gas sorption.

We market and sell our products primarily through a sales force based in North America, Europe and Asia. The efforts of our sales force are supported by a small number of sales consultants with extensive knowledge of a particular market or region. Our sales force is responsible for establishing and maintaining customer and partner relationships, delivering highly technical information and ensuring high-quality customer service.

Our salespeople work directly with end-user customers and engineering firms to promote the qualification, specification and acceptance of our aerogel and thermal barrier products. We also rely on an existing and well-established channel of qualified insulation distributors and contractors in more than 50 countries around the world to ensure rapid delivery of our aerogel products and strong end-user support.

Thermal Barrier: We are also actively developing a number of promising aerogel products and technologies for the electric vehicle market. We have developed and are commercializing our proprietary line of PyroThin aerogel thermal barriers for use in battery packs in electric vehicles. Our PyroThin product is an ultra-thin, lightweight and flexible thermal barrier designed with other functional layers to impede the propagation of thermal runaway across multiple lithium-ion battery system architectures. Our thermal barrier technology is designed to offer a unique combination of thermal management, mechanical performance and fire protection properties. These properties enable electric vehicle manufacturers to achieve critical battery performance and safety goals. In addition, we are seeking to leverage our patented carbon aerogel technology to develop industry-leading battery materials for use in lithium-ion battery cells. These battery materials have the potential to increase the energy density of the battery cells, thus enabling an increase in the driving range of electric vehicles.

The commercial potential for our PyroThin thermal barriers and our carbon aerogel battery materials in the electric vehicle market is significant. Accordingly, we are hiring additional personnel, incurring additional operating expenses, incurring significant capital expenditures to expand aerogel manufacturing capacity, establishing an automated thermal barrier fabrication operation, enhancing research and development resources and expanding our battery material research facilities, among other items.

We have entered into production contracts with certain major OEMs, including General Motors LLC ("General Motors"), to supply fabricated, multi-part thermal barriers for use in the battery system of its next-generation electric vehicles. Pursuant to the contracts with General Motors, we are obligated to supply the barriers at fixed annual prices and at volumes to be specified by the customer up to a daily maximum quantity through the term of the agreements, which expire at various times from 2026 through 2034. While General Motors has agreed to purchase its requirement for the barriers from us at locations to be designated from time to time, it has no obligation to purchase any minimum quantity of barriers under the contracts. In addition, General Motors may terminate the contracts any time and for any or no reason. All other terms of the contracts are generally consistent with General Motors's standard purchase terms, including quality and warranty provisions customary in the automotive industry.

Growth Potential

Revenue from Aspen Aerogel’s Thermal Barrier (electric vehicle) segment is just now starting to exceed that of the Energy Industrial segment (see revenue table, earlier), and the company just raised its forward guidance in the most recent quarterly earnings call (a good thing), in part related to new business awards from Scania and Audi.

Aspen believes it is on track to have business awards from six original equipment manufacturers (OEM’s) by year end (this is a big deal because it drives revenue growth). Here’s what CEO Don Young had to say about it on the most recent earnings call:

In Q3, it’s no surprise that the lion’s share of our 26% quarter-over-quarter revenue ramp was driven by 160% increase in demand for PyroThin EV thermal barriers for General Motors Ultium platform vehicles. GM has more than doubled its production run rates for Ultium powered vehicles from Q2 into Q3, and barring any interruptions we expect this ramp to continue. This ramp in demand from General Motors drives a revenue guidance range to above $225 million for 2023.

For a little more perspective, here is a look at the major GM name plates set to scale:

However, the long term upside potential is also an important part of the story. For example, according to Allied Market Research:

“The global aerogel market was valued at $1.3 billion in 2022, and is projected to reach $7.5 billion by 2032, growing at a CAGR of 19.4% from 2023 to 2032.”

Also noteworthy:

“The aerogel market is highly fragmented, with several players including Active Aerogels, Aerogel Technologies, LLC., Armacell, Aspen Aerogels, Inc., BASF SE, Cabot Corporation, Dow, Guangdong Alison Hi-Tech Co., Ltd., Svenska Aerogel AB and Thermablok Aerogels Limited.”

And according to CEO Don Young on the latest earnings call:

“We maintain our full longer term upside potential as we continue to win design awards from EV OEMs to expand our profitable base load of energy industrial revenue and to leverage our aerogel technology platform into additional high value markets, including our ongoing work in battery materials.”

Valuation:

From a valuation standpoint, Aspen is not profitable (net margin is negative as it continues to work to scale in capturing the EV opportunity). However, it does have positive (and improving) gross margins. In particular, gross profit margins during the most recent quarter were 21% and 24% for the Energy Industrial and EV thermal barrier segments, respectively. And the company expects gross margins to reach 35%, as the business continues to grow.

Noteworthy, major investors in Aspen Aerogels include General Motors and Koch Industries. According to last year’s shareholders letter, the company:

“Secured substantial financing to fund our second aerogel manufacturing facility in Statesboro, Georgia (Plant II). In February 2022, Koch Industries made a second investment in Aspen of $150 million, through the purchase of convertible notes and common stock. In November 2022, we concluded an offering of approximately $263 million in equity proceeds, which included an additional $100 million investment from Koch. At the same time, General Motors provided a secured term loan of $100 million, adding another dimension to our longstanding technical and commercial relationship.”

This is important because on a go-forward basis, the company aspires to protect shareholders from dilution. According to the latest quarterly call:

“The key point is that we are seeking to avoid unnecessary dilution for our shareholders by optimizing the use of our existing assets and opportunities to create a dynamic and cash generating business.”

Additionally:

Given the challenging capital environment, we are working to avoid unnecessary dilution for our shareholders by seeking to operate from a position of operational and financial strength, and potentially by partnering with the DOE Loan Programs Office, with whom we remain in close contact regarding our Advanced Technology Vehicle Manufacturing loan application. We believe a more measured ramp in OEM EV production may enable us to have a capital efficient growth path utilizing our current assets that leads to profitability in the near-term and without sacrificing our full growth opportunities in the longer-term.

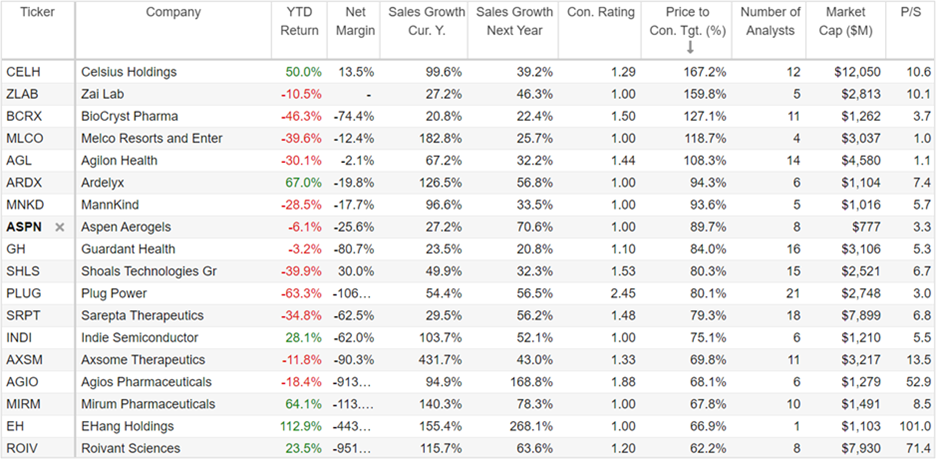

On a price-to-sales basis, Aspen Aerogels trades at around 3.3x, which is reasonable. Remember, this isn’t some asset-light SaaS company (they often trade above 10x and have +75% gross margins). But considering the growth trajectory and market opportunity, Aspen is attractively priced.

For example, among the eight Wall Street analysts covering the shares, the average rating is “strong buy,” and the consensus price target suggests the shares have nearly 90% upside from here.

Risks:

Small Cap: Of course, Aspen Aerogels faces a lot of risks. For starters, it’s very much a small cap (market cap below $1 billion), and small caps can be a lot more volatile than large caps. Furthermore, considering it lacks net profitability and the industry is nascent, investors should expect a lot more price volatility for these shares versus a more traditional blue chip large cap company. As such, we recommend potential investors consider investing with a relatively small allocation of their total portfolio if they are considering investing in this company, or in individual small cap stocks in general.

Operational Risks and EV Hype: Another risk is that the company may attempt to scale too fast or too slow relative to growing demand from the electric vehicle industry. For example, here is what CEO Don Young had to say on the quarterly call:

“A third key element of our strategy is the balancing of growth, scale, and profitability, which includes the right timing of Plant 2 in Georgia. Our focus prior to the restart of full construction of Plant 2 is to utilize our existing assets, supply arrangements and current commercial opportunities to build a business that has the potential to produce annually approximately $550 million of revenue, approximately $200 million of gross profit, and approximately $140 million of EBITDA.”

Input Costs: Another risk is the price of materials costs and inflation in general. For example, as per Don Young:

“I think the other factor at play here is certainly costs of both ours and those of our competitors which are going up, driven by increasing environmental and regulatory factors. And in order to support our customers in a sustainable way, we need to earn a fair return on these investments and higher operating costs. And so in order to do that, additional pricing is necessary. And this is certainly an industry wide issue, and our customers care about this because they too value our commitment to sustainability. And I think it's important to their own value proposition to their customers in terms of promoting more sustainable products.”

Conclusion:

Aspen is an attractive disruptive growth business, trading at an attractive price and valuation, and it is starting to regain lost momentum following the collapse of the pandemic bubble. Wall Street Analysts have very high expectations (they rate it a “strong buy” and expect ~90% upside), and we agree the potential for large gains exists. However, this is a very risky stock, as explained (i.e. it’s a small cap with plenty of operational risks). We do not currently have a position in these shares, but we are considering adding a small amount to our Disciplined Growth Portfolio in the relatively near future (i.e. before year end). Stay tuned.