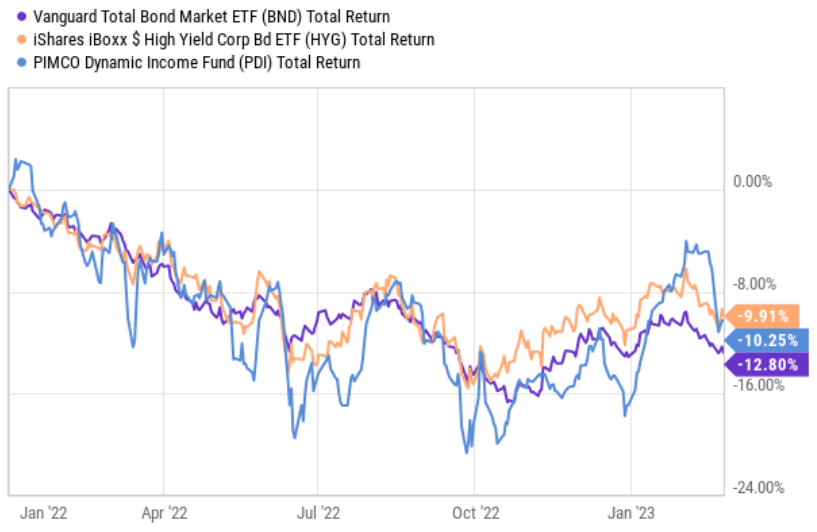

Bonds have been a disaster for many investors over the last year. As interest rates have risen, bond prices have fallen, and “safe” bond funds have delivered very negative returns (such as (BND) (HYG) and (PDI), to name a few, see chart below). In this report, we review a bond ETF that pays monthly, offers a 6.1% yield and avoids all the interest rate risk (i.e. if you hold it until maturity in December, your annualized yield to maturity will be 6.1%). We review all the important details and then conclude with our strong opinion on who should consider investing.

BulletShares 2023 High Yield Corp Bond ETF (BSJN), Yield-to-Maturity: 6.1%

A lot of investors like the idea of investing in “bond funds” because they provide instant diversification benefits (i.e. they hold a lot of individual bonds). However, the problem is that unlike individual bonds, bond funds generally have no maturity date. Therefore, when interest rates rise (like they have been) the value of bond funds fall (like they have been). With individual bonds, you can simply hold them until maturity and you will receive the stated yield-to-maturity (as long as they don’t default), whereas with most bond funds there is no escaping the value reducing impact of rising interest rates (i.e. the higher the duration, the bigger the losses).

BulletShares bond funds are different because they have a stated maturity date. For example, BulletShares 2023 High Yield Corporate Bond ETF (which invests passively in high yield corporate bonds) will mature on (or very close to) December 15th of this year (at which time it will be liquidated and investors will get paid in full). This can be extremely appealing because you will have totally avoided the risks of interest rate increases by simply holding this bond ETF to maturity. Specifically, you will have received the full yield-to-maturity of 6.1% through BSJN’s monthly interest payments plus the return of your own capital at maturity.

Generally speaking, all of the underlying bond holdings within this ETF are set to mature (or be called) before December 15th (i.e. the fund’s maturity date). For example, here is a look at the fund’s top 10 holdings.

Also important to note, this ETF has an expense ratio of 0.42% per year (this amount will detract from your net returns).

Yield to Maturity:

Important to note, yield to maturity (or YTM) is different than current yield. YTM is your annualized yield including all interest payments plus any appreciation in the value of the bonds (i.e. bonds typically mature at $1,000 each, but can trade above or below the price based on market conditions). In the case of BSJN, the current yield (which is the most recent monthly interest payment annualized then divided by the current ETF price of $23.47) is 4.6%. But because the underlying bonds in this fund pay on different dates, the monthly interest payments vary from around $0.06 in February to $0.12 in December. This ETF price will bounce around a bit, but as long as you hold until maturity (and the bonds don’t default) you receive the full YTM (i.e. a 6.1% return on your investment).

High-Yield Bonds

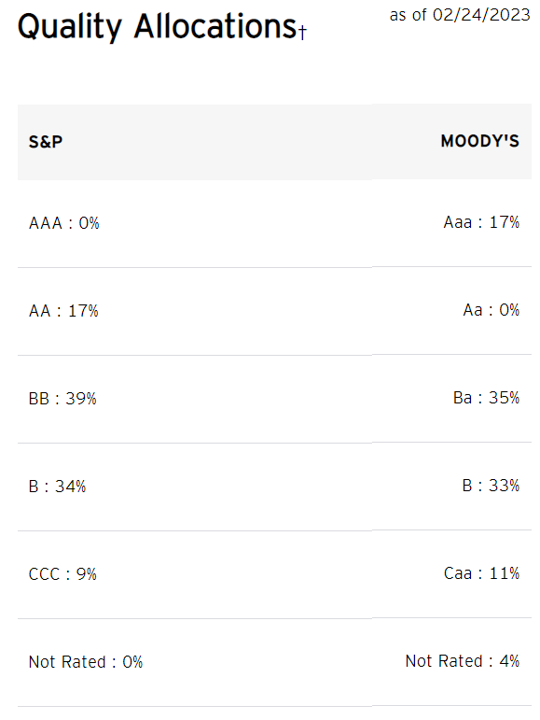

BSJN is focused on high yield bonds, which are considered riskier than investment grade bonds. Historically speaking, around 3.8% of all US high yield bonds default in a year. And for 2023, Fitch Ratings recently predicted around 2.5% to 3.5% will default. So if 3.0% of this fund defaults in 2023 (and goes to $0.00, which is unlikely, bondholders usually get cents on the dollar) then this fund’s yield would be reduced by 3.0% from 6.1% to 5.9%. And 5.9% is still a very good 1-year annualized yield-to-maturity. Realistically, this fund will likely have less than a 3.0% default rate considering the actual credit quality of the underlying holdings, as you can see in the charts below. For example, 16.88% of the fund is in US Government Securities (very safe) and a lot of the holding are rated “investment grade” (i.e. better than high yield).

It is extremely likely that the default rate on bonds in this fund will be significantly lower than the high-yield market in general, especially as we approach the fund’s December maturity date.

Tax Considerations:

We generally recommend holding this type of ETF in a non-taxable account (such as an IRA) so you can avoid any tax inefficiencies created by this fund. For example, since this ETF’s inception date in 2015, nearly all of the monthly “dividend” payments have been sourced from interest on the underlying holdings (and taxed as ordinary income); however in December of every year so far, a small portion of the dividend has been sourced from capital gains (sometimes long-term, sometimes short-term) and/or a tiny return of capital. These can cause different tax consequences if you hold this ETF in a taxable account. Additionally, this fund does occasionally trade its positions which can increase unpredictable tax consequences from realized gains and and losses.

Overall, BulletShares ETFs (including this fund) are fairly efficient at delivering tax consequences as would be expected, however it’s not quite as good as if you bought all the individual bonds on your own and held them to maturity, and we generally recommend owning BSJN in non-taxable accounts when possible.

Conclusions:

If you are looking for to earn a 6.1% annualized rate of return on your money between now and December, this BulletShares 2023 High-Yield Corporate Bond ETF (BSJN) is a decent option because it eliminates the interest rate risk (as long as you hold to maturity, you will earn the 6.1% yield to maturity) and it pays interest monthly. And if you are willing to go out a little further, the BulletShares 2024 High-Yield Corporate Bond ETF (BSJO) offers an even higher yield to maturity of 7.4%. Also, we’d be remiss not to mention the yield on 6-month and 1-year US treasuries are currently 4.9% and 5.0%, respectively (very decent rates if you hold them to maturity considering they are 100% guaranteed by the US government), considerably higher than they were just one year ago (see chart below).

Our bottom line is simply that as interest rates rise, most bond funds face significant duration risk (as interest rates rise, bond prices fall). However, by holding individual bonds until they mature you can avoid the interest rate risk and earn the full yield to maturity (as long as they don’t default). We view BulletShares bond ETFs as a decent way to get instant diversification, earn higher yields and avoid the interest rate risk (as long as you hold to maturity). In fact, BulletShares Bond ETFs can be a good complement to other bond funds (with no maturity dates) within a prudently-diversified income-focused investment portfolio. We currently have no position in BulletShares, but they are high on our watchlist and we may initiate a position in the relatively near future.