Business Development Companies (“BDCs”) are like banks, only riskier. And some BDCs are heavily concentrated in the venture capital (“VC”) space, just like Silicon Valley Bank (SIVB) that just shuttered its doors as the result of a VC-led bank run. In this report, we review Ares Capital (including its investment industry exposures and risks) and then compare it to 40 other BDCs, including four in particular that are heavily concentrated in the VC space. We conclude with our strong opinion about investing in BDCs, Ares Capital and VC-focused BDCs in particular.

BDC Overview:

BDCs provide financing (mostly loans) to smaller (middle market sized) businesses. More specifically, they generally provide the types of loans that are too small, too unique and/or too risky for traditional banks (especially following the more stringent bank lending requirements following the Great Financial Crisis of 2008-2009). As such, BDCs generally pay large dividends (they are mostly exempt from corporate income tax) based on the higher rates they earn on the higher risk loans they provide.

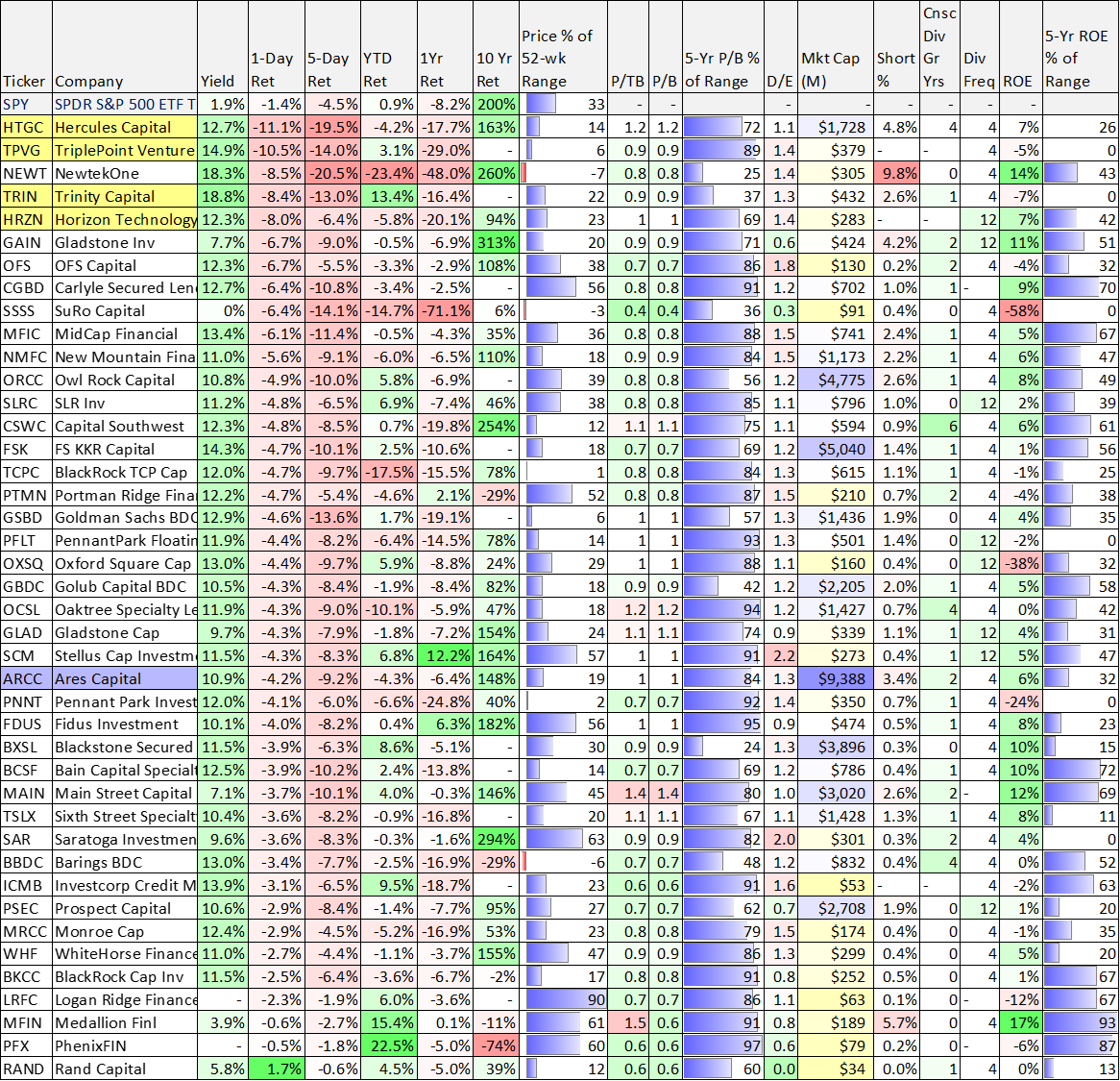

And as you can see in the following table (data as of Friday’s close), BDCs have had a mixed start to 2023. In particular, you’ll notice the four BDCs highlighted in yellow are down a lot over the last few days because those are the ones heavily concentrated in the VC space (i.e. the same space as Silicon Valley Bank that just collapsed).

data as of Fri March 10th. Source: Stock Rover

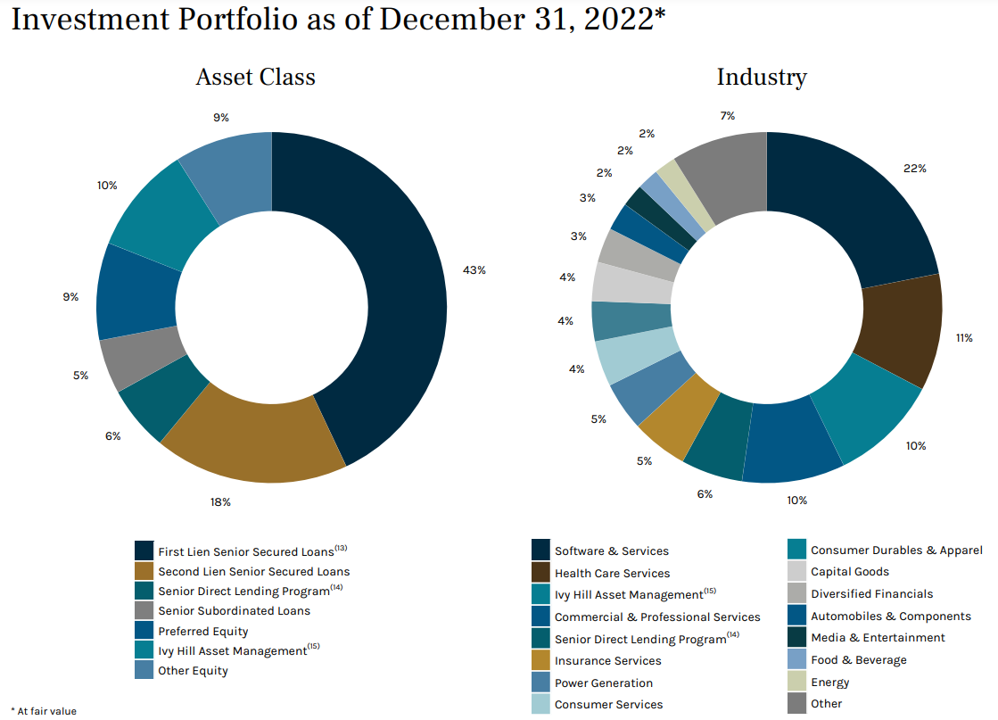

Fortunately, Ares Capital (the focus on this report) is well-diversified across many industries. However, it does have significant and unique risk exposures that we will cover later in this report.

Worth noting from a high level (and with regard to essentially all of the BDCs in the above table) as economic conditions become more challenging (i.e. rising rates, slowing growth), BDCs face increasing risks. For example, as rates rise, the risk of loan defaults rises (because it becomes increasingly challenging for many loan recipients to stay current on their floating rate loans). It also makes it harder for BDCs to originate new loans (simply because the economy has slowed, and their are less healthy middle market businesses looking for loans).

And of course, these challenges can be magnified according the each BDC’s focus. In particular, the four BDC’s we’ve highlighted in yellow (in the table above) are heavily focused on Venture Capital financing—the exact industry that just created a bank run that took Silicon Valley bank under. We’ll have more to say about the four VC-focused BDCs highlighted in yellow later in this report, after we dig into Ares Capital, in particular.

Overview: Ares Capital Corp (ARCC)

Ares Capital Corporation is a market-leading BDC and one of the largest direct lenders in the U.S. Its global platform combines extensive origination capabilities and knowledge to provide comprehensive solutions to meet the underserved financing needs of private middle-market companies across a wide range of industries. Ares describes itself as “a patient, long-term investor with permanent capital… able to hold large positions and [with] the ability to offer sponsors and management teams enhanced certainty of execution.”

To add more detail on this business, Ares provides revolver, first lien, second lien, stretch senior, unitranche, subordinated loans, private/public high yield, and non-control equity financing. And this financing can take the form of leveraged buyouts, acquisitions, recapitalizations, growth capital, general refinancing, project finance/power generation, rescue financing and restructurings.

Important to note here, only a portion of Ares business is focused on growth capital (which include the venture capital space that is currently being hit hard, such as Silicon Valley Bank).

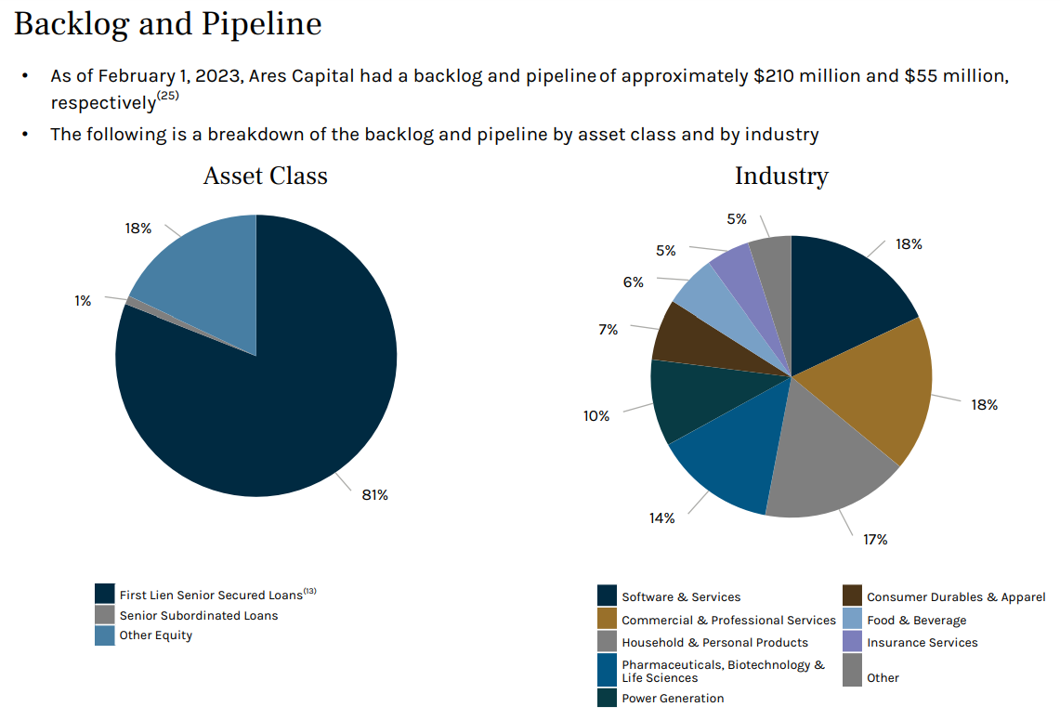

Ares generally targets companies in the EBITDA range of $10 to $250 million, and makes commitments in $30 - $500 million range. And Ares primary target industries include health care services, software & services, commercial & professional services, consumer services and consumer durables & apparel.

Note: Ivy Hill Asset Management is a registered investment advisor and a wholly owned portfolio company of Ares Capital.

Current Market Environment:

As basically a lending company, Ares makes more money when interest rates rise (all else equal) because net interest margins increase (i.e. the spread between the interest rate Ares lends at—and the rate Ares borrows at—widens). For example, here is how Ares describes this phenomenon in their most recent quarterly earnings press release:

“We generated record quarterly core earnings per share, $0.63. This 26% quarterly increase in core earnings was largely driven by the benefit of rising market interest rates and our net interest income, but also from strong capital structure and fee income on the fourth quarter transactions.”

Further, during its latest quarterly earnings call, Ares had this to say about rising interest rates:

"Market spreads on new deals are at least 100 to 150 basis points higher than at year-end 2021, and we believe that the total return opportunity afforded by the higher base rate in addition to the spread expansion is very compelling.”

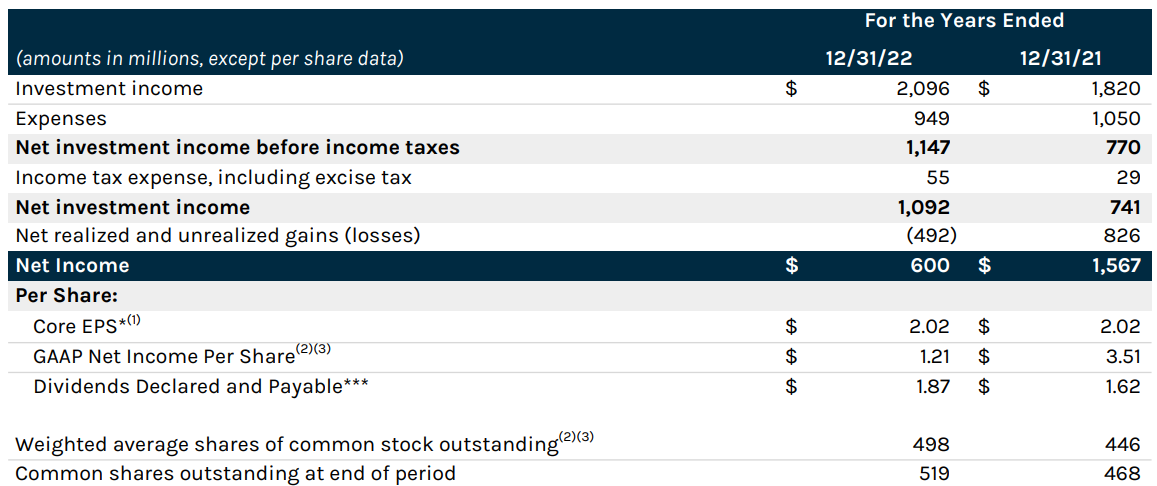

So it is basically higher interest rates that led to the increase in core EPS that you see in the first line of the following table.

However, as interest rates increase, so does unrealized depreciation on Ares loan assets, which is why GAAP earnings were below Core earnings in the table above. Ares explained this as follows on the quarterly call:

On a GAAP basis, our fourth quarter and full year earnings of $0.34 per share and $1.21 per share, respectively, were below our core earnings and has been recognized $0.03 per share and $1.08 per share, respectively, of net unrealized depreciation due largely to widening market yields.”

Further, as the economy increasingly heads towards recession, that puts more of Ares loans at risk of default (i.e. when the companies Ares lends to—struggle—some of them cannot pay back their loans). For example, you can see in this next graphic, Ares loans on non-accrual status are still small, but already starting to rise (not a good thing).

So basically, Ares is putting a positive spin on its current health by emphasizing core earnings (which are strong) instead of GAAP earnings which are weak. And as long as Ares survives any looming recession relatively unscathed, then the core earnings make the most sense. But the GAAP earnings are already recognizing that the market is showing signs of weakness and things can still get much worse.

As a reminder, as a BDC, Ares lends to companies that are often too small, too risky and too unique for normal banks to even deal with. And these are the types of loans that generally suffer the most in a recession. So in this sense, Ares’ risks are increasing.

Dividend Strength:

Ares’ dividend continues to be well covered its core EPS (see below) and by its net investment income (both good things). For example, you can see in the table below (top line) that net investment income continued to grow in 2022 versus 2021. However, after factoring in unrealized losses (as described earlier), GAAP net income per share does not cover the dividend per share.

The shortfall in GAAP net income per share versus the dividend per share is concerning because it indicates some weakness and possible future losses, but at this point the shortfall is due mainly to unrealized losses (not actual losses) and as long as the company survives any potential recession relatively unscathed (in terms of defaults) Ares remains in relatively good share and the dividend remains relatively healthy.

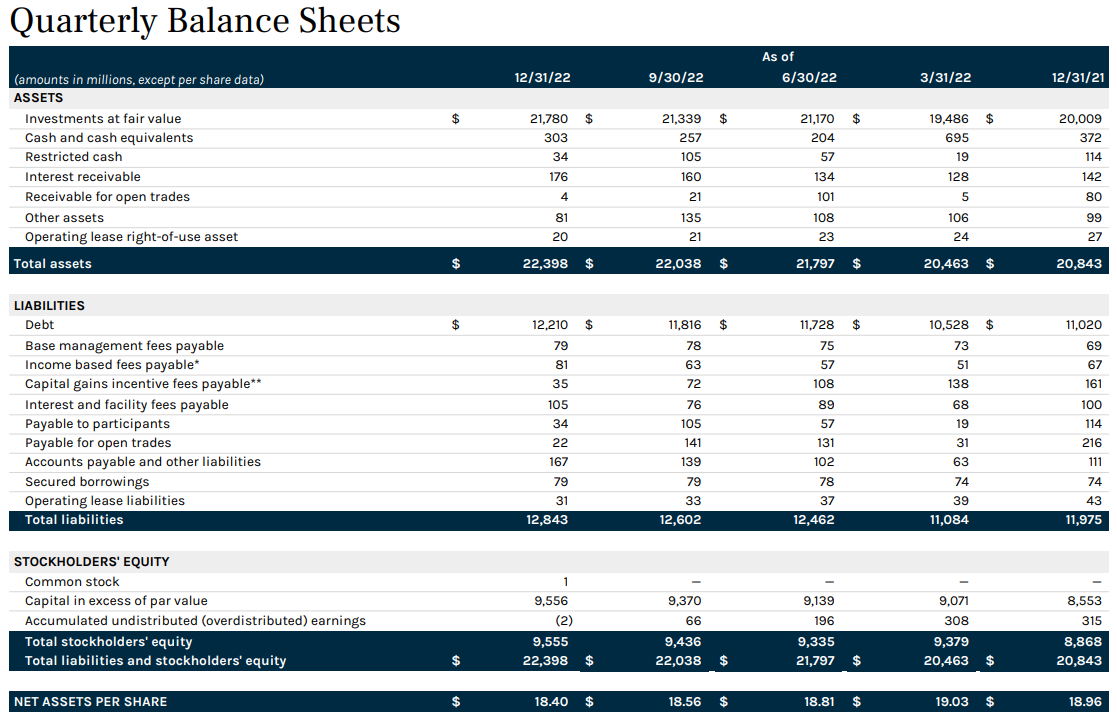

Also worth mentioning, Ares is in a strong cash position (see balance sheet below) and it also has an investment grade credit rating (for example, Fitch rates it BBB). These are both indications of health and ongoing dividend safety.

Also, if you plan to hold Ares in a taxable account, here is the recent tax treatment of its 2022 dividend payments, for your information.

As a note, BDCs can generally avoid corporate taxation if they pay out their income as dividends. That’s designed to be a tax incentive to help small (middle market) businesses by making it easier (less expensive) for BDCs to provide financing for them. And it is also good for income-focused investors that like big dividends.

Valuation:

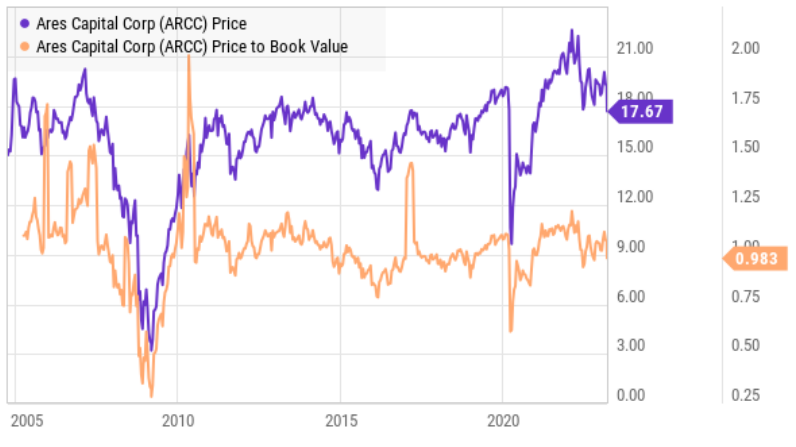

One of the most basic way to value BDCs is price to book value. Specifically, the market cap (or share price) divided by the book value (or balance sheet equity) of a BDC (or the share price of a BDC). Here is how Ares currently and historically stacks up.

Historically, Ares typically trades at a small premium to its book value, but currently it trades at a small discount. Some investors prefer to buy BDCs at a discount to book value (which has happened historically for Ares during times of market wide distress). We believe Ares current price-to-book valuation remains reasonable, considering current market conditions, and especially if you are an income-focused investor that likes the big dividend payments.

Also noteworthy, you can see in our earlier table that Ares’s shares outstanding increased in 2022 as the company continued to issue shares to fund new growth. In some regards, it is preferrable that Ares is able to issue new shares at a premium (rather than a discount) to book value (the company recently issued more shares on January 12, 2023).

It is encouraging that Ares is able to issue new shares and also encouraging that the backlog and forward pipeline of investment opportunities remain healthy, as you can see in the following graphic.

Risks:

It’s worth explicitly restating that Ares does face increasing risks as the economy moves towards recession. The company puts its best foot forward by saying increased interest rates help improve net investment income (and that is true thus far), but increasing interest rates also put increasing pressure on portfolio companies to pay back their loans to Ares (especially as we move towards recession). And if more companies start defaulting, that is bad for Ares.

We expect Ares to have adequate financial wherewithal to survive a mild recession (and if the shares fall sharply that could be a buying opportunity), but if the recession proves to be severe—that could be bad news for BDCs across the board. Fortunately, Ares is financially stronger than many other BDCs (it is the largest BDC, and has an investment grade credit rating).

For more perspective, BDCs are allowed financial leverage up to 2.0x (this is up from only 1.0x prior to new regulations passed in 2019), and most BDCs remain well below this level. For example, you can see in our earlier table above that most BDCs have debt-to-equity ratios of just over 1.0x (well below the 2.0x regulatory limit). And as long as the economy doesn’t great dramatically worse, BDCs generally have plenty of strength to weather current economic challenges.

Venture Capital Focused BDCs

VC-focused BDCs (such as the four described below) face heighted risk because the VC industry is more sensitive to economic cyclicality than other industries. And considering we are facing slowing growth and rising rates, VC-focused BDCs have been hit hard, especially following the bank run on VC-focused bank, Silicon Valley Bank, which has stoked fear in the markets (even if the regulators are stepping in to resolve the Silicon Valley Bank situation).

Hercules Capital (HTGC) is a business development company. The firm specializes in providing venture debt, debt, senior secured loans, and growth capital to privately held venture capital-backed companies at all stages of development from startups, to expansion stage including select publicly listed companies and select special opportunity lower middle market companies that require additional capital to fund acquisitions, recapitalizations and refinancing and established-stage companies.

TriplePoint Venture Growth (TPVG) is a business development company specializing investments in venture capital-backed companies at the growth stage investments. It also provides debt financing to venture growth space companies which includes growth capital loans, secured and customized loans, equipment financings, revolving loans and direct equity investments.

Horizon Technology Finance (HRZN) is a business development company specializing in lending and and investing in development-stage investments. It focuses on making secured debt and venture lending investments to venture capital backed companies in the technology, life science, healthcare information and services, cleantech and sustainability industries.

Trinity Capital (TRIN) is a business development company. It is a venture capital firm specializing in venture debt to growth stage companies looking for loans and/or equipment financing.

In our view, there may be some short-term trading opportunities surrounding the heightened volatility for the four VC-focused BDCs described above. However, as long-term investors we are staying away. At this time, we prefer to focus on BDCs that are better diversified, such as the three BDCs we currently own in our High Income NOW portfolio.

Conclusion:

As interest rates rise and economic growth continues to slow, the entire BDC space is risky (especially considering BDCs provide financing to businesses that are often too risky for traditional banks). However, we believe Ares is attractive considering its well-diversified portfolio (it’s not concentrated in the increasingly troubled VC space, like Hercules, TriplePoint, Horizon and Trinity) and considering Ares trades below book value yet has plenty of financial wherewithal. There may be some short-term trading opportunities among highly volatile VC-focused BDCs in the coming days, but as long-term income-focused investors, we greatly prefer Ares, especially within the constructs of a prudently-diversified, long-term, high-income portfolio.