The already inexpensive British American Tobacco (BTI) just got more inexpensive following Wednesday’s announced $31.5 billion write down (mainly related to its U.S. cigarette brands). The shares fell sharply on the news (because it adds to the multiple big risks the company already faces). However, this big non-cash impairment doesn’t impact the company’s cash position and it won’t impact future capital allocation decisions (including the monster big dividend, currently yielding nearly 10%). In this report, we review the business, the details of the impairment charge, the company’s valuation and the big risks. We conclude with our strong opinion on investing.

British American Tobacco (BIT), Yield: 9.7%

British American Tobacco is a UK-based company that sells tobacco and nicotine products to consumers worldwide. It trades in the US as an American Depository Receipt (“ADR”), and the shares currently trade at a very low valuation (we will explain why, in detail, throughout this report).

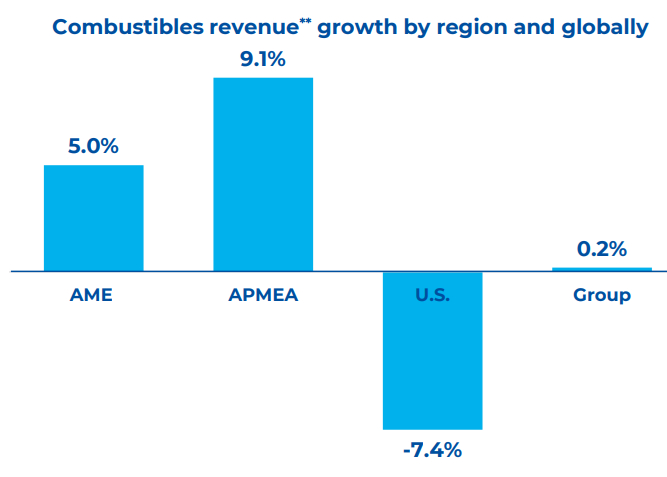

For a little perspective, the company’s largest operating segment by geography is the United States, as you can see in the following graphic.

And you may be familiar with some of the company’s products and brands, including combustible tobacco (see graphic below).

Also, British American Tobacco has been expanding into newer, non-combustible, categories (such as those in the graphic below).

The New $31.5 Billion Impairment

As mentioned, British American Tobacco just announced a big new impairment charge, that had a very negative impact on the share price (i.e. the U.S. shares fell from ~$32 to ~$29, nearly a double digit percentage decline).

And here is how the company explained the big impairment charge in its newly released conference call:

“Consistent with our vision to ‘Build a Smokeless World’, and in combination with the current macro-economic headwinds impacting the U.S. combustibles industry, in 2023 we will take an accounting, non-cash, adjusting impairment charge of around 25 billion pounds. This accounting adjustment mainly relates to some of our acquired U.S. combustibles brands, as we now assess their carrying value and useful economic lives over an estimated period of 30 years. Accordingly, we will commence amortisation of the remaining value of our U.S. combustibles brands from January 2024. This non-cash amortisation charge will be treated as an adjusting item and does not impact future capital allocation decisions. Work is ongoing as part of our normal year end process, and we will disclose further details at our Full Year results in February.”

Importantly, this big impairment is a non-cash item, and it will NOT impact capital allocation decision going forward. This is really important for the safety of the big dividend (and the potential future resumption of share repurchases), as we will cover in more detail later in this report.

So before we get into how this impairment charge impacts the company’s current valuation, let’s first consider the revenue growth trajectory of British American Tobacco.

Revenue Breakdown and Growth

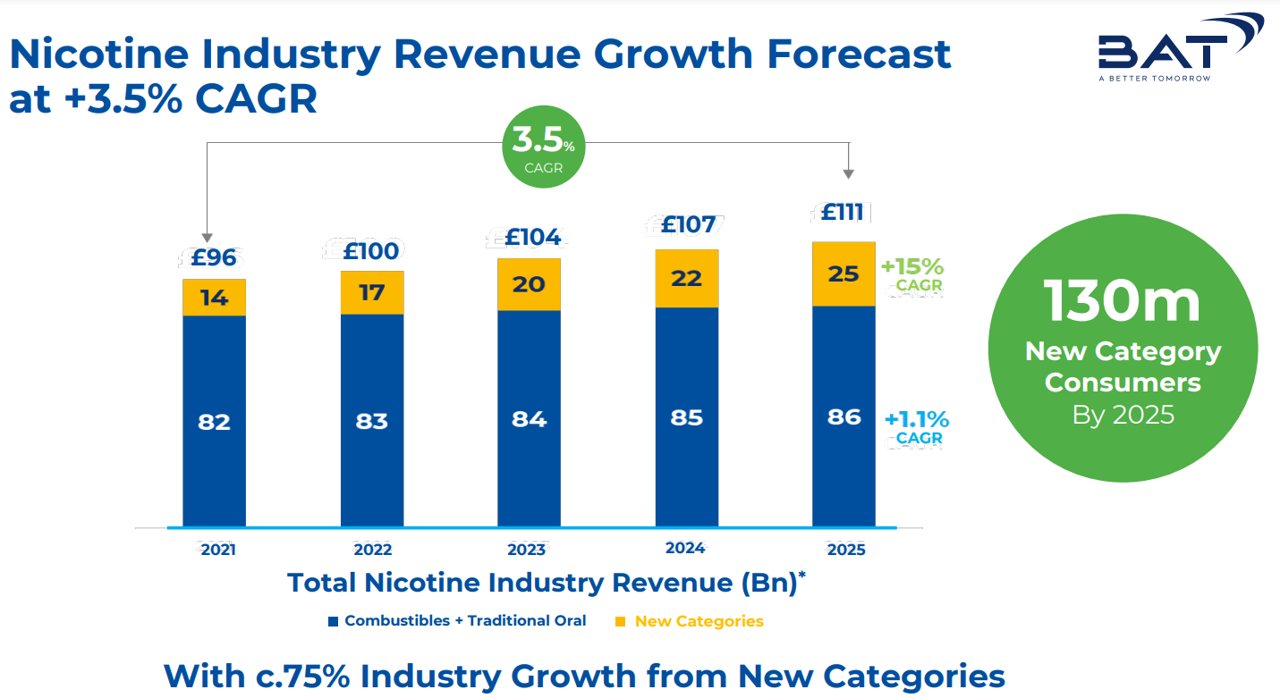

Traditional tobacco (combustible) products still make up the lion’s share of the business, as you can see in this revenue graphic below.

And this next chart shows that the smaller “New Categories” are actually growing much faster, but of course they are still smaller by revenue than traditional combustible products.

Also worth mentioning, British American Tobacco also owns a 29.7% stake of ITC Limited (formerly the Indian Tobacco Company) which has actually been growing combustible revenues rapidly.

Business Strategy:

And this revenue breakdown (in our earlier chart) is consistent with the company’s strategy to be a leader (and capture market share) in newer non-combustible categories, such as vaping, heating tobacco and oral products

Also important to note, BTI’s products are diversified across premium products, mid-tier and low-cost products. This gives it some pricing power (in the premium space), but also helps diversify risks as consumer preferences can (and do) change over time.

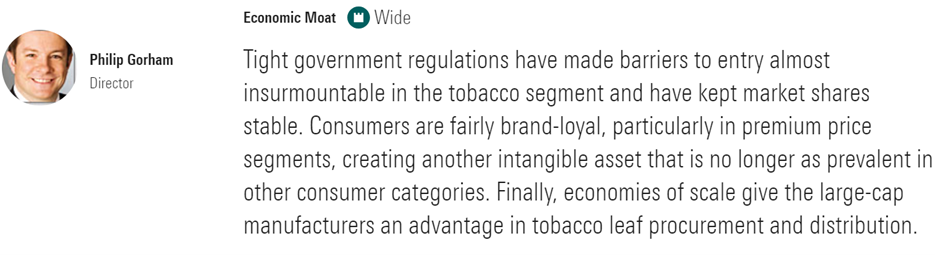

BTI’s Wide Moat:

BTI has a variety of “wide moat” competitive advantages. For example, regulations (especially in the US) make it virtually impossible for new entrants in the traditional combustible tobacco space. And BTI’s large size also gives it competitive advantages through economies of scale. Not to mention, the nicotine in BTI’s products is highly addictive (which helps ensure customers stick around). Here is what Morningstar Director, Philip Gorman has to say about BTI’s moat:

Big Dividend Safety

From a high-level perspective, BTI is a very profitable company (as we will see in the valuation section of this report), but it’s not growing rapidly (tobacco isn’t exactly a popular product to market—especially in the US—considering its addictive nature and side effects, as we will cover later in the risks section of this report).

As such, BTI should return extra profits and cash flows to investors through dividends and share repurchases (because they don’t have compelling high-growth opportunities to reinvest back into the company). And that is exactly what BTI does (especially the big dividend part).

BTI’s current dividend yield is ~9.7%, and the company has increased its dividend every year for over two decades straight. However, as a US investor, the dividend fluctuates because currency exchange rates (British Pound versus US dollar) also fluctuate. Importantly, as per the company:

The equivalent quarterly dividends receivable by holders of ADSs in US dollars will be calculated based on the exchange rate on the applicable payment date. A fee of US$0.005 per ADS will be charged by Citibank, N.A. in its capacity as depositary bank for the British American Tobacco American Depositary Receipt (“ADR”) programme in respect of each quarterly dividend payment.

For some perspective, here is a look at the company’s cash flows as compared to the dividend payout (i.e. the dividend is very well covered), as of the end of last year.

These numbers bounce around, and have been lower in the first half of 2023, but as per the company’s most recent earnings release:

“Commitment to dividend growth in sterling terms and our long-term 65% dividend pay-out ratio”

That is a very strong dividend coverage ratio.

And with regards to share repurchases (i.e. another way to return cash to shareholders), BTI made clear earlier this year that it is currently prioritizing the dividend (and paying down debt) ahead of share buybacks (emphasis ours):

"Our business is highly cash generative; we achieved another year of excellent operating cash conversion, delivering 100%, well ahead of our 90% guidance and we expect as a Group to generate c.£40 billion of free cash flow before dividends over the next five years.

"The Board reviews our capital allocation priorities taking into account the macro-economic environment and potential regulatory and litigation outcomes. At this time, the Board has decided to take a pragmatic approach. Given our incremental investment plans in 2023 to further accelerate our transformation, and in light of the uncertain macro environment, higher interest rates, outstanding litigation and regulatory matters, the Board has decided to prioritise strengthening the balance sheet. This will provide greater business resilience while continuing to support future financial agility, as we aim to reduce leverage more quickly towards the middle of our target 2-3x corridor.

In line with our progressive dividend policy, the dividend will increase by 6.0% to 230.9p. "We strongly believe that share buy-backs have an important role to play within our capital allocation framework, and we will continue to keep it under review as we progress through the year.

And for reference, the company has been making progress towards the middle of the 2-3x corridor referenced above (which is debt to adjusted EBITDA).

So even though share repurchases have been paused, the dividend remains very healthy and growing. Further, the company wisely chose to start paying down debt in advance of the increase in interest rates we’ve experienced this year (note: BTI has experienced a higher interest expense this year as the average cost of debt has increased to 4.3%, compared to 4.0% in 2022, and in line with higher interest rates in the market). Overall, BTI is behaving prudently and the dividend is big, strong and appears very safe.

Valuation:

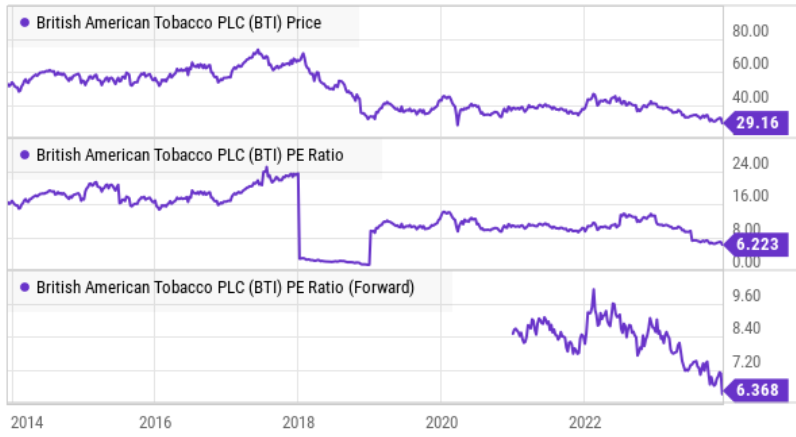

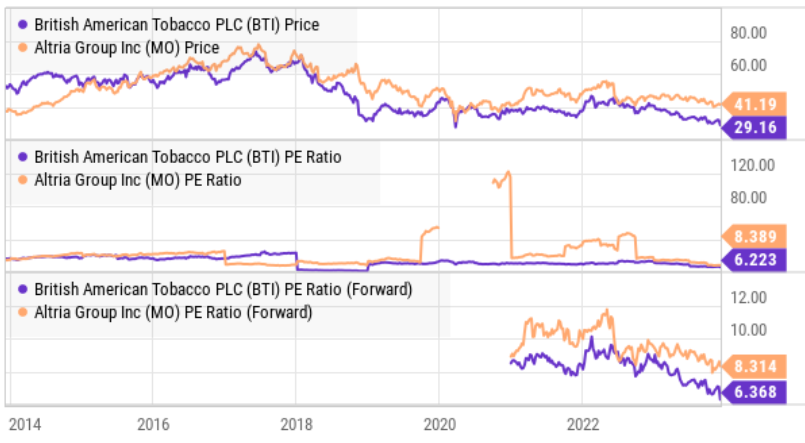

Typically, investors talk about price-to-earnings ratios, but the inverse of that is the “earnings yield.” BTI’s current P/E ratio is 6.2x, so its earnings yield (i.e. how much earnings you, as a shareholder, get in exchange for the price you pay per share) is 16.1%. That is a very high and attractive earnings yield, and an indication that BTI is trading at an attractive low price. And for perspective, here is a look at BTI’s historical P/E ratio as compared to tobacco competitor Altria (MO).

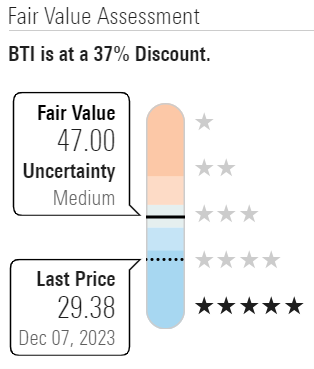

BTI is currently trading at an attractively low valuation, especially considering its strong cash flow and healthy (and improving) balance sheet (BTI has a BBB+ “investment grade” credit rating from S&P, and is actively using cash to strengthen the balance sheet (paydown debt) as described earlier).

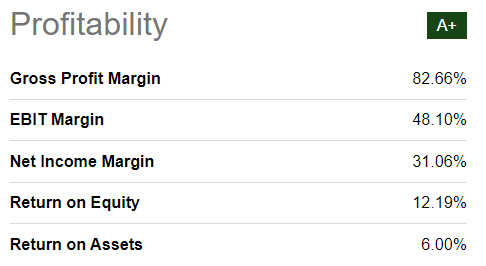

In a nutshell, BTI is a healthy, steady business with a well-covered safe dividend; and BTI also has a wide moat (as described earlier) to defend its very strong profit margins (as shown in the table below).

Profit margins as high as BTI’s are impressive. Another impressive stat is the company’s free cash flow per share of $5.62 (ttm) versus a current share price of only $29.15 (free cash flow covers the share price in only 5.2 years). Impressive!

And just for a little more perspective, here is how Morningstar Director, Philip Gorham (mentioned earlier), rates the shares (i.e. a 5-star, “strong buy”).

Risks:

Of course BTI does face risks. For starters, it is a tobacco company. Tobacco/ nicotine products are addictive and its products can literally cause cancer. As such, the company is severely restricted in terms of advertising and it is constantly at risk of new damaging regulations and lawsuits. For perspective, you can see how litigation impacted cash flow results in recent years in the table below.

Another risk is that BTI may or may not get its growth strategy right. For example, there is a certain degree of experimentation (and research and development costs) associated with developing and releasing new products. Further still, BTI has made expensive inorganic acquisitions in the past that have negatively impacted its margins (such as its 2017 Reynolds acquisition).

Further still, the new impairment charge could be an indication of an increasingly hostile regulatory environment for combustible tobacco products, whereby the company is trying to get ahead of even more challenges to come.

Further still, the company faces competition from illicit trade, geopolitical tensions and foreign currency exposure/volatility, to name a few.

All things considered, BTI is a very healthy business from a profitability and dividend standpoint, but there are risks, particularly tail risks related to the challenges the entire tobacco industry faces.

Conclusion

Previously, we had a 1% allocation to British American Tobacco (in our High Income NOW portfolio), but have just increased our position size to 2.5% (following the impairment-induced price decline). Further, we have updated our Top 10 Big Yield rankings, to add British American Tobacco at #9. If you are looking for a big, steady, dividend grower, that also has share price appreciation potential, British American Tobacco is absolutely worth considering.