With BDC earnings season set to kick off this week (starting with Ares Capital on Tuesday pre-market), we’ll also be watching Owl Rock closely (set to announce two weeks later). One key metric to watch will be book value as the economy heads towards recession and write-downs could start to more significantly detract from the benefits of rising interest rates. This quick note shares data on 40 big-yield BDC, and digs into Owl Rock in more detail.

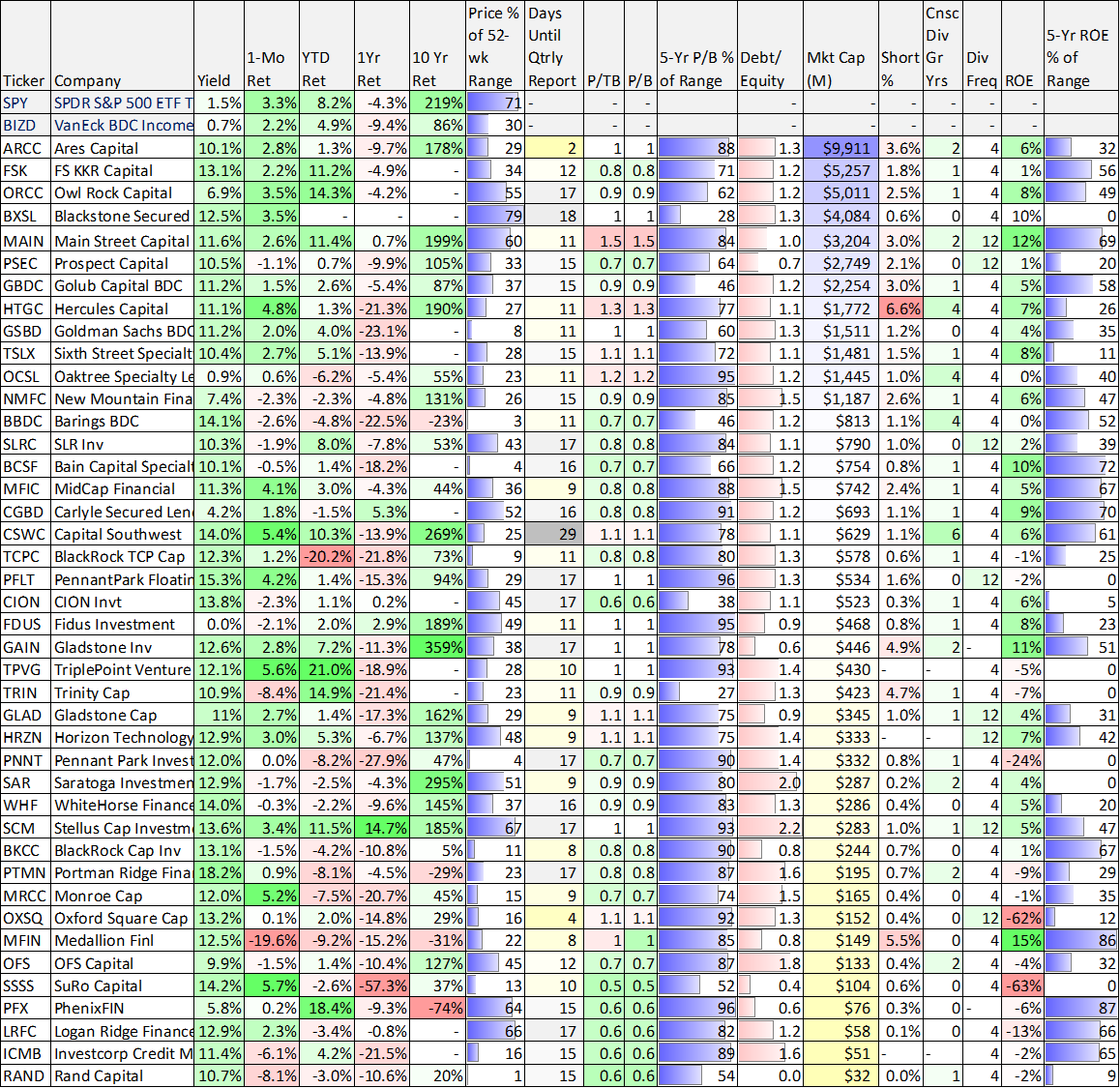

40 Big-Yield BDCs

For starters, here is a look at data for 40 big-yield BDCs. Keep in mind that book value (in the price-to-book or P/B ratio columns) is only updated quarterly, while price is updated every day the market is open. So even though these BDCs appear increasingly inexpensive on a price-to-book value basis (many of them are below 1.0x) these price-to-book value ratios could mathematically rise quickly if quarterly earnings reveals significant write-downs to book values (as the economy heads towards recession).

For a little more color, book value is the value of all the investments (mainly loans) that these BDCs have made to their portfolio companies. And as these smaller (middle market) companies face increasing macroeconomic headwinds (from the slowing economy) there may be increased risks of default, thereby forcing BDCs to write-down their book values in this upcoming batch of quarterly earnings announcements (again, set to begin this week, starting with Ares Capital announcing Tuesday before the market opens).

Owl Rock Capital (ORCC), Yield: 10.3%

Owl Rock Capital Corporation is an attractive business development that currently offers a base dividend of $0.33 per quarter, plus an additional supplemental dividend (recently $0.04). This dividend combination can cause many reporting websites to under-report the dividend, so be sure to understand the two parts (base plus supplemental dividend payments). For some color, per Owl Rock’s previous quarterly call:

As a reminder, we also announced several capital actions with our third quarter results, including a $0.02 increase in our base dividend to $0.33 and the introduction of a supplemental dividend component going forward. The supplemental dividend is equal to 50% of earnings in excess of our base dividend and given our increase in NII, our supplemental dividend increased to $0.04 for the fourth quarter… we also announced that our Board had authorized a $150 million repurchase program

Owl Rock is relatively new on the BDC scene (it was founded in 2016, and had its initial public offering in 2019), but is already one of the largest. For your information, Owl Rock Capital makes investments in a variety of senior secured or unsecured loans, subordinated loans or mezzanine loans and also considers equity-related securities including warrants and preferred stocks also pursues preferred equity investments and common equity investments. And within private equity, Owl Rock seeks to invest in growth, acquisitions, market or product expansion, refinancings and recapitalizations,

We like Owl Rock for its large size, well diversified portfolio and financial strength. For example, with a current debt-to-equity ratio of only around 1.2x (well below the 2.0x regulatory limit) and a price-to-book value of just 1.0x. the shares may prove particularly attractive if the upcoming recession proves mild. Specifically, ORCC is in a stronger financial position than other BDCs and its quarterly results have continued to strengthen thus far as the economy recovers from the pandemic slump. For example, according to CEO Craig Packer on the previous quarterly call:

We are pleased to once again report another quarter of very strong results with earnings momentum that reflects the continued pull-through of higher rates the ongoing strong performance of our portfolio.

To put this in perspective, NII increased 18% versus the fourth quarter of last year and over 30% in the second half of the year as we have seen the benefit of rising rates and stable credit performance. On our call last quarter, we highlighted that we expected to earn at least $0.39 of NII in the fourth quarter based on our visibility at the time. We are pleased to report even stronger results.

However, Packer also explained:

We expect broader economic headwinds and the potential for a recession later this year. We believe our portfolio is well positioned for this environment and our borrowers are already demonstrating resilience. Our borrowers continue to report low-single-digit growth quarter-over-quarter on a revenue and EBITDA basis, although we note that the pace of growth has slowed versus prior quarters.

The Bottom Line

We believe Owl Rock is well positioned to weather an upcoming recession better than many peers, and if the recession bring price volatility that could create an attractive buying opportunity. We’ll be watching the earning report from BDC leader Ares Capital on Tuesday morning because it could be a good indication of what we will hear from other BDCs (like Owl Rock), especially in terms of any book value write-downs or adjustments, as earnings season progresses. We are currently long shares of Owl Rock because we believe the valuation is reasonably attractive, and because we believe it is very well positioned to keep delivering strong quarterly dividends going forward.